Janction (JCT) is a Layer 2 solution for artificial intelligence applications. JCT aims to bridge the gap between blockchain scalability and AI’s high computing needs. It draws investor interest with its GPU marketplace and smart contract features.Janction (JCT) positions itself at the forefront of this Web3 evolution, proposing a decentralized protocol to redistribute advertising value directly to content creators, website owners, and users. As the digital advertising market undergoes scrutiny over data privacy, fairness, and revenue distribution, projects like Janction offer a compelling, albeit ambitious, alternative. This report provides a comprehensive analysis of the Janction project, its native JCT token, and a detailed price forecast from 2025 through 2030. It is crucial to preface this analysis with a clear disclaimer: cryptocurrency markets are inherently volatile and speculative. The following price predictions are based on a synthesis of current project fundamentals, technical analysis, and broader market cycle theories. They are for informational and educational purposes only and should not be construed as financial advice. All investment decisions carry risk, and individuals must conduct their own rigorous research (DYOR).

What is Janction (JCT)?

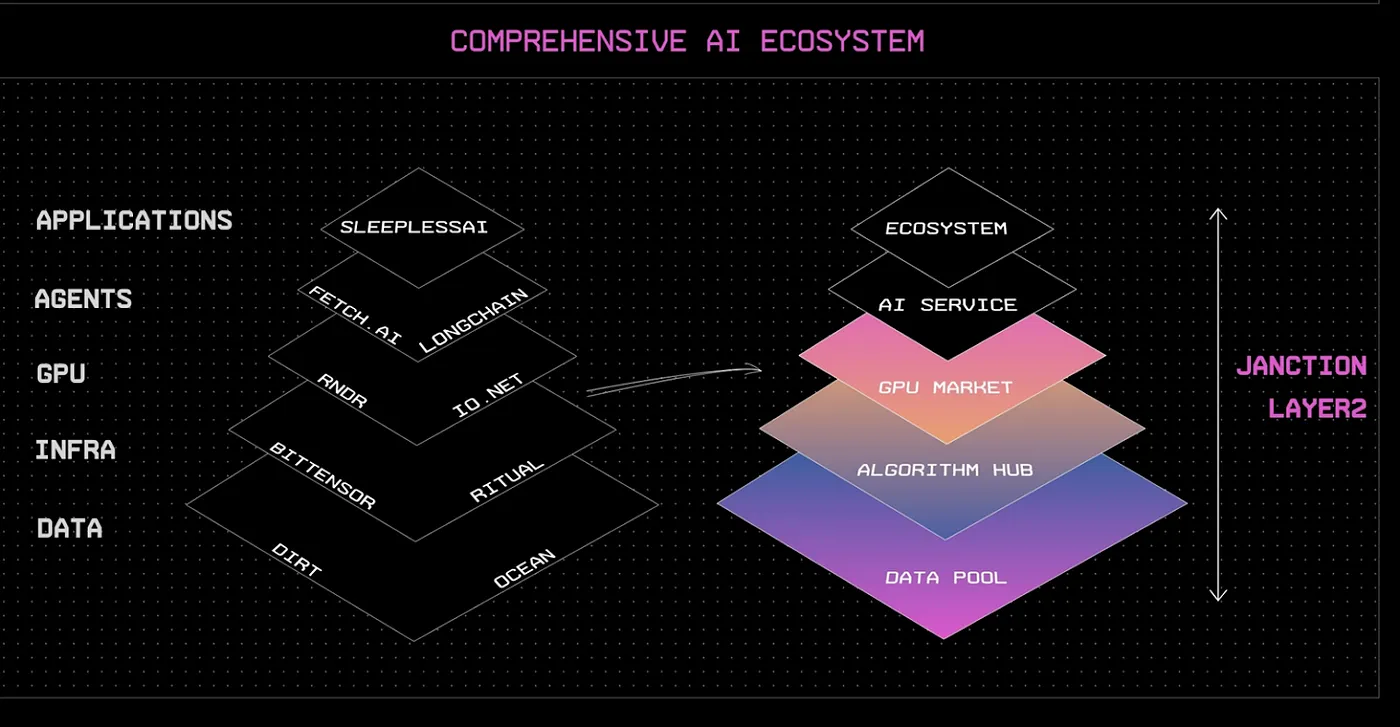

Janction (JCT) is the first Layer 2 blockchain protocol focused on scalable, verifiable AI services. Built on Ethereum, it uses smart contracts to automate machine learning and AI workflows. Janction brings together key AI features,such as models, GPU computing, data input, and labeling in a single ecosystem. This setup supports shared processing. It allows easier collaboration among developers, data providers, and computing resources, breaking down barriers in traditional AI development.

One of Janction’s main features is its GPU Marketplace. It aggregates GPUs from various sources to provide affordable, large-scale computing power. This makes high-performance computing more accessible, which is essential for AI model training and deployment. The platform’s GPU cluster handles scheduling, task allocation, load balancing, and fault tolerance. This ensures both efficiency and security. Payments are handled transparently and automatically with JCT tokens. These tokens utilize proof-of-work for verifiable computations.

About GPU Market

In 2023, as the inaugural year for AI/AIGC, from OpenAI to various internet giants around the world, there has been an active layout in the AI field. This trend also provides huge development opportunities for AI startups.

If break down the AI industry, it is inevitably find its three core elements: computing power, algorithms (Models), and data. It’s evident that computing power, in particular, is crucial and indispensable for the advancement of AI startups. Take OpenAI’s ChatGPT-3, for example; this massive model boasts 175 billion model parameters and requires immense GPUs computing power for training, which can take several months.

Additionally, computational power is also required for model deployment and inference stages. Similarly, the companies rely on GPU computing power for the development and deployment of AI models.

Insufficient GPUs

Despite the strong demand for GPU computing power, the supply side faces capacity shortages. NVIDIA has launched various high-end ,high-performance GPUs such as H100 and A100. However, due to capacity limitations at TSMC, the supply is clearly insufficient. Even if these GPUs can be produced, they are primarily supplied to the giants, and small and medium-sized enterprises often have to meet their computing power needs through cloud-based GPUs.

At the same time, with Ethereum’s shift from PoW to PoS, NVIDIA’s previous-generation GPUs (such as the GeForce RTX 3090) has resulted in a large amount of idle GPU resources.

Additionally, the supply of high-quality and diverse datasets is crucial for AI model performance, and the release of Microsoft’s small-scale parameter language models suggests new directions for future AI models.

