The global financial markets are holding their breath as the Federal Open Market Committee (FOMC) prepares to conclude its final policy meeting of 2025 on December 11. This meeting is poised to be one of the most consequential in recent months, with markets nearly certain of another interest rate cut while simultaneously anticipating a major shift in the Fed's balance sheet strategy.

Beyond the immediate decision, this meeting sets the stage for 2026, a year that will see a critical leadership transition. All eyes are on Chair Jerome Powell, who may not only guide the committee to its third rate cut of the year but also unveil a new $45 billion monthly Treasury bill purchase program. For cryptocurrency investors, these decisions represent a powerful macroeconomic catalyst. Historically, shifts in Fed liquidity and interest rate policy have acted as a primary driver for risk asset performance, including Bitcoin and the broader digital asset space. This guide breaks down the key expectations, mechanics, and potential market impacts of this critical juncture in monetary policy.

When Is The Next Fed Meeting? Rate Cut Expectations

At 3:00 AM Beijing time on December 11th, global markets will see the Federal Reserve's final interest rate decision of 2025. Following this, Chairman Jerome Powell will hold a press conference on monetary policy.

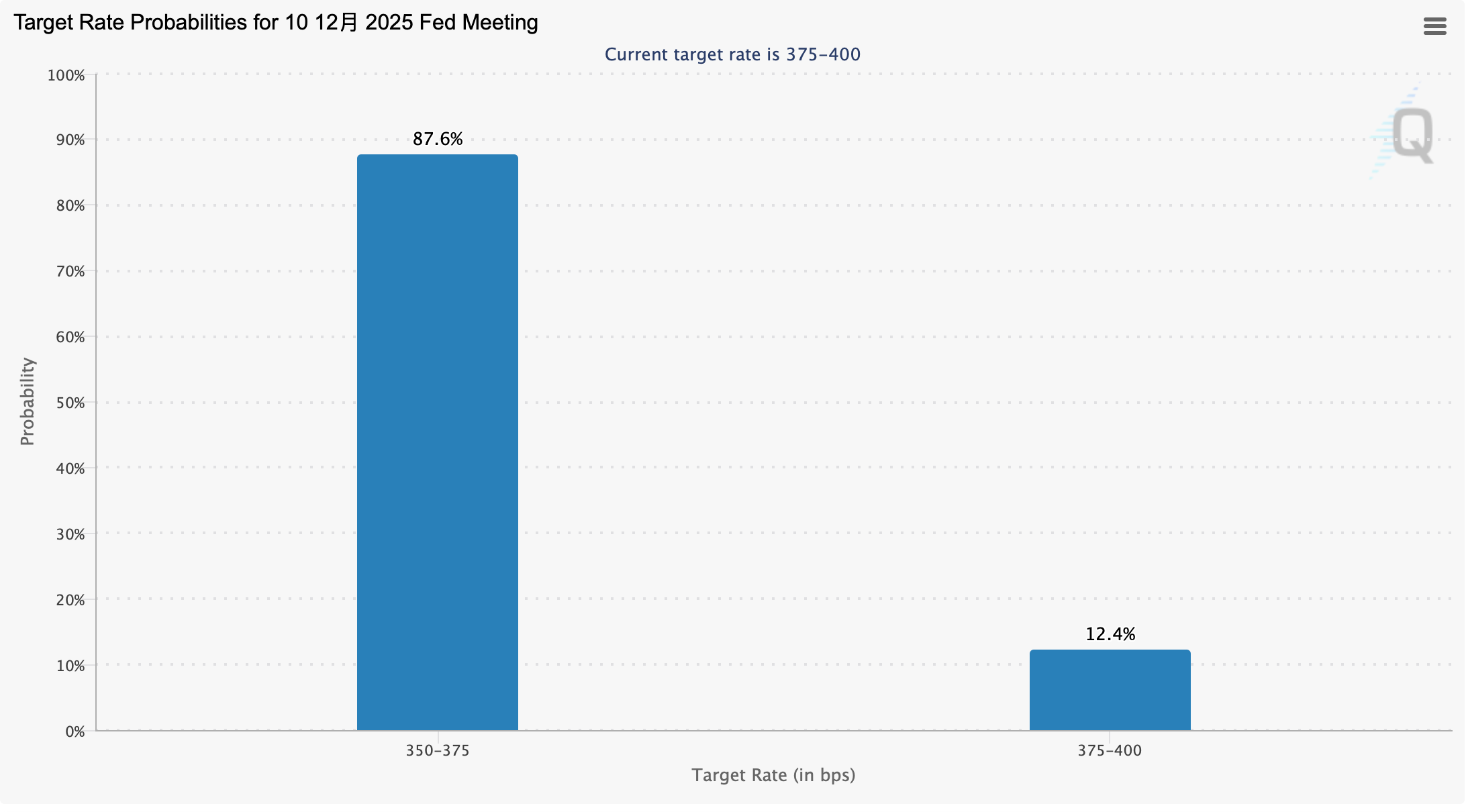

Market expectations, as derived from the CME Group's FedWatch Tool, are overwhelmingly leaning toward a dovish outcome. Futures pricing indicates 87.5% for a 25-basis-point rate cut. This would lower the benchmark federal funds rate target range to 3.75%-4.00%, continuing the easing cycle that began earlier this year. This anticipated move aligns with the "dot plot" projections released in September, which signaled committee members' intent for gradual easing through 2025.

Rate cut probabilities ratio. Source: CME

The rationale for this cut is rooted in recent economic data. Reports have shown a continued moderation in inflation metrics toward the Fed's 2% target, alongside signs of softening in the labor market and consumer spending. While the economy remains resilient, the Fed appears focused on preventing an overly restrictive policy stance from derailing economic expansion. Major financial institutions, including J.P. Morgan and Goldman Sachs, have adjusted their forecasts to align with this consensus view of a December cut, marking a shift from earlier expectations of a prolonged pause.

The Looming Fed Chair Election: Political Pressures and Policy Independence

While immediate policy is the focus, a significant undercurrent for future meetings is the impending leadership change. Chair Jerome Powell's term is set to expire in May 2026, sparking intense speculation about his successor. The selection process is inherently political, nominated by the President and confirmed by the Senate, and the outcome could significantly influence the monetary policy trajectory for the latter half of the decade.

