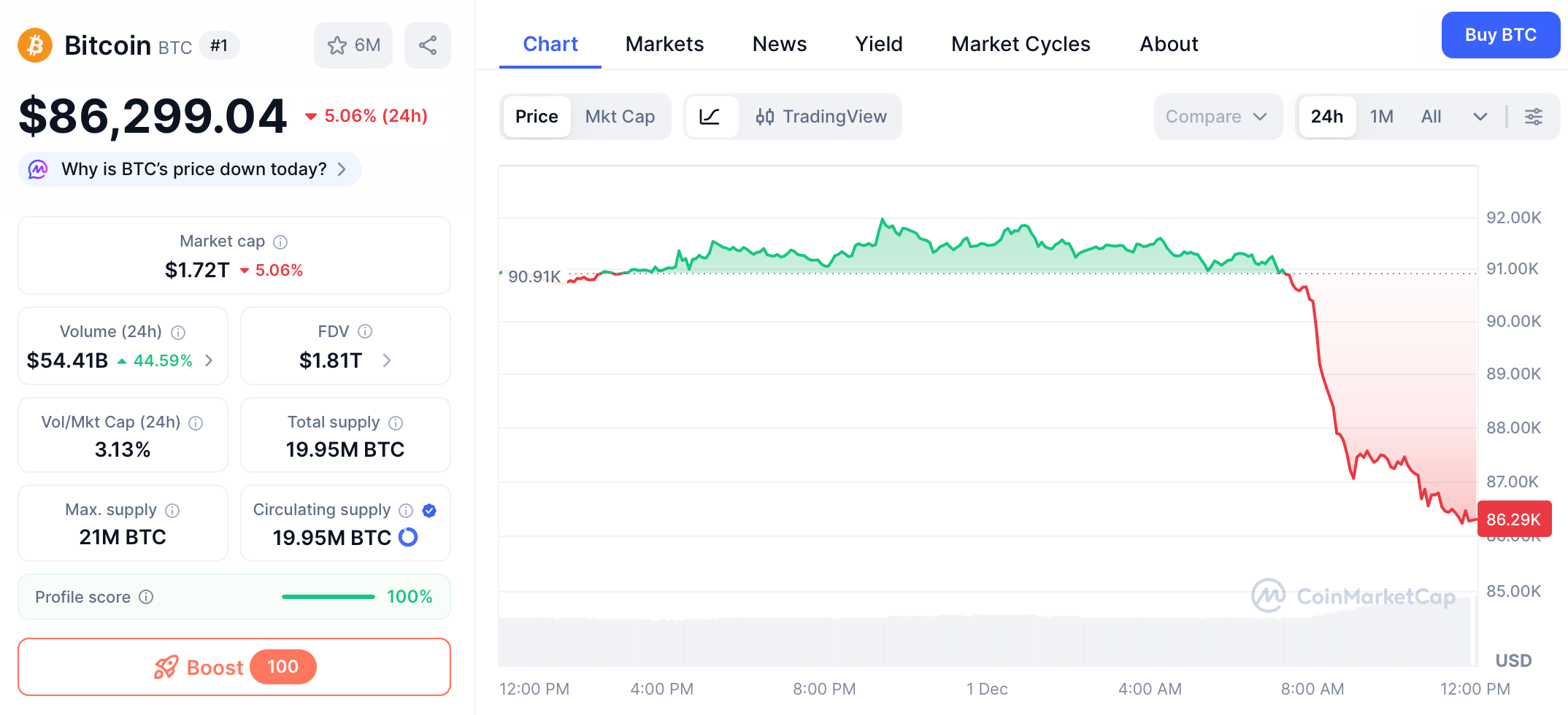

The cryptocurrency market was rocked by a violent sell-off on December 1, 2025, witnessing a staggering $140 billion evaporation from its total market capitalization within a mere four hours. This sharp decline marks a dramatic reversal for a market that, just two months prior, saw Bitcoin achieve a historic peak of $126,000.