Solution

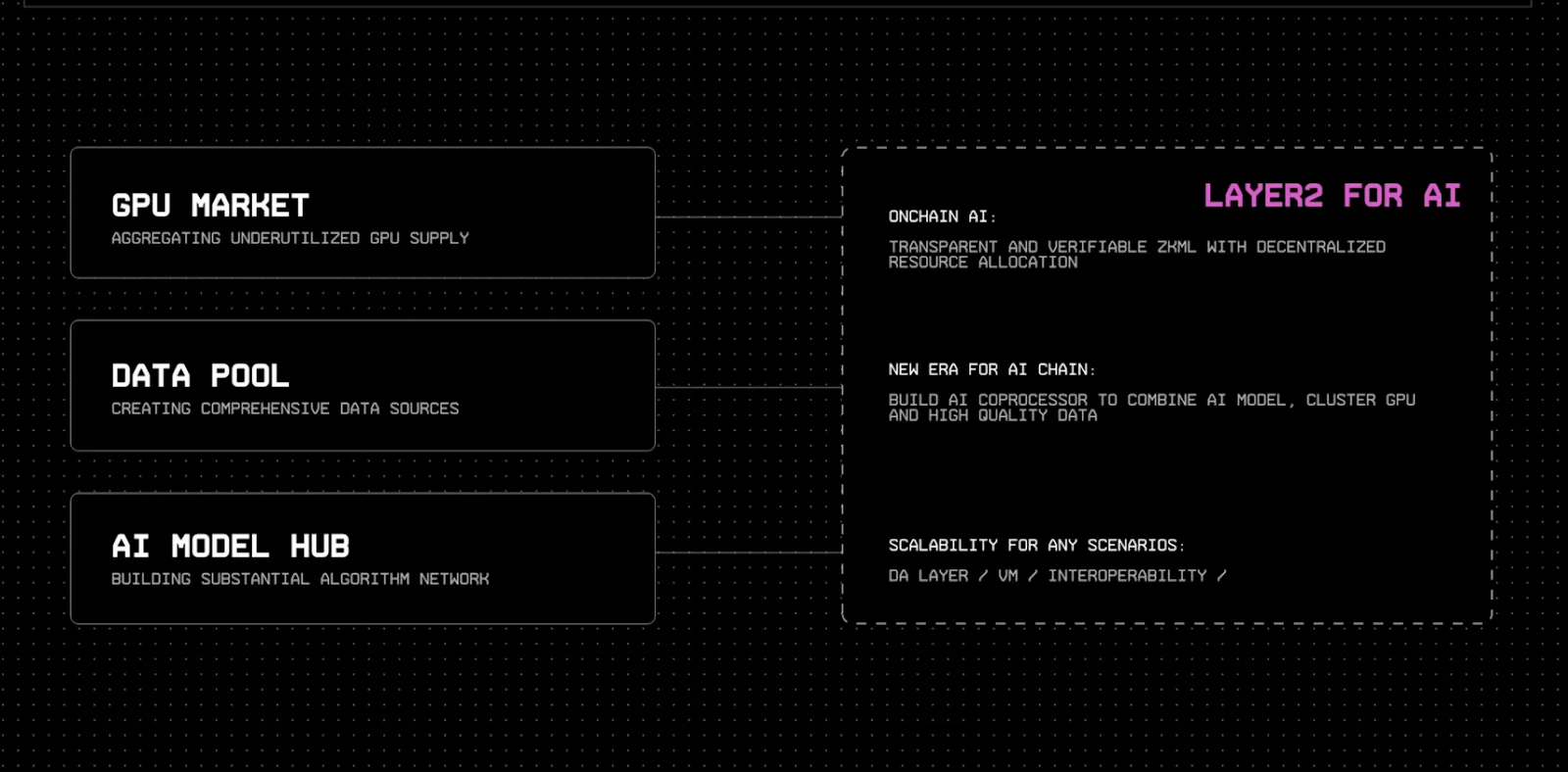

After extensive research, we conclude that developing a new, independent L2 can effectively approach to address the current challenges in the AI industry.

Onchain AI can use smart contracts to automate and dynamize machine learning and artificial intelligence. At the same time, blockchain technology provides transparent and verifiable solutions for all aspects of AI (such as zkML/opML). Additionally, key elements like AI models, GPU computing power, data feeding, and data labeling can all be integrated into a Layer 2 specifically designed for AI.

Current AI public chains typically only decentralize specific segments and fail to form effective collaborative effects. For instance, while some projects specialize in high-quality AI models, distributed GPU computing power, or data quality assurance, these limitations prevent current AI public chains from providing sufficient support.

Layer 2, as a lightweight and flexible option, can freely choose to integrate with Bitcoin (not yet realized, but has potential), Ethereum. Additionally, it adopts a mature execution layer technology stack, offering many benefits. This allows attracting EVM ecosystem projects and users, along with benefits like low transaction fees and high TPS.

Furthermore, building L2 connections on AI public chains can overcome the limitations of the underlying public chain and enhance interoperability.

Recently, many large-scale projects have adopted L2 as a primary solution, indicating the widespread adoption and prospects of L2 in the AI and blockchain fields. This proposal holds the potential to drive new deployments and innovations in the AI industry.

