The cryptocurrency market is experiencing a profound downturn, with Bitcoin (BTC) plunging to approximately $86,000, erasing its 2025 gains and rattling investor confidence. This decline is not an isolated event but the result of a confluence of powerful macroeconomic forces. A "crypto winter" has descended, driven by a hawkish U.S. Federal Reserve, a crisis of confidence in crypto's core decentralization narrative, a parallel sell-off in the overheated AI sector, and a puzzling downturn in traditional safe havens like gold. This article delves into the intricate web of these macro factors, exploring how regulatory actions, technological centralization risks, and a broad shift away from speculative assets are collectively reshaping the digital asset landscape. Understanding these dynamics is crucial for navigating the current volatility and anticipating the future trajectory of not just Bitcoin, but the entire ecosystem built around it.

BTC price chart. Source: CoinMarketCap

Liquidity Evaporates in Plain Sight

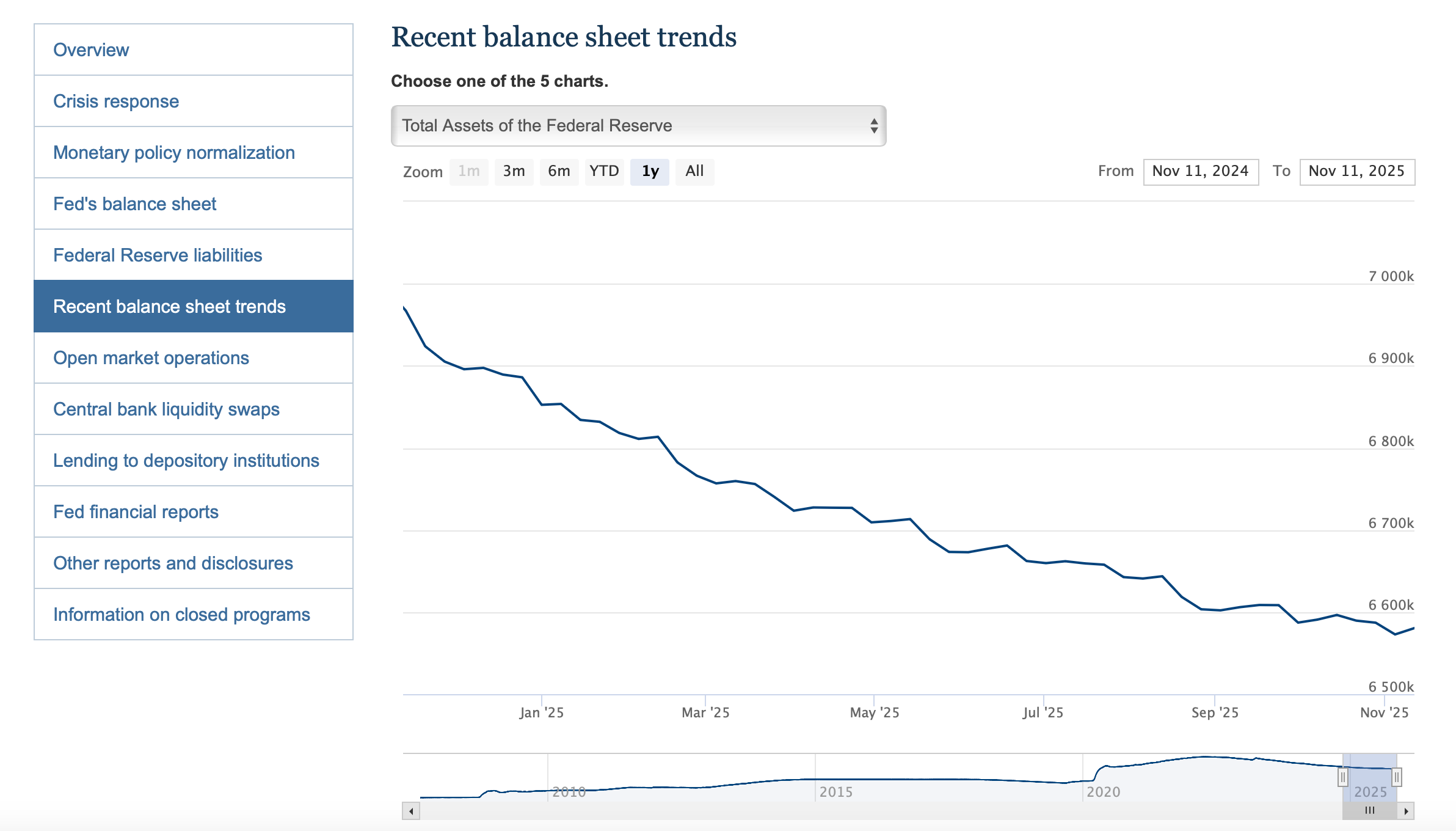

The Fed is reducing its balance sheet primarily to combat inflation and to normalize its balance sheet size after it ballooned during the COVID-19 pandemic. This process, known as quantitative tightening (QT), works by allowing maturing assets to roll off the balance sheet without being reinvested, which cools the economy by removing excess liquidity.

Primary reasons for balance sheet reduction

-

To fight inflation: By reducing the money supply and cooling the economy, the Fed aims to bring inflation down to its long-run target.

-

To normalize the balance sheet: The Fed's balance sheet more than doubled to nearly $9 trillion during the pandemic as it purchased assets to support the economy. Reducing it helps transition from "abundant" to "ample" reserves in the banking system.

-

To restore balance sheet capacity: A smaller balance sheet during normal times gives the Fed more capacity to expand its holdings and use the balance sheet as a tool during future crises or periods of financial stress.

How balance sheet reduction works

-

Quantitative Tightening (QT)

: The Fed allows a certain amount of its assets, such as Treasury securities and mortgage-backed securities, to mature without reinvesting the principal.

-

Monthly caps: The Fed sets monthly caps on how much of these assets can roll off. The caps are adjusted to control the pace of the reduction and to avoid causing disruption in financial markets.

-

Impact on reserves: This process reduces the level of reserves in the banking system, which in turn helps to put downward pressure on inflation and other interest rates.

