In June 2025, Circle Internet Financial, Inc., the issuer of the world's second-largest USD stablecoin USDC, successfully listed on the New York Stock Exchange (NYSE) under the ticker symbol CRCL. This fintech company, founded in 2013, thus became the first stablecoin company to complete an IPO. Its listing was widely regarded as the most significant cryptocurrency-related public offering since Coinbase's debut in 2021, symbolizing an important milestone in the integration of digital assets and traditional finance.

Circle's listing attracted significant attention. Priced at $31 per share in its IPO, the stock soared more than 168% on its first trading day, briefly touching a high of $103.75 during the session and climbing to $165 in subsequent days—representing a fourfold increase from the offering price. Such market performance highlighted investors' strong interest in crypto infrastructure and stablecoin services, but also raised the question: after such impressive gains, does CRCL stock still possess long-term investment value? Can it achieve another breakthrough?

This article provides an in-depth analysis of Circle's business model, market performance, financial health, future growth catalysts, and potential risks, offering a comprehensive perspective on CRCL's investment outlook.

Company Overview

Circle's core achievement is the creation and management of USD Coin (USDC). This is a stablecoin pegged 1:1 to the US dollar, fully backed by regulated dollar reserves (including cash and short-term US Treasury bonds). Its operating principle is: when users deposit US dollars through Circle's partners, Circle mints an equivalent amount of USDC; when users redeem USDC, the corresponding tokens are "burned" and users receive an equivalent amount of US dollars. Through its extreme commitment to compliance and transparency (such as monthly publication of reserve audit reports by Deloitte), USDC has gained the trust of numerous exchanges, institutions, and corporate users, becoming the world's second-largest stablecoin after Tether (USDT), with a market capitalization of approximately $61 billion as of June 2025.

Circle's revenue is highly dependent on interest generated from USDC reserve assets. In a high-interest rate environment, this revenue stream is substantial, but also makes the company extremely sensitive to interest rate changes. Between 2022 and 2024, interest income accounted for over 95% of its revenue.

Beyond its stablecoin business, Circle is actively expanding its payment network (CPN), cross-chain transfer protocol (CCTP), and other services, with plans to launch the Arc blockchain specifically designed for "stablecoin finance," aiming to diversify its revenue sources.

