As of December 22, 2025, the crypto market on December 22, 2025, entered a phase of subdued activity as holiday thinning liquidity took hold, with major assets showing muted price action amid broader caution. The total market capitalization stood around $3 trillion, reflecting a 0.58% increase over the past 24 hours but remaining down over 2% on the week as investors digested mixed macro signals and year-end positioning. Bitcoin, the sector's anchor, traded near $88,700, up 0.77% daily after bouncing from recent lows, while Ethereum hovered around $3,025, up 1.65% but struggling with relative weakness. Meanwhile, Uniswap’s UNI token rallied about 19% over the past 24 hours as on-chain voting began on a major governance proposal that would activate protocol fees and introduce a long-discussed UNI burn mechanism. Northern Data sold its bitcoin mining subsidiary Peak Mining for up to $200 million to a group of companies controlled by the Tether. VanEck has updated its filing for an Avalanche exchange-traded fund, VAVX, to include staking rewards and generate income for investors.

Crypto Market Overview

BTC (+0.77% | Current Price: $88,700.02)

Bitcoin's performance on December 22 demonstrated a period of market consolidation, with asset trading around $88,700 after a daily increase of 0.77%, which reduced weekly losses to approximately 0.72%. This stability followed a corrective week during which Bitcoin tested lows near $84,000, influenced by profit-taking and broader macroeconomic factors such as the Bank of Japan’s recent rate decision.

From a technical perspective, Bitcoin maintained support at the $84,000 level, aligning with the 50-day exponential moving average and previous range lows. The relative strength index dipped below 30 earlier in the week, indicating oversold conditions and suggesting potential exhaustion among sellers, which permitted a modest rebound. Nevertheless, the daily MACD histogram remained negative, signaling ongoing bearish momentum unless renewed buying activity occurs. Key resistance is identified at $90,000, which is a psychological level that previously served as a point of breakdown. Conversely, a drop below $84,000 could potentially lead to a decline toward $80,000, aligning with deeper Fibonacci retracement levels.

On December 19th, Bitcoin exchange-traded funds (ETFs) registered a total net outflow of $158.3 million, with BlackRock's IBIT seeing an outflow of 173.6 million.

ETH (+1.65% | Current Price: $3,025.78)

Ethereum traded around $3,025 on December 22, experiencing a 1.65% increase day-over-day but a decline of over 6% on a weekly basis, underperforming Bitcoin amidst ongoing network challenges. The ETH/BTC ratio continued to decline, reaching multi-month lows and indicating sustained relative weakness as investor capital favored larger cryptocurrencies.

Price action demonstrated consolidation above the $3,000 level, with daily lows approaching the $2,900 support zone. Oversold technical indicators suggested potential for a rebound; however, bearish MACD divergence indicated that downward momentum remained in place. Technical analysis pointed to increased vulnerability below the $2,800 mark, which corresponds to the 200-day moving average.

Network metrics revealed low activity levels. Gas fees remained at historic lows around 0.027 Gwei, facilitating inexpensive transactions but reflecting reduced network congestion and subdued demand within DeFi and NFT sectors. Daily active addresses remained muted, aligning with decreased revenue streams and a shift toward layer-2 solutions. While staking yields provide stability, overall activity levels suggest a delayed recovery momentum.

On December 19th, ETH ETFs experienced a total net outflow of $75.9 million, with BlackRock's ETHA saw an outflow of $75.9 million.

Altcoins

Altcoins experienced selective gains on December 22; however, the sector overall underperformed, with aggregate market capitalization declining amid Bitcoin's continued dominance. Supply pressure resulting from token unlocks impacted mid-tier projects, totaling over $566 million released in December. Overall, the underperformance of altcoins has reinforced Bitcoin's leading position, with recovery closely linked to broader market stabilization.

The Crypto Fear & Greed Index stood at 29 on December 22, indicating fear as investors processed recent volatility. This uptick from extreme lows reflects tentative stabilization, but prolonged fear suggests caution, historically preceding rebounds when extremes exhaust. The Altcoin Season Index lingered at 17 on December 22, confirming Bitcoin dominance as fewer top coins outperformed over 90 days. This low reading signals capital concentration in majors, with thresholds above 75 needed for rotation.

