The cryptocurrency futures market has evolved significantly since its inception, now offering sophisticated products that rival traditional financial derivatives. Platforms like CoinCatch have emerged to serve this growing demand, providing user-friendly interfaces and educational resources to help traders navigate the complexities of leveraged trading. Whether you're looking to hedge your spot positions or speculate on price movements, understanding the mechanics of futures trading is essential for managing risk and maximizing potential opportunities in the volatile crypto market.

What Are Futures?

Futures are standardized financial contracts that obligate the buyer to purchase, and the seller to sell, a specific asset at a predetermined price and date in the future. Unlike spot trading where assets are exchanged immediately, futures contracts derive their value from an underlying asset but are settled at a later date. In the cryptocurrency context, these contracts allow traders to speculate on the future price of digital assets like Bitcoin, Ethereum, and other cryptocurrencies without actually owning the underlying assets.

The concept of futures trading isn't new to cryptocurrency—it has existed in traditional markets for centuries, dating back to ancient civilizations where farmers would negotiate future delivery of crops. Modern financial futures originated in 1970s Chicago, but cryptocurrency futures represent a relatively recent innovation, having gained significant traction only since the late 2010s. The fundamental purpose remains the same: to allow market participants to manage price risk by locking in prices for future transactions.

In cryptocurrency markets, futures have become particularly popular due to the high volatility of digital assets. They offer traders the ability to profit from both rising and falling markets, provide leverage opportunities, and enable sophisticated trading strategies that aren't possible with spot trading alone. The standardization of these contracts across exchanges has created a liquid market where participants can easily enter and exit positions.

How Do Futures Work?

Futures contracts operate through a centralized exchange that standardizes the terms of each contract, including the contract size, expiration date, and settlement method. When a trader opens a futures position, they're required to post collateral known as margin, which represents a fraction of the total contract value. This margin requirement enables the leverage effect that characterizes futures trading.

The mechanics of futures trading involve two primary positions: long and short. When a trader goes long, they're agreeing to buy the underlying asset at a specified price in the future, anticipating that the price will rise. Conversely, when a trader goes short, they're agreeing to sell the underlying asset at a specified price, expecting the price to fall. This ability to profit from both directions is one of the key attractions of futures trading, especially in volatile cryptocurrency markets.

Cryptocurrency futures typically use one of two settlement methods: physical delivery or cash settlement. Physical delivery requires the actual transfer of the underlying cryptocurrency upon expiration, while cash settlement converts the position into its monetary value based on the difference between the entry price and settlement price. Most crypto traders prefer cash-settled contracts due to their convenience and the fact that they don't require handling the actual cryptocurrencies.

Table: Key Components of Futures Contracts

| Component |

Description |

Example in Crypto Futures |

| Contract Size |

The amount of underlying asset per contract |

1 Bitcoin per BTCUSD contract |

| Tick Size |

Minimum price movement of the contract |

$0.50 for Bitcoin futures |

| Expiration Date |

When the contract settles and expires |

Last Friday of the quarter |

| Margin Requirement |

Collateral required to open a position |

5-15% of contract value |

| Settlement Type |

How the contract is settled at expiration |

Physical delivery or cash settlement |

Basic Concepts of Futures Trading

Understanding futures trading requires familiarity with several key concepts that govern how these instruments function. These concepts form the foundation for developing effective trading strategies and managing risk appropriately.

Leverage and Margin: Leverage allows traders to control a large position with a relatively small amount of capital. In futures trading, this is made possible through margin requirements, which typically range from 2% to 50% of the contract value depending on the asset and exchange. While leverage can amplify profits, it also magnifies losses, making risk management crucial. Cryptocurrency futures are known for offering high leverage options, sometimes as high as 100x or more on certain platforms, though regulatory changes in some jurisdictions have limited maximum leverage amounts.

Mark Price and Funding Rate: Unlike traditional futures, cryptocurrency perpetual futures (the most popular type) don't have an expiration date. Instead, they use a funding rate mechanism to ensure the futures price converges with the spot price. The funding rate is a periodic payment between long and short traders based on the difference between the mark price (a fair value estimate) and the spot price. When the funding rate is positive, long positions pay short positions; when negative, shorts pay longs. This mechanism helps prevent excessive price divergence between futures and spot markets.

