The stablecoin market, valued at over

$284 billion

, has just welcomed a groundbreaking new participant. On

September 15, 2025

, MetaMask, the world's leading self-custodial cryptocurrency wallet, launched

MetaMask USD (mUSD)

, its native stablecoin. This isn't just another dollar-pegged token; it represents a strategic shift towards integrated financial services within wallet ecosystems and marks the first time a major self-custodial wallet has ventured into native stablecoin issuance. The launch comes at a pivotal moment, following regulatory clarity provided by the

U.S. GENIUS Act

, and signals MetaMask's ambition to evolve beyond a simple wallet into a comprehensive

DeFi super application

.

mUSD Chart. Source: MetaMask

A New Era of Wallet-Native Stablecoins

MetaMask USD (mUSD) is designed from the ground up for seamless integration within the MetaMask ecosystem. Unlike existing stablecoins that operate independently of wallets, mUSD is

natively woven into MetaMask's core functionality, including its

Swap and

Bridge features. This deep integration allows over

100 million MetaMask usersworldwide to access low-cost fiat on-ramps, execute swaps, and conduct cross-chain transactions without ever leaving the wallet interface.

The initial launch supports both the

Ethereum

mainnet and

Linea, Consensys's Layer-2 scaling solution. This dual-chain approach ensures broad compatibility while positioning mUSD as a foundational asset for the growing Linea

DeFi ecosystem, where it is expected to fuel protocol growth and increase total value locked (TVL).

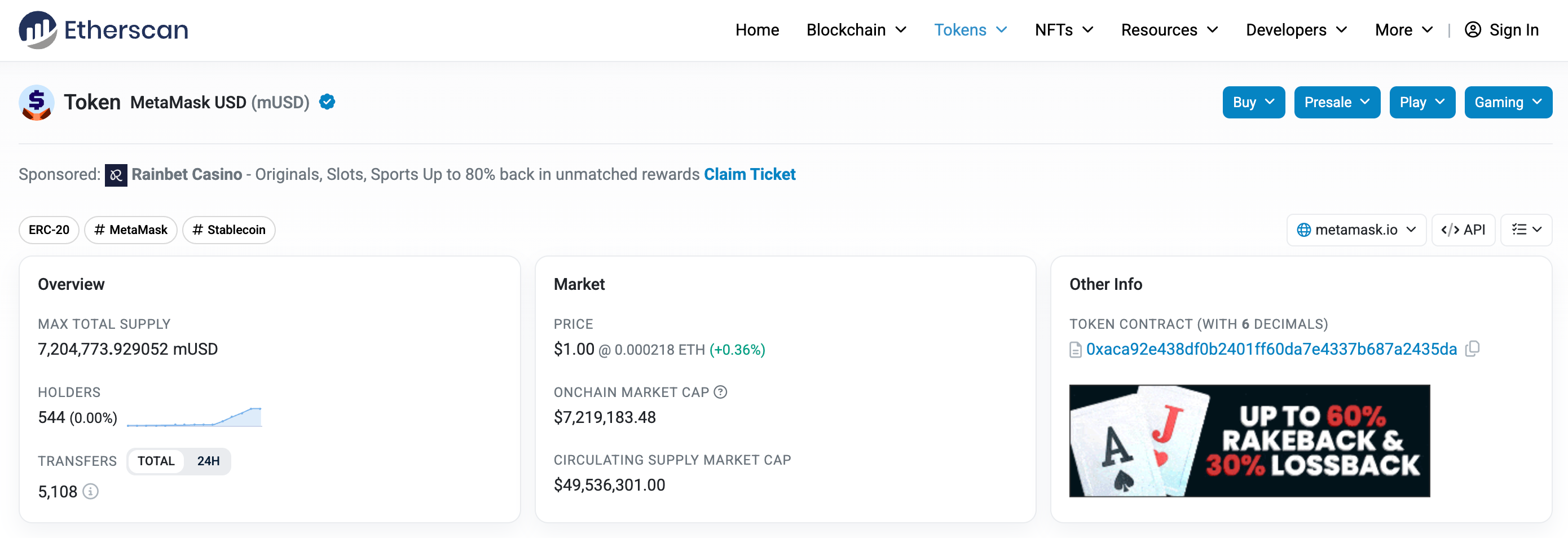

Currently, the MetaMask official website has provided an interface for purchasing and exchanging mUSD. Less than 24 hours after mUSD went online, according to

Etherscan data . As of the time of writing, the current circulating supply of mUSD is 49.41 million, of which 545 holders have held the currency and 5,109 transactions have been completed.

