Imagine a world where software doesn't just follow commands but actually thinks, learns, and makes decisions on its own—without needing someone to constantly guide it. That's what AI Agents do. They are intelligent programs that operate independently. They can learn from information, decide what to do, and take actions all by themselves.

But what happens when these AI Agents are combined with blockchain technology? They then become powerful financial tools—helping with trading, managing risks, and even protecting networks. While this sounds very promising, there are some challenges involved, and understanding these obstacles is important to making the most of these tools.

So, what exactly are AI Agents, and how are they changing the world of cryptocurrency? Let’s explore.

The Functionality and Applications of AI Agents

AI agents operate through steps that include goal definition, data gathering, analysis, decision-making, monitoring and continual learning. They utilize large language models (LLMs) to process vast amounts of data and adapt to dynamic environments effectively. Unlike traditional programs, AI agents can self-learn and adjust their actions based on real-time conditions, making them suitable for complex tasks in the web3 environment.

AI agents are autonomous software programs that perform tasks, make decisions, or interact with users, based on goals, prompts, or real-time data. While traditional AI agents operate across industries like finance, healthcare, or customer support, the Web3 ecosystem is now giving rise to crypto-native agents with distinct capabilities and roles.

In Web3, AI agents are evolving to specialize. Some act as on-chain DeFi agents, executing trades, managing yield strategies, or serving as portfolio copilots. Others are social agents, representing users in decentralized social apps, managing profiles, or even responding to messages and interactions. In the gaming space, we’re seeing a new category of game-native agents, AI companions trained on lore, game mechanics, or player behavior, serving as helpful guides or even opponents.

This isn’t theoretical. According to cookie.fun, a protocol tracking the agent economy, 1,748 AI agents are already active across various environments. On Virtuals Protocol, which allows users to create and deploy their own AI agents, over 17,000 agents have been launched since its inception in November 2024. The real number is likely even higher, as multiple chains are now prioritizing infrastructure for AI agent creation, training, and deployment.

AI Agent Tokens: Utility, Hype, and Capital

Most AI agents in Web3 don’t launch alone, they come with a token. These tokens can serve multiple roles depending on the project’s vision. In many cases, they are designed to power community governance, enable access to advanced features, or serve as a mechanism for funding development, especially as training and maintaining AI agents remains resource-intensive.

For others, the token is simply a capitalization strategy, a way to bootstrap liquidity, reward early adopters, or tap into market momentum. And in some cases, they’re closer to memecoins in AI clothing, tokens launched around vague agent narratives with little technical substance, riding waves of speculative hype.

Despite the noise, the AI agent token market has seen impressive traction. At the time of writing, the total market capitalization for AI-related tokens sits at $5.9 billion, representing 0.18% of the entire crypto market. Daily trading volume is significant too, crossing $1.4 billion in the last 24 hours.

However, the trend hasn’t been bullish recently. At the start of the month, the AI agent sector held a market cap of $16.6 billion, meaning the space has shed 64% of its value in a matter of weeks. This drop reflects broader market conditions, not just sentiment toward AI. But it also shows the volatility that comes with early-stage sectors where token hype often outpaces real utility.

AI agents are here to stay. But their tokens? The signal-to-noise ratio still needs work.

