BitMine Immersion Technologies (BMNR), once a rising star in the cryptocurrency treasury space, now finds itself navigating turbulent waters. The company's aggressive strategy to accumulate 5% of all Ethereum in circulation dubbed the "5% alchemy" has come under intense scrutiny as its stock price plummeted nearly 80% from its July peak. This dramatic decline has triggered a fierce debate among investors: is BitMine experiencing a temporary value mismatch that presents a buying opportunity, or are its fundamental business model flaws being rightfully exposed by the market?

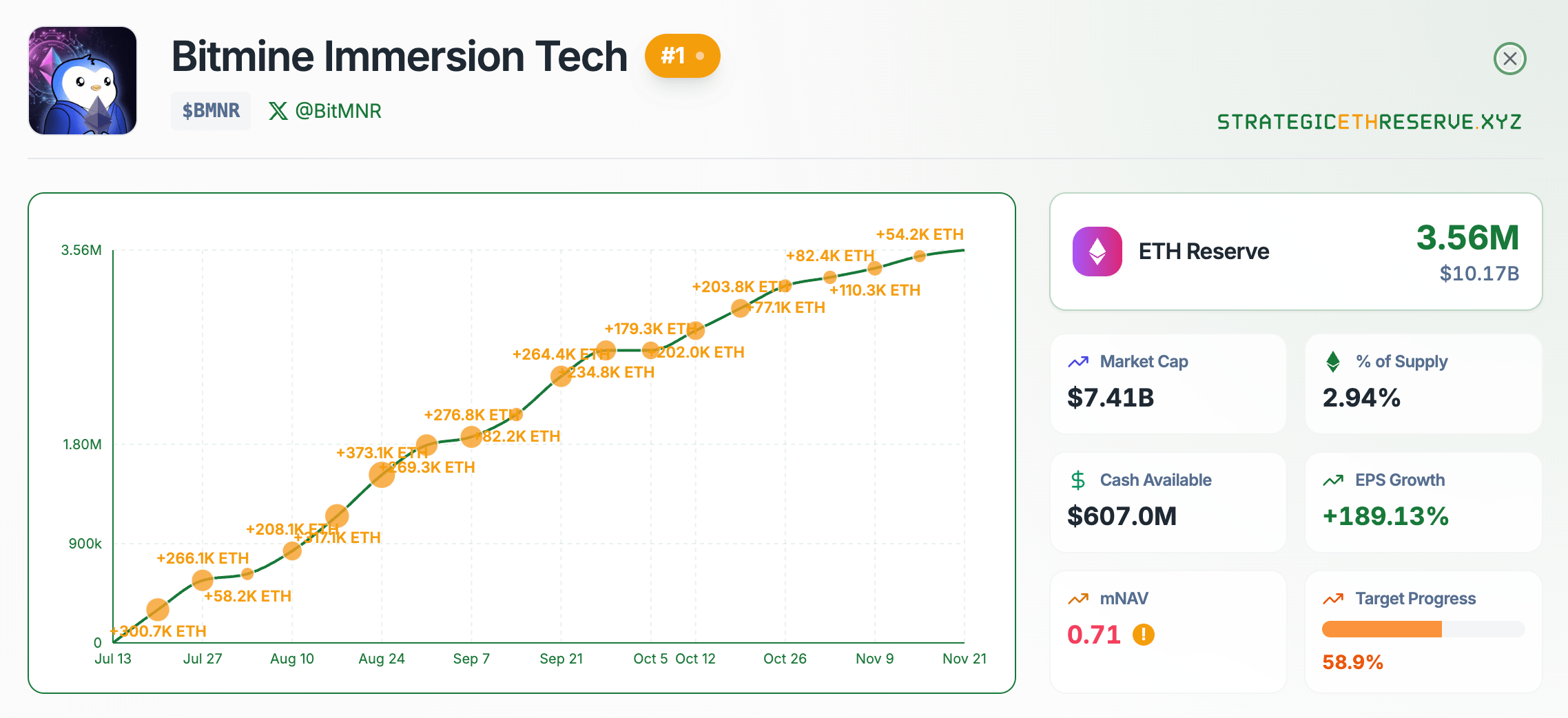

The company's current predicament represents a crucial test for the emerging category of digital asset treasury (DAT) companies. As BitMine continues to purchase Ethereum despite market headwinds, with holdings now reaching 3.56 million ETH (approximately 2.94-3% of total supply) , analysts are divided on whether this constitutes visionary conviction or dangerous folly. With prominent investors like ARK Invest and JPMorgan increasing their positions while Peter Thiel's Founders Fund significantly reduced its holdings, the financial community appears deeply split on BitMine's prospects.

This article examines the complex factors underlying BitMine's current crisis, from its substantial unrealized losses to structural challenges in the Ethereum ecosystem, to determine whether the company represents a compelling value opportunity or a cautionary tale in the making.

The Ambitious "5% Alchemy" Strategy and Its Financial Toll

At the heart of BitMine's business model lies an audacious goal: to accumulate Ethereum representing 5% of the entire circulating supply, positioning the company as a dominant force in the

ETH ecosystem. This "5% alchemy" strategy has already resulted in holdings of approximately 3.56 million

ETH, worth roughly $10.6-14.2 billion at current prices, placing the company more than halfway toward its ambitious target.

