Whether it is a traditional bank or a crypto trading exchange, users’ top concern is whether they can withdraw their money anytime. Here’s a look at the deposit reserve system adopted by traditional banks and the 100% proof of reserve in the crypto industry. How the two systems work to ensure users’ withdrawals will be also explained clearly.

Fractional Reserve and Bank Run

Deposit reserve refers to the amount of cash that financial institutions must hold in reserve to guarantee clients’ withdrawal. The reserve ratio refers to the proportion of the said amount in the total deposits. For example, Alice deposits $1,000 in a bank. Assuming that the current reserve ratio is set at 10%, the bank can use Alice’s deposit of $900 to make loans or financial investments, and hold the remaining $100 in reserve to ensure that it will not refuse Alice’s withdrawal due to lack of cash.

Given that 10,000 users make deposits of $1,000 just like Alice, a reserve ratio of 10% will allow 1,000 users to withdraw money simultaneously. Since it is rare that massive withdrawals are made in a short time, a reasonable reserve ratio generally works.

A bank run occurs when large groups of depositors withdraw their money from financial institutions simultaneously due to market panic or the fear that the bank will become insolvent. Banks face insolvency when they run out of cash. Hence, they will suspend withdrawals or seek government assistance during bank runs. Many countries, including the US, Russia and the UK, have suffered bank runs in history.

The 100% Proof of Reserve in the Crypto Industry

Some exchanges mistakenly think they have the liberty of using deposits for other purposes just as traditional banks do, leading to the abuse of user assets in the industry as we see today.

When a bank run occurs, even deposit insurance cannot guarantee that clients will immediately withdraw their money. Major traditional banks may become insolvent during bank runs. Similarly, crypto exchanges cannot rely on fractional deposits to protect the security of users’ funds. When large numbers of users withdraw their deposits simultaneously, only financial institutions with a reserve ratio of 100% can manage to cope.

To ensure the security of users’ funds, crypto exchanges should maintain a 100% reserve and hold actual assets in reserve for the withdrawal of funds like BTC/ETH/USDT. The 100% proof of reserve refers to the proof that the exchange keeps a reserve ratio of 100%, and the proof is transparent and verifiable.

How to Use the Merkle Tree and Signature To Verify the Proof of Reserve?

The 100% proof of reserve takes three steps:

-

Reveal the total amount of assets deposited by all users on the exchange;

-

Reveal the amount of assets available for withdrawal on the exchange;

-

Compare the total deposits of users and the total assets of the exchange to verify the reserve ratio.

