The

stablecoin

market has evolved from a niche crypto tool into a $280 billion financial behemoth, with issuers like Tether and Circle reporting quarterly profits rivaling those of traditional finance giants. Tether’s Q2 2025 earnings reached $4.9 billion, while Circle’s revenue hit $658 million in the same period. This explosive growth—fueled by regulatory clarity, institutional adoption, and technological innovation—raises a critical question: How do companies offering "1:1 dollar-pegged" tokens achieve such profitability? This article examines the economic mechanics, revenue streams, and future challenges underlying the stablecoin industry’s lucrative business model.

How Are Stablecoins Created?

Stablecoins can be centralised or decentralised, depending on the developing company. Financial institutions and organisations create these coins with financial backing and complex mechanisms that keep the currencies fixed ratio to 1:1 with the underlying fiat currency.

Stablecoins can be collateralised by crypto/fiat currencies, commodities, algorithms or a combination of them. Smart contracts and blockchain oracles are two components that perform and maintain the pegging mechanism.

Smart contracts execute minting or burning operations to keep the balance, while oracles provide real market news and price updates to smart contracts.

The Foundation: Interest Income From Reserve Assets

The primary revenue source for stablecoin issuers stems from

reserve management. When users convert fiat currency into stablecoins like

USDT or USDC, issuers pool these funds into low-risk, liquid assets—predominantly U.S. Treasury bills and reverse repurchase agreements. In a higher-interest-rate environment, these reserves generate substantial returns. For instance, Tether’s $172 billion USDT reserves, largely allocated to Treasuries, yielded $4.9 billion in Q2 2025 alone. Similarly, Circle’s $600 billion USDC reserves contributed over 95% of its revenue through interest income.

This model, termed the "four-cent ambition" by DeFi researchers, implies that every dollar of stablecoin in circulation generates ~4 cents annually for the issuer. With Tether and Circle collectively controlling ~80% of the stablecoin market, scale amplifies their earnings exponentially. However, this reliance on reserve income introduces

interest-rate sensitivity. Analysts warn that a 100-basis-point rate drop could reduce Circle’s annual EBITDA by $200 million, highlighting the vulnerability to macroeconomic shifts.

Diversification: Fees, Services, and Ecosystem Expansion

While reserve income dominates, leading issuers are aggressively diversifying:

Transaction and Platform Fees:

Circle’s Cross-Chain Transfer Protocol (CCTP) and Circle Payments Network (CPN) generated a 350% growth in service revenue in Q2 2025. These tools enable interoperability across blockchains and streamline B2B cross-border payments, capturing fees from volume-based transactions.

Strategic Investments: Tether has allocated $20 billion to ventures in

AI, renewable energy, and Bitcoin mining, aiming to transform into a tech conglomerate. Its proposed $200 billion fundraising round—targeting a $500 billion valuation—would fuel further expansion beyond stablecoins.

Banking and Compliance Services: Emerging players like JP Morgan’s JPMD deposit token target institutional clients for settlements, while Core Foundation’s Rev+ protocol shares gas fee revenue with developers. These initiatives redistribute value within ecosystems, fostering loyalty and usage.

Despite these efforts, diversification remains nascent. Circle still derives 95% of its income from reserves, underscoring the challenge of reducing interest-rate dependence.

Technology and Liquidity: The Infrastructure Advantage

Stablecoin profitability is inextricably linked to

liquidity provision and

blockchain

efficiency.

Multi-Chain Deployment: USDC operates on 16 blockchains, with Solana emerging as a preferred network due to its 65,000 TPS capacity and low fees. This interoperability reduces transaction costs and enhances utility for DeFi protocols, where USDC dominates 70% of lending markets.

Liquidity as a MoAT: Tether’s first-mover advantage and deep integration across exchanges and payment rails (e.g., Stripe’s Stablecoin Financial Accounts) create network effects that deter competitors. Daily stablecoin transactions now rival traditional payment systems, processing ~$500 billion monthly.