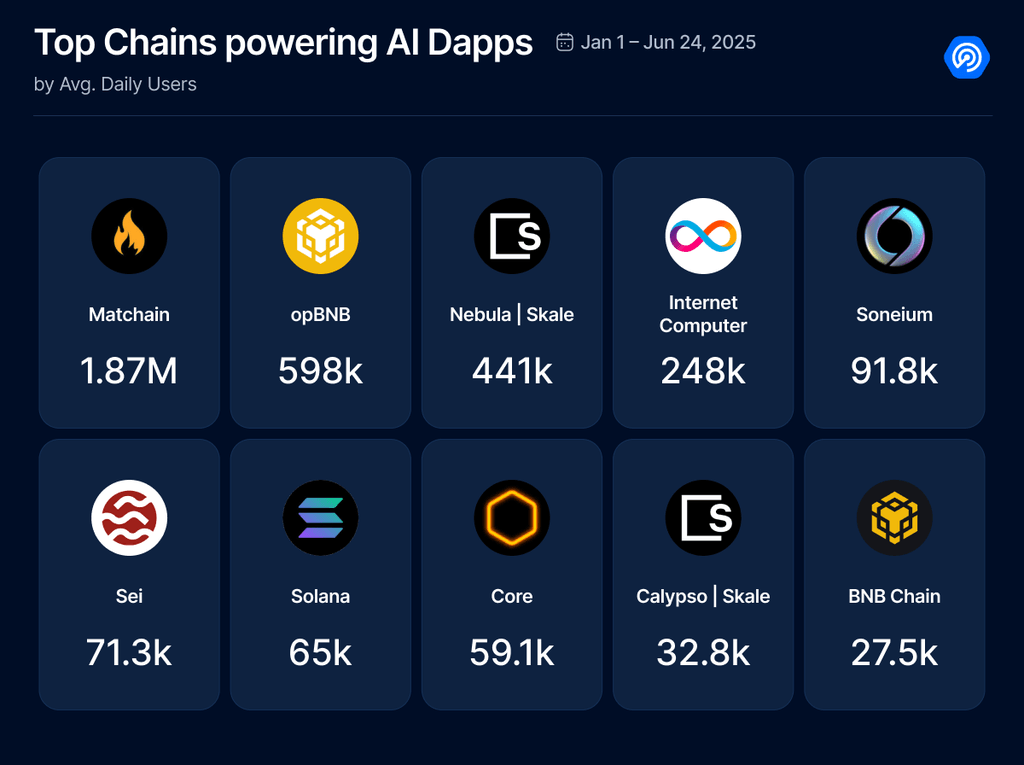

Top Chains Powering AI Dapps

While AI agents are often the visible layer, interacting with users, executing trades, or providing in-game assistance, their success depends heavily on the infrastructure underneath. Chains that support high-volume AI dapps are effectively laying the foundation for AI agent deployment, training, and interaction.

Between January and June 24, 2025, the following chains have emerged as the most active in terms of AI dapp usage:

Matchain dominates with nearly 1.9 million daily users, pointing to a thriving AI infrastructure, driven by social or agent-facing dapps. opBNB and Nebula follow, both showing strong usage that are linked to lightweight to gamified AI services.

While not all of these dapps currently deploy agents, the momentum is clear. As AI agent frameworks mature, these chains could be positioned to onboard the next wave of autonomous agents, be it in DeFi, gaming, or social applications.

We’re likely still in the infrastructure phase of the AI agent movement, and these networks are leading the build.