JANCTION — Layer 2

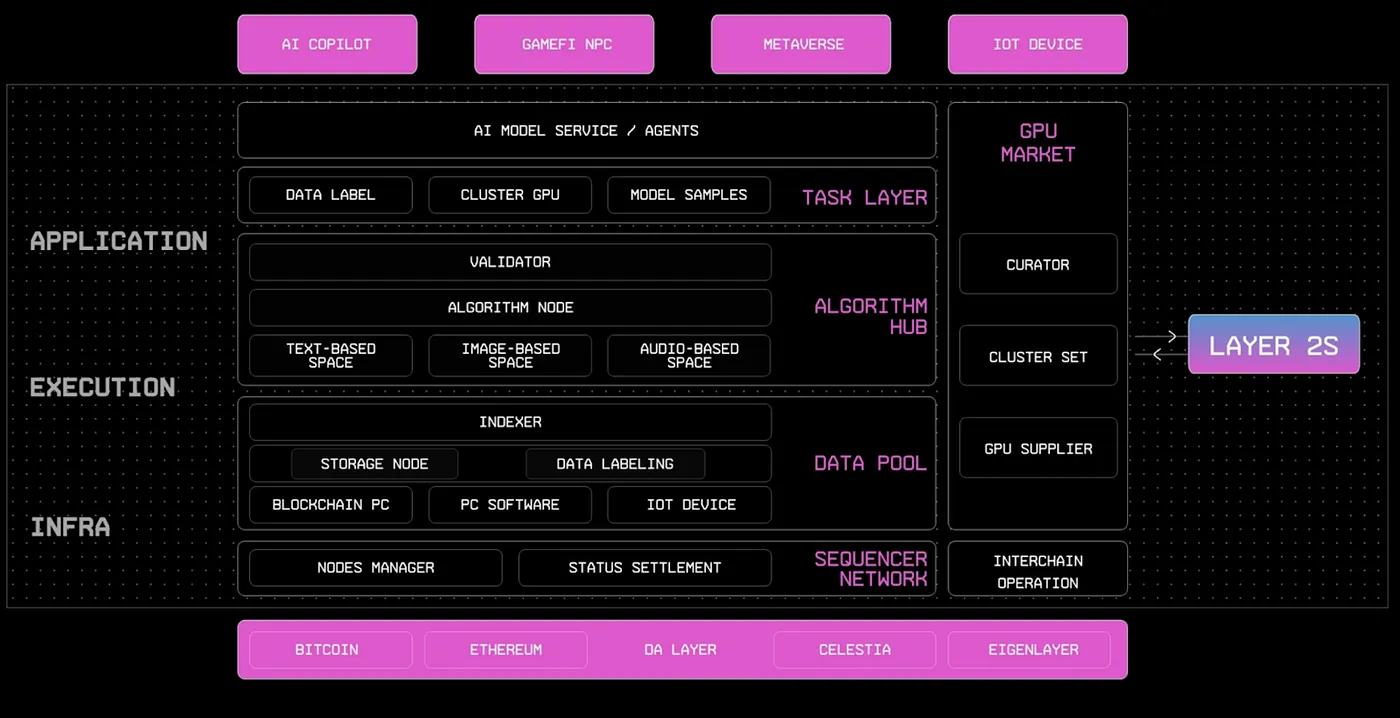

Regarding the overall architectural design of

JANCTION, it provides a detailed explanation following a bottom-up hierarchical structure. At the bottom layer, Janction stores public datasets (pools) necessary for AI model pre-training. These datasets are optimized, accelerated, and compressed (for instance, the GPT-3 model requires about 700GB of disk space). When training and inferring models, we adopt distributed and parallel processing strategies to enhance efficiency. In addition, Janction have designed specialized annotation protocols for different types and modalities of data, including data labeling standards, data quality checks, and feedback correction schemes.

In the middle layer of architecture, it has been established a public vector database primarily for processing Prompts, equipped with an algorithm Hub for different scenarios and model optimization and fine-tuning, to enable scene adaptation and continuous improvement of models. Moreover, a powerful computing layer is the core of the entire architecture. We have aggregated idle GPU computing power to support the efficient operation of upper-layer applications.