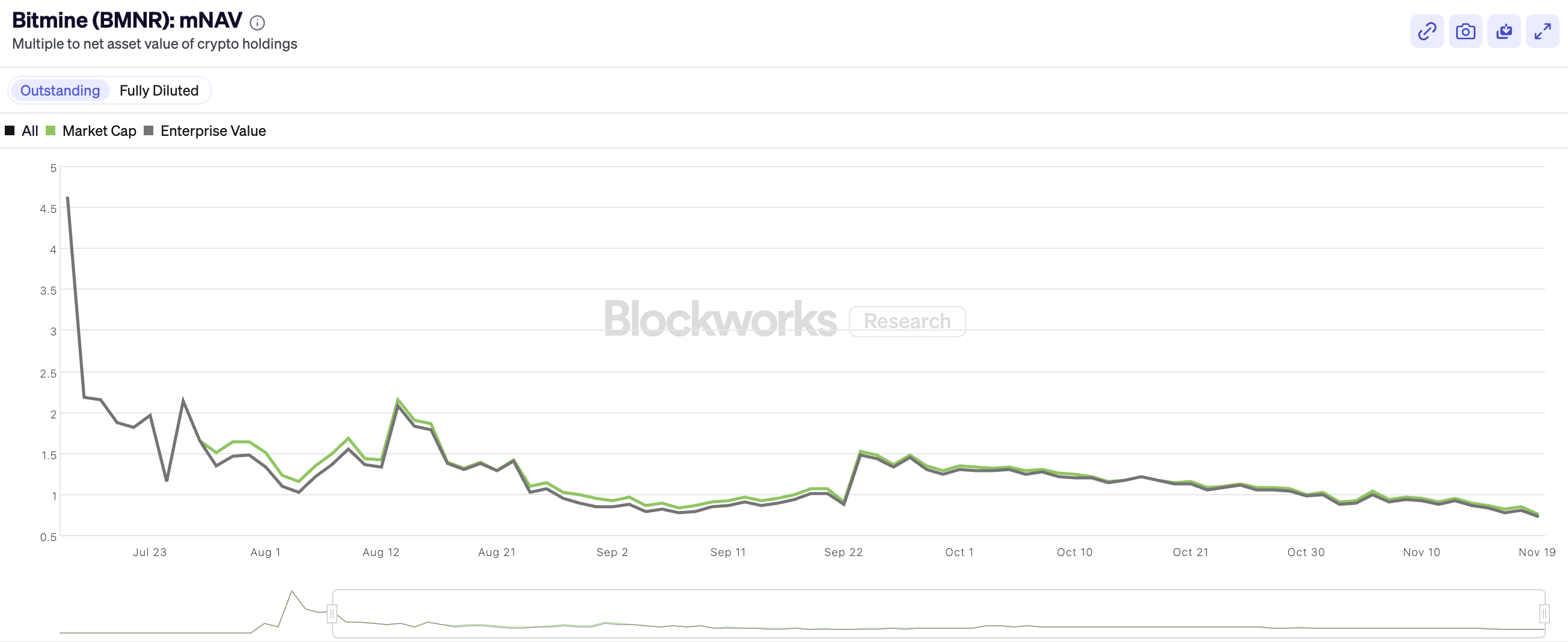

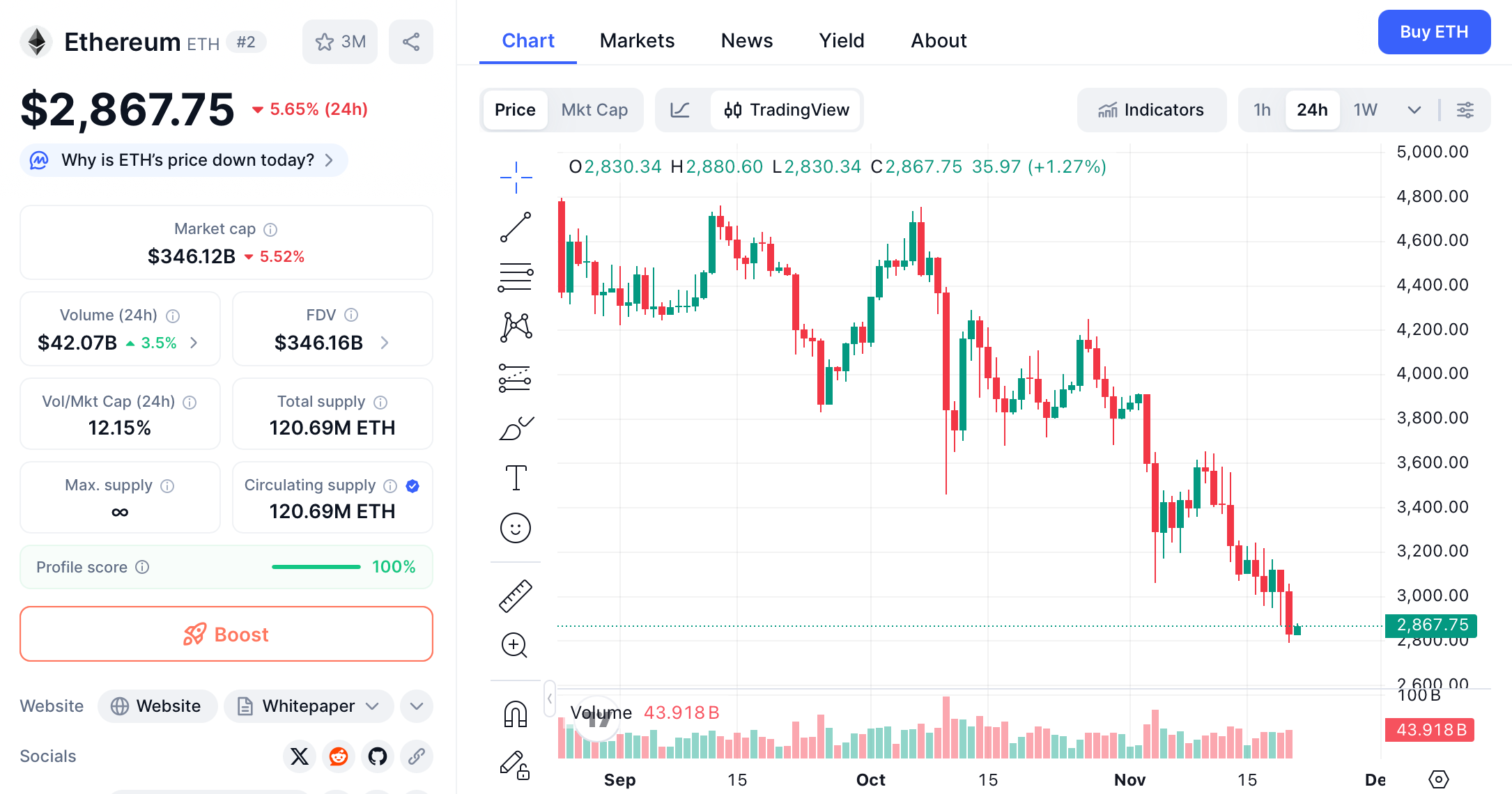

However, this aggressive accumulation has come at a significant cost. With an average purchase price of approximately $4,009-4,051 per ETH, BitMine now faces substantial unrealized losses as Ethereum trades around $3,000. These paper losses total nearly $3 billion according to some estimates, while others calculate the deficit at approximately $3.7 billion. This dramatic depreciation has inevitably impacted BitMine's financial metrics, with its market NAV (mNAV) ratio declining to 0.77-0.92, indicating that the company's market capitalization has fallen below the value of its underlying assets.