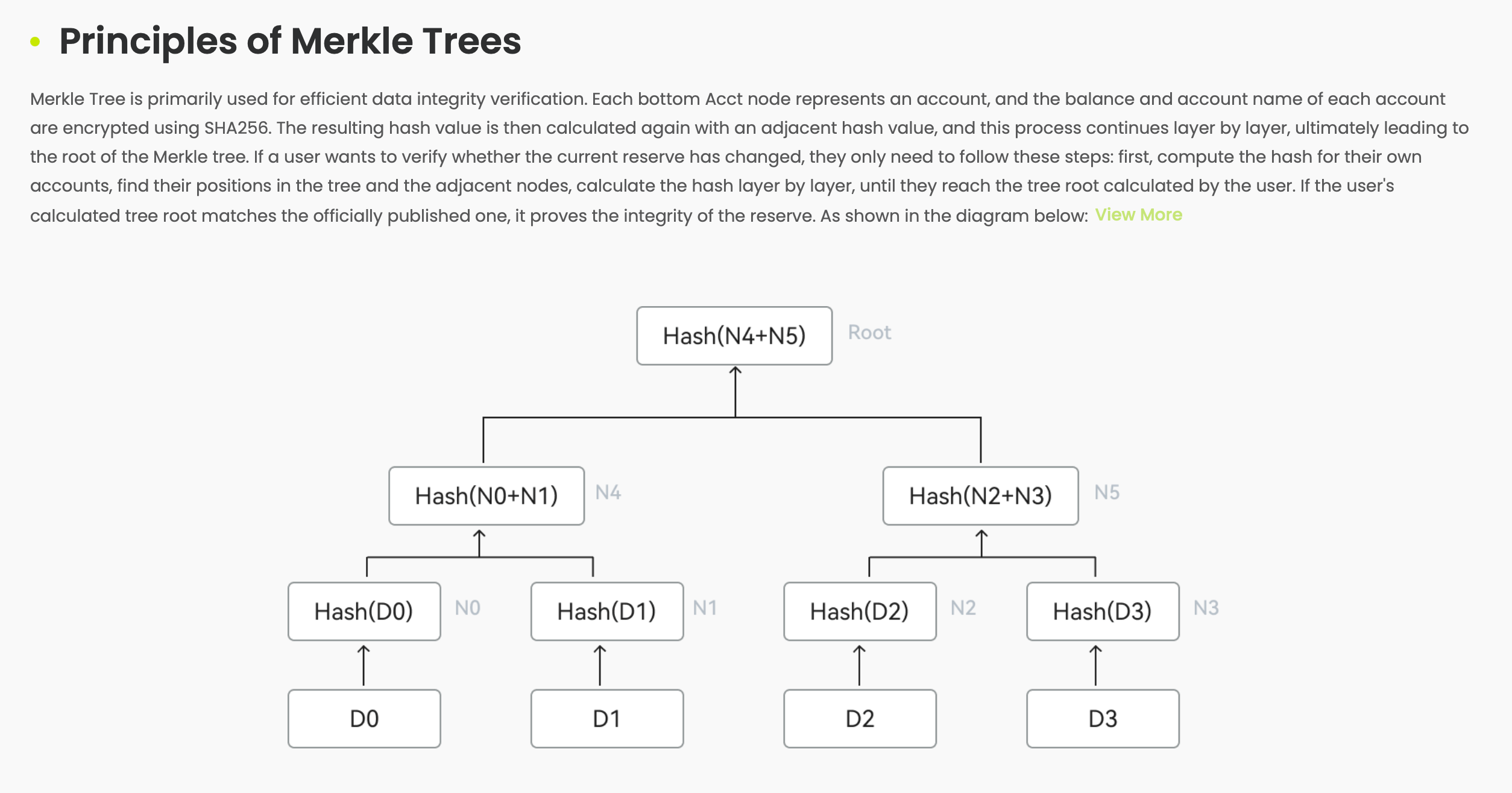

Merkle Tree is primarily used for efficient data integrity verification. Each bottom Acct node represents an account, and the balance and account name of each account are encrypted using SHA256. The resulting hash value is then calculated again with an adjacent hash value, and this process continues layer by layer, ultimately leading to the root of the Merkle tree. If a user wants to verify whether the current reserve has changed, they only need to follow these steps: first, compute the hash for their own accounts, find their positions in the tree and the adjacent nodes, calculate the hash layer by layer, until they reach the tree root calculated by the user. If the user's calculated tree root matches the officially published one, it proves the integrity of the reserve. As shown in the diagram below:

For example, D0 has 1 BTC and 1 ETH. The parent node Hash (D0) can be calculated based on the data. The Hash (N0+N1) can be calculated based on the sibling node Hash (D0) on the path, and then the root Hash (N4+N5) can be calculated accordingly.

If the Merkel tree omits or tampers with the data of D0, all the parent nodes including Hash (D0) and Hash (N1+N1) calculated will change. Finally, the value of the root Hash (N4+N5) obtained will be different from that published by the exchange. Users will immediately find that the exchange has tampered with the data. This mode of user self-verification can effectively prevent the exchange from falsifying the data of users’ total assets.

For Step 2, the asymmetric encryption algorithm is used for signature verification. As is well known, a cryptocurrency address is generated by algorithms during an encryption process from the private key to the public key. Hence, the exchange can encrypt a message through the private key to generate a signature, and users can decrypt the original message through the signature and address (public key). In this way, it is verified that the exchange holds the private key to the address.

The Merkle tree and the process of signature verification are based on irreversible algorithms, so the authenticity of dates can be well guaranteed. After verifying the authenticity of the data about users’ total assets and the assets held by the exchange, the two data can be compared. When the assets held by the exchange are more than or equal to the total assets of the users, it proves that the exchange has maintained a reserve ratio of 100%.

