The cryptocurrency world holds its breath as December 11, 2025, approaches. On this date, Do Kwon, the once-celebrated co-founder of Terraform Labs, will be sentenced in a U.S. federal court for his role in one of the most catastrophic failures in financial history: the $40 billion implosion of the Terra ecosystem in 2022. This event is not merely the conclusion of a personal legal saga; it represents a pivotal moment of accountability for the entire digital asset industry. Kwon's journey from a visionary tech founder to an international fugitive, and finally to a defendant pleading guilty, encapsulates the extreme risks, regulatory challenges, and profound consequences of the "wild west" era of decentralized finance. This article examines the rise and fall of Terra, the technical mechanics of its failure, the extensive legal repercussions culminating in Kwon's imminent sentencing, and the uncertain future of its native token, LUNA.

What is Terra? The Vision of Algorithmic Stability

Terra was a blockchain protocol launched in 2018 by Do Kwon and Daniel Shin, with a grand vision to revolutionize global payments. Its core innovation was a suite of algorithmic stablecoins, primarily TerraUSD (UST), designed to maintain a 1:1 peg with the US dollar not by holding cash reserves, but through a complex, automated financial mechanism. Unlike traditional stablecoins backed by assets in a bank, UST's stability was engineered purely by code and market incentives. The protocol promised instant settlements, low fees, and seamless cross-border transactions, attracting millions of users and a formidable list of investors, including Coinbase Ventures and Binance Labs. It positioned itself as the foundation for a new, decentralized financial system.

What Is LUNA? The Engine of the Terra Ecosystem

LUNA was the native, volatile sister token of UST and the fundamental cog in Terra's algorithmic machine. The two tokens existed in a symbiotic relationship, characterized by burn-and-mint dynamics. Users could always burn $1 worth of LUNA to mint 1 UST, and vice versa. This arbitrage mechanism was intended to be the self-correcting force for UST's peg. If UST traded below $1, arbitrageurs could buy the discounted UST, burn it, and receive $1 worth of newly minted LUNA, theoretically reducing UST supply and restoring its price. LUNA also functioned as the network's governance and staking token, granting holders the right to vote on protocol upgrades. Its value was directly tied to the demand for using UST; as the Terra ecosystem grew, so did LUNA's price, which soared to an all-time high near $119 in early 2022, boasting a market capitalization in the tens of billions.

The Relation and Difference Between Luna Classic and LUNA?

Regarding the relationship between Terra and Terra Classic, in short: Terra Classic (LUNC) is the remnants of the "original" chain, while Terra (LUNA) is the "rebooted" new chain, and the two have completely diverged.

Their connection exists only in the past, both originating from the same initial Terra blockchain project (the one launched in 2018). The current Terra Classic (LUNC) is the original blockchain that suffered a devastating collapse in May 2022. The current Terra (LUNA), often referred to as Terra 2.0, is a completely new blockchain relaunched in May 2022 on the ruins of the old chain.

Token conversion: When the new chain was launched, holders of the old chain (Terra Classic) received an airdrop of LUNA tokens on the new chain (Terra 2.0) based on a specific snapshot and ratio. This was the last direct value connection between the two.

What Happened to Terra Classic in 2022?

The collapse in May 2022 was a swift and brutal demonstration of the fatal flaw in Terra's design. The crisis began when large amounts of UST were suddenly unstaked from the Anchor Protocol, which is a lending platform on Terra offering unsustainably high yields and sold on the open market. This massive sell pressure caused UST to depeg from its $1 value. As panic set in, the intended arbitrage mechanism inverted into a destructive feedback loop known as a "death spiral".

To restore the peg, the protocol mandated the burning of UST and the minting of astronomical amounts of LUNA. This hyperinflation of LUNA's supply crashed its price from over $80 to fractions of a penny in less than a week. As LUNA became worthless, the collateral backing the entire system evaporated, destroying any remaining confidence in UST. The $40 billion ecosystem evaporated almost overnight. Crucially, it was later revealed that a similar depeg event in May 2021 was secretly quelled not by the algorithm, but by a clandestine deal with a trading firm, which is a fact Kwon admitted to concealing from investors.

What is UST?

UST is a stablecoin whose price is pegged to the US dollar. Stablecoins can be categorized into three types based on how they maintain their price peg: fiat-backed, digital asset-backed, and algorithmic. UST is generated by burning LUNA, and burning UST can also generate LUNA in reverse. This mechanism utilizes arbitrage opportunities based on price differences to maintain the stability of the UST price. Because UST is not backed by any assets but instead uses an algorithm to regulate market supply and demand, UST is considered an algorithmic stablecoin.

The Terra protocol uses a novel minting and burning mechanism: users can mint 1 UST by burning LUNA tokens worth $1; conversely, users can burn 1 UST to mint LUNA tokens worth $1. This mechanism, also known as two-way burning and minting, helps UST maintain its $1 price peg through changes in supply and demand driven by price differences.