Circle IPO and Market Performance

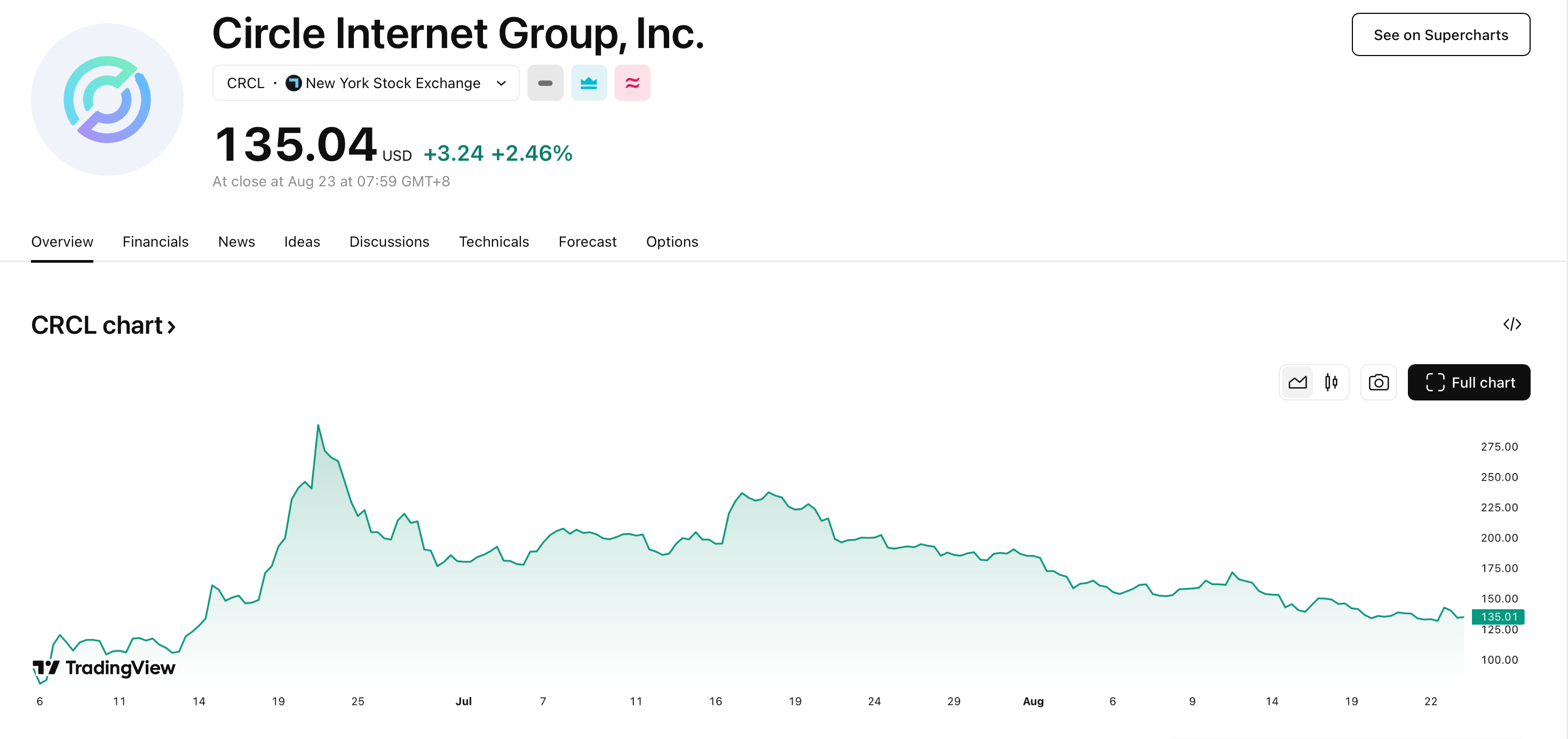

CRCL Internet Group, Inc. Source: TradingView

Circle's IPO itself was a notable event.

IPO Spectacle: Circle's IPO received enthusiastic response from investors, reportedly oversubscribed by 25 times, leading to an increase in the offering size. The final offering price was set at $31 per share, exceeding the initial expected range of $27 to $28, raising approximately $1.1 billion and giving the company a fully diluted valuation of about $8.1 billion. The IPO was underwritten by major Wall Street institutions including JPMorgan, Citigroup, and Goldman Sachs, enhancing the credibility of the transaction.

Post-IPO Price Volatility: CRCL stock experienced remarkable gains when it began trading on the New York Stock Exchange. It opened between $69.33 and $69.50 on its first day, surging 168% to 175% above the IPO price, and briefly reached an intraday high of $103.75. In the following days, the stock price continued to climb, once breaking through $165. However, as the initial enthusiasm subsided and early investors (such as Ark Invest) took profits, the price retreated from its highs and entered a period of consolidation and volatility.

Financial Performance

Circle's Q2 2025 earnings report revealed the core strengths and challenges of its business:

Strong Revenue Growth, but Concentrated Structure: Circle's revenue for Q2 2025 was $251 million, exceeding some analysts' expectations. The vast majority of its revenue comes from interest generated by USDC reserves. For instance, in 2024, interest income accounted for 99.1% of its total revenue. This structure benefits from high interest rates but is extremely sensitive to interest rate changes, potentially amplifying the impact of market fluctuations on performance.

Multifaceted Profitability: The report showed that Circle's adjusted EBITDA for the second quarter was $126 million, exceeding market expectations. However, under US Generally Accepted Accounting Principles (GAAP), the company reported a net loss, primarily affected by IPO-related stock-based compensation and other expenses related to the fair value measurement of convertible notes.

Impressive USDC Metrics: Supporting Circle's financial performance is the continued growth of USDC. As of June 2025, the circulating supply of USDC exceeded $61 billion and achieved significant expansion across multiple blockchains. For example, on the Solana blockchain alone, USDC issuance reached $24 billion in 2025, with a total supply of approximately $11.4 billion, reflecting a threefold growth. Furthermore, USDC holds immense potential for applications such as cross-border payments. Although stablecoins currently account for less than 1% of the global cross-border payment market, their total addressable market (TAM) based on non-G20 markets is estimated at $16.5 trillion.