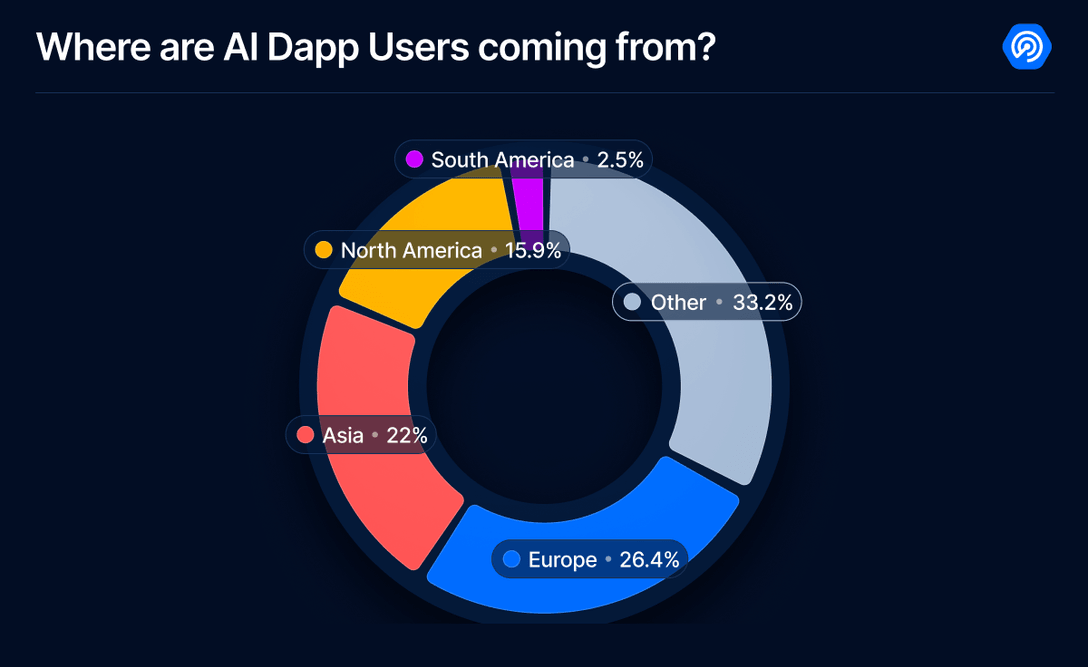

Where Are Users Coming From?

AI agents may live on-chain, but their users are distributed across the globe. Understanding where engagement is coming from helps paint a clearer picture of adoption trends, localization needs, and potential market opportunities.

Between January and June 2025, data from our own traffic reveals that Europe leads in AI-related dapp interactions, accounting for 26.2% of all sessions. Close behind is Asia, with 21.9%, followed by North America at 15.8%. While South America represents a smaller slice at 2.5%, its emerging user base is growing. Interestingly, a significant share, 33% comes from unspecified or less easily categorized regions, grouped here as “Other.” This includes traffic from anonymized sources, VPNs, or long-tail geographies.

This global spread indicates that AI agents are not a localized phenomenon. Whether it’s a DeFi agent managing trades in Asia, a social agent representing users in Europe, or gaming companions interacting with players in North America, the demand is diverse, and increasingly cross-continental.

As the sector matures, we expect more regionalized agent behavior, better language modeling, and even geo-specific agent personalities. For now, the playing field is broad, and the race for user mindshare is global.

Investment Flows into AI Agents

The AI narrative continues to dominate headlines, and funding rounds. While centralized AI giants like OpenAI, Anthropic, and Mistral have captured billions in capital, the AI agent economy within Web3 is starting to draw serious attention of its own.

So far in 2025, $1.39 billion has been raised by AI agent projects representing a 9.4% increase compared to 2024. This signals growing conviction from investors that autonomous, on-chain agents could be the next frontier, not just an experimental layer. And while this number still trails centralized AI funding by several multiples, it’s worth noting that funding in the AI agent space now rivals or exceeds other Web3 verticals like blockchain gaming.

The comparison matters. Centralized AI investment is still dominant, with tens of billions flowing into model development, chips, and infrastructure. But in Web3, investors are increasingly seeing AI agents as a new primitive, one that could reshape how users interact with protocols, navigate dapps, or even automate personal financial strategies.

The momentum is building. And if this pace continues, 2025 could be the first year AI agents attract more capital than any other Web3 vertical.

Conclusion

The growth of AI agents shows a big change in how we connect with decentralized systems. From cryptocurrency traders and social friends to game helpers, these agents are becoming more than just experimental programs—they are turning into essential infrastructure.

The numbers tell the story: over 17,000 agents have been launched on Virtuals since late 2024. The AI token market is now worth $5.9 billion, even during tough market times. This year alone, startups focused on AI agents have raised $1.39 billion in funding. People around the world are engaging with these tools, especially in Europe, Asia, and North America.

However, there are still challenges. Many tokens are driven more by hype than actual usefulness. Not all agents work fully on their own as promised. Also, the infrastructure across different blockchain networks is still developing unevenly. But as the technology improves and real-world uses become clearer, interacting with AI directly on the blockchain is becoming more common—almost the new normal.

The race is on to create smarter agents, better ecosystems, and clearer standards. And we are still in the early stages of this development.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.