For example, if for some reason the price of UST exceeds $1, such as a 50% surge to $1.50, if you hold LUNA tokens, you can burn $1 worth of LUNA to obtain 1 UST. Since the price of UST is $1.50, you can then sell the UST for other dollar-pegged stablecoins, immediately making a 50% profit. Therefore, when the price of UST is above $1, arbitrageurs in the market have an incentive to burn LUNA and mint UST. This will decrease the total supply of LUNA and increase its price, while increasing the total supply of UST and decreasing its price, ultimately restoring the price to $1.

So what happens if the price of UST falls below $1? If for some reason the price of UST plummets to only $0.50, you can buy 2 UST with one other dollar-pegged stablecoin. After burning these 2 UST, you can generate $2 worth of LUNA, which you can then sell for other dollar-pegged stablecoins, immediately making a 100% profit. Therefore, when the price of UST falls below $1, arbitrageurs in the market will have an incentive to burn UST and mint LUNA. This will increase the total supply of LUNA and cause its price to fall, while the total supply of UST will decrease and its price will rise, eventually returning to $1.

Features and Flaws of the Terra (LUNA) Model

Staking

LUNA token holders can stake their tokens within the consensus mechanism of the Terra ecosystem. Users who stake LUNA are eligible to obtain rewards on the Terra protocol, which are derived directly from exchange fees. Users must pay these fees if they move their balance from LUNA to a Terra stablecoin.

Governance

Having LUNA is also an excellent way to take part in the governance process of the platform. Staking your LUNA tokens allows you to create and vote on ideas for modifying the Terra protocol.

AirDrops

Another relatively hidden benefit emerges from keeping and staking LUNA tokens. This advantage will be provided to you in the form of airdrops. Whenever the Terra ecosystem welcomes new applications and the associated tokens, LUNA stakers are eligible to receive a proportional amount of those new applications and tokens as free gifts, known as airdrops.

Check out the current values of MIR and ANC crypto using Shrimpy if you're curious whether or not the Terra ecosystem airdrops have been successful for holders of LUNA. These two tokens, which respectively represent Mirror Protocol and Anchor Protocol, have been airdropped and have shown to be quite successful.

Do Kwon Faces Sentencing on December 11

Do Kwon's legal journey has been as dramatic as Terra's crash. After months as a fugitive, he was arrested in Montenegro in March 2023 for using a forged passport. Following a protracted extradition battle, he was brought to the United States. In August 2025, in a stunning reversal, Kwon changed his plea to guilty on two felony counts: conspiracy to commit fraud and wire fraud. In a Manhattan courtroom, he stated, "I concealed the role of a trading firm in restoring the peg... My conduct was wrong. I am sorry," and accepted full responsibility.

As part of the plea deal, he agreed to forfeit over $19 million in illicit proceeds. While the charges carry a maximum sentence of 25 years, prosecutors agreed to seek a term of no more than 12 years. However, Kwon's defense team is urging the presiding judge, Paul Engelmayer, to impose a sentence not exceeding five years, arguing that his time already served in harsh conditions and his financial ruin constitutes significant punishment. The sentencing on December 11 will bring a measure of closure, though Kwon still faces separate criminal charges in South Korea, where prosecutors could seek up to 40 years.

Impact of the Sentencing: Accountability, Regulation, and Market Closure

The sentencing carries profound implications beyond the courtroom.

-

Unprecedented Accountability: It sets a powerful precedent that founders of decentralized protocols can and will be held personally liable for fraud and misrepresentation. Alongside the 25-year sentence for FTX's Sam Bankman-Fried, it signals the end of impunity for crypto executives.

-

Regulatory Catalyst: The Terra collapse has become the central case study for regulators globally. It has intensified the push for clear, stringent rules, particularly for stablecoins, moving them to the forefront of policy debates. The U.S. Securities and Exchange Commission (SEC) has already enforced penalties, as seen in its $123 million settlement with Jump Crypto's subsidiary for its negligent role in the 2021 depeg incident.

-

Market Sentiment and "Overhang" Removal: For the crypto market, a final sentence removes a multi-year legal overhang. The uncertainty surrounding Kwon's fate and potential extradition battles has been a lingering shadow. A conclusive resolution allows investors and the industry to fully process the chapter and may be interpreted as a step toward resolving Terra's legacy risks, potentially allowing capital to move forward.

LUNA Price Prediction: A Token in the Shadow of Its Past

Predicting the price of LUNA is an exercise fraught with extreme uncertainty. The original chain (renamed Terra Classic, LUNC) is a ghost of its former self. The current LUNA token exists on a new, separate blockchain (Terra 2.0) launched after the collapse, struggling to rebuild trust from a decimated community.