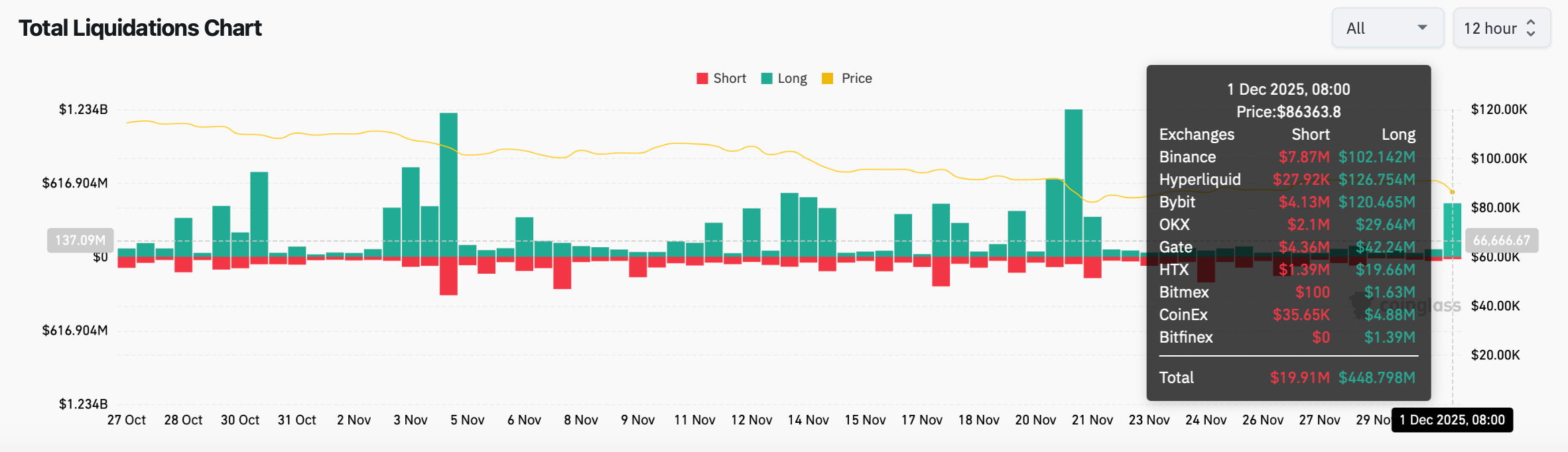

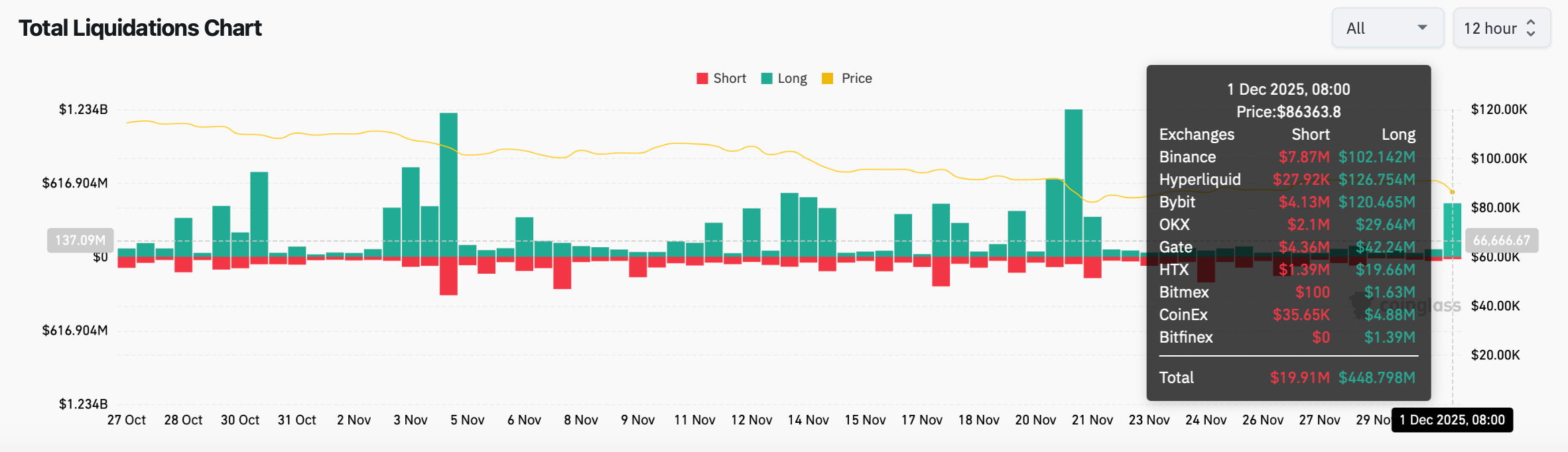

The flagship cryptocurrency, Bitcoin, plummeted precipitously, briefly crashing through the $87,000 support level and erasing all its gains for the year. Similarly, Ethereum nosedived, losing its footing above $2,900. The broader market mirrored this descent, with major altcoins like Solana (SOL) and Cardano (ADA) recording losses nearing 6%. The scale of the liquidation was immense, with data from Coinglass revealing that over 466 million crypto derivatives positions were liquidated within 24 hours, affecting approximately 177,200 to 180,000 traders. The carnage was disproportionately felt by those betting on higher prices, with long positions accounting for an overwhelming $448 million of the total liquidations.