At the top layer, the AI application layer and intelligent agent layer (Agents), mainly oriented towards C-end users, can seamlessly access our underlying layer. These applications and agents can fully utilize the underlying data, models, and computing resources to provide users with a rich and intelligent service experience. Through such an overall architectural design,

JANCTION can achieve full-process optimization from data to application, bringing more efficient and convenient AI services to users.

JANCTION — Core Architecture

Examining

JANCTION’s architecture from the perspective of Layer 2, it is clearly to see that it still integrates the classic Data Availability (DA) layer. In this layer, a DA layer that meets both the performance requirements of the AI field has been selected and is cost-effective, ensuring efficient data utilization and cost control. Additionally,

JANCTION also involves transaction ordering and batch sequencers, ensuring the effectiveness of data processing.

At the AI execution level, data has been encapsulated by using data pool technology, achieving core functions such as data storage, indexing, and data annotation. These functions together constitute

JANCTION’s powerful data processing capabilities. Subsequently, an algorithm Hub has been deployed tailored for different scenarios, providing a rich array of algorithmic support for various AI applications.

At the same time, to ensure a stable supply of computing power, a comprehensive set of GPU-related modules has been built. These modules include a GPU market, Curator, clusters, and GPU supply, all of which work together to provide strong computing power support for

JANCTION’s AI applications.

Through such architectural design,

JANCTION has achieved a perfect integration of data, algorithms, and computing power at the Layer 2 level, laying a solid foundation for the rapid development of AI applications.