Current discourse, as reported by financial outlets like Bloomberg, highlights former Council of Economic Advisers Chair Kevin Hassett and former Fed Governor Kevin Warsh as potential front-runners. The political environment adds a layer of complexity. Public statements from the current administration emphasizing growth and lower rates could pressure the Fed's operational independence, a cornerstone of its credibility in fighting inflation and managing economic cycles.

Potential candidates like Hassett have publicly advocated for further rate reductions, though without committing to a specific timeline. The uncertainty surrounding this transition creates a backdrop for the March 2026 meeting and beyond, as markets begin to price in the potential for a more dovish or hawkish leadership style.

Powell May Announce a $45 Billion Treasury Bill Purchase Plan

Perhaps the most technical yet market-sensitive item on the agenda is a potential change to the Fed's balance sheet policy, known as Quantitative Tightening (QT). Since 2022, the Fed has been allowing up to $60 billion in Treasury securities and $35 billion in Mortgage-Backed Securities (MBS) to mature monthly without reinvestment, slowly reducing its holdings.

However, signals from money markets suggest this aggressive runoff may need to be adjusted. Analysts, including former New York Fed staff, predict Chair Powell could announce a new program to purchase approximately $45 billion per month on Treasury bills. This is not a return to the crisis-era Quantitative Easing (QE) but rather a "technical adjustment" to maintain ample liquidity in the banking system and ensure smooth functioning of short-term funding markets.

Key indicators prompting this shift include:

-

A steep decline in the Fed's Reverse Repo (RRP) facility balance, which has fallen from over $2 trillion to roughly $600 billion, indicating a drain on excess liquidity.

-

Periodic spikes in overnight repo rates, suggesting occasional scarcity of cash reserves.

-

Increased usage of the Fed's Standing Repo Facility (SRF), a backstop for banks.

This planned purchase program would effectively slow or halt the pace of QT for Treasuries, providing a passive but steady injection of liquidity into the financial system, a nuanced but critical detail for all asset classes.

Outlook for the March meeting: The pace of consecutive rate cuts

Looking ahead to the first meeting in 2026 (expected in March), the path of monetary policy will be more complex. Nomura Securities predicts that, under the likely leadership of a new Federal Reserve Chairman, the Fed will cut interest rates by 25 basis points in June and September 2026, respectively.

