Introduction to the GENIUS Act

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) represents the first comprehensive federal effort to regulate stablecoins—cryptocurrencies pegged to stable assets like the U.S. dollar. The Genius Act was passed by the U.S. Senate on June 17, 2025 with a vote of 68-30. The core content of the bill includes: requiring stablecoins to be 1:1 backed by highly liquid assets (such as cash, short-term U.S. Treasury bonds, etc.); prohibiting stablecoins from paying interest or income; establishing a federal and state dual-tier regulatory system; clarifying the capital and liquidity requirements of stablecoin issuers.

The legislation is one of three bills, along with ones to address market structure and central bank digital currencies, that Republican House leaders had been pushing as part of the party’s “crypto week” plans.

The Other Major Bills At the Heart of Crypto Week 2025

1. The CLARITY Act (Digital Asset Market Structure)

The CLARITY Act is designed to settle one of the most contentious issues in crypto regulation: whether digital assets should be treated as securities or commodities. The bill draws clear lines between the jurisdictions of the SEC and the CFTC, aiming to prevent overlapping (and often conflicting) enforcement actions. It also introduces a framework for crypto projects to launch and operate legally without getting caught in regulatory limbo. For builders and exchanges, this could finally mean knowing which rules to follow, and which agency is watching.

2. The Anti-CBDC Surveillance State Act

This bill takes a firm stance against a government-backed digital dollar. If passed, it would ban the Federal Reserve from issuing a central bank digital currency (CBDC) without explicit approval from Congress. Supporters argue it’s about protecting financial privacy and preventing surveillance through programmable money. Critics say it’s more political theater than policy necessity, since the Fed hasn’t announced any concrete plans to launch a CBDC. Still, the bill reflects growing resistance to centralized digital currencies, especially among privacy-focused lawmakers and crypto advocates.

Main Highlights of the GENIUS Act

The GENIUS Act seeks to establish a regulatory framework for stablecoin issuers, requiring them to hold reserves of safe, liquid assets such as U.S. dollars and Treasury bills. This measure is intended to protect consumers by ensuring that stablecoins maintain their value and can be redeemed for fiat currency. Additionally, the bill mandates monthly public disclosures of these reserves.

The legislation also introduces restrictions on non-financial public companies wishing to issue stablecoins, requiring them to obtain special approval from a regulatory committee. This aims to prevent large technology firms from dominating the stablecoin market without proper oversight.

Market Impact and Competitive Shifts

The Act disproportionately affects major stablecoin players:

-

Tether (USDT): Faces existential threat due to non-compliant reserves. Only 81.5% of USDT is backed by cash/short-term deposits—below the 100% high-liquidity mandate. Its Italian auditor, BDO, lacks U.S. (PCAOB) certification. With a three-year transition window, USDT risks exclusion from U.S. banking and payment systems.

-

Circle (USDC): Emerges as a clear winner. Its fully compliant reserves (80% short-term Treasuries, 20% cash) and U.S. operational base aligns with the bill. Circle's stock surged 35% post-Senate passage, and partnerships like Shopify signal institutional adoption.

-

DeFi and Innovation: While the yield ban disrupts protocols relying on interest-bearing stablecoins (e.g., DeFi lending pools), it may force healthier innovation. Projects must build "external yield" via auditable strategies (e.g., delta-neutral hedging) rather than embedding returns in stablecoins themselves.

Support and Criticism

Advocates of the GENIUS Act contend that it will establish much-needed regulatory clarity, thereby encouraging the adoption of stablecoins and fostering innovation within digital payments. They believe the legislation will strengthen consumer protections and promote healthy competition among stablecoin issuers.

Conversely, some critics, including certain Democratic senators, have expressed concerns regarding the bill's perceived leniency toward the cryptocurrency industry. They argue that the proposed regulations may be inadequate to address potential conflicts of interest and issues of governance, particularly in light of past controversies involving political figures and their associations with the cryptocurrency sector.