BMNR mNAV. Source: Blockworks

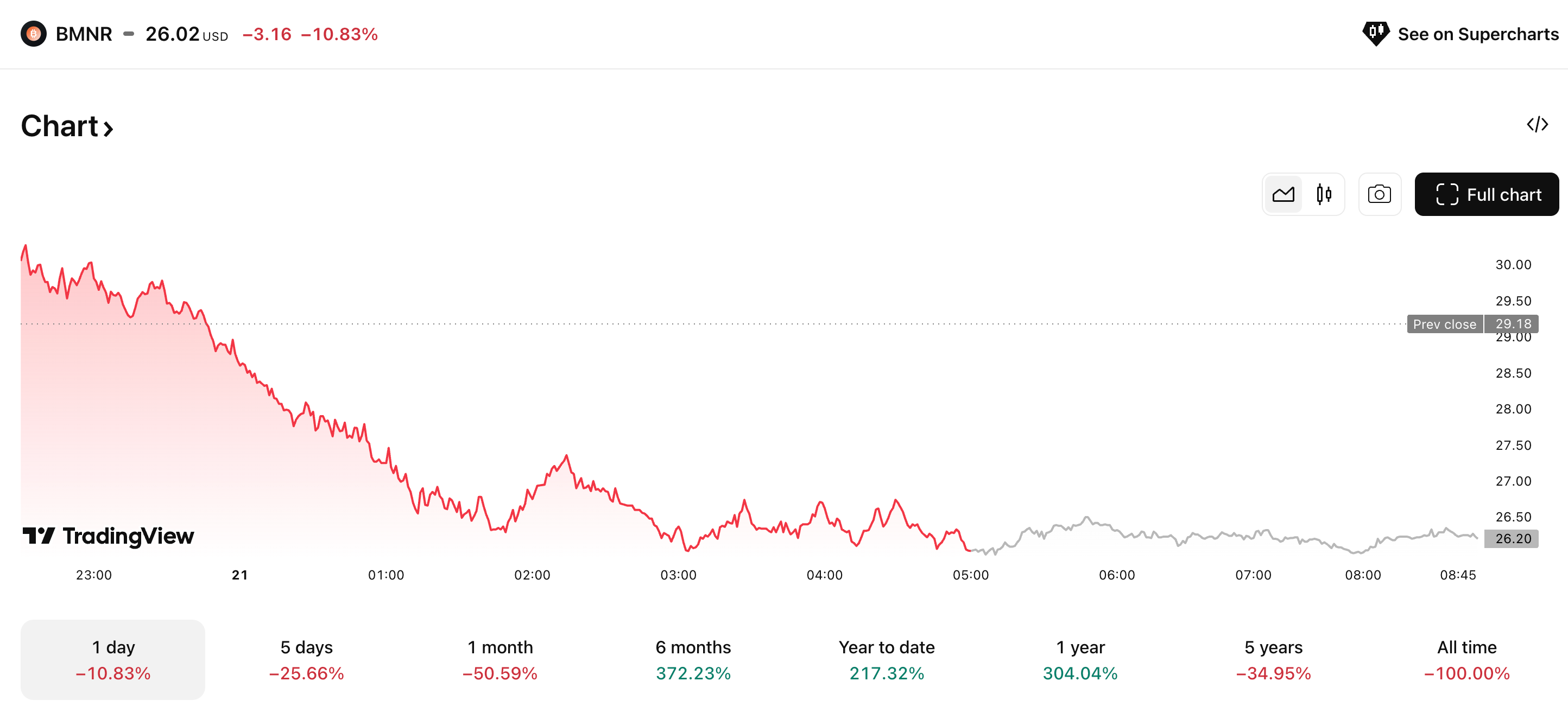

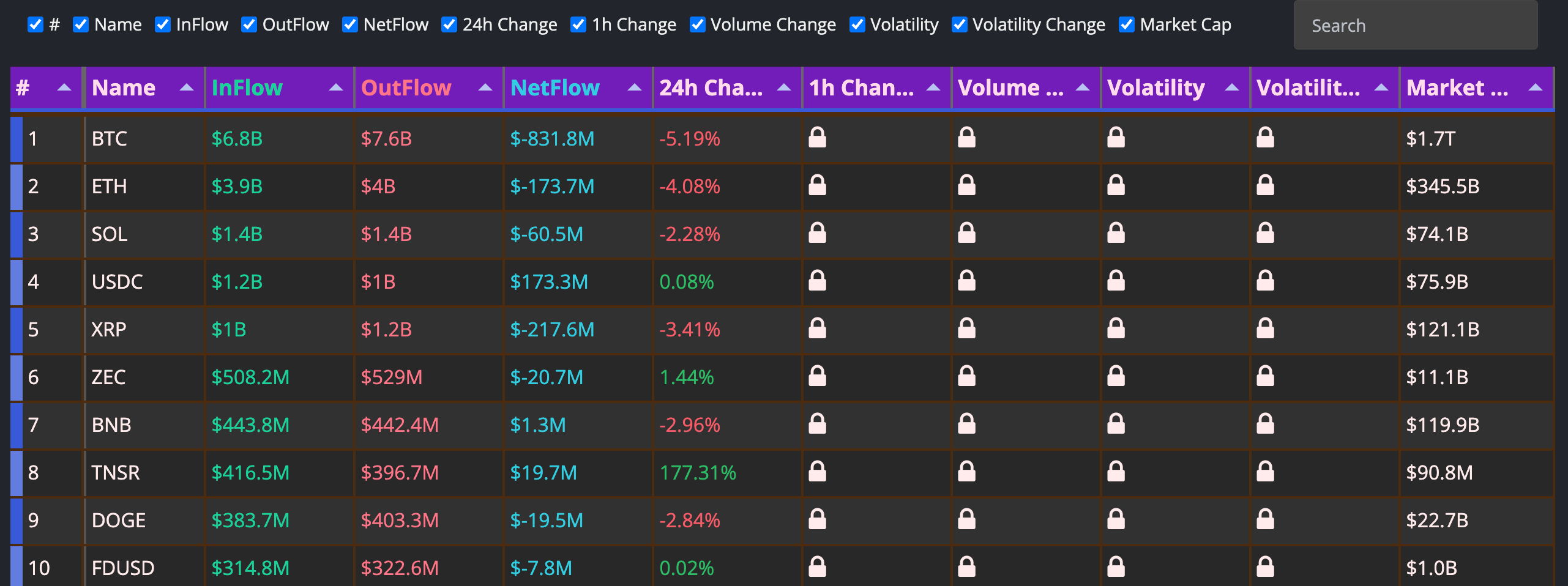

BitMine's stock performance reflects these concerns. BMNR shares have declined approximately 80% from their July peak, with a particularly sharp drop of nearly 11% on November 20 alone. This decline occurred amid a broader cryptocurrency market downturn, though BitMine significantly underperformed the general market, with the S&P 500 falling only 1.6% on the same day.

BMNR stock price chart. Source: TradingView

The company's ability to continue executing its strategy hinges on two primary funding sources: cryptocurrency-generated income (from Bitcoin mining and Ethereum staking) and secondary market financing through an At-The-Market (ATM) stock offering program. BitMine currently holds approximately $607 million in uncollateralized cash, but persistent ETH price weakness could eventually strain these financial resources.

Mounting Challenges: The Four Primary Risks

Extreme Ethereum Price Volatility

ETH 24H chart. Source: CoinMarketCap

BitMine's business model inherently amplifies Ethereum's price volatility. As a concentrated holder of