To explain more about what happened recently:

Quantitative Tightening (QT) Drain: The Fed’s balance sheet reduction, ongoing since 2022, has siphoned over $2.4 trillion in liquidity. While the Fed plans to halt QT on December 1, 2025, the damage is already felt. Bank reserves have tightened, and the reverse repo facility, which is a liquidity sink for money-market funds, has dwindled to $28.8 billion, down from $214 billion just months earlier.

Fed's balance sheet. Source: Federal Reserve

Technical Breakdowns in Lending: As reserves shrink, the largest banks have grown hesitant to lend cash in repo markets. This echoes the 2019 episode analyzed by the BIS, where “banks’ cash buffers… reduced their willingness to lend”. Today, dealers report similar caution, exacerbated by year-end balance-sheet constraints.

Structural Vulnerabilities Exposed: A 2024 Fed study highlighted that banks like SVB faced “too little useable liquidity relative to their runnable funding”. Now, systemwide metrics like the Lower Friction Liquidity (LFL) ratio show many firms could cover only

one-third of runnable liabilities without breaching capital requirements.

The Centralization of "Decentralized" Finance

Simultaneously, the very foundation of the crypto world's ideology is being shaken. A reckoning is underway as research reveals that the promise of decentralization is largely an illusion. According to analysis, between 60% and 75% of daily digital-asset project revenue flows through fiat-pegged tokens issued by centralized entities like Tether (

USDT) and

Circle (USDC). Furthermore, many so-called decentralized networks, particularly Layer-2 and Layer-3 projects, operate on centralized ledgers controlled by private foundations or small developer teams, creating hidden single points of failure.

This "great deception" carries systemic risks. The collapse of one centralized project can trigger a contagion, much like the fallout from the FTX failure in 2022. A stark example of this centralization is found in projects like

World Liberty Financial (WLFI), where a Trump-affiliated entity, DT Marks

DeFi LLC, controls 23% of the tokens and has the power to unilaterally freeze user assets, fundamentally undermining decentralization claims. Such cases, coupled with ongoing U.S. lawmaker investigations into alleged ties to sanctioned entities, are eroding investor trust at a structural level. When the core narrative of censorship-resistant and trustless finance is challenged, the value proposition of the entire asset class suffers.

