The cryptocurrency market is demonstrating resilient recovery attempts amid persistently fearful sentiment. Current market conditions reflect a tension between improving technical setups and underlying macroeconomic uncertainties that continue to weigh on investor confidence. Bitcoin currently trades at $91,198, showing tentative stability after recent volatility, while Ethereum faces a critical test at the $3,000 psychological barrier. Meanwhile, Under proposals published this week, HM Revenue and Customs (HMRC) signaled support for a “no gain, no loss” (NGNL) approach to crypto lending and liquidity pool arrangements. MegaETH, an upcoming Ethereum Layer 2 scaling solution, announced that it has decided to return all capital raised from its Pre-Deposit Bridge. South Korea's leading cryptocurrency exchange Upbit announced an urgent suspension of digital asset deposits and withdrawals following the detection of irregular withdrawal activity involving certain Solana network tokens.

Crypto Market Overview

BTC (-0.30% | Current Price: $91,198.04)

Bitcoin is currently trading at $91,198, showing a 0.30% decrease over the past 24 hours after testing support around $89,600 during yesterday's session. This represents a stabilization following recent volatility, though BTC remains significantly below its October peak of approximately $126,000. The zone between $89,300 and $90,500 represents a crucial support area where a high concentration of leverage long positions exists. A breakdown below this range could trigger cascading liquidations and push prices toward stronger support around $85,000. Key Resistance: The $92,000 to $93,000 range contains concentrated short positions. A decisive break above this barrier could trigger significant short covering, potentially fueling a rally toward $95,000.

On November 27th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $21.2 million, with BlackRock's IBIT saw an inflow of $42.8 million.

ETH (+1.33% | Current Price: $3,008.18)

Ethereum is currently trading around $3,008, facing a critical juncture as it tests the psychologically significant $3,000 resistance level. ETH has established a recovery wave from recent lows around $2,620, successfully climbing above the 100-hourly Simple Moving Average and establishing $2,850 as initial support. A key bearish trend line is evident on the hourly chart with resistance at $2,970, creating a significant barrier for further upside. The $2,950-$3,000 zone represents a major inflection point where bullish momentum must overcome substantial selling pressure. A decisive break above $3,050 could ignite renewed buying interest, targeting resistance at $3,120 and potentially $3,250 in the near term. Failure to hold above $2,840 could initiate a fresh decline toward $2,780 support, with a break below this level potentially targeting $2,650

On November 27th, ETH ETFs experienced a total net inflow of $60.8 million, with BlackRock's ETHA saw an inflow of $50.2 million.

Altcoins

The Crypto Fear & Greed Index stands at 20, reflecting continued "Extreme Fear" among market participants despite a slight improvement from yesterday's reading of 18.

Macro Data

Market sentiment remains heavily influenced by shifting expectations for Federal Reserve policy, particularly regarding potential interest rate cuts in December:

-

Rate Cut Probabilities: The likelihood of the Fed lowering interest rates by 25 basis points has risen to 85.3% from just 50.1% a week ago, according to the CME FedWatch Tool. This dramatic shift follows surprisingly dovish comments from Fed official John Williams, who historically maintained a hawkish stance.

-

Market Sensitivity: Cryptocurrency prices have moved almost entirely in sync with changing Fed expectations, with Bitcoin dropping as low as $80,600 when hawkish meeting minutes pushed rate cut expectations down to 22%, before sharply recovering on Williams' more dovish commentary.

On November 27th, the S&