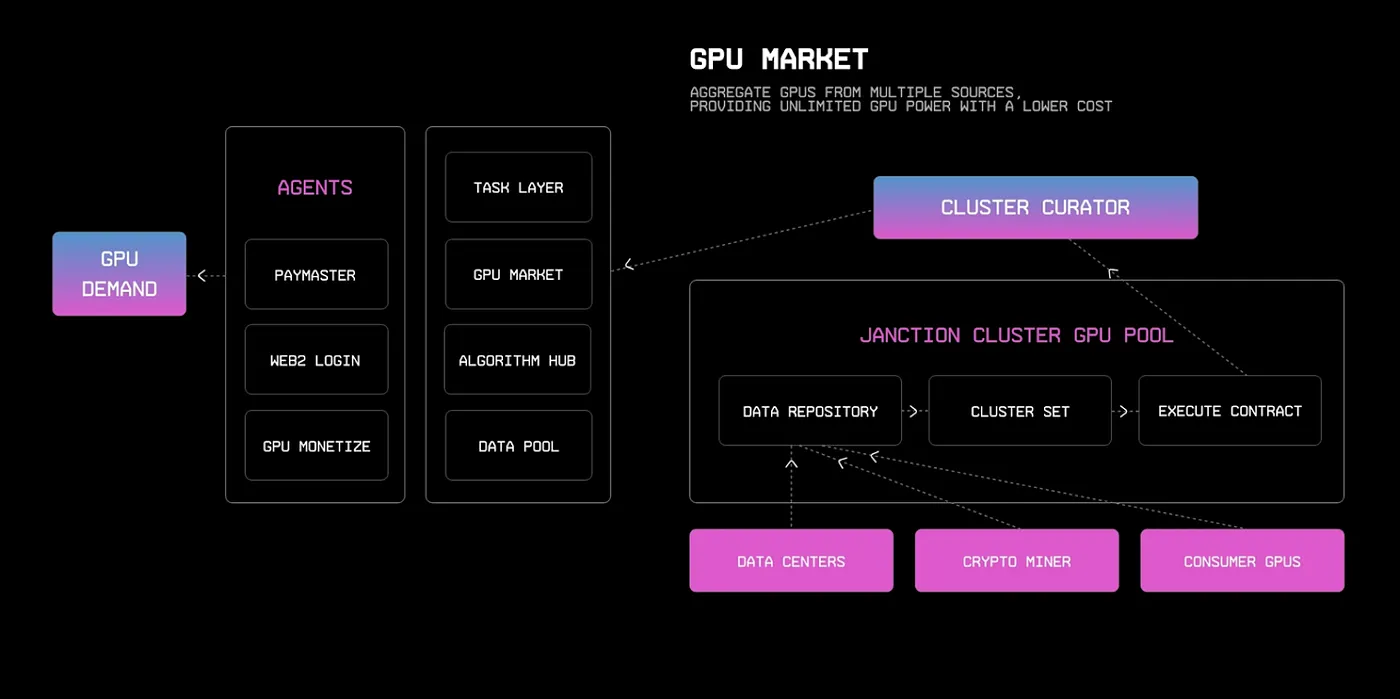

In delving into

JANCTION’s GPU modules, it is clear that the core component is a powerful Cluster GPU pool. This pool has the capability to aggregate computing power from multiple sources, including data centers, cryptocurrency miners, and consumer GPUs, thereby creating an efficient GPU cluster. These clusters are strictly managed by execution contracts, ensuring reasonable allocation and use of resources.

To achieve optimal configuration of GPU resources,

JANCTION introduces two key components: Curator and the GPU market. The Curator is responsible for monitoring and managing the status of the GPU clusters, ensuring they are always in the best working condition. Meanwhile, the GPU market provides a platform where suppliers and demands of computing power can efficiently match and transact.