Vertical Integration:

DeFi protocols like Aave’s GHO and Ethena’s USDe are challenging incumbents by redistressing reserve yields to users. However, their scale remains limited—GHO’s issuance costs briefly hit 8%, far exceeding generated revenue.

What is the Size of the Stablecoin Market?

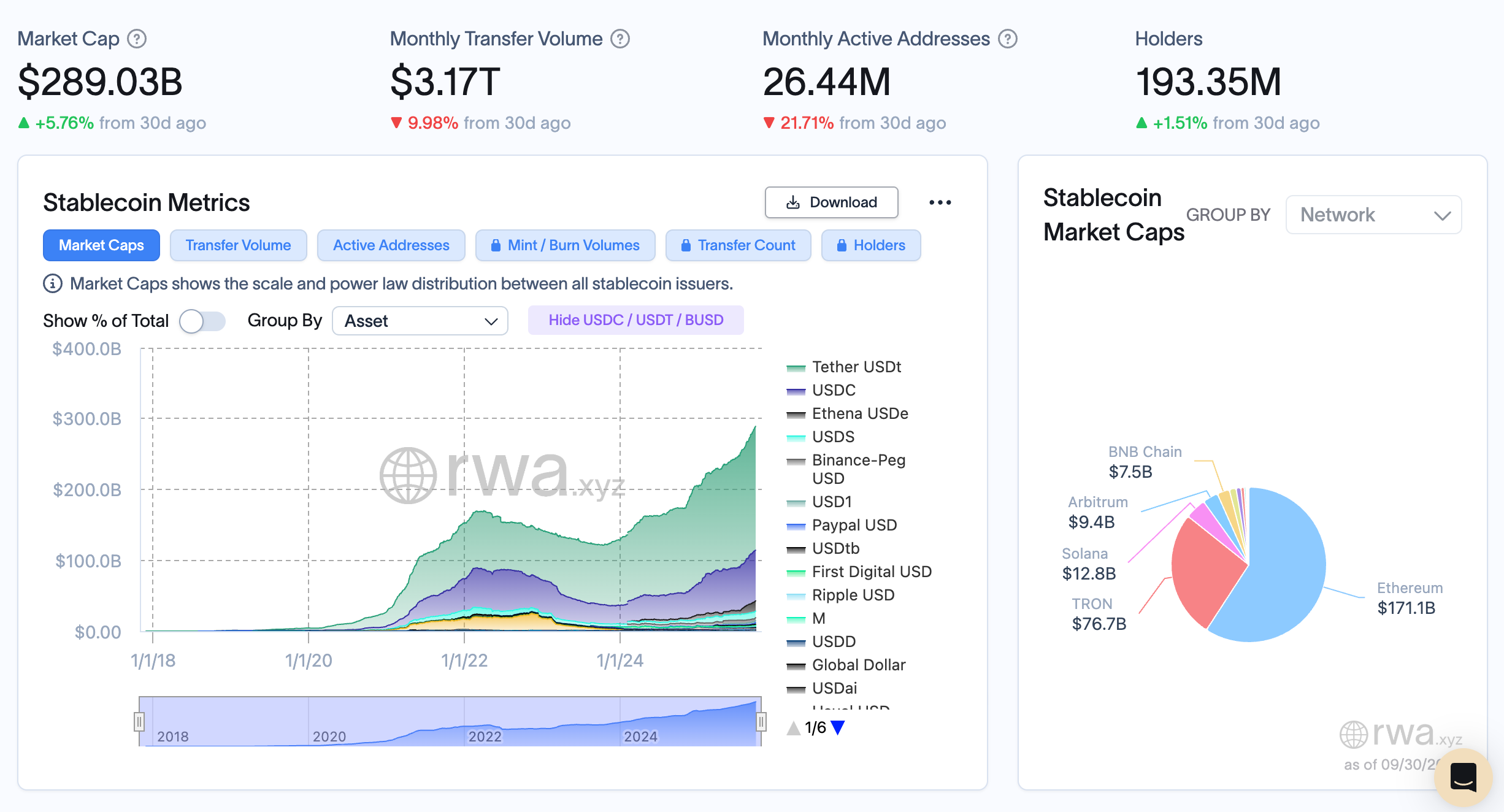

Stablecoins market cap. Source: RWA.xyz

Today, the U.S. dollar-denominated stablecoin market, which makes up around 99% of the global stablecoin market, has grown to $289 billion, accounting for roughly 9% of the broader $3 trillion crypto ecosystem tracked by J.P. Morgan Global Research.