Legislative Roadblocks and Recent Developments

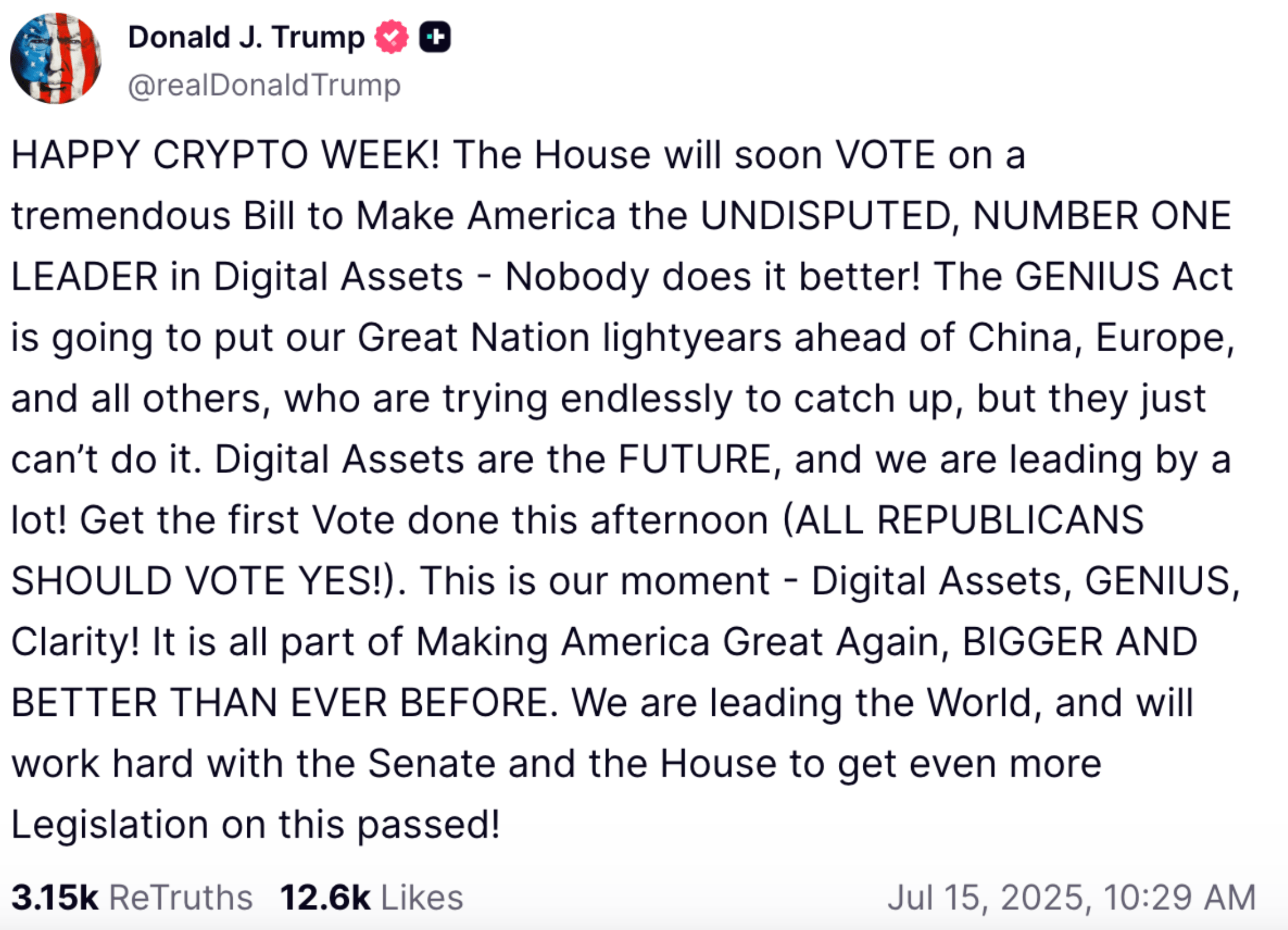

In a Tuesday post on his social media platform Truth Social, Trump ordered all Republicans to vote yes on the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, a bill designed to regulate payment stablecoins in the US.