Liquidation and Risk Management: Futures positions are subject to liquidation if the market moves against a trader's position to the point where their margin balance falls below maintenance requirements. To avoid liquidation, traders can add margin to their positions or set stop-loss orders to automatically close positions at predetermined price levels. Understanding liquidation processes is critical for futures traders, as unexpected liquidations can result in significant losses.

Types of Crypto Futures Products

The cryptocurrency futures market has evolved to offer a variety of products designed to meet different trading needs and preferences. Understanding these product types is essential for selecting the most appropriate instruments for your trading strategy.

Perpetual Futures: Perpetual futures, also known as perpetual swaps, are the most popular type of crypto futures contract. Unlike traditional futures, they have no expiration date, allowing traders to hold positions indefinitely as long as they can cover funding payments. These contracts use a funding rate mechanism to ensure the futures price tracks the underlying spot price closely. The funding rate is typically exchanged every 8 hours, though this can vary by exchange. Perpetual futures account for the vast majority of trading volume in crypto derivatives markets due to their flexibility and convenience.

Quarterly and Monthly Futures: These time-based futures contracts have fixed expiration dates, typically settling on the last Friday of the contract month. Quarterly futures (expiring in March, June, September, December) are especially popular among institutional traders as they align with traditional financial market cycles. The price of these futures contracts tends to diverge more significantly from spot prices as expiration approaches, creating potential arbitrage opportunities. These contracts are preferred by traders who want defined time horizons or who wish to avoid the funding rate payments associated with perpetual contracts.

Inverse Futures: Some cryptocurrency futures contracts are settled in the base cryptocurrency rather than stablecoins or fiat currency. For example, a Bitcoin inverse futures contract would be quoted in USD but settled in BTC. This means traders profit or lose in Bitcoin terms rather than dollar terms. These contracts are particularly useful for traders who primarily think in cryptocurrency terms or who want to maintain their exposure to the base currency while trading derivatives. However, they can be more complex to manage from a risk perspective due to the changing value of the settlement currency.

Risk Management Strategies for Futures Trading

Effective risk management is the cornerstone of successful futures trading, especially in the highly volatile cryptocurrency markets. Implementing robust risk management strategies can mean the difference between sustainable trading and rapid capital depletion.

Position Sizing and Leverage Management: One of the most fundamental aspects of risk management is proper position sizing. Traders should never risk more than a small percentage of their total capital on any single trade—a common rule is 1-2% of total portfolio value. When using leverage, position sizing becomes even more critical as losses are magnified. Conservative leverage levels (5-10x) are generally recommended for beginners, while even experienced traders rarely exceed 20x leverage for most trades. It's also important to consider the volatility of the specific cryptocurrency being traded—more volatile assets require smaller position sizes and lower leverage.

Stop-Loss and Take-Profit Orders: Stop-loss orders are essential tools for limiting potential losses on futures positions. These orders automatically close a position when the price reaches a predetermined level, preventing further losses. Similarly, take-profit orders allow traders to lock in profits by automatically closing positions when favorable price targets are reached. There are various types of stop orders, including standard stop-loss orders, trailing stops that follow favorable price movements, and partial close orders that allow scaling out of positions gradually. Traders should always use stop-loss orders and avoid the temptation to "wait out" losing positions in hopes of a reversal.

Table: Risk Management Techniques for Futures Traders

| Technique |

Description |

Implementation Tips |

| Position Sizing |

Determining appropriate trade size based on account size and risk tolerance |

Risk no more than 1-2% of capital per trade |

| Leverage Management |

Using appropriate leverage levels for market conditions |

Use lower leverage (3-10x) in high volatility environments |

| Stop-Loss Orders |

Automatic order to close position at predetermined loss level |

Set stops based on technical levels, not arbitrary percentages |

| Diversification |

Spreading risk across different assets and strategies |

Trade uncorrelated assets to reduce portfolio risk |

| Correlation Analysis |

Understanding how different assets move in relation to each other |

Avoid overexposure to highly correlated assets |

Technical Analysis for Futures Trading

Technical analysis plays a crucial role in futures trading decisions, helping traders identify potential entry and exit points based on historical price patterns and market statistics.