This severe market tremor was not an isolated event but the culmination of several converging factors: the lingering aftershocks of the October 11th "clearing event," a deteriorating macroeconomic backdrop, and a market rumor that, albeit unconfirmed, sowed sufficient uncertainty to exacerbate the downturn.

The Immediate Catalyst: A Market on Edge Succumbs to Rumors

The already fragile crypto market was pushed over the edge during the early hours of December 1st by a potent, albeit likely false, rumor circulating among traders. According to unverified "market gossip," Federal Reserve Chair Jerome Powell was speculated to announce his resignation at an emergency meeting. Such a development would represent a monumental shock to global financial markets, injecting extreme uncertainty into the future of U.S. monetary policy.

Although major international media outlets did not corroborate this claim, and analysts quickly suggested it was probably misinformation, its impact was very real. In a climate already rife with anxiety, the mere whisper of instability at the helm of the world's most influential central bank was enough to trigger a panicked sell-off. This episode underscores the crypto market's continued sensitivity to news and speculation, particularly when it concerns the foundational policies of traditional finance.

Compounding the rumor was a simultaneous announcement from former President Donald Trump, who stated he had already decided on his nominee for the next Fed Chair, with current National Economic Council Director Kevin Hassett considered a frontrunner. The potential for a leadership change at the Fed towards a figure perceived as more aligned with political pressures for aggressive rate cuts added another layer of uncertainty, further unsettling investors in risk-sensitive assets like cryptocurrencies.

Unresolved Systemic Weaknesses from "1011" Liquidation Event

Beneath the surface of the immediate rumor-driven panic lies a more profound structural vulnerability that set the stage for this downturn: the legacy of the October 11th ("1011") mass liquidation event. Venture capitalists and industry analysts point to this event as a primary driver behind the market's recent weakening trajectory.

As explained by Rob Hadick, General Partner at Dragonfly, the "1011" event was catastrophic deleveraging triggered by a combination of "low liquidity, poor risk management, and weak oracle or leverage mechanisms". This cascade of forced selling, estimated to have wiped out 190 billion in leveraged positions shortly after Bitcoin's all-time high, created tremendous market uncertainty and exposed critical flaws in the ecosystem's infrastructure.

Boris Revsin, General Partner and Managing Director at Tribe Capital, characterized it as a "leverage washout" that produced a chain reaction across the entire market. The events of December 1st demonstrate that the market has not yet fully recovered from this shock. The high number of long liquidations suggests that excessive leverage, a key factor in the "1011" event, had once again built up in the system, leaving the market acutely vulnerable to any negative catalyst.

Macroeconomics Holds A Hostile Environment for Risk Assets

Simultaneously, the broader macroeconomic environment has turned increasingly hostile toward risk-on investments, including cryptocurrencies. Over the past two months, a series of economic data and geopolitical developments have dampened investor enthusiasm.

Key among these pressures are fading expectations for near-term interest rate cuts from the Federal Reserve, persistent inflation, and signs of a weakening U.S. job market. Anirudh Pai, Partner at Robot Ventures, emphasized concerns about a slowdown in the U.S. economy, noting that key growth indicators like the Citi Economic Surprise Index and 1-year inflation swaps have begun to weaken. "This pattern has appeared before concerns about recession, driving a broader risk-off sentiment," Pai stated.

This "risk-off" mood has led to a broad withdrawal of capital from speculative assets. Furthermore, as noted by Dan Matuszewski, Co-Founder of CMS Holdings, the crypto market has seen almost no "incremental capital inflow" beyond corporate treasuries and token buybacks, with the once-reliable support from Bitcoin ETF inflows also showing signs of stalling. With new demand drying up and the macro winds no longer at its back, the market lacked the fundamental strength to resist a downward spiral.