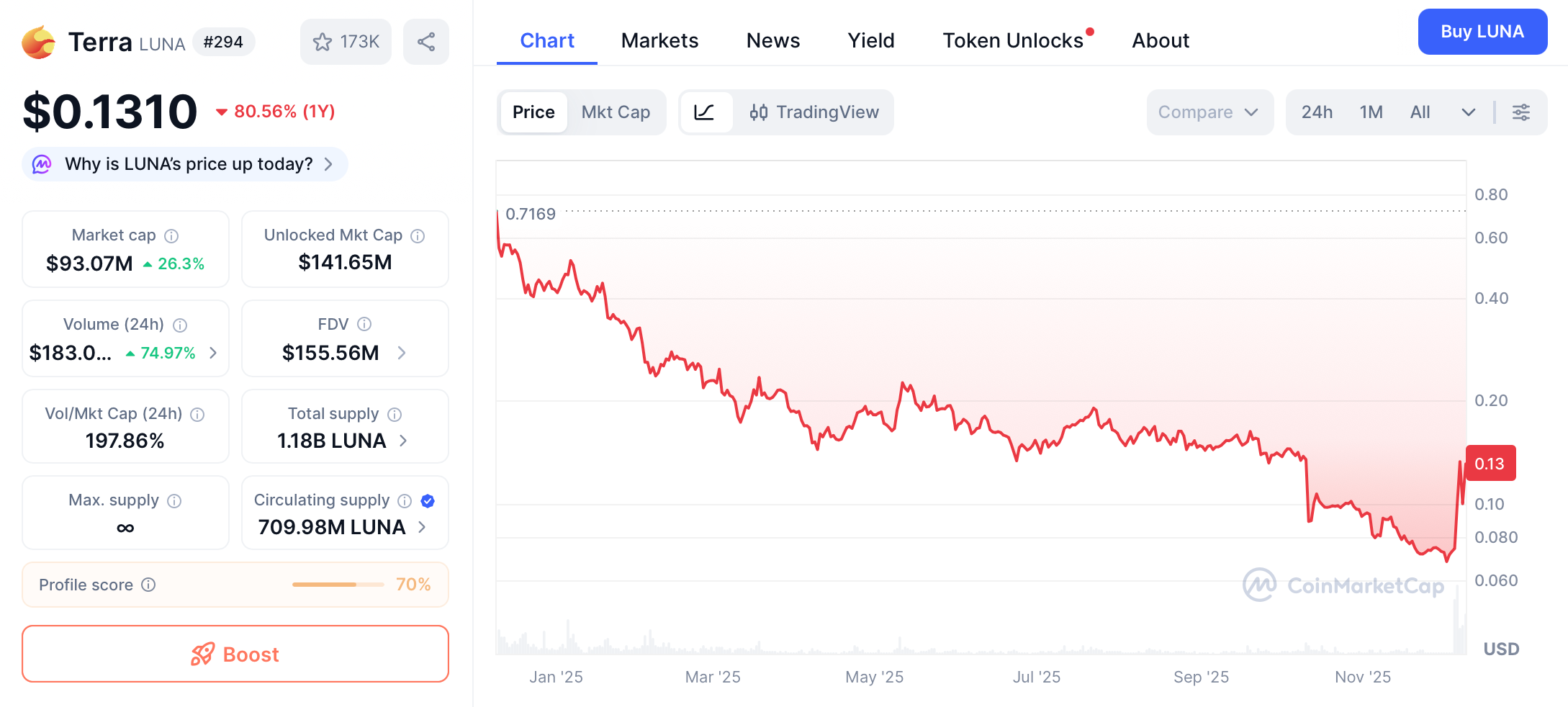

As of early December 2025, LUNA trades around $0.13, down over 80% in the past year, with a market cap under $93.08 million. Its future is not tied to its previous algorithmic model but to the utility and adoption of this new chain. Some automated prediction models suggest a slow, speculative crawl, with average price forecasts around $0.37 for 2025 and highly optimistic long-term scenarios suggesting values of $4.51 by 2035. However, these projections are purely mathematical and should be treated with extreme caution.

The fundamental reality is that LUNA's price is now more susceptible to the general crypto market trends and any niche development on its new chain than to its own historic narrative. The catastrophic collapse and the founder's criminal conviction have inflicted permanent reputational damage, likely capping its potential for mainstream revival. For most investors, LUNA stands as a stark reminder of risk, not a return vehicle.

Conclusion

The sentencing of Do Kwon on December 11, 2025, will mark the end of a defining tragedy in the history of cryptocurrency. The Terra story is a cautionary tale of how technological ambition, when built on a flawed economic model and compounded by fraudulent misrepresentation, can lead to ruin on a massive scale. It underscored the critical need for transparency, sustainable design, and robust regulatory oversight in decentralized finance.

While the legal system delivers its judgment to the architect of the crash, the market has already delivered its verdict on the technology. Algorithmic stablecoins of Terra's kind have been largely abandoned by serious builders. The industry, chastened by a $40 billion lesson, continues its march toward maturity, with the specter of Terra serving as a permanent guardrail against unbridled, unaccountable innovation. The final gavel for Do Kwon will close a judicial case, but the lessons of Terra will resonate for generations of financiers and technologists to come.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.