Existing Market Condition and Pricing

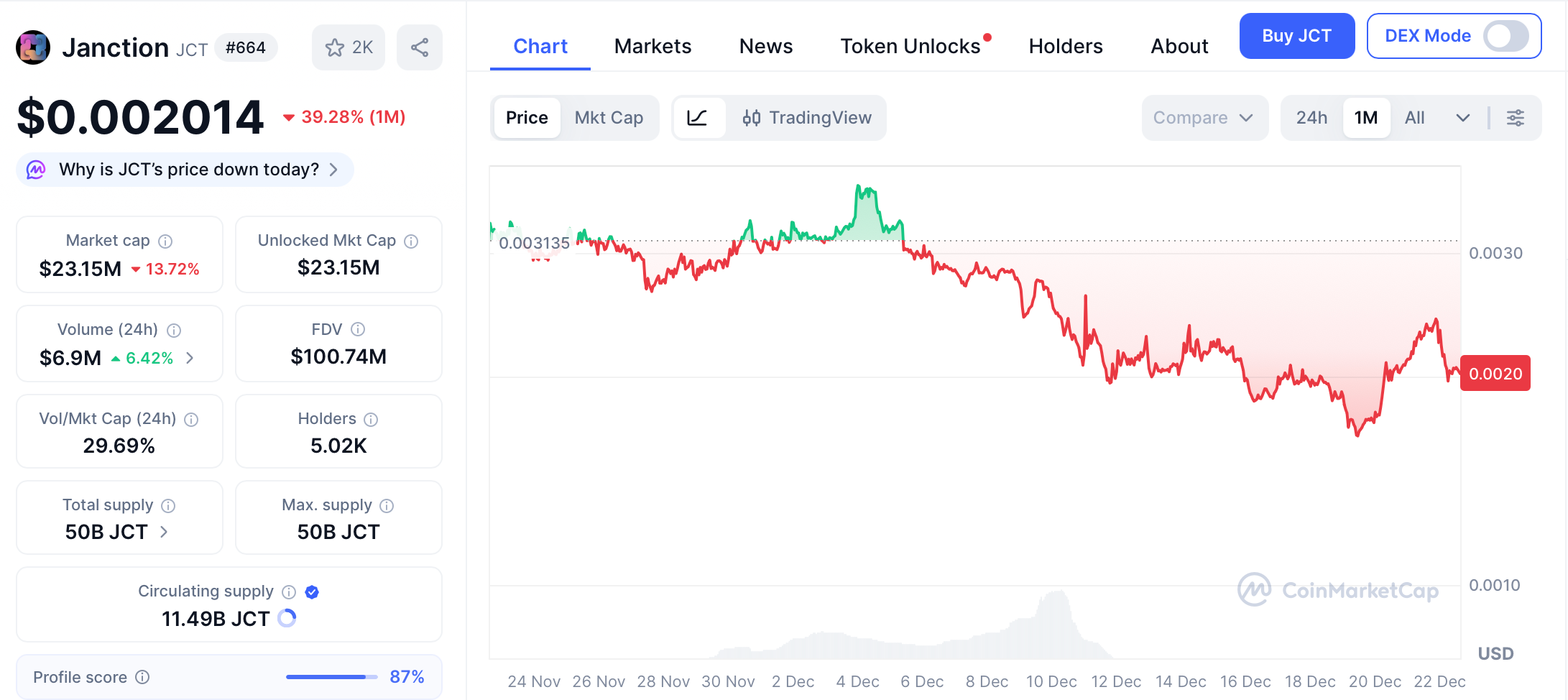

On December 22, 2025, Janction (JCT) traded at $0.002014, representing a 39.21% decrease over the previous month. Recently, the token hit a high of $0.01214 on November 10 before dropping low. Its low of $0.001629 on December 19.

The price action of JCT is heavily influenced by two primary forces. First, broader cryptocurrency market sentiment plays an outsized role. During bullish phases when capital flows into riskier altcoins, projects like Janction can see disproportionate gains. Conversely, in bear markets or periods of risk aversion, smaller-cap tokens often experience severe contractions as liquidity dries up. Second, project-specific developments cause significant volatility. Announcements such as mainnet launches, major partnership agreements with established websites or ad agencies, successful security audits, or listings on new, prominent exchanges can trigger rapid price appreciation. The lack of sustained, high-volume trading, however, means the price can also be susceptible to manipulation or large, single-order movements. The token's value is currently sustained by a community of believers in its vision and traders speculating on its short-term momentum, rather than by widespread, organic utility demand from a massive advertising user base.

Factors Affecting Janction (JCT) Price

The future price trajectory of JCT will be determined by a complex interplay of internal project execution and external market dynamics.

1. Fundamental Factors (Project-Specific):

Platform Adoption and Usage Metrics: The single most critical factor for JCT's long-term value is the real-world adoption of the Janction protocol. Key performance indicators (KPIs) to watch include: the number of websites and publishers integrating the Janction SDK, the total monthly advertising spend processed in JCT, the volume of user attention rewards distributed, and the growth in unique advertisers on the network. A rising trend in these metrics would directly increase transactional demand for the JCT token, creating sustained buy-side pressure.

