The cryptocurrency market is in the throes of a pronounced downturn. As of November 21, the overall market has declined by approximately 2% to 8% over the past 24 hours. This sell-off has erased over $1.2 trillion from the total crypto market value in just six weeks, highlighting the scale of the current correction. Meanwhile, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls edged up by 119,000 in September, significantly beating Wall Street’s consensus estimate of 50,000 but revealing broader weakness as employment “has shown little change since April.” The latest downward moves in crypto have now erased more than $1 trillion in market value since early October. JPMorgan says Strategy could face billions in outflows if MSCI and other major indices remove it.

Crypto Market Overview

BTC (-7.14% | Current Price: $85,902.37)

Bitcoin, the market bellwether, is leading the downturn. Its price has fallen over 20% from its September highs and recently broke below the critical $90,000 support level. BTC fell below $86,000, a level not seen since April. Technically, Bitcoin's 50-day moving average has fallen below its 200-day average, forming a bearish "death cross" pattern. The market exhibits a tug-of-war. Spot Bitcoin ETFs have seen massive outflows, with approximately $1.1 billion redeemed in November alone, putting it on track for its worst month on record. Data indicates notable outflows from wallets controlled by large institutions. However, this is contrasted with on-chain data showing accumulation by other large investors, or "whales". Analysts are watching the $85,000 level closely, as there is a strong demand for downside protection (put options) at this level. A break below could open the path towards $82,000.

On November 20th, Bitcoin exchange-traded funds (ETFs) registered an outflow of $547.7 million. Fidelity's FBTC saw an outflow of 190.4 million.

ETH (-7.46% | Current Price: $2809.33)

ETH price dropped to around $2,870 before a slight bounce. It is currently testing its most critical on-chain support level near $2,800. This zone is historically significant as it aligns with the average acquisition price for both retail and whale investors and has marked cycle bottoms in the past. In a surprising divergence, Ethereum's average Gas fee has plummeted by 95% over the past year, now sitting at just 2.7 gwei. This means the average cost for a swap is only $0.39, drastically improving network affordability but also potentially indicating reduced on-chain activity. A classic bottoming signal may be emerging. On-chain data shows that while retail holders are selling in panic, whale addresses (holding 10,000+ ETH) are steadily accumulating at these levels. Furthermore, long liquidations have slowed, suggesting that forced selling may be exhausting

On November 20th, ETH ETFs experienced a total net outflow of $139.0 million, including an outflow of $90.5 million from Fidelity's FETH.

Altcoins

The altcoin market is facing severe pressure as investors flee riskier assets. The performance across sectors is mostly negative, though some areas show remarkable strength. A long-term altcoin trader who has held since 2021 reportedly exited their position in late 2025, suffering significant losses. This symbolizes the broader shift in sentiment. The Crypto Fear & Greed Index is 11, solidly in "Extreme Fear" territory.

Macro Data

The primary driver is a hawkish U.S. Federal Reserve, which has dampened expectations for a December rate cut. This has strengthened the U.S. dollar and triggered a broad "risk-off" mood, negatively impacting high-risk assets like crypto. The correlation between Bitcoin and the S&P 500 has strengthened, indicating crypto is being treated as a risk-on "digital macro asset"

On November 20th, the S&P 500 fell 1.56%, standing at 6,538.76 points; the Dow Jones Industrial Average dropped 0.84% to 45,752.26 points, and the Nasdaq Composite fell 2.15% to 22,078.05 points.

Trending Tokens

TNSR Tensor (+155.63%, Circulating Market Cap: $98.02 Million)

TNSR is trading at $0.1954, up approximately 155.63% in the past 24 hours. Tensor (TNSR) stands out as a pivotal player in the cryptocurrency landscape, particularly within the Solana blockchain ecosystem. At its core, Tensor is a foundation that empowers community-led governance over its protocols, fostering the growth of the Tensor DAO and the broader Tensor ecosystem. This foundation supports both Tensor and Vector protocols, which are essential trading infrastructures for NFTs on Solana and tokens across multiple chains. TNSR broke out of a multi-month descending channel pattern on November 20, confirmed by a daily close above $0.13(CCN). This triggered bullish signals across indicators like the Directional Movement Index (DMI+ at 52.7 vs. DMI- at 12.1) and MACD histogram rising to 0.015. Technical traders interpreted the breakout as a reversal signal, driving spot buying. The price now faces resistance near $0.17 (May 2025 high), but sustained volume could extend gains.