ETH, the company experiences magnified effects from market downturns. The recent crypto market decline, exacerbated by expectations that the Federal Reserve will not cut interest rates in December, has highlighted this vulnerability. When Ethereum prices fall, BitMine suffers a dual impact: the value of its treasury decreases, and its stock price typically declines even more sharply, behaving like a leveraged version of ETH itself.

Share Dilution Concerns

Building a massive cryptocurrency treasury requires substantial capital. BitMine primarily raises equity to fund its Ethereum purchases, potentially diluting existing shareholders, especially during market downturns. This dilution risk becomes particularly pronounced when the company's stock trades below the value of its treasury, making new capital raises more challenging and potentially slowing the entire accumulation strategy. The delicate balancing act between aggressive ETH acquisition and shareholder value preservation becomes increasingly difficult in weak market conditions.

Liquidity Weakness in Crypto Markets

Crypto liquidity changes. Source: Cryptometer.io

Tom Lee himself has identified liquidity trends in cryptocurrency markets. He noted that "crypto prices have not recovered since the liquidation event on October 10th," suggesting that "a market maker (or two) suffering from a crippled balance sheet". When market makers reduce their liquidity functions, it creates a quantitative tightening effect on cryptocurrencies, dampening prices and creating additional headwinds for BitMine's strategy, which relies on deep markets and strong risk appetite.

Extreme Concentration Risk

Unlike a diversified investment strategy, BitMine has concentrated its holdings almost exclusively in Ethereum, tying its fate directly to the long-term trajectory of a single cryptocurrency network. This lack of diversification means the company bears full exposure to potential regulatory challenges, network disruptions, or demand reductions specific to Ethereum. While this concentration potentially amplifies gains if Ethereum prospers, it also eliminates the risk mitigation that diversification typically provides.

Structural Challenges in the Ethereum Ecosystem

BitMine's struggles occur alongside concerning trends within the broader Ethereum ecosystem that potentially threaten the fundamental thesis behind its accumulation strategy.

The Ethereum validator ecosystem shows signs of weakening, with the daily active validator count declining approximately 10% since July, reaching the lowest level since April 2024. This represents the first significant decline since Ethereum's transition from proof-of-work to proof-of-stake in September 2022. The reduction stems partly from validators exiting to realize profits after price increases, but also reflects declining staking yields, which have fallen to approximately 2.9% APR from a historical high of 8.6% in May 2023.