Development Roadmap and Execution: The project's ability to deliver on its technical roadmap is paramount. Successful upgrades that enhance scalability, reduce transaction fees for micro-payments, introduce new ad formats, or improve user privacy features will build credibility. Conversely, delays, failure to meet milestones, or security vulnerabilities in smart contracts could severely damage trust and lead to sell-offs.

Competitive Landscape: Janction does not operate in a vacuum. It competes with both entrenched Web2 advertising behemoths and other Web3 advertising/monetization projects (e.g., Basic Attention Token - BAT). JCT's ability to differentiate itself through superior technology, better publisher economics, or a more engaged community will be crucial for capturing market share.

2. Technical and On-Chain Factors:

Tokenomics and Supply Dynamics: The specific details of JCT's token supply are vital. Analysts must scrutinize the total supply, circulating supply, and any vesting schedules for team, advisor, or investor tokens. A large, sudden release of unlocked tokens into the circulating supply (a "token unlock") can create significant sell pressure. Conversely, well-designed tokenomics with mechanisms for burning (permanently removing tokens from supply) or rewards for long-term staking can be price-positive.

Exchange Listings and Liquidity: Gaining listings on top-tier centralized exchanges (CEXs) like Binance, Coinbase, or Kraken is a major catalyst for altcoins. Such listings dramatically increase accessibility, liquidity, and visibility to a global retail and institutional audience, often leading to substantial price re-ratings.

