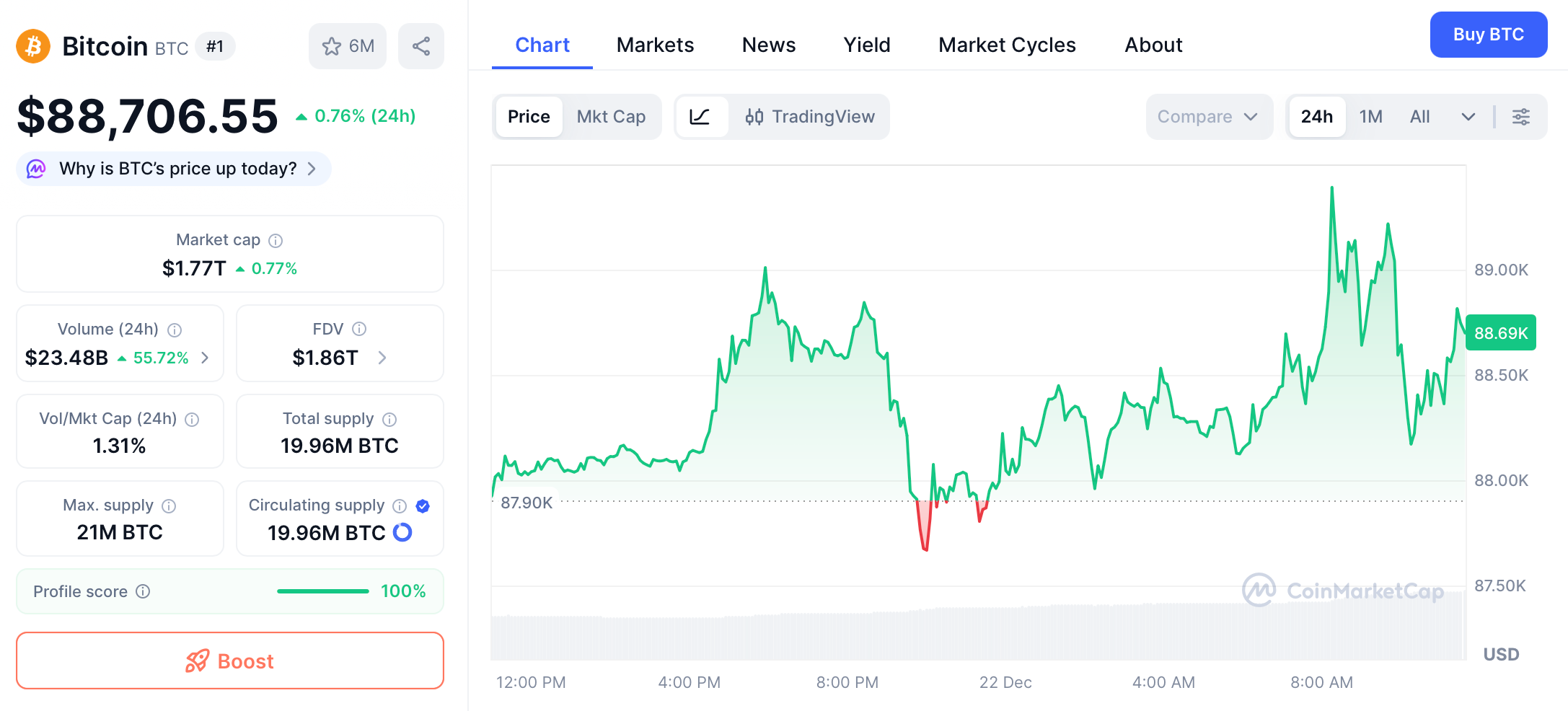

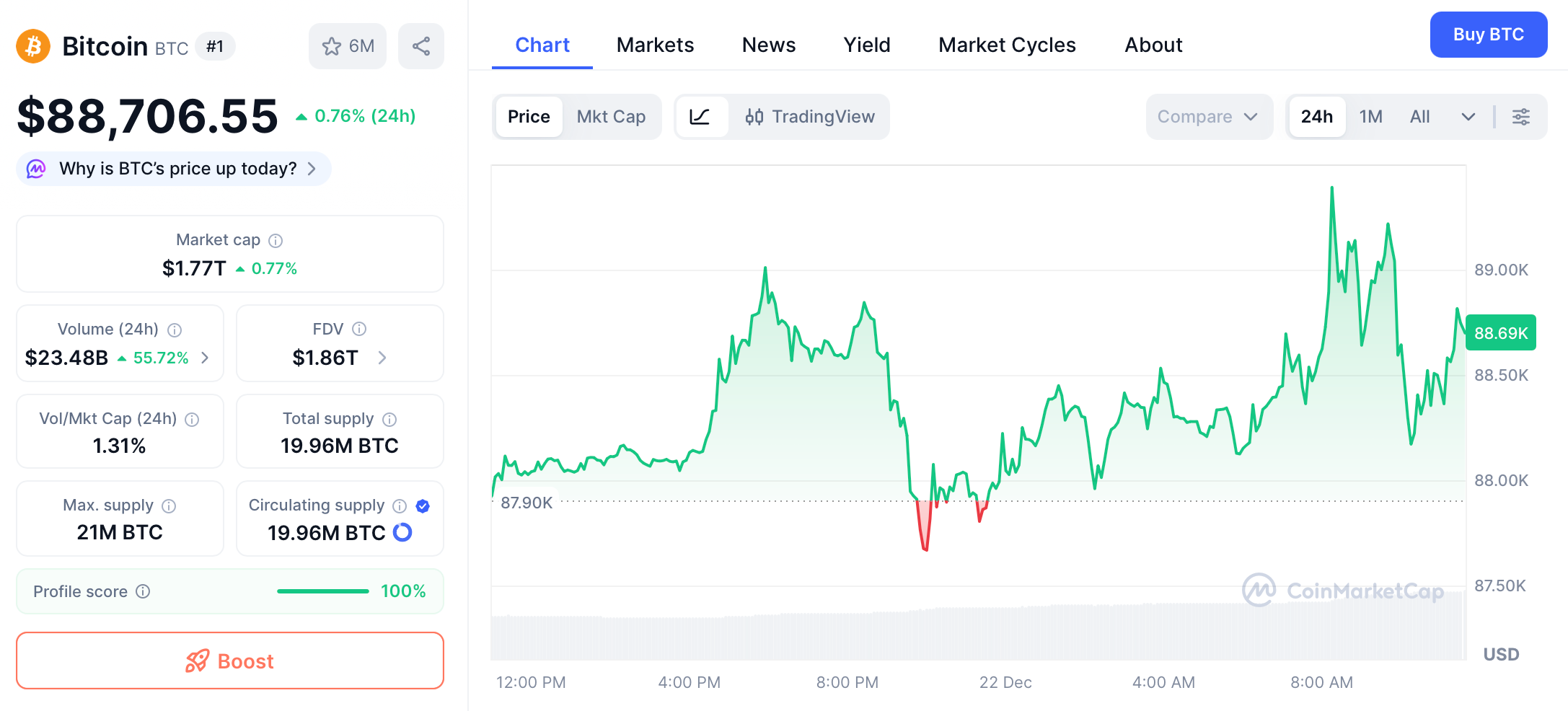

Michael Saylor, the outspoken Bitcoin advocate and executive chairman of MicroStrategy, has once again stirred the crypto community with a bold prediction. In a recent post on X, Saylor claimed that if companies like MicroStrategy were to accumulate 5% of Bitcoin's total supply through corporate treasury strategies, the asset's price could rocket to $1 million per coin. He further escalated the vision, suggesting that at 7% corporate holdings, Bitcoin could reach $10 million. This statement, made amid a volatile December 2025 market where Bitcoin hovers around $88,000, underscores Saylor's unwavering belief in Bitcoin as a superior store of value. As of December 22, 2025, Bitcoin trades at approximately $88,706, reflecting a modest weekly recovery from mid-month lows near $84,000, while MicroStrategy's stock (MSTR) closed at $164.82 on December 19, down significantly from its yearly highs but still tied closely to Bitcoin's fortunes.