Chart Patterns and Price Action: Price action analysis involves studying historical prices to identify patterns that may indicate future market movements. Common chart patterns in futures trading include support and resistance levels, trend lines, channels, and classic formations like head and shoulders, triangles, and double tops/bottoms. These patterns help traders anticipate potential breakouts or breakdowns and set appropriate profit targets and stop-loss levels. In futures trading, understanding how these patterns form and their typical outcomes can provide valuable insights for both entry and exit decisions.

Technical Indicators and Oscillators: Technical indicators are mathematical calculations based on price and/or volume that help traders analyze market conditions and identify potential trading opportunities. Popular indicators for futures trading include moving averages (for trend identification), Relative Strength Index (RSI) and Stochastic (for overbought/oversold conditions), and MACD (for trend changes and momentum). Volume indicators are particularly important in futures trading as they can confirm the strength of price movements. However, it's important to avoid indicator overload—using too many indicators can lead to analysis paralysis and conflicting signals.

Market Structure and Time Analysis: Analyzing market structure involves identifying key levels where price has historically reacted, understanding the context of price movements within larger trends, and recognizing patterns in how markets transition between trending and ranging conditions. Time analysis examines how price behaves at different times of the day, days of the week, and in relation to specific events (such as Bitcoin options expirations or Federal Reserve announcements). Cryptocurrency markets operate 24/7, but certain times show higher volatility and volume, which can present both opportunities and risks for futures traders.

Fundamental Analysis for Crypto Futures

While technical analysis focuses on price patterns and market statistics, fundamental analysis examines the underlying factors that drive value and market sentiment in cryptocurrency markets.

On-Chain Metrics: On-chain analysis involves examining blockchain data to gauge network health, adoption trends, and potential market movements. Key metrics include network hash rate (for Proof-of-Work cryptocurrencies), active addresses, transaction volume, supply distribution, and exchange flows. For example, increasing exchange inflows might indicate selling pressure, while growth in active addresses could signal increasing adoption and potential price appreciation. These metrics are particularly valuable for futures traders looking to take longer-term positions based on fundamental network strength rather than short-term technical patterns.

Macroeconomic Factors: Cryptocurrency markets don't exist in isolation—they're increasingly influenced by broader macroeconomic conditions and traditional financial markets. Factors such as interest rate changes, inflation data, currency movements, and stock market performance can all impact cryptocurrency prices. For instance, expectations of loose monetary policy often benefit risk assets including cryptocurrencies, while tightening cycles can create headwinds. Futures traders need to monitor these macroeconomic developments and understand how they might influence market sentiment and capital flows into and out of digital assets.

Project-Specific Fundamentals: Beyond broad market factors, individual cryptocurrencies have project-specific fundamentals that can impact their prices. These include development activity, protocol upgrades, partnership announcements, regulatory developments, and changes to tokenomics. For futures traders, understanding these project-specific factors is essential when trading altcoin futures, as positive or negative developments can cause significant price movements relative to Bitcoin or the broader market. Following official project communications, developer communities, and credible industry news sources can help traders stay informed about these fundamental drivers.