The Rise of Privacy Coins and the Regulatory Paradox

In a direct response to the erosion of transactional privacy on transparent blockchains like Bitcoin and Ethereum, the privacy coin sector has experienced a monumental rally. High-profile seizures of Bitcoin by U.S. authorities, such as the 127,000 BTC confiscated from a Cambodian gang, have demonstrated the vulnerability of transparent ledgers to government surveillance. This has triggered a "

privacy awakening" among users, especially high-net-worth individuals and institutions, who seek to protect their holdings from tracking, hacking, and strategic analysis.

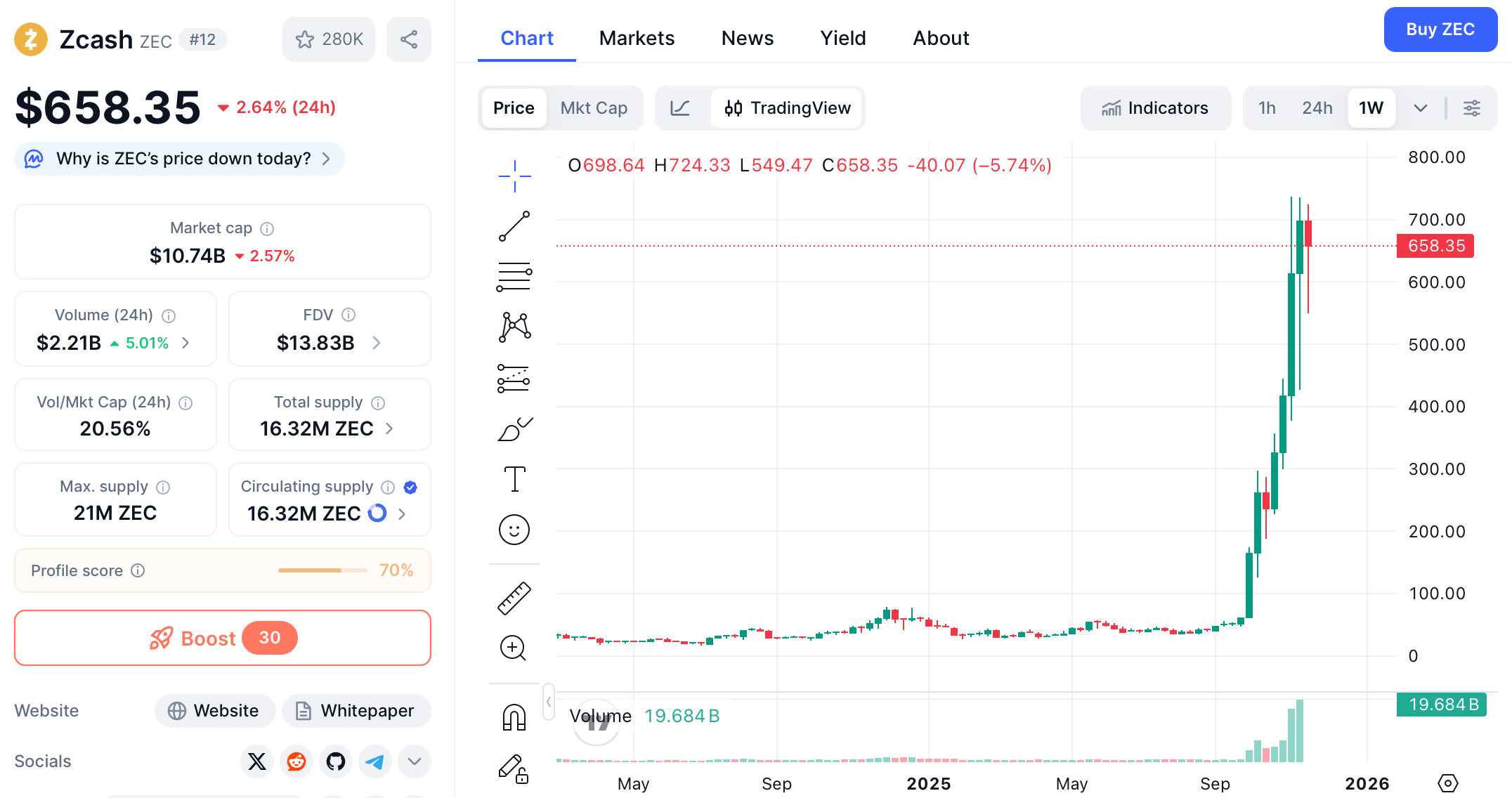

Zcash price chart. Source: CoinMarketCap

Consequently, privacy coins have undergone a dramatic value revaluation.

Zcash (ZEC), for instance, skyrocketed from $35 in August 2025 to a peak of $750 in November, which is a gain of over 2,200%. Monero (XMR) has also seen strong momentum. This surge represents a market-driven bet on enhanced financial privacy. However, this boom exists in a paradoxical relationship with regulation. The European Union's upcoming AMLR regulations threaten to restrict "high-anonymity" assets by 2027. This regulatory pressure is creating a divergence within the privacy sector, favoring projects like Zcash that offer "compliant privacy" through features like view keys for selective auditability, over more opaque coins like Monero, which face greater regulatory headwinds and potential delistings.

