The global cross-border payment system, a network moving over $200 trillion annually, is undergoing its most significant transformation since the creation of SWIFT. While traditional systems continue to serve global commerce, new architecture is emerging from the edges, one built on blockchain technology, stablecoins, and decentralized protocols that promise to make international money movement as seamless as sending a text message.

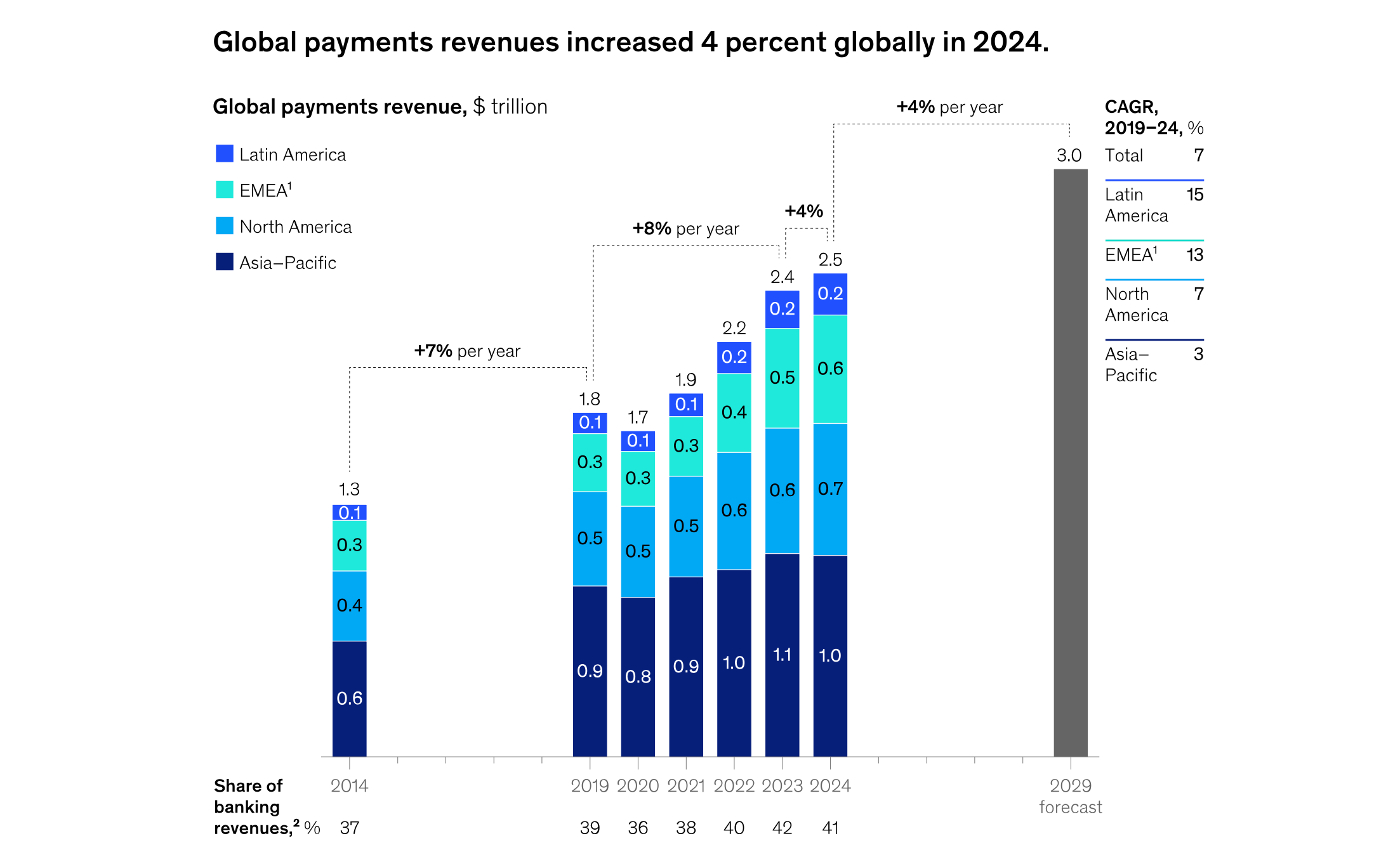

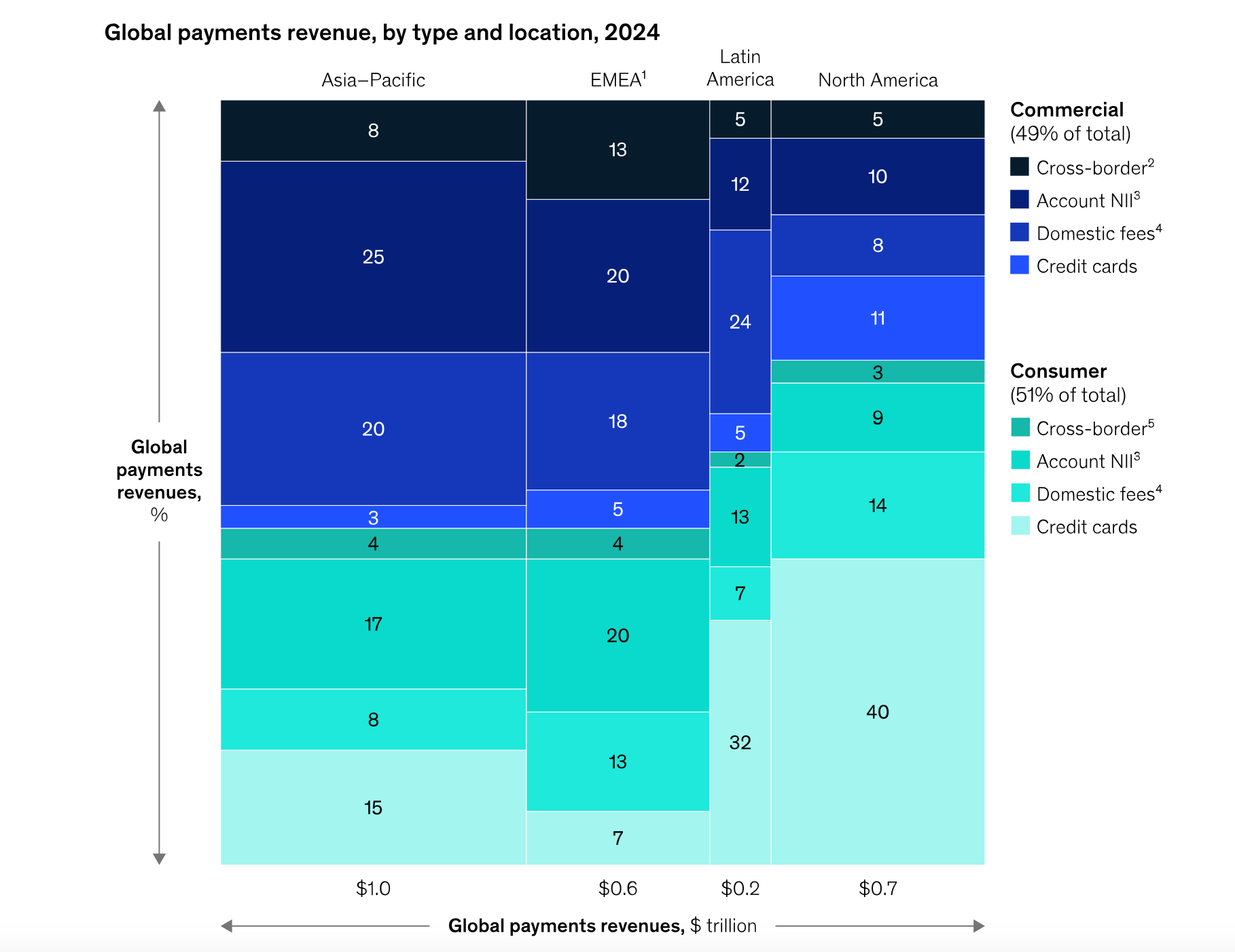

The current system shows cracks: despite processing enormous value, it remains fragmented, expensive, and inaccessible to many. As McKinsey's 2025 Global Payments Report reveals, the payment industry generated $2.5 trillion in revenue in 2024, with cross-border flows representing a substantial portion. Yet, beneath these impressive numbers lies inefficiency: traditional cross-border transactions often take days, cost 3-6% in fees, and exclude billions from the formal financial system.