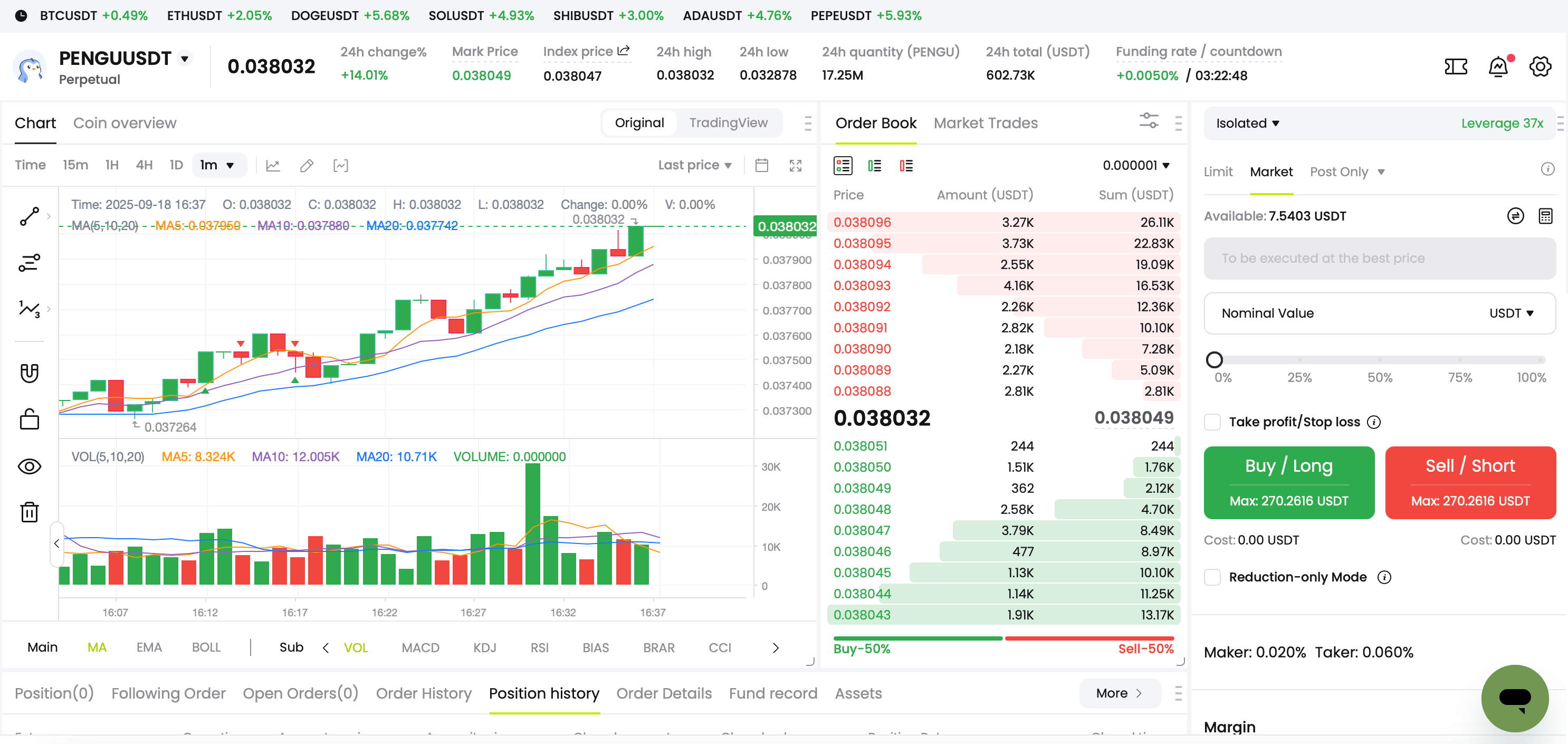

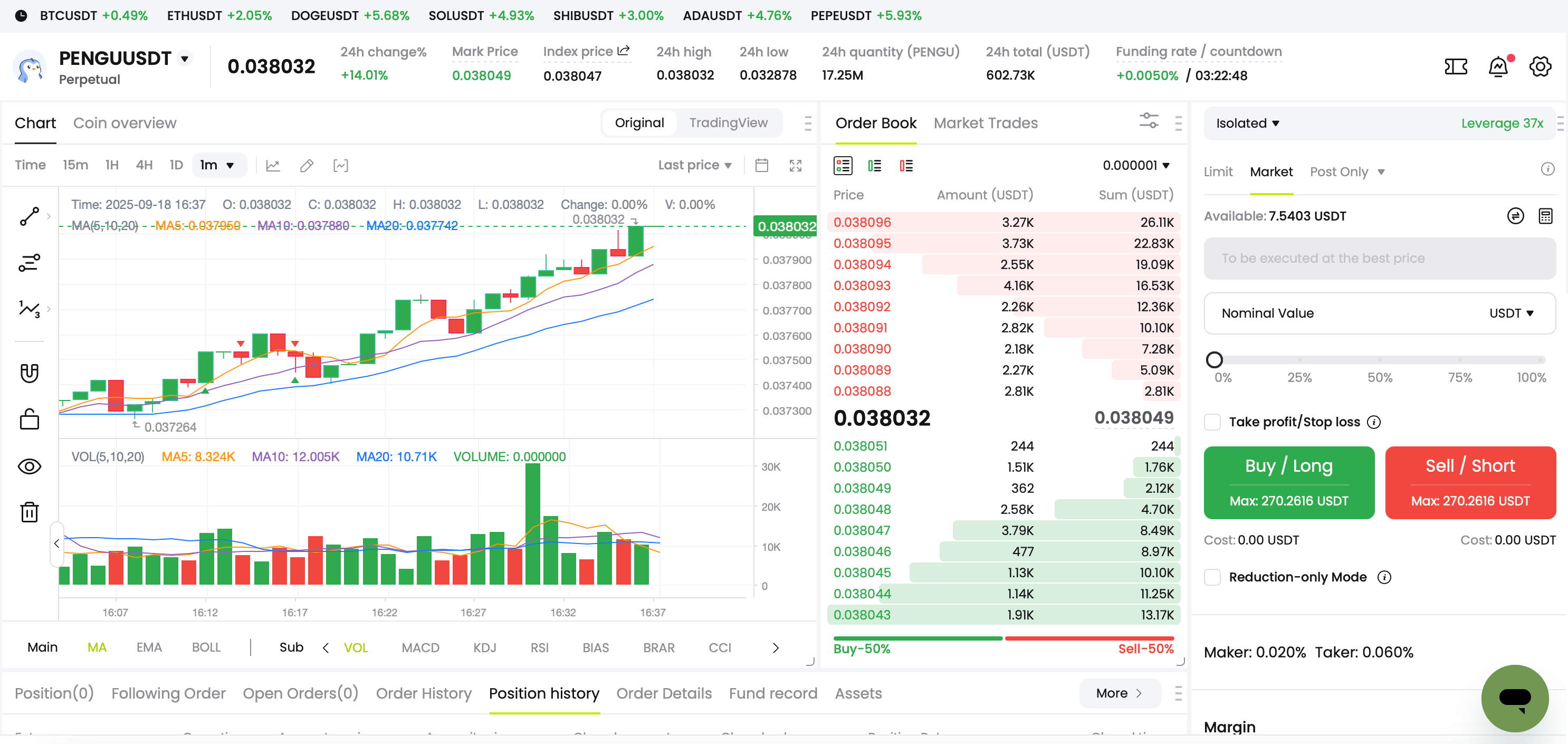

How to Trade Futures on CoinCatch

Step 1: Register a

CoinCatch account, and enter the futures page on CoinCatch. New traders can read the futures tutorial on CoinCatch

Academy.

Step 2: Transfer funds from other accounts to the futures account;

Step 3: Select cryptocurrency for your futures position (CoinCatch features over 250 futures trading pairs);

Step 4: Set up a leverage ratio for your position (CoinCatch now offers leverage ranging from 1x to 200x);

Step 5: Adjust the margin ratio of the position according to your own risk tolerance;

Step 6: Place an order according to the order types provided by CoinCatch Futures.

To know more about order types and strategies, please read:

Conclusion

Futures trading offers cryptocurrency market participants powerful tools for speculation, hedging, and portfolio diversification. However, these complex financial instruments also carry significant risks, particularly when combined with the inherent volatility of digital assets. Successful futures trading requires a solid understanding of contract mechanics, risk management principles, and market analysis techniques, both technical and fundamental.

As the cryptocurrency market continues to mature, futures products are likely to become increasingly sophisticated and integrated with traditional finance. Platforms like CoinCatch are making these instruments more accessible to retail traders, but accessibility shouldn't be mistaken for simplicity. Prospective futures traders should approach these markets with caution, beginning with small positions and low leverage while they develop their skills and understanding. Demo accounts and paper trading can provide valuable practice without risking real capital.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.