On July 15, 2025, the House failed to advance the GENIUS Act in a procedural vote (196-223), stalling its progress alongside the CLARITY Act and Anti-CBDC Act1. Key reasons include:

Republican Divisions: 13 Republicans joined 210 Democrats opposing the motion. Internal disputes centered on merging the GENIUS Act with the broader CLARITY Act, which defines SEC/CFTC jurisdiction over digital assets.

Unrelated Amendments: Efforts to attach contentious amendments, like Rep. Ro Khanna's proposal to release Epstein files, further complicated debate. The House Rules Committee rejected this amendment 5-7, with Republicans arguing it was irrelevant to crypto regulation.

House Speaker Mike Johnson reportedly said the chamber may take up another vote “this afternoon.”

The GENIUS Act remains stalled in the House. Its advancement requires renewed bipartisan negotiation, likely involving concessions on oversight structures (e.g., the controversial "Digital Asset Oversight Committee") and consolidation with broader crypto reforms. While the Senate’s approval marked a landmark step toward regulatory clarity, the House impasse underscores the volatile intersection of innovation, politics, and financial sovereignty.

Signing off on a Stablecoin Law While Investing in Stablecoins?

Trump has personally come under scrutiny for his role in pushing stablecoin legislation due to his involvement in his family-backed crypto company World Liberty Financial (WLF), which issued its own stablecoin and suggested a conflict of interest. Bloomberg reported on Friday that Binance helped create WLF’s USD1 stablecoin, also used by an Abu Dhabi-based investment firm to settle a $2 billion investment into the crypto exchange.

“World Liberty Financial has received a significant portion of its funding from overseas, which has brought about serious ethical and national security concerns,” said California Representative Maxine Waters’ office on Tuesday, adding: “ Foreign investment is not just a business deal, it’s a direct payment to the sitting US president with the goal of currying favor and influence within the White House.”

Many Democratic leaders have responded to Republicans’ push for the digital assets bills with their own “anti-crypto corruption week” agenda. They are calling for amendments to the three bills to address consumer protection and prevent the president, vice president, and members of Congress from holding or promoting crypto over concerns with conflicts of interest.

Crypto Week 2025 Schedule: Key Dates

The Congress has scheduled a comprehensive agenda for Crypto Week, including floor debates, procedural votes, and the anticipated final approval of at least one significant piece of legislation. While congressional schedules are subject to change, here is the expected timeline:

Monday, July 14: Official commencement of Crypto Week. The House Rules Committee convened to establish the terms for debate on three key bills, determining debate durations and whether amendments will be permitted.

Tuesday, July 15: Formal debates are set to begin on the House floor. Lawmakers will present arguments for and against the CLARITY Act, the GENIUS Act, and the Anti-CBDC Act. No votes are scheduled at this stage, but the discussions will outline the legislative direction.

Wednesday, July 16: The first major votes are anticipated. The House is expected to vote on the CLARITY Act (regarding market structure) and the Anti-CBDC Act (concerning digital dollar bans).

Thursday, July 17: The House is scheduled to vote on the GENIUS Act (pertaining to stablecoin regulation), which has already received Senate approval and may proceed directly to the President for signature.

Friday, July 18: A buffer day is allocated for any remaining votes or procedural matters. Members may also utilize this time for press briefings and post-vote analyses.

This concentrated schedule is somewhat unusual for Congress, as dedicated weeklong focus on a single policy area is rare. It indicates a strong congressional interest in crypto legislation and a concerted effort to establish a clear regulatory framework.

Conclusion

The GENIUS Act is seen as a pivotal step in the broader effort to regulate the cryptocurrency market. Its passage could pave the way for additional legislation addressing other aspects of the crypto ecosystem, such as the regulation of crypto exchanges and the classification of digital assets.

The bill's progress has been closely watched by industry stakeholders, who are eager to see how it might influence the future of digital finance in the United States. The outcome of this legislative effort could have significant implications for the global cryptocurrency market.

As the GENIUS Act moves through the legislative process, it remains a focal point of debate among lawmakers, industry leaders, and consumer advocates. While the bill represents a significant step towards regulating stablecoins, its ultimate impact will depend on the final provisions and how they are enforced. The ongoing discussions highlight the challenges and opportunities of integrating digital currencies into the mainstream financial system.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.