Overview of mUSD token. Source: Etherscan

The Tripartite Model: Architecture and Key Partners

MetaMask's innovative approach to mUSD involves a collaborative tripartite model that leverages the strengths of specialized partners for issuance, compliance, and technological infrastructure.

Bridge (A Stripe Company): The Regulated Issuer

Bridge, acquired by payment giant Stripe for

$1.1 billion in 2024, serves as the regulated entity responsible for mUSD issuance. It handles the critical functions of

compliance, monitoring, and reserve management, ensuring that every mUSD token is backed 1:1 by highly liquid dollar-equivalent assets like cash and short-term U.S. Treasuries. Bridge's technology dramatically reduced the development and integration time for mUSD, compressing a process that traditionally took over a year into just a few weeks.

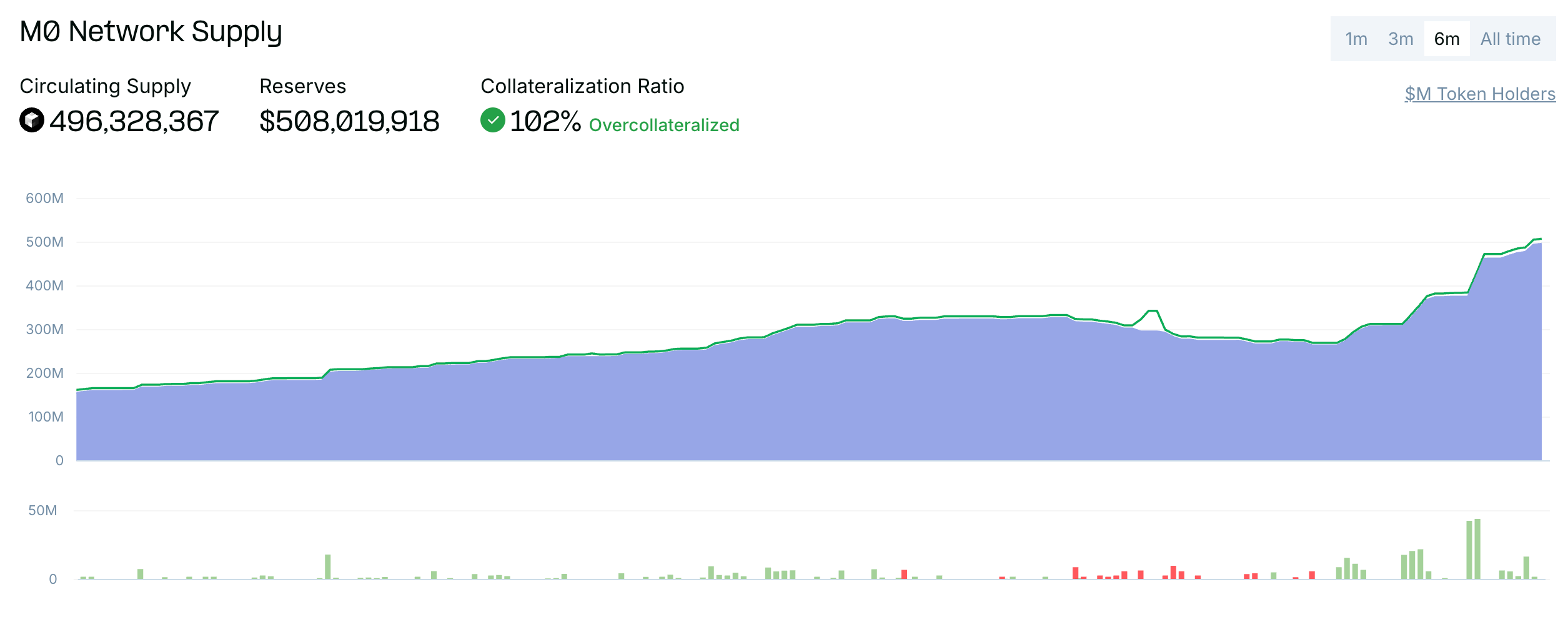

M0: The Programmable Infrastructure Layer

M0 provides the decentralized technical infrastructure that powers mUSD's on-chain operations. Its platform separates reserve management from programmability, allowing developers to define rules for minting, burning, and transferring tokens while enabling customization for new revenue streams and loyalty opportunities. M0, which raised

$40 millionin late August 2025, also implements a

real-time

proof-of-reserves mechanism, allowing users to transparently verify that mUSD's circulating supply is fully backed at all times.