This article explores how Web3 technologies are dismantling and rebuilding global payment infrastructure from the ground up, creating a more inclusive, efficient, and open financial future.

The State of Global Digital Payments: A System Under Strain

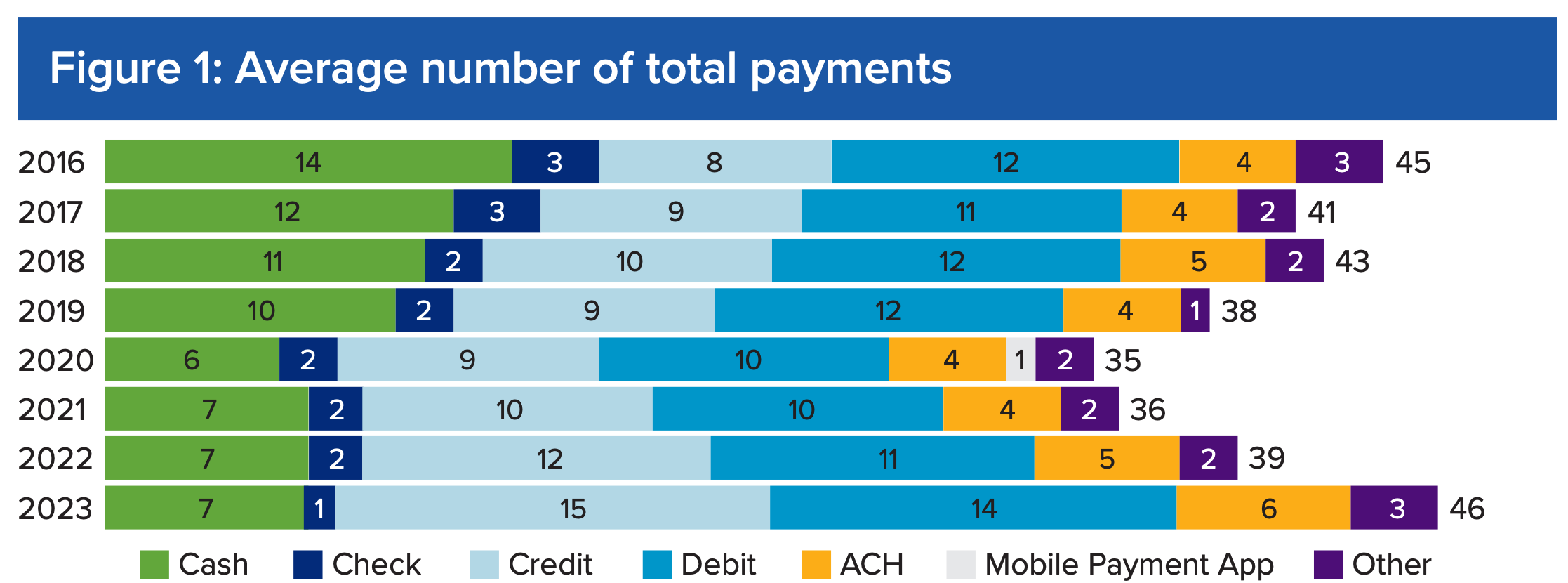

The traditional cross-border payment ecosystem is a complex web of correspondent banks, card networks, and messaging systems. While digital payments have advanced significantly, with the share of payments made with cash decreased to 16%, though it remained the third most-used payment instrument behind credit and debit cards, the underlying infrastructure for international transfers has struggled to keep pace with globalization.

The current system faces fundamental challenges. Payment networks are becoming increasingly fragmented and regionalized, with countries pursuing "payment sovereignty" through local systems like India's UPI and Brazil's Pix. This fragmentation reflects a broader trend: the once-unified global payment landscape is breaking into regional pieces with different standards, timelines, and trust anchors.

Meanwhile, the industry faces economic headwinds. After years of strong growth, payment revenue expansion slowed to 4% in 2024, down from 12% in 2023. This slowdown comes despite payment services remaining the most valuable segment in financial services, with an average return on equity of 18.9%.