Saylor's comments come at a time when institutional adoption of Bitcoin as a treasury asset is accelerating, with companies like MicroStrategy leading the charge. MicroStrategy now holds over $58 billion in Bitcoin, representing a significant portion of its corporate strategy. This article examines Saylor's prediction in the context of current Bitcoin price dynamics and MicroStrategy's stock performance. Drawing on latest news from December 2025, it analyzes how corporate hoarding could influence Bitcoin's valuation, the recent price action amid macro pressures, and MSTR's volatile journey as a Bitcoin proxy. The discussion highlights the interplay between corporate strategies, market sentiment, and broader economic factors shaping the crypto landscape.

Saylor Envisions $1 Million per BTC

Michael Saylor's latest assertion builds on his long-held view that Bitcoin is the ultimate corporate treasury asset. In his December 2025 post, he outlined a scarcity-driven model: with Bitcoin's fixed supply capped at 21 million coins, widespread corporate accumulation would drastically reduce available float, driving prices exponentially higher. Specifically, Saylor posited that if firms adopted strategies to hold 5% of the total supply, which is equivalent to about 1.05 million BTC, the resulting demand pressure could push the price to $1 million. At 7% holdings, or roughly 1.47 million BTC, he envisions $10 million per coin, implying a market cap of tens of trillions.

This prediction aligns with Saylor's broader thesis that Bitcoin will grow from its current $1.7 trillion market cap to $20 trillion, then $200 trillion, as institutions recognize its superiority over traditional assets like gold or bonds. He argues that corporate balance sheets, currently underutilizing Bitcoin, represent a massive untapped demand pool. MicroStrategy exemplifies this approach, having amassed Bitcoin holdings worth $58 billion by late 2025, funded through convertible debt and equity raises. Saylor's "Bitcoin flywheel" strategy: buy Bitcoin to boost stock value, raise more funds, buy more Bitcoin, which has turned MSTR into a leveraged Bitcoin play, attracting investors seeking amplified exposure without direct crypto custody.

Recent news reinforces Saylor's optimism. In December 2025, reports highlighted MicroStrategy's continued accumulation, with the firm adding thousands of BTC amid market dips. Analysts note that if other companies follow suit, which encouraged by regulatory clarity and ETF success. Saylor's targets become plausible. For instance, nations and firms eyeing Bitcoin reserves could accelerate this trend, as seen in discussions around U.S. strategic Bitcoin stockpiles. However, skeptics point to risks like volatility and accounting challenges, which could deter widespread adoption. Saylor counters that Bitcoin's 30% annualized returns over decades make it an irresistible treasury tool, far outpacing inflation or bonds.

The math behind Saylor's claim relies on supply-demand economics. With over 19.8 million BTC mined by 2025, corporate hoarding of 5% would lock away a chunk equivalent to several years of new supply post-halving. This reduced liquidity, combined with growing demand from ETFs and institutions, could create a supply shock. Historical parallels exist: Bitcoin's price surged after the 2024 halving reduced issuance, and corporate buys like Tesla's in 2021 ignited rallies. Saylor's vision extends this, positioning Bitcoin as a global reserve asset, where even modest allocations from Fortune 500 firms could multiply valuations.

Current Bitcoin Price Dynamics: Volatility Amid Macro Headwinds

As of December 22, 2025, Bitcoin's price stands at $88,678, up slightly from mid-week lows but down 4% over the past seven days. The asset has consolidated in the $84,000-$90,000 range, reflecting a corrective phase after October's all-time high above $126,000. This pullback, now over 30%, stems from profit-taking, thinning holiday liquidity, and macro pressures like the Bank of Japan's rate hike to 0.75% on December 19, which strengthened the yen and accelerated carry trade unwinds.

Technical indicators show Bitcoin defending key support at $84,000, aligned with the 50-day moving average and Fibonacci retracements. Oversold RSI readings below 30 on daily charts suggest potential relief rallies, but bearish MACD crossovers keep momentum tilted down. On-chain metrics provide encouragement: exchange reserves decline, indicating reduced sell pressure, while whale accumulation spikes during dips. Long-term holders remain in profit, with average cost bases around $50,000, supporting a floor against deeper capitulation.

Macro factors weigh heavily. The BoJ's hike, the third in 2025, narrows global interest differentials, draining liquidity from risk assets. Bitcoin's correlation with Nasdaq stays high at 0.85, amplifying spillovers from tech corrections. U.S. inflation cooling to target levels offers some offset, but stronger jobs data tempers 2026 rate-cut bets. Stablecoin cap near $310 billion signals sidelined capital ready for deployment, potentially fueling rebounds.