Jan Hatzius, chief economist at Goldman Sachs Research, offered another prediction: the Federal Reserve may pause rate cuts in January next year, and then continue to cut rates in March and June, eventually bringing the federal funds rate down to the 3.00%-3.25% range.

The potential new chairman will influence future policy direction. Analysts believe that if Hassett is appointed Federal Reserve Chairman, he is expected to favor significantly lowering interest rates to stimulate economic growth and investment.

The domestic political environment in the United States has also increased uncertainty. The Trump administration plans to replace many of the economic policies implemented during the Biden administration, including energy and auto industry policies, which could push up U.S. inflation.

Crypto Market Transmission Mechanism: A Dual Game Between Liquidity and Risk Appetite

The cryptocurrency market, while nascent, has shown increasing correlation with macro liquidity conditions. A Fed rate cut and a shift in balance sheet policy would impact crypto through several key transmission channels:

The Liquidity and "Cheap Money" Channel: Lower interest rates decrease the yield on traditional safe-haven assets like U.S. Treasuries. This pushes investors seeking higher returns further out on the risk spectrum. The proposed $45 billion monthly T-bill purchases would directly increase the amount of cash (liquidity) in the financial system. Historically, excess liquidity has a tendency to find its way into higher-risk, higher-reward assets, a category that prominently includes cryptocurrencies.

The U.S. Dollar and Inflation Hedge Channel: Rate cuts typically exert downward pressure on the U.S. Dollar Index (DXY). A weaker dollar makes dollar-denominated assets like Bitcoin relatively cheaper for international investors, potentially increasing global demand. Furthermore, if markets interpret the Fed's actions as a long-term commitment to easier financial conditions, it could revive inflation-hedging narratives. Bitcoin's fixed supply and "digital gold" thesis often gain traction in such environments.

Risk Sentiment and Correlation: Crypto assets have increasingly traded as a high-beta segment of the technology/risk asset complex. A Fed pivot perceived as supportive of economic growth and equity markets generally improves overall investor risk appetite. This positive sentiment often flows into the crypto market, lifting prices across major assets. A clear and confident dovish message from Powell could act as a strong catalyst.

Potential Risks and Nuances: It is crucial to apply "buy the rumor, sell the news" logic. A significant portion of the expected rate cut is likely already priced into current crypto valuations. The market's reaction will hinge on the forward guidance, i.e., Powell's description of the future path rather than the cut itself. Furthermore, the T-bill purchase plan, being a technical adjustment, may have a more muted and gradual effect than the dramatic QE programs of the past. Any hint from Powell that inflation is persisting or that the Fed is done cutting after December would likely be interpreted as hawkish and could trigger a short-term sell-off across risk assets, including crypto.

Potential Risks and Market Balance

The market needs to remain clear-headed, as the Federal Reserve's policy shift still faces multiple constraints. Inflation risks have not been completely eliminated; the CPI rose 2.9% year-on-year in August, while core CPI rose 0.3% month-on-month, still above the 2% target level.

Opinions remain divided within the Federal Reserve. At the September meeting, differing voices emerged within the FOMC regarding interest rate cuts, with newly appointed Governor Stephen Miran even advocating for a 50-basis-point reduction. This meeting may see as many as four "hawks" oppose a rate cut.

The risk of overheated asset prices should not be ignored. US stock valuations are already at historical highs, leverage in the cryptocurrency market is rising, and open interest in derivatives is increasing faster than spot trading.

From a technical perspective, Bitcoin faces significant resistance around $117,000. The market needs substantial new capital inflows and continued policy easing to break through this key resistance level.

Conclusion

While Wall Street traders are glued to the Federal Reserve's decision, Bitcoin prices have quietly strengthened amid expectations of a potential liquidity injection. The flattening yield curve, the decline in the 10-year Treasury yield, and the simultaneous rise in Nasdaq futures overnight trading all indicate that the market is pricing in a "technical expansion."

Hassett, a leading candidate for the next Federal Reserve Chair, recently stated, "Trump has many good options. If I had to be that option, I would be happy to help him." This statement suggests that whoever succeeds Powell may face the complex situation of balancing political pressure with monetary stability.

The market's initial reaction to the resolution may just be the prelude. The real drama will unfold a month from now, and whether the $45 billion monthly injection actually flows into the market, and how these funds are distributed between traditional finance and the crypto world, will be key to determining asset price trends in 2026.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.