DYM Dymension (+69.65%, Circulating Market Cap: $55.65 Million)

DYM is trading at $0.1360, up approximately 69.65% in the past 24 hours. Dymension (DYM) is a modular blockchain network designed to simplify the creation and interoperability of scalable, application-specific chains (RollApps) while providing shared security and liquidity. DYM’s 7-day RSI hit 85.75 (overbought), while the MACD histogram turned positive (+0.0052). Price broke above 50% Fibonacci retracement level ($0.138). Momentum traders are chasing the rally, but RSI extremes hint at overheated conditions. A close below $0.138 could trigger profit-taking.

NMR Numeraire (+35.16%, Circulating Market Cap: $106.61 Million)

NMR is trading at $13.96, up approximately 35.16% in the past 24 hours. Numerai is an

Ethereum-based platform allowing developers and data scientists to experiment and create machine learning models with improved reliability. The platform’s main goal is to bring decentralization to the data science field and allow developers to compete in creating effective machine learning prediction models. On November 20, Numerai announced a $30M Series C round led by university endowments, valuing the AI-driven hedge fund at $500M – 5x its 2023 valuation (CoinTelegraph). J.P. Morgan also committed $500M in hedge fund capacity, doubling Numerai’s AUM to ~$1B. Institutional validation strengthens NMR’s use case as a staking token for data scientists contributing to Numerai’s trading models. Increased AUM correlates with higher demand for NMR to participate in prediction tournaments, creating buy pressure.

Market News

U.S. Employment Report Released: September Jobs Data Shows 119K Payrolls Added as Bitcoin Holds $92K

Crypto markets are processing the long-awaited September employment report released today after a six-week delay caused by the federal government shutdown. The U.S. Bureau of Labor Statistics reported that nonfarm payrolls edged up by 119,000 in September, significantly beating Wall Street’s consensus estimate of 50,000 but revealing broader weakness as employment “has shown little change since April.”

The unemployment rate ticked up to 4.4% from 4.1% a year earlier, with 7.6 million Americans now jobless. Bitcoin is trading around $92,000, up roughly 0.6% over the past 24 hours, holding above the critical psychological level despite record ETF outflows and extreme fear gripping crypto markets.

The jobs data comes at a pivotal moment, as Fed rate-cut odds have collapsed to just 33% from nearly 100% three weeks ago, leaving crypto traders caught between modest employment growth that could keep rates higher for longer and underlying labor-market weakness that typically supports eventual monetary easing.

The report reveals troubling undercurrents beneath the headline number. July and August payrolls were revised down by a combined 33,000 jobs, with August actually showing a loss of 4,000 positions rather than the initially reported 22,000 gain. Federal government employment has plunged by 97,000 since January. Transportation and warehousing shed 25,000 jobs in September alone, and the data collection rate of 80.2% raises questions about accuracy, given the shutdown disruptions.

Crypto World Wipes Out $1 Trillion After Latest Bitcoin Drop

The latest downward moves in crypto have now erased more than $1 trillion in market value since early October, when the crypto market cap was about $4.2 trillion. On Thursday, that figure was under $3 trillion.

On October 10, a massive liquidation event unexpectedly sent crypto markets into free fall. It marked the largest bitcoin liquidation in history, as investors offloaded $19 billion in leveraged positions; however, some estimates suggest the true number is closer to $30 billion.

Over a month later, conditions haven't improved, and bitcoin's slide has pulled other coins down with it. Bitcoin was trading at $86,398 on Thursday, down 31% from its October 6 high above $126,000. The token is now in the red for the year, down more than 5% to date.

The ongoing crypto bear market seems to be testing even the most steadfast bitcoin bulls, who fear a deeper market freeze may be setting in until a new catalyst can bring fresh upside.

"Wealthy Bitcoin investors are selling and ETFs are seeing outflows," read a report from crypto asset manager 21Shares. "Long-term investors have offloaded ~42K BTC (~$4B) this month, while spot Bitcoin ETFs posted three consecutive weeks of outflows. Thursday alone saw $866M in redemptions, the second-largest day on record."

The firm's strategists cited a combination of technical factors and macro pressures that continue to push bitcoin and other cryptocurrencies lower. Prices remain volatile due to forced liquidations and thin market liquidity, while commentary on lower odds of a rate cut from the Fed next month is denting the bull case for risk assets like bitcoin.

JPMorgan Says Strategy Could Face Billions in Outflows If MSCI and Other Major Indices Remove It

Michael Saylor’s Strategy (formerly MicroStrategy) could see billions of dollars leave its stock if MSCI removes it from major equity indices, according to JPMorgan analysts.