The AI Tech Bubble and Correlated Risk-Off Sentiment

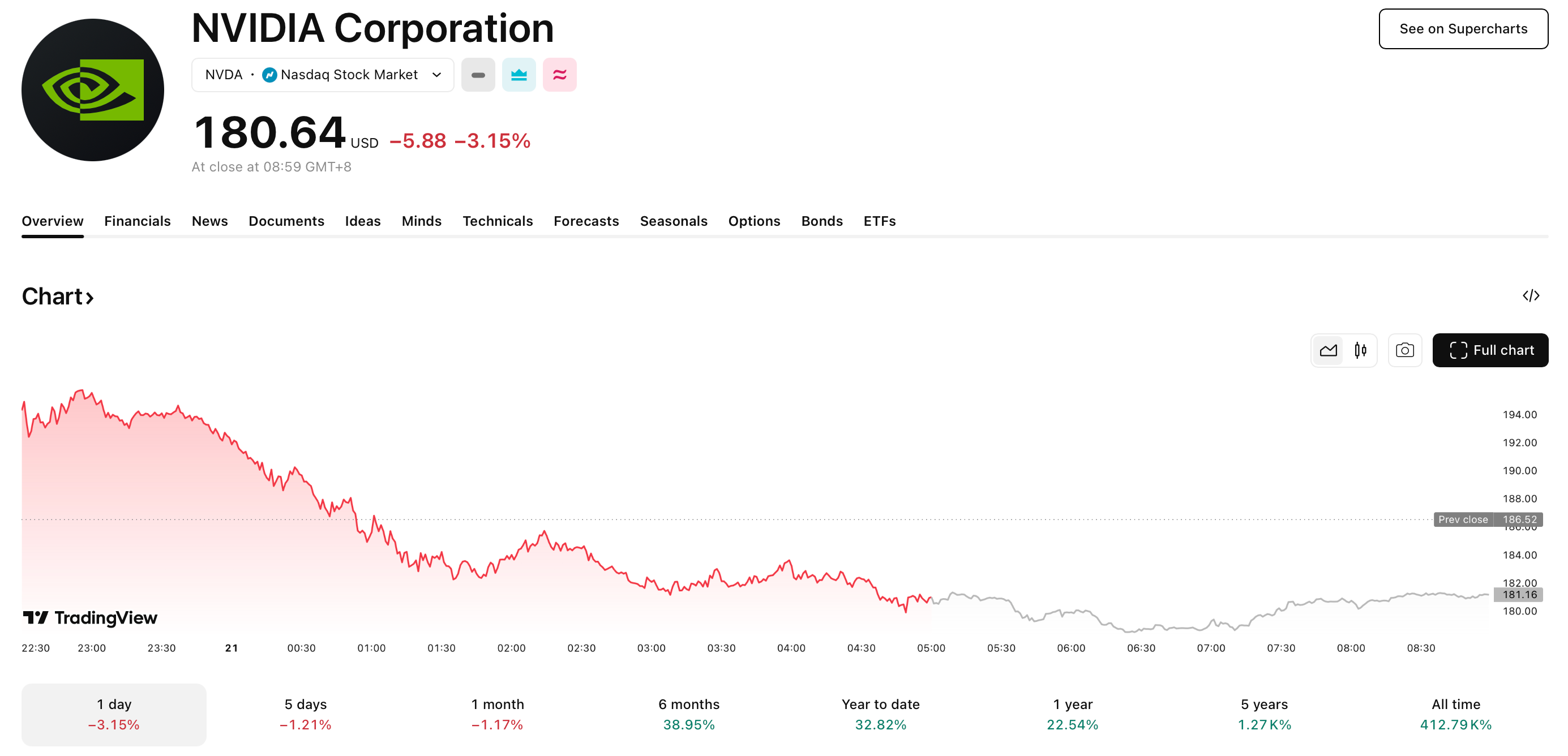

The crypto market downturn is also moving in lockstep with a broader correction in the technology sector, particularly in Artificial Intelligence (AI). AI-related stocks have remained under pressure, with major players seeing declines of 10-15% in recent trading. This signals a declining appetite for high-risk, high-growth investments across the board. As noted by the International Monetary Fund, the correlation between crypto assets and equities has risen in recent years, meaning stock market volatility often synchronizes with crypto price movements.

Nvidia stock price. Source: TradingView

This correlation creates a feedback loop. When AI stocks tumble on fears of a popped bubble and economic uncertainty, the sentiment spills over into cryptocurrency markets. AI-focused crypto tokens like

Fetch.ai (FET) and

Render (RNDR) have mirrored the losses of their equity counterparts, with FET falling about 8% in the previous quarter. This interconnectedness means that a loss of confidence in one speculative sector can rapidly transmit to the other, amplifying the overall sell-off as investors flee risk and seek safety in cash or less volatile assets.