Growth Catalysts and Future Strategies

Circle's future growth depends on several key factors:

Regulatory Clarity: The proposed GENIUS Act in the US aims to provide a clear regulatory framework for stablecoins. If passed, it would offer a clearer operating environment for highly compliant companies like Circle and create a potential "regulatory moat," further driving adoption of USDC by mainstream financial institutions.

Business Diversification: Circle is actively expanding businesses beyond interest income. This includes launching the Circle Payments Network (CPN), currently live in Hong Kong, Brazil, Nigeria, and Mexico, aiming to solidify the use of stablecoins in emerging markets and dollarization scenarios. Additionally, the company announced the Arc blockchain, a programmable infrastructure solution designed for payments, foreign exchange, capital markets, and other areas, with USDC serving as its native token. These initiatives are expected to open new revenue streams for Circle and reduce its dependence on interest rates.

Strategic Partnerships and Market Expansion: Collaborations with leading financial institutions and tech companies like BlackRock (managing over 90% of its reserves), Coinbase, Visa, and Mastercard help further expand USDC's application scenarios and global influence.

Risks and Challenges

Investing in CRCL also involves several risks:

Interest Rate Sensitivity: Circle's revenue is highly dependent on interest rate levels. If the Federal Reserve enters a rate-cutting cycle, its interest income could significantly decrease, impacting profitability and the stock price.

Intensifying Competition: The stablecoin market is becoming increasingly competitive. Circle faces ongoing pressure from Tether (USDT) (holding 61%-66% market share) and new entrants from traditional financial institutions like Fidelity, PayPal (with PYUSD), and Ripple (with Ripple USD).

Valuation Volatility: As of August 2025, CRCL's P/E ratio was as high as 509x, indicating the market has priced in very high expectations for its future growth. This high valuation also means the stock price could be very sensitive to any negative news or performance that falls short of expectations. Some analysts, such as those from JPMorgan and Mizuho, while acknowledging growth in parts of its business, remain concerned about valuation and market share, maintaining "Underweight" or "Underperform" ratings.

Investment Outlook

Financial market analysts hold differing views on CRCL's future trajectory, reflecting its characteristic blend of opportunity and risk:

Bullish Views: Some institutions are optimistic about Circle's leading position in the stablecoin market and its long-term growth potential. For example, Seaport Research set a price target of $280, citing that CRCL is the purest stablecoin investment play in the public market, and its deep cooperation with major trading platforms and the continued demand for stablecoins in decentralized finance (DeFi) will drive its growth.

Cautious and Neutral Views: More analysts, while affirming Circle's business fundamentals, express caution regarding its valuation and competitive landscape. Baird maintained a "Neutral" rating on CRCL, although lowering its price target from $210 to $185, noting that its core growth driver (USDC circulation) is expected to maintain a 40% compound annual growth rate (CAGR). JPMorgan, while raising its price target from $80 to $89, maintained an "Underweight" rating, concerned about its high valuation and stagnant USDC market share growth.

Conclusion

The listing of Circle Stock (CRCL) is undoubtedly a milestone event in the convergence of cryptocurrency and traditional finance. As a leading global regulated stablecoin issuer, Circle, through USDC, occupies a favorable position in the rapidly growing digital currency ecosystem. Potential regulatory clarity, its active efforts towards business diversification (like the Arc blockchain and payments network), and opportunities in vast potential markets like global cross-border payments all provide possible catalysts for its long-term growth.

However, investors must also be clearly aware of the challenges CRCL faces: its dependence on the interest rate cycle, exceptionally fierce market competition, and currently high valuation. These factors mean its stock price may continue to experience significant volatility.

Whether to invest in CRCL depends on the investor's risk appetite, investment horizon, and judgment regarding the long-term prospects of stablecoins and blockchain technology. For investors bullish on the future of the "digital dollar" and willing to tolerate higher volatility, CRCL offers a unique opportunity to directly participate in the growth of crypto financial infrastructure. For risk-averse investors, it might be prudent to wait for a more reasonable valuation entry point or clearer signals of falling interest rates.

In conclusion, Circle's story is far from over. It is filled with the potential to reshape the financial landscape but must also navigate storms on the path forward. Investors need to stay informed, evaluate carefully, and be prepared for a long-term commitment.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.