The analysts, led by Nikolaos Panigirtzoglou, noted in a Wednesday report that Strategy’s share price has fallen more than bitcoin in recent months as its valuation premium viewed by some investors as "unjustified", has sharply compressed. But they noted the more recent slide likely reflects growing concern that the company may be dropped from key benchmark indices.

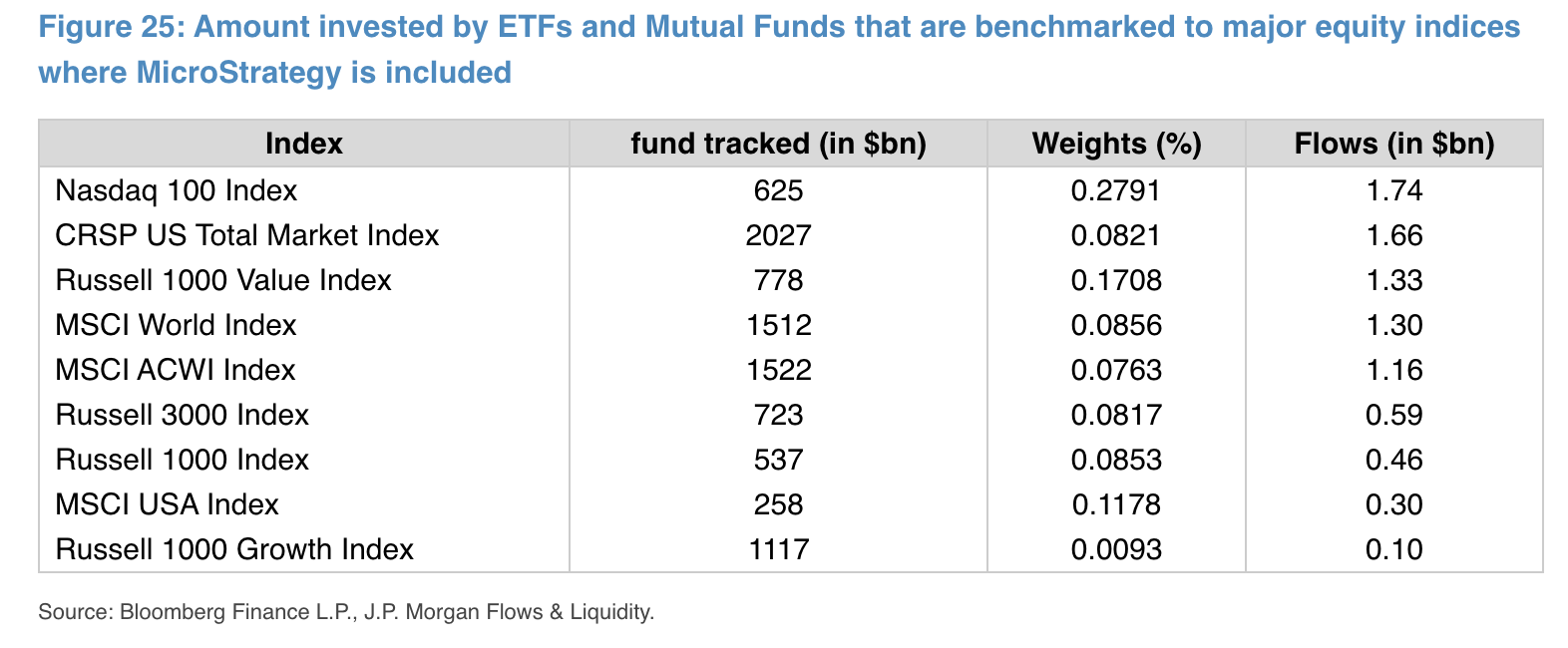

Strategy is currently included in major indices such as the Nasdaq-100, MSCI USA, and MSCI World. The JPMorgan analysts estimate that roughly $9 billion of its $50 billion market value sits in passive funds that track these indices.

That index inclusion has effectively allowed bitcoin exposure to seep into both retail and institutional portfolios via passive investment vehicles. A removal would reverse that flow, the analysts warned.

"If MicroStrategy is excluded from these indices, it could face considerable pressure to its valuation given that passive index-tracking funds represent a substantial share of its ownership," the analysts wrote. "Outflows could amount to $2.8 billion if MicroStrategy gets excluded from MSCI indices and $8.8 billion from all other equity indices if other index providers choose to follow MSCI."

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.