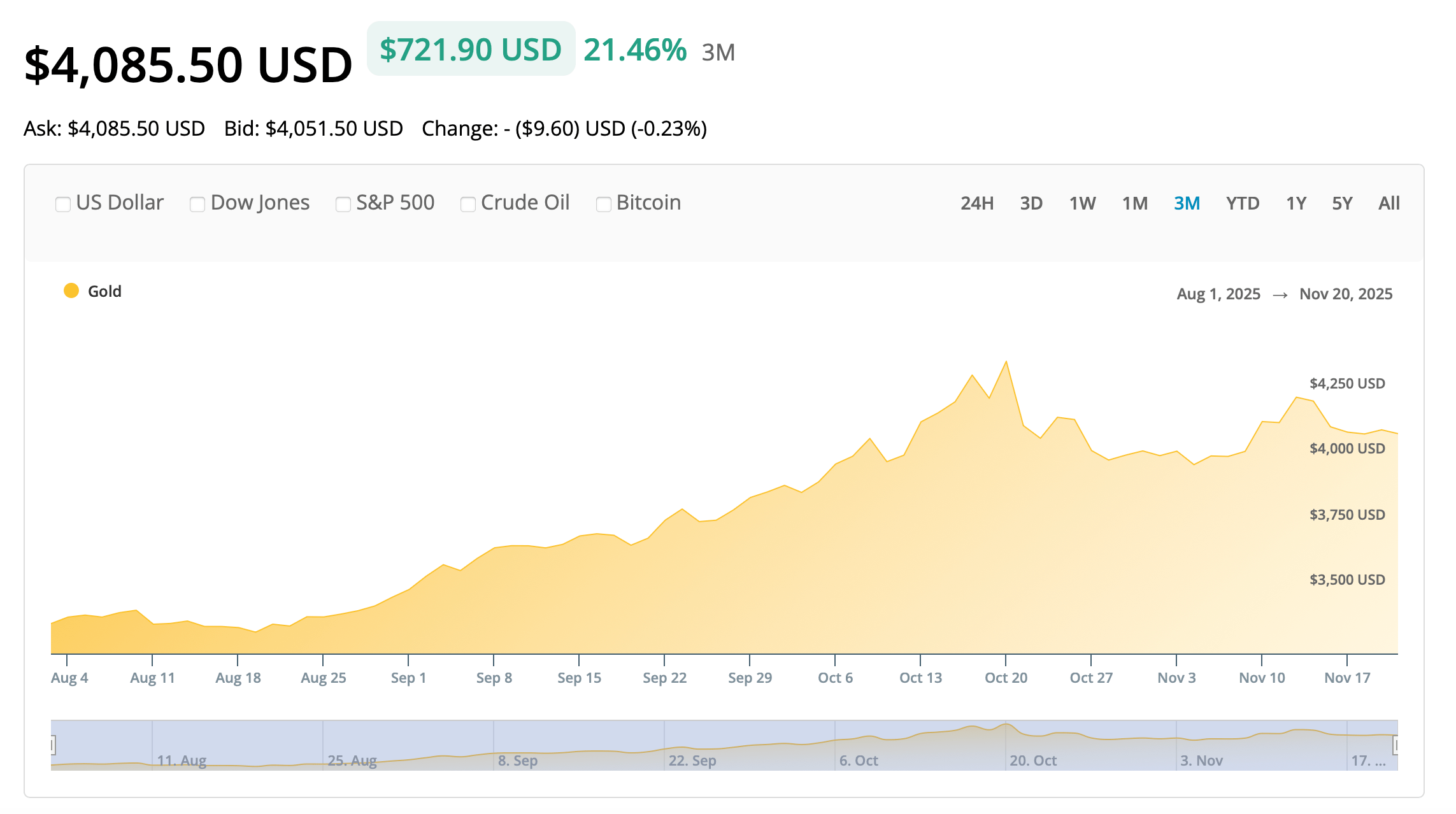

The Gold Conundrum: A Traditional Safe Haven Also Falters

Intriguingly, the current macro environment has also pressured traditional safe havens, most notably gold. This simultaneous decline in both digital and traditional hedges points to a unified underlying cause. Gold prices have slipped, briefly falling below $4,000 an ounce, with the SPDR Gold Shares (GLD) ETF losing about 7.8% over the past month. The primary reason is the strengthening U.S. dollar, as measured by the Invesco DB US Dollar Index Bullish Fund (UUP), which has gained 1.3% over the same period. Gold, which is priced in dollars, typically underperforms in a rising dollar environment.

Gold price chart. Source: APMEX

Furthermore, fading expectations for a near-term Fed rate cut have diminished gold's appeal. As a non-yielding asset, gold benefits from lower interest rates; when rate-cut hopes recede, its opportunity cost increases. Interest-rate swaps in November 2025 showed less than a 50% chance of a December rate reduction, a sharp pullback from market expectations just a month prior. Despite this short-term pressure and being on track for its best annual performance since 1979, gold's current weakness highlights the overwhelming power of the "strong dollar, higher-for-longer rates" narrative, which is proving to be a headwind for a wide spectrum of alternative assets, from crypto to bullion.

Conclusion

The decline in Bitcoin's price is a complex story woven from several macro threads. It is a tale of restrictive monetary policy choking off speculative capital, of a foundational ideological narrative being questioned, of a market pivot towards privacy in response to state surveillance, and of a broad-based retreat from risk assets in both the tech and crypto sectors. Even gold, the age-old store of value, is not immune to the prevailing power of a strong dollar and high interest rates.

The path forward for Bitcoin and the broader crypto market hinges on the evolution of these factors. A pivot by the Fed toward rate cuts could revitalize investor appetite. However, the sector's longer-term health depends on its ability to address its centralization paradox and rebuild trust through verifiable decentralization and transparent governance. The spectacular rise of privacy coins underscores a persistent and growing demand for financial sovereignty, but their future is inextricably linked to an uncertain regulatory outcome. For now, the market remains in a state of heightened sensitivity, where macroeconomic indicators and regulatory developments will continue to dictate its rhythm, demonstrating that the era of crypto moving in isolation is decisively over.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.