Simultaneously, three traditional sources of Ethereum buying pressure have shown concerning trends:

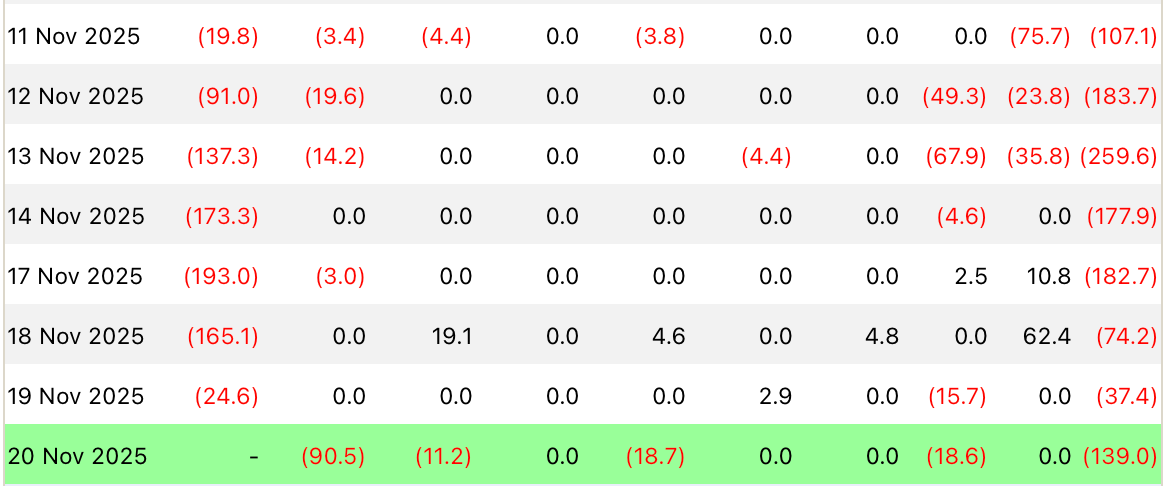

ETF Outflows: Ethereum ETFs have experienced significant net outflows, with single-day outflows reaching as high as $180 million in November. This reversal from the previous net inflow pattern suggests weakening institutional demand through traditional financial channels.

ETH ETF outflows in 10 consecutive days. Source: Farside

DAT Industry Contraction: Other digital asset treasury companies have slowed their Ethereum accumulation dramatically, with BitMine becoming virtually the only remaining large-scale buyer. Some smaller DATs have even begun selling portions of their ETH holdings to address liquidity needs or support their stock prices.

Long-Term Holder Distribution: Blockchain data reveals increased selling pressure from long-term Ethereum holders, with approximately 45,000 ETH (worth about $140 million) being sold daily by addresses holding for more than 155 days—the highest selling level since 2021.

These ecosystem challenges compound BitMine's company-specific difficulties, creating a complex web of headwinds that extend beyond simple price volatility.

The Case for Value Mismatch

Despite these significant challenges, compelling arguments suggest BitMine may currently be experiencing a substantial value mismatch rather than a fundamental breakdown.

Structural Advantages Over MicroStrategy

While frequently compared to MicroStrategy for their similar treasury accumulation strategies, BitMine possesses several structural differences that could provide advantages. Unlike MicroStrategy, which relies heavily on debt financing with substantial interest obligations, BitMine operates with minimal interest-bearing debt. This distinction becomes crucial during market downturns, as BitMine lacks the fixed financial obligations that can pressure leveraged strategies.

Additionally, BitMine's Ethereum holdings generate approximately $400-500 million in annual staking income,providing a relatively stable cash flow stream that exhibits lower correlation to price movements than MicroStrategy's business model. This revenue source represents a significant advantage, creating a buffer during market weakness.

Unique Ethereum-Based Opportunities

As one of the world's largest institutional Ethereum holders, BitMine can pursue value-generating strategies unavailable to Bitcoin-focused companies. These potential opportunities include:

-

Restaking: Earning additional yields (approximately 1-2%) by participating in Ethereum's restaking ecosystems

-

Node Infrastructure: Operating validator nodes and related infrastructure services

-

Yield Tokenization: Creating structured products based on staking yields

-

Institutional Products: Developing Ethereum-based financial instruments for institutional investors

These potential revenue streams remain largely untapped but could significantly enhance BitMine's value proposition if successfully implemented.