Macro Data

Macro factors have contributed to cautious market sentiment, with the Bank of Japan's December 19 interest rate increase to 0.75% supporting the Japanese yen and exerting downward pressure on cryptocurrencies through carry unwinds. While easing U.S. Inflation has provided some relief, with a strong employment report has tempered expectations of further easing. Upcoming economic indicators, such as the Personal Consumption Expenditures (PCE) data, will be closely monitored to assess market sensitivity.

On December 19th, the S&P 500 increased 0.88%, standing at 6,834.50 points; the Dow Jones Industrial Average up 0.38% to 48,134.89 points, and the Nasdaq Composite gained 1.31% to 23,307.62 points. The price of gold is $4,394.4, up 0.92%, at 4:00 UTC, December 22nd.

Trending Tokens

NIGHT Midnight (+40.13%, Circulating Market Cap: $1.83 Billion)

NIGHT is trading at $0.1102, up approximately 40.13% in the past 24 hours. Midnight is a new generation of blockchain, developed by Charles Hoskinson - the cofounder of Ethereum and founder of Cardano, that uses zero-knowledge (“ZK”) proof technology to offer utility without compromising data protection or ownership, enabling applications that safeguard user, commercial, and transaction data and metadata. Midnight introduces a novel blockchain architecture designed to address key privacy-limiting designs of existing public blockchains, supporting applications that require a balance between privacy and disclosure. The Midnight protocol combines the use of a ZK proofs-based, public-private dual-state ledger architecture to protect data, with a composite, dual-component tokenomics design to protect metadata. The Midnight Foundation confirmed receiving a legal contract for a stablecoin partner, pending final review. This aligns with NIGHT’s role as a network capacity token for private transactions. A partnership would validate Midnight’s regulatory-friendly privacy model, potentially boosting demand for NIGHT to generate transaction fuel. This addresses concerns about real-world utility for a token currently driven by speculation.

ASR AS Roma Fan Token (+18.5%, Circulating Market Cap: $14.64 Million)

ASR is trading at $1.82, up approximately 18.5% in the past 24 hours. Tokens are generally assets that can represent proof of ownership or even membership. As tokens are already being used for a wide range of purposes, many specialized blockchains have been developed with native intent to support tokens, the most common of which is currently Ethereum and their ERC standard tokens. Socios.com is an app for football (soccer) fans, where users acquire voting rights to influence the clubs they support by acquiring club-specific Fan tokens. ASR’s 24h trading volume spiked 236.42% to $112M, with Binance Futures users noting 25.6% gains in the token. Toobit’s ASR perpetual contracts (launched August 2025) allow up to 75x leverage, attracting speculative capital. High leverage amplifies price swings, creating a feedback loop of buying pressure. The spot vs. perpetuals volume ratio (0.19)suggests derivatives dominate short-term moves, increasing volatility.

YGG Yield Guild Games (+16.84%, Circulating Market Cap: $50.47 Million)

YGG is trading at $0.07395, up approximately 16.84% in the past 24 hours. Yield Guild Games (YGG) is the world’s first and biggest web3 gaming guild where players can find their community, discover games and level up together. Its mission is to become the leading community-based user acquisition platform in web3 gaming. YGG broke above 23.6% Fibonacci retracement ($0.08456) and its 7-day SMA ($0.0638). The MACD histogram turned positive (+0.00069), and RSI (42.23) suggests room for upside before overbought conditions.