The overcollateralization ratio is approximately 102%. Source: Dashboard

MetaMask: The Ecosystem Integrator

MetaMask's role is to seamlessly embed mUSD into its wallet experience for its massive user base. It manages the user-facing elements, including purchasing, swapping, and soon, spending via the MetaMask Card.

Strategic Positioning and Target Applications

mUSD is strategically positioned as a high-utility stablecoin within two primary spheres: the digital blockchain environment and the physical world of everyday commerce.

On-Chain Utility: Within web3, mUSD aims to be the default dollar-denominated asset for trading, lending, borrowing, and transacting across decentralized applications (dApps) in the MetaMask ecosystem. Its native integration eliminates the need to bridge external stablecoins, reducing friction and costs for users.

Real-World Payments: A cornerstone of mUSD's strategy is its integration with the

MetaMask Card. By the end of 2025, holders will be able to spend their mUSD directly at over

150 million merchants worldwide that accept Mastercard. This functionality bridges the gap between digital assets and traditional finance, offering a practical use case for cryptocurrencies in daily life.

Gal Eldar, Product Manager at MetaMask, stated this integration is "a key step in bringing the world on-chain" and helps "break down some of the most stubborn obstacles in web3, reducing entry friction and costs for users.".

Reserve Mechanism and Transparency

Trust in a

stablecoin is paramount, and mUSD addresses this through a commitment to transparency and robust collateralization.

The reserve mechanism is designed for stability and auditability. mUSD employs an

over-collateralization model. At launch, the collateral value (

$24,814,938) exceeded the circulating supply (

$24,318,639), resulting in an over-collateralization ratio of approximately

102%. The system also maintains a

stability reserve of nearly $500,000 as an additional buffer against market volatility.

The collateral backing mUSD consists exclusively of

highly liquid, low-risk assets such as U.S. Treasury bonds. Furthermore, M0's infrastructure provides real-time, on-chain verification of reserves, moving beyond traditional periodic audit reports to offer continuous transparency.

Fueling the Ascent of Linea and MetaMask's Super App Ambitions

The launch of mUSD is more than a product release; it's a strategic move in a competitive market. Recent data indicates a dip in MetaMask's monthly active users, with its market share among wallets falling to

14.8%. Meanwhile, established DeFi protocols like Uniswap and Aave are evolving into multi-functional super applications.

mUSD represents a direct response to this competitive pressure. By launching its stablecoin, MetaMask aims to:

Increase Ecosystem Loyalty: Keeping users within the MetaMask ecosystem for all their financial activities, from managing funds to spending them.

Capture New Value: potentially generating revenue through means such as interest in reserve assets or ecosystem fees.

Boost Linea's Growth: As a foundational asset on Linea, mUSD is expected to attract liquidity and drive the growth of DeFi protocols on the network, increasing its overall TVL and activity.

This initiative is a critical component of MetaMask's transformation from a

tool into a

destination, a comprehensive super application for DeFi and beyond.

Future Outlook and Conclusion

The future roadmap for mUSD includes expansion across several dimensions.

Wormhole has been confirmed as an interoperability partner to facilitate mUSD's expansion to multiple blockchain ecosystems, enhancing its liquidity and utility across DeFi. Furthermore, while not yet active for mUSD, MetaMask has previously explored

savings and yield-earning features for stablecoins, suggesting that native yield-bearing options for mUSD could be a likely future development.

In a recent interview, Consensys CEO

Joe Lubin hinted at even broader ambitions for the MetaMask ecosystem, stating that a native MetaMask token is coming and might arrive "sooner than you expect". This suggests that mUSD could be a foundational element in a much larger token-based economic system within the wallet.

Conclusion

MetaMask's launch of mUSD is a watershed moment for the integration of stablecoins and wallet services. By leveraging a unique tripartite model with Bridge and M0, MetaMask has introduced a stablecoin that is deeply integrated, transparently backed, and poised for both digital and real-world use.

Beyond competing in the vast stablecoin market, mUSD is a strategic gambit to solidify MetaMask's position as a central hub in the crypto economy. It accelerates the convergence of decentralized finance and traditional payment rails, potentially onboarding millions to a new financial paradigm where the wallet is not just a gateway but the foundation for a seamless, unified economic experience.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.