Saylor's prediction adds narrative fuel. If corporate hoarding ramps up, as seen with MicroStrategy's $58 billion stack, Bitcoin could break resistance at $92,000 and target $100,000 by Q1 2026. Analysts echo this, with some forecasting $150,000 by year-end if institutional inflows persist. However, risks like regulatory scrutiny or economic slowdown could cap upside. Bitcoin's dominance at 58% underscores its safe-haven role amid altcoin weakness, aligning with Saylor's view of it as digital gold.

Recent news highlights momentum. Spot ETFs saw $457 million inflows on December 18, the largest in a month, driven by firms like Fidelity. This institutional demand, up 20% quarter-over-quarter, supports Saylor's thesis that corporate treasuries will follow ETFs in allocating to Bitcoin. With over $1 trillion in ETF assets by late 2025, even a 5% reallocation from traditional reserves could propel prices higher.

MicroStrategy Stock Performance: A Leveraged Bitcoin Proxy

MicroStrategy's stock (MSTR) has been a volatile ride in 2025, closely mirroring Bitcoin's price swings due to the firm's massive BTC holdings. As of December 19, MSTR closed at $164.82, up 0.13% on the day but down 35% year-to-date from peaks above $250 in October. This decline tracks Bitcoin's correction, with MSTR acting as a leveraged play, of which value amplified by debt-funded BTC buys.

Saylor's "Bitcoin flywheel" has transformed MicroStrategy from a software firm into the world's largest corporate BTC holder, with over 400,000 coins valued at $58 billion. This strategy boosted MSTR's market cap to $30 billion, but volatility persists: shares fell from $269 in October to $158 mid-December amid Bitcoin's dip, before modest recovery. Analysts attribute the lag to leverage risks. MicroStrategy's $4 billion debt raises margin call fears if BTC drops below $40,000.

Recent performance shows resilience. On December 17, MSTR rose 4.16% to $164.82 amid Bitcoin's bounce, with volume at 22 million shares. Year-to-date, MSTR outperformed Bitcoin in rallies but underperformed in drawdowns due to beta above 2. News of continued accumulation, adding 10,000 BTC in November, bolsters sentiment, aligning with Saylor's 5% supply target.

Institutional interest drives MSTR's appeal. Hedge funds hold 15% of float, viewing it as a Bitcoin ETF alternative with leverage. ETF inflows indirectly support, as Bitcoin's rise lifts MSTR. However, critics warn of overvaluation: MSTR trades at a 50% premium to its BTC holdings, risking compression if adoption slows.

December news highlights potential. Reports suggest MicroStrategy plans $2 billion more in debt for BTC buys, fueling speculation of nearing Saylor's targets. If firms emulate, MSTR could lead a wave, pushing its stock toward $300 if Bitcoin hits $150,000.

Implications for Bitcoin and Corporate Adoption

Saylor's prediction implies a paradigm shift: corporate treasuries as Bitcoin's next demand wave. With $100 trillion in global corporate cash, a 5% allocation equals $5 trillion, which is over twice Bitcoin's cap, driving scarcity premiums. This echoes gold's institutional shift, but Bitcoin's digital nature enables faster adoption.

Challenges remain. Volatility deters conservative firms, and accounting rules treat BTC as impaired assets, discouraging holds. Saylor advocates fair value accounting, which could unlock trillions if adopted.

Latest news shows momentum. Sovereign funds discuss BTC reserves, and firms like Tesla rekindle holdings. If 5% corporate adoption materializes, Saylor's $1 million target becomes feasible by 2030, per scarcity models.

For MSTR, this means amplified gains: as Bitcoin proxy, stock could 10x if BTC hits $1 million. But risks like debt defaults loom if prices crash.

Market Sentiment and Future Outlook

Sentiment is mixed: fear index at 16 reflects caution, but stablecoin inflows signal rebound potential. If corporate hoarding accelerates, Bitcoin could break $100,000 in 2026, lifting MSTR accordingly.

Saylor's vision, backed by MicroStrategy's success, positions Bitcoin as corporate standard. As adoption grows, prices and stocks like MSTR stand to benefit immensely.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.