Reasons for 100% Proof of Reserve

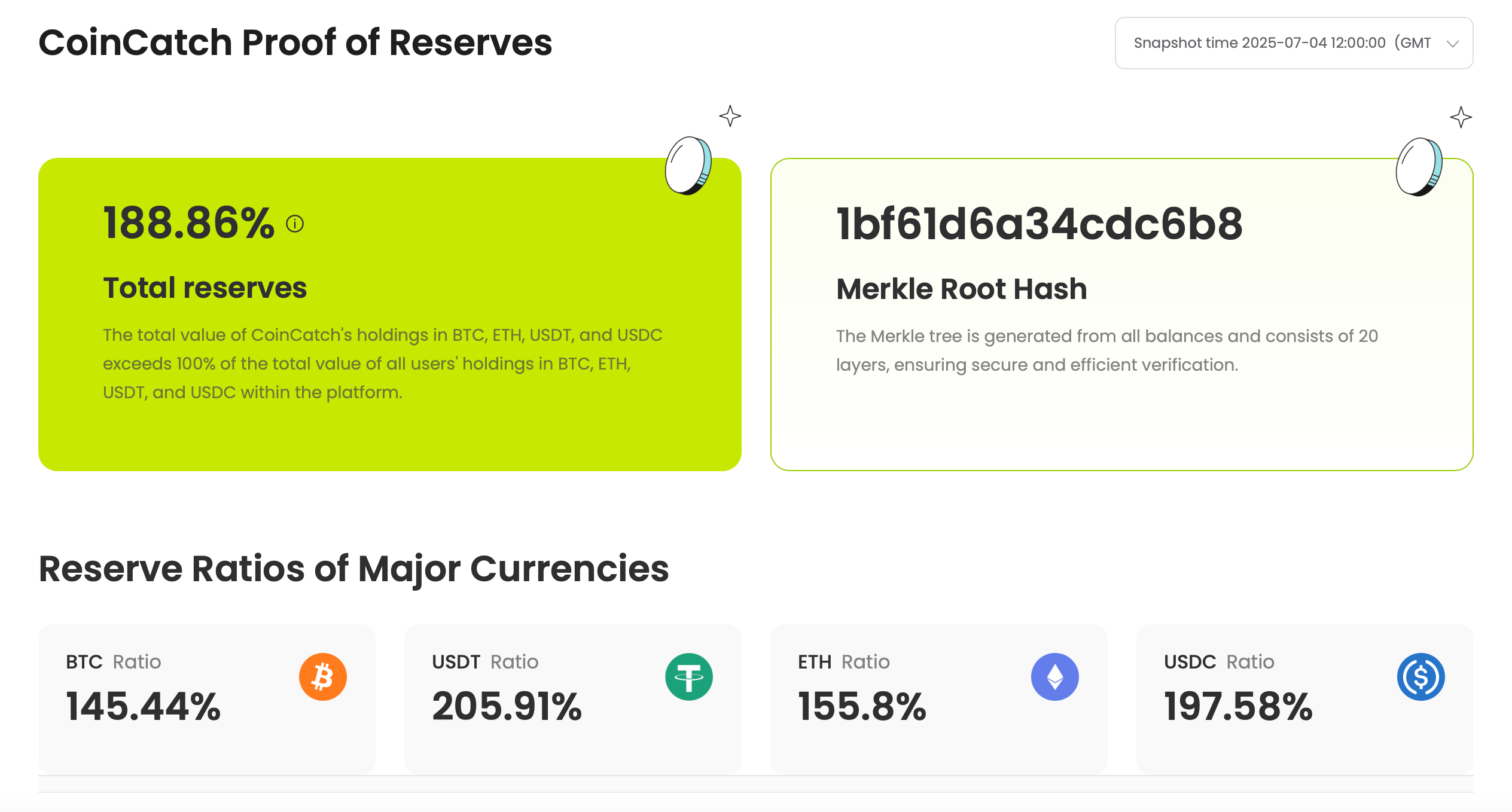

The proof of reserve can help to improve transparency for the benefits of both the industry and users. Currently, the misappropriation of assets by some exchanges has concerned numerous users. As a long-term believer in the crypto industry, CoinCatch aims to build a trust system for the industry and promote the sound development of the crypto world. That is why the exchange is among the first in the industry to reveal its Proof of Reserve.

CoinCatch always regards security as the bottom line. The exchange never uses users’ crypto assets for any other purposes, and always honors 100% of their withdrawals.

Openness, transparency, security and trust represent the future trends of the crypto world. CoinCatch has relied on the trust and support of its users over the years. In days to come, CoinCatch will continue to maintain its commitment that all funds will be reserved and adhere to the openness and transparency of the reserve and assets. Driven by its slogan of “

Best

Crypto Exchange

Worldwide for Derivatives Trading

.”, it aims to provide users with a safe and trustworthy crypto investment environment.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.