The human impact of these inefficiencies is particularly visible in marginalized communities and developing economies, where access to formal financial services remains limited. It's precisely these underserved areas that have become the testing ground for Web3 payment solutions.

The "Rural Encirclement" Strategy: Web3's Bottom-Up Adoption

While flashy crypto projects capture headlines, Web3 payment adoption is following a more subtle path—growing from the edges of the global financial system inward, much like the "rural encirclement" strategy of revolutionary movements.

Web3 and stablecoins, in peripheral regions like Africa and Latin America, have demonstrated potential revolutionary significance and enormous development potential through a "rural-to-urban" strategy. This model has long been overlooked in mainstream narratives. Its core highlight lies in the fact that payments are realized entirely through real-time transfers via cryptocurrency wallets, without relying on traditional intermediaries like USB cards.

In regions with well-developed payment infrastructure, instant transfers via QR code scanning are commonplace. This unique environment, accumulated through internet development, is difficult to directly replicate.

Currently, some users in Vietnam scan VietQR codes using Bitget Wallet. The front-end experience is similar to using Alipay, but the underlying layer relies on the Solana network for cryptocurrency transfers, which are then instantly converted to fiat currency through an intermediary protocol and credited to the merchant's account.

Essentially, this difference stems from "replicability"—the Vietnamese solution can theoretically be extended to any country with a local instant payment system.

Especially in Africa and Latin America, where smartphone adoption and e-wallet development are already established, traditional financial infrastructure remains relatively weak, providing an opportunity for the development of new payment technologies.

The Stablecoin Evolution: From Chain Transfers to Banking Bypass

Phase 1: Pure On-Chain Transfers

The earliest stablecoin payment models involved direct blockchain transfers between parties. While revolutionary in their bypassing of financial intermediaries, these pure on-chain transactions faced limitations: blockchain fees during network congestion, price volatility concerns, and the technical complexity for end-users.

Phase 2: The "U Card" Era

The next evolution came through partnerships with traditional card networks. Companies like Thredd enabled crypto exchanges to issue Visa and Mastercard payment cards, allowing users to instantly convert cryptocurrencies to fiat for spending. Bybit Card, for instance, has gained over 2 million users worldwide by bridging digital assets with everyday payments.