And the sector continues to grow. “The market cap of the basket of stablecoins we track ended June +2% higher month over month, sustaining seven consecutive months of positive market cap growth despite a more volatile crypto market year-to-date,” added Kenneth Worthington, a Brokers, Asset Managers and Exchanges equity analyst at J.P. Morgan.

Looking ahead, the stablecoin market could hit $500–750 billion in the coming years. There are reports out there that say stablecoins could grow to $2 trillion by the end of 2028, which we believe is a little bit optimistic. A more realistic scenario is that the market could grow two to three times from where we are right now in the next couple of years, which is equivalent to $500 to $750 billion. Admittedly, this is just our best estimate.

This is largely because the stablecoin ecosystem is still nascent, and new infrastructure will take time to build out. In addition, more conservative liquidity investors, whether retail or institutional, may not immediately seek out stablecoins as a cash alternative.

Regulation and Compliance: Navigating New Frontiers

Regulatory clarity has become a tailwind for profitability:

The GENIUS Act: Passed in July 2025, this U.S. law mandates 100% reserve backing with cash or short-term Treasuries, banning algorithmic stablecoins. Compliant issuers like Circle benefit from institutional trust, while non-compliant rivals face exclusion from regulated markets.

Global Frameworks: Europe’s MiCA and Hong Kong’s stablecoin licensing (effective August 2025) require rigorous reserve audits and capital buffers. These rules legitimize stablecoins for corporate use, as seen with Walmart and Amazon exploring proprietary tokens for supply-chain payments.

Transparency Pressures: Tether’s partnership with Cantor Fitzgerald for its $200 billion funding round aims to bolster its regulatory credibility. Similarly, Circle’s monthly reserve reports have made USDC the preferred stablecoin for institutional DeFi.

Challenges and Future Outlook

The industry faces pivotal hurdles:

Interest Rate Volatility: Declining yields could compress profit margins, forcing issuers to rely on fee-based services.

Competition and Vertical Integration: DeFi protocols are "reclaiming" yield via native stablecoins, threatening issuer dominance.

Systemic Risks: Moody’s warns that stablecoin growth could undermine monetary policy in emerging markets, prompting stricter oversight.

Despite these challenges, Citigroup projects the stablecoin market to reach $1.9–4 trillion by 2030. This growth will be driven by cross-border payments (e.g., 43% of Southeast Asian B2B transactions already use stablecoins) and tokenization of real-world assets.

Capital, Narrative, and the Big Gamble on the Future

Back to the original question: Is issuing stablecoins really that profitable? The answer is yes, but these huge profits accrue to giants that leverage network effects and first-mover advantage. Tether's valuation leap from $12 billion to $500 billion is the result of its robust profitability, shrewd capital management, and a grand narrative about its future. This wasn't just a fundraising exercise; it was a strategic move to declare its value to the mainstream financial world and secure a dominant position in the future digital landscape of the US dollar.

However, Tether's success isn't guaranteed. On the one hand, newcomers hoping to capture a share of the pie need to find differentiated, hard-to-replicate solutions and be prepared to pay a hefty price. On the other hand, the wave of vertical integration emerging from the DeFi world is attempting to fundamentally upend the existing profit distribution landscape.

As Tether's CEO stated, USDT's success stems largely from the dire economic conditions of many countries, providing a financially safe haven for hundreds of millions of people. The battle over stablecoins extends far beyond the crypto world; it concerns the flow of global capital, the transformation of financial infrastructure, and the possibility of a more open and equal financial future. Tether's $500 billion valuation is the most compelling bargaining chip in this gamble of the century.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.