Institutional Confidence

Despite the negative sentiment, several prominent institutional investors have demonstrated confidence in BitMine's strategy. ARK Invest, led by Cathie Wood, purchased 215,000 additional BMNR shares (worth approximately $806 million) on November 6, while JPMorgan established a 197,000-share position. This institutional support suggests that sophisticated investors perceive potential in BitMine's approach, particularly at current discounted levels.

Competing Investment Vehicles: The ETF Threat

The emergence of Ethereum ETFs, particularly those offering staking features, presents a competitive challenge to BitMine's value proposition. Financial giant BlackRock recently registered a new staked Ethereum ETF in Delaware, potentially creating a low-cost, high-convenience alternative for investors seeking Ethereum exposure.

According to analysis from 10x Research, "When more investors realize that a 0.25% management fee is much lower than the embedded costs of DATs (

Digital Asset Treasury), they may begin allocating funds to BlackRock's potential staked Ethereum fund". This competitive pressure could potentially compress BitMine's mNAV premium over time as investors gravitate toward more cost-efficient vehicles.

However, BitMine advocates would argue that their active management strategy and potential value-added services differentiate them from passive ETF products, potentially justifying any fee premium through superior performance or additional utility.

Analyst Perspectives and Price Target Controversy

The analytical community remains deeply divided on BitMine's prospects. In a dramatic move on November 20, B. Riley analyst Fedor Shabalin slashed his price target for BMNR from $90 to $47 per share. Despite this significant reduction, Shabalin maintained his "Buy" rating on the stock, suggesting that even at the reduced target, the stock presents substantial upside from current levels.

This dichotomy captures the current narrative struggle surrounding BitMine: near-term challenges are acknowledged through price target reductions, while maintained bullish ratings suggest underlying confidence in the long-term strategy. This perspective aligns with the "value mismatch" thesis, acknowledging current headwinds while anticipating potential recovery.

Technical indicators present a mixed picture, with the MACD (Moving Average Convergence Divergence) flashing sell signals despite some recent optimistic trading sessions. This technical ambiguity reflects the fundamental uncertainty surrounding BitMine's future trajectory.

Conclusion

BitMine Immersion Technologies stands at a critical juncture, caught between its ambitious vision to become a dominant Ethereum holder and the harsh realities of a bearish cryptocurrency market. The company's substantial unrealized losses, concentrated risk profile, and ecosystem challenges present legitimate causes for concern. Yet its structural advantages, potential revenue streams, and significant institutional support suggest the current deep discount to NAV may overstate the company's vulnerabilities.

The ultimate resolution of BitMine's crisis likely depends on two interrelated factors: Ethereum price recovery and the company's ability to successfully monetize its substantial holdings beyond simple price appreciation. If Ethereum stages a sustained recovery and BitMine effectively leverages its unique position within the ecosystem, current prices may indeed represent a significant value mismatch. Conversely, if the crypto winter persists or BitMine fails to execute on its broader strategy, the company's ambitious "5% alchemy" could transform from visionary to disastrous.

For investors, BitMine represents a high-conviction, high-volatility opportunity that demands careful consideration of personal risk tolerance and belief in Ethereum's long-term potential. The company offers potentially leveraged exposure to Ethereum's success but carries substantial idiosyncratic risks that differentiate it from direct ETH ownership or more diversified cryptocurrency investments.

As the digital asset treasury model undergoes its first significant stress test, BitMine's trajectory will provide crucial insights into the viability of corporate cryptocurrency accumulation as a sustainable business strategy. The coming quarters will prove decisive in determining whether current prices represent a temporary value mismatch or the appropriate pricing of a fundamentally challenged enterprise.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.