Market Psychology and the "Extreme Fear" Indicator

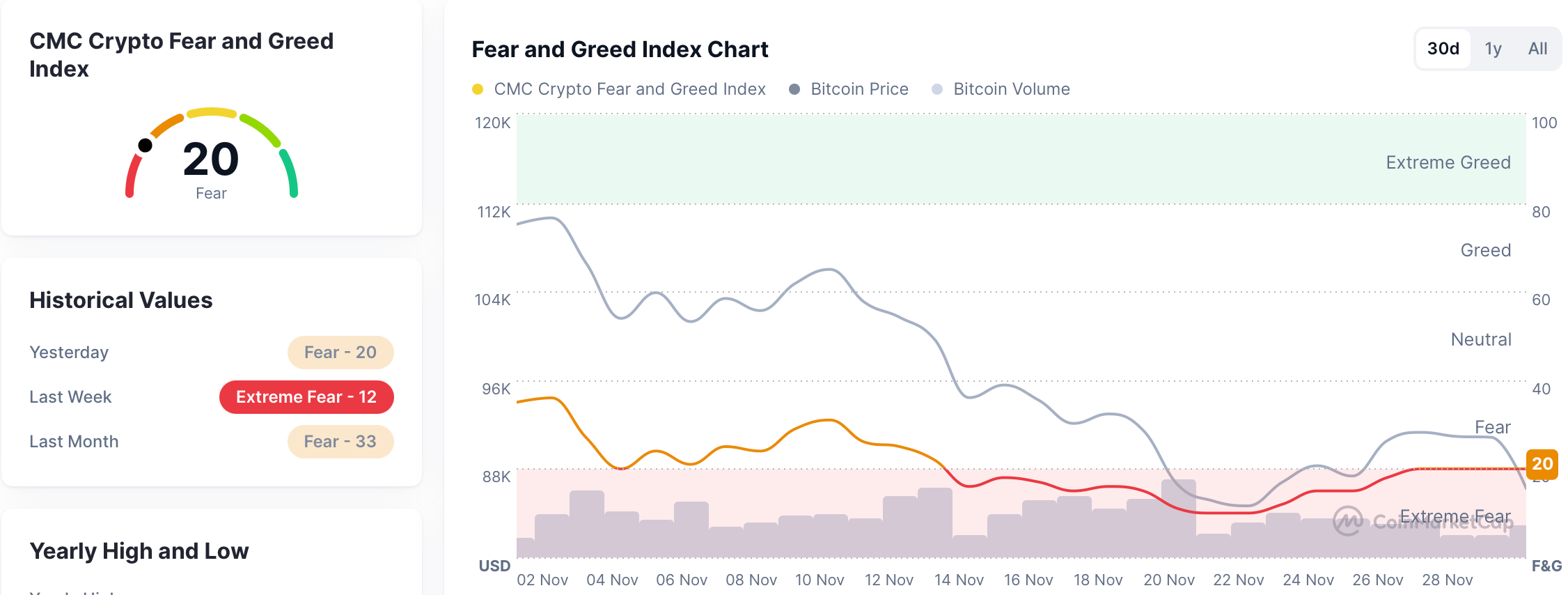

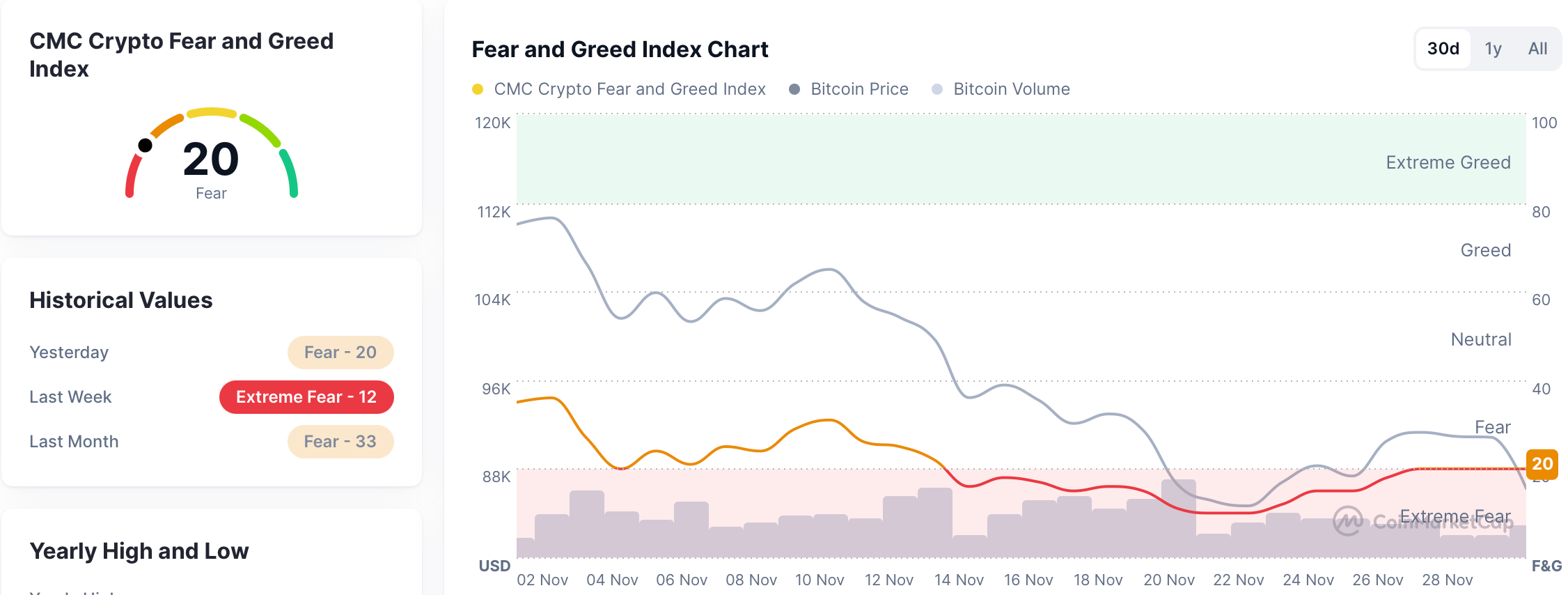

The collective psyche of the crypto market has taken a severe hit, a sentiment starkly quantified by the Cryptocurrency Fear and Greed Index. On December 1st, the index plummeted to 20. This index, which synthesizes data from volatility, market momentum, social media sentiment, and surveys, serves as a clear barometer of investor anxiety. The current reading indicates a market dominated by panic and pessimism, where selling pressure overwhelms any attempts at bullish momentum.

This pervasive fear is also reflected in on-chain data and market activity. Reports indicate that overall market trading volume has remained persistently low, and Bitcoin's attempt to reclaim the 92,000 level failed over the previous weekend due to a lack of sustained buying interest. Sean McNulty, Asia-Pacific Head of Derivatives at FalconX, captured the mood succinctly: "The most worrying thing is the lack of Bitcoin ETF inflows and the absence of bargain-hunting buyers." He identified the 80,000 level as the next critical support level for Bitcoin, a line in the sand that many traders are now watching closely.

Regulatory Tremors from China

Adding to global pressures, regulatory headwinds from China contributed to the negative sentiment. The People's Bank of China (PBOC) recently reaffirmed its tough stance on virtual currencies, specifically highlighting concerns about stablecoins and vowing to crack down on illegal activities.