3. Macro and Regulatory Factors:

Overall Crypto Market Cycles: JCT's price will inevitably be correlated with the fortunes of Bitcoin and the broader altcoin market. A sustained bull market driven by Bitcoin ETF inflows, institutional adoption, or favorable macro conditions (e.g., easing monetary policy) would provide a powerful tailwind. A prolonged bear market would present a severe headwind, regardless of Janction's individual merits.

Regulatory Environment for DeFi and Advertising: The regulatory stance of major economies (the U.S., EU, etc.) towards decentralized finance (DeFi) protocols and digital asset usage will impact Janction. Clear, supportive regulation could foster growth, while harsh, restrictive policies could impede adoption and limit the pool of potential users and advertisers.

Janction (JCT) Price Prediction 2025 to 2030

Forecasting the price of an emerging asset like JCT requires scenario analysis, combining cautious optimism about its niche potential with respect for market realities.

2025: This year is likely to be foundational. Assuming the project continues development and begins to onboard its first wave of pilot publishers and advertisers, price action may be dominated by speculation on future potential rather than current revenue. Success in securing a listing on a mid-tier centralized exchange could be a key catalyst. Expect high volatility, with prices capable of testing new highs on positive news but remaining vulnerable to sharp pullbacks. A reasonable range might see JCT trading between $0.045 and $0.120, heavily dependent on broader altcoin market sentiment.

2026: By 2026, the focus will shift from promise to proof. The market will demand evidence of growing platform metrics. If Janction can demonstrate consistent month-over-month growth in ad spend and publisher count, it may start to be perceived as a legitimate player rather than just a concept. This "product-market fit" phase could lead to more stable, organic demand for the token. If the broader crypto market is in an accumulation or early bull phase, JCT could see a significant revaluation, with a potential range of $0.15 to $0.35.

2027-2028: This period could represent a major growth inflection point if execution is successful. Widespread adoption by a recognizable cohort of websites (e.g., popular blogs, niche forums, indie media) would validate the model. Integration with other Web3 platforms or a strategic partnership with a traditional media company could serve as a major breakthrough. During what could be the peak of the next major crypto bull market cycle, enthusiasm for niche utility tokens could peak. In an optimistic scenario with strong execution and a favorable macro climate, JCT could challenge its all-time highs and explore a range between $0.40 and $0.90.

2029-2030: The long-term forecast moves into highly speculative territory. By 2030, the project will either have established a sustainable, growing niche within the Web3 advertising stack or have struggled to achieve critical mass. In a success scenario, Janction would be a mature protocol with a diversified advertiser base and a robust treasury. Price growth would then be tied more closely to the fundamental growth of the platform's GDP. A potential consolidation and growth range could be $0.60 to $1.50+, assuming the project has captured meaningful market share. The lower end of the range accounts for potential bear market cycles or competitive pressures.

Conclusion

Janction (JCT) presents a visionary attempt to decentralize and democratize the online advertising industry, a sector ripe for Web3 innovation. Its potential to redirect value towards content creators and users is a powerful narrative that could drive significant interest during periods of bullish sentiment for utility-focused altcoins. However, the path from a compelling concept to a widely adopted protocol is fraught with challenges, including intense competition, the need for flawless technical execution, and the overarching influence of unpredictable crypto market cycles.

The price predictions outlined from 2025 to 2030 chart a course from speculative volatility toward potential value grounded in utility, contingent entirely on the project's ability to execute its vision and capture market adoption. For investors and observers, the key metrics to monitor are not short-term price fluctuations, but the tangible growth of the Janction network itself—the number of publishers, the volume of ad transactions, and the vibrancy of its developer and user community. As with all investments in crypto space, especially in micro-cap projects, the risks are substantial. The potential for high returns exists alongside the possibility of significant loss. Therefore, any consideration of JCT should be part of a well-researched, diversified strategy, approached with caution and a clear understanding of the project's ambitious goals and the formidable obstacles it must overcome to achieve them.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.