Market News

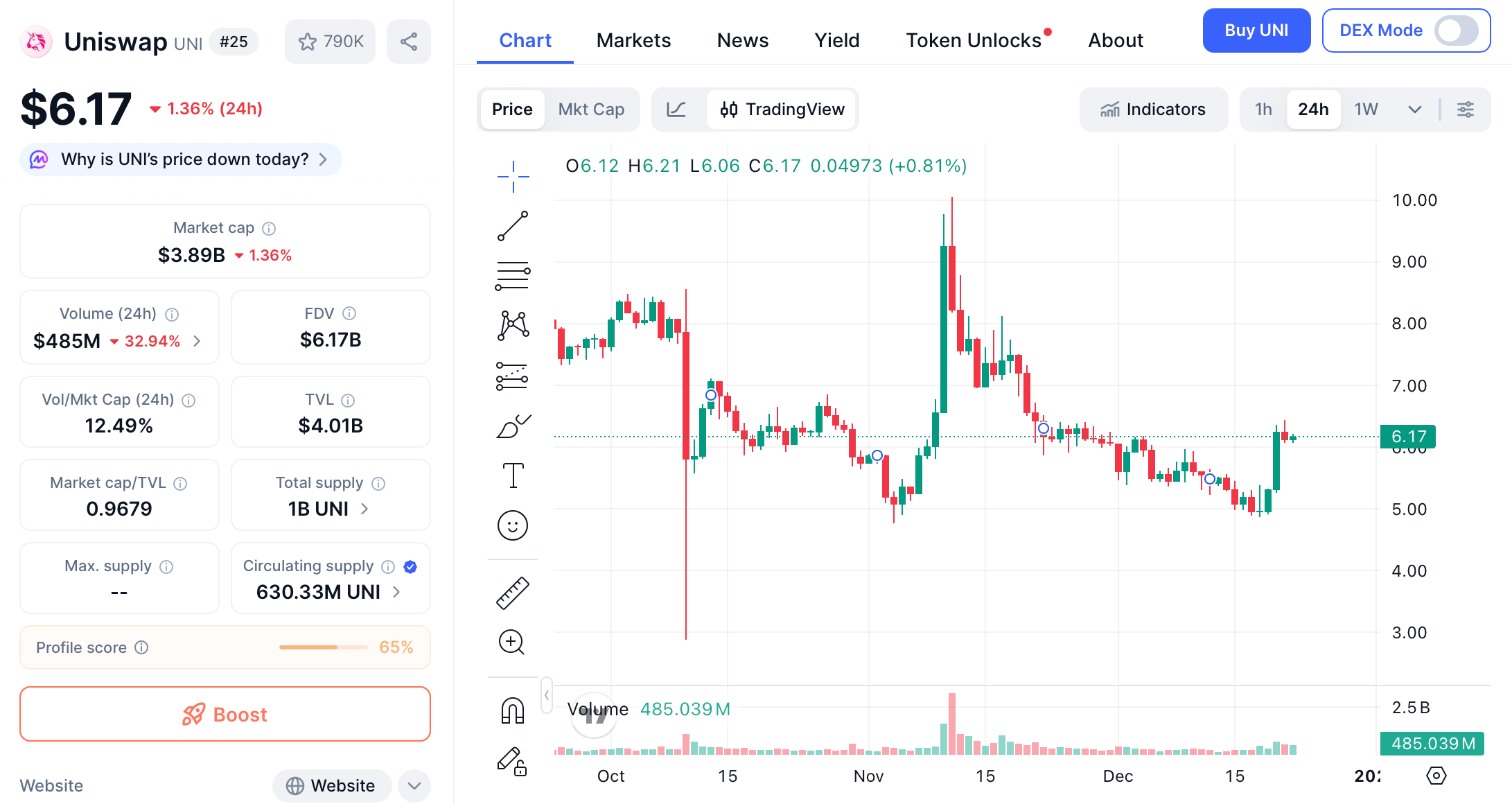

Uniswap’s UNI Jumps 19% as Governance Vote to Activate Protocol Fees Opens

Uniswap’s UNI token rallied about 19% over the past 24 hours as on-chain voting began on a major governance proposal that would activate protocol fees and introduce a long-discussed UNI burn mechanism.

UNI began climbing shortly after the voting period opened at 03:50 UTC on Dec. 20, according to Uniswap governance data. A one-day UNI-USD chart from TradingView shows the sharpest leg of the rally unfolding during the early hours of the voting window, with the price breaking out from the $5.40–$5.50 range and continuing to trend higher throughout the day, alongside rising trading volume.