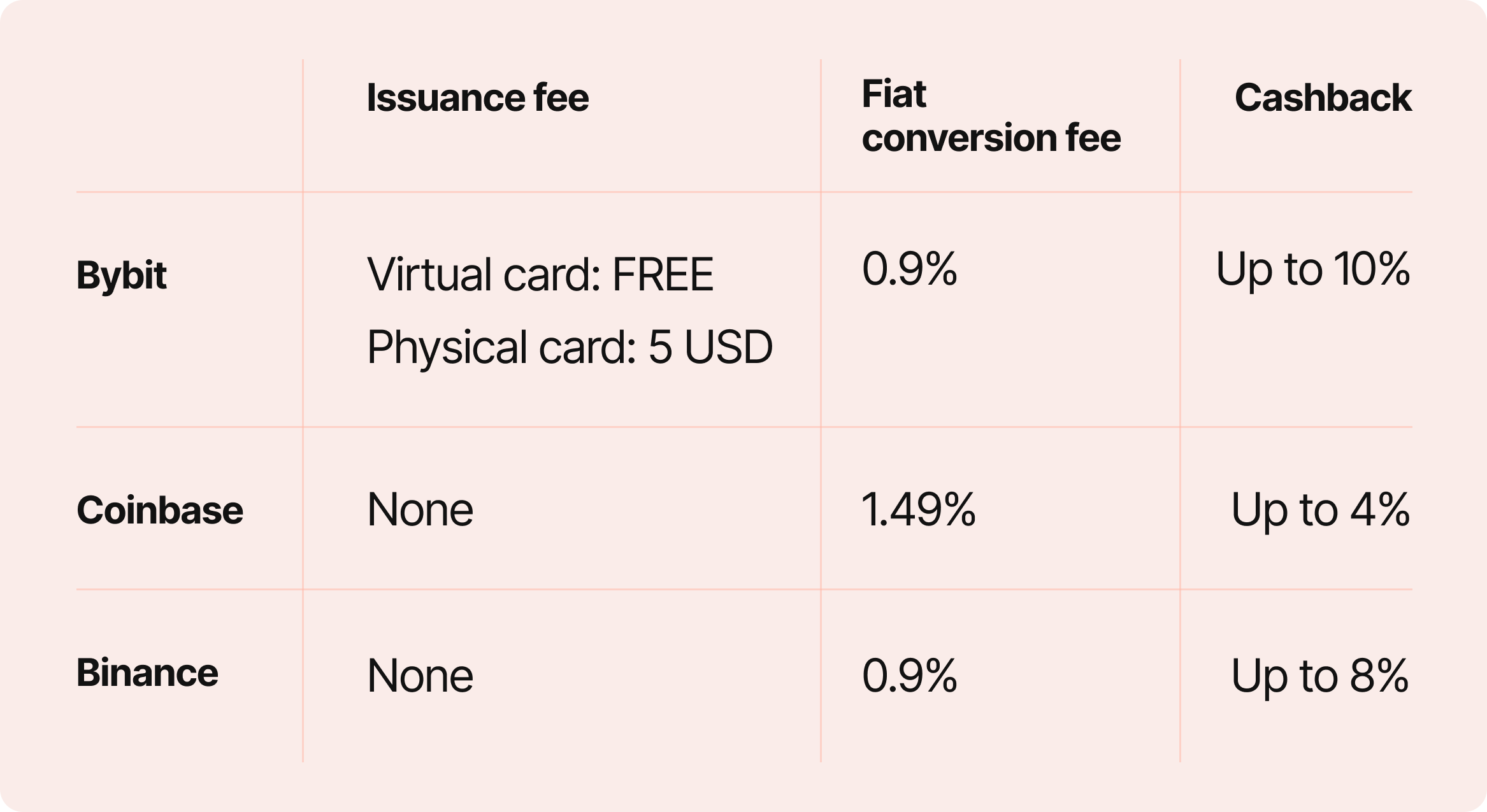

While more user-friendly, this model carries significant limitations. The KYC processes are often cumbersome, card issuance fees can be prohibitive, and transaction costs remain high compared to pure crypto transfers. Additionally, these solutions ultimately rely on the very traditional financial infrastructure that cryptocurrencies aimed to disrupt.

Phase 3: Direct-to-Bank Networks

The most promising development in stablecoin payments is the emergence of Direct-to-Bank networks that connect blockchain-based assets directly with merchant acceptance points. This model bypasses both card networks and issuing banks, creating a more efficient payment rail.

Stablecoins are uniquely positioned to disrupt payments because they're "better, faster, cheaper" than traditional alternatives. The emerging crypto payment stack mirrors traditional financial infrastructure but with greater efficiency, featuring layers for custody, liquidity provision, banking-as-a-service, and consumer-facing applications.

This architecture enables payments that settle in seconds rather than days, with fees substantially below the 1.95-2% typical of traditional card processing. As technology matures, stablecoins are approaching their "breakout moment," with daily transaction volume reaching approximately $30 billion and regulatory frameworks becoming clearer in key markets like the U.S., EU, and UK.

Payment Giants Respond: Adaptation and Integration

Facing the Web3 challenge, traditional payment giants are pursuing a dual strategy: integrating blockchain elements while strengthening their existing advantages in trust and compliance.

PayPal has embraced stablecoins as a solution for specific payment scenarios, particularly cross-border transfers. As CEO Alex Chriss noted, "I'm very supportive of stablecoins. The real breakthrough is cross-border. The company is focusing on areas where traditional payment rails remain weak, while simultaneously developing AI-driven "Agentic Commerce" where AI assistants handle shopping and payments on behalf of users.

Visa and Mastercard are pursuing cloud-first infrastructures while forming strategic partnerships with crypto native companies. Visa's Cloud Connect program, for instance, allows partners to access VisaNet through their own cloud infrastructure, representing a gradual accommodation of new technologies within existing networks.