The PBOC stated that stablecoins fail to meet requirements for customer identification and anti-money laundering controls, signaling a continued and intensified crackdown. This announcement had an immediate ripple effect, causing a slump in Hong Kong-listed stocks of financial firms with stablecoin-related businesses. Companies like Yunfeng Financial Group and Bright Smart Securities saw their shares drop by nearly 10% and 7%, respectively. This regulatory posture from a major global economy serves as a reminder of the persistent and fragmented regulatory challenges facing the digital asset industry, further unnerving investors.

Conclusion

The events of December 1st paint a picture of a crypto market at a critical juncture. The rapid 140 billion decline was not a black swan event but the result of a predictable confluence of factors: unsubstantiated rumors exploiting a nervous market, the unresolved structural legacy of excessive leverage from the "1011" event, and a tightening macroeconomic vise that is squeezing risk assets globally.

The market is currently in a state of "initial stabilization but not reversal," according to VC analyses. While a bounce from the 80,000 level is possible, most analysts agree that a sustained recovery would require a clear change in the macro landscape, such as a resumption of Fed rate cuts and a calming of geopolitical tensions—coupled with a return of consistent capital inflows into Bitcoin ETFs and a cautious rebuilding of leverage.

For now, the sentiment is captured by the Fear and Greed Index's "Extreme Fear" reading. Investors are advised to brace for continued volatility. The path forward hinges on the market's ability to navigate an increasingly complex and challenging environment, where both traditional finance dynamics and internal crypto-specific weaknesses will continue to dictate its trajectory.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.