By around 19:30 UTC, UNI was trading near $6.17. The move stood out against a relatively muted broader market, with bitcoin consolidating near $88,300 and ether trading slightly lower around $2,976. The overall crypto market capitalization was up about 1% over the same period, underscoring UNI’s relative outperformance.

The vote centers on a sweeping governance proposal known as “Unification,” a name that reflects its goal of aligning Uniswap’s economic incentives, governance structure and development efforts under a single framework. If approved, the proposal would implement protocol fees across Uniswap v2 and select v3 pools, routing those fees into a programmatic mechanism that burns UNI tokens.

The proposal also includes a retroactive burn of 100 million UNI from the treasury, intended to approximate the amount that might have been burned had protocol fees been active since Uniswap’s early years. Additional components would direct Unichain sequencer fees into the same burn mechanism and introduce new auction-based systems designed to internalize MEV while improving liquidity provider returns.

Beyond fee activation, the proposal formalizes closer operational alignment between Uniswap Labs, the Uniswap Foundation and on-chain governance. Under the plan, Labs would focus on protocol development and growth, while removing fees from its interface, wallet, and API. Development and ecosystem initiatives would be funded through a governance-approved growth budget.

Tether-backed Northern Data Sold Bitcoin Mining Arm to Companies Run by Tether's Own Executives

Northern Data, the German AI and data center company majority-owned by USDT, sold its bitcoin mining subsidiary Peak Mining for up to $200 million to a group of companies controlled by the stablecoin giant's top executives, the Financial Times first reported Friday.

Corporate filings reviewed by the FT show that the buyers of Peak Mining-Highland Group Mining Inc., Appalachian Energy LLC, and 2750418 Alberta ULC, which are tied directly to Tether's leadership. British Virgin Islands records indicate that Highland Group Mining is controlled by Giancarlo Devasini, Tether's co-founder and chairman, and Paolo Ardoino, the company's CEO. Canadian documents list Devasini as the sole director of Alberta ULC. The ownership of Delaware-registered Appalachian Energy LLC remains opaque, with no directors publicly listed.

Northern Data announced the Peak Mining divestment in November but did not initially identify the buyers. The company is listed on a regulated but unofficial German market segment that requires certain corporate disclosures but does not mandate reporting of related-party transactions, meaning there was no obligation to reveal that Tether executives were on both sides of the deal.

The sale marks the second attempt to offload Peak Mining to entities linked to Devasini. In August, Northern Data announced a nonbinding agreement to sell the mining unit to Elektron Energy for $235 million. Elektron is also controlled by Devasini, according to British Virgin Islands filings. That deal never closed, and Peak Mining was instead sold at a lower price to the trio of companies identified in the recent filings.

Tether also extended a €610 million loan to Northern Data. Per the Rumble acquisition terms, half of that loan will convert into Rumble stock upon closing, with the remainder becoming a new loan from Tether to Rumble secured by Northern Data's assets. Tether, Northern Data, and Rumble did not immediately respond to a request for comment from The Block.

VanEck's New Avalanche ETF Filing to Include Staking Rewards for AVAX Investors

VanEck has updated its filing for an Avalanche exchange-traded fund, VAVX, to include staking rewards and generate income for investors.

In an amended S-1 filed with the U.S. Securities and Exchange Commission, the firm disclosed that the fund may stake up to 70% of its AVAX holdings to generate yield, with Coinbase Crypto Services listed as the initial staking provider. Any rewards, minus a 4% service fee from Coinbase, would accrue to the fund and be reflected in the ETF’s net asset value. Under the plan, AVAX will be held with regulated custodians, including Anchorage Digital and Coinbase Custody, both of which store tokens offline in cold wallets.

The fund will not utilize leverage or derivatives, and it will track AVAX’s price through the MarketVector Avalanche Benchmark Rate, a custom index constructed from major exchanges. If approved, the fund would trade under the ticker VAVX on Nasdaq. Bitwise last month updated its spot Avalanche ETF filing with the SEC to also enable yield generation.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.