Meanwhile, the competitive landscape is evolving. As Chriss noted, "Sometimes I feel we're competing with everyone", capturing how payment providers now operate across multiple domains including payment processing, P2P transfers, e-commerce checkout, and the emerging field of AI-agent commerce.

How to Rationally View the PayFi Project?

Following these popular projects, in addition to exciting data and visions, maintaining a prudent judgment is equally important. You can examine them from the following aspects:

Focus on the actual implementation of the product: PayFi's core value lies in solving real-world payment problems. Therefore, whether a project has a running or testable product (such as the wallet beta versions of Remittix and PayFi) is an important indicator of its progress.

Understand the deeper logic of PayFi: PayFi is not just about "paying with cryptocurrency." Its deeper innovation lies in using blockchain technology to deconstruct traditional financial services (such as credit, bridging, and settlement) into freely combinable "Lego modules," thereby creating more efficient financial processes. For example, Huma Finance's model involves obtaining on-chain credit by pledging accounts receivable.

Recognize the risks and challenges:

Compliance: Cross-border payment businesses are closely linked to financial regulatory frameworks such as KYC (Know Your Customer) and anti-money laundering, which are challenges that all projects must face.

Market Competition: This sector not only has emerging projects, but traditional payment giants (such as Visa and Stripe) and large centralized exchanges (such as OKX and Coinbase) are also developing similar services, making the competition extremely fierce.

PayFi's Ultimate Form: When Wallets Become "Invisible Banks"

Perhaps the most transformative vision for Web3 payments comes through the emerging concept of PayFi, which is a system that leverages the time value of money to create entirely new financial primitives.

As explained by Solana Foundation President Lily Liu, PayFi aims to fulfill Bitcoin's initial vision of "program money, open financial system, digital property rights, self custody and economic sovereignty". Unlike DeFi, which primarily creates financial products, PayFi focuses on building systems around goods and services.

PayFi's core innovation lies in leveraging the time value of money to create new payment models. One implementation is "Buy Now Pay Never", where users deposit funds into DeFi products that generate sufficient yield to cover present-day purchases over time. In this model, a $5 coffee payment might be covered by locking $50 in a lending protocol, with the generated interest eventually covering the cost while the principal remains intact.

This approach transforms wallets from simple storage tools into sophisticated financial managers that automatically optimize for both present needs and future growth. As these wallets evolve, they begin to function as "invisible banks"—providing banking services without traditional banking infrastructure.

The potential impact is particularly significant for emerging markets and underserved businesses. Projects like Arf provide licensed financial institutions with unsecured, short-term, USDC-based working capital credit lines, freeing up the $4 trillion currently locked in pre-funded accounts for cross-border payments. Similarly, Huma has facilitated nearly $890 million in payment financing with a 0% default rate by allowing users to borrow against future earnings.

Conclusion

The Web3 payment revolution is following a paradoxical path: growing from the periphery rather than the center, embracing regulation rather than rejecting it, and building bridges to traditional finance rather than simply disrupting it.

As McKinsey notes, the payment landscape is evolving toward one of two scenarios: a "multi-track ecosystem with global passkeys" where various systems interoperate smoothly, or "fragmentation upgrade with erosion of global standards" where regional systems dominate. The outcome will significantly influence how quickly Web3 payments achieve mainstream adoption.

What's clear is that stablecoins and blockchain-based payment systems represent what Primitive Ventures investment partner YettaS calls "the most native innovation" in crypto, which is something that previously didn't exist and would be impossible without the emerging technology paradigm.

For consumers and businesses, the transformation promises a future where cross-border payments become nearly invisible, fast, cheap, and integrated into everyday commerce. As Alex Chriss of PayPal envisions, we're moving toward a world where consumers "don't want to think about 'what currency do I have? What payment method should I use? Which wallet works?' They just want to live their lives".

The companies that succeed in this new landscape will be those that solve the "golden triangle" of stablecoin strategy: liquidity supply, channel control, and yield design. Those that balance all three elements while navigating the complex regulatory landscape will lead the next generation of global payments.

With the industry poised between fragmentation and integration, between traditional and decentralized models, one thing remains certain: the future of payments will be built on multiple tracks, multiple currencies, and multiple technologies and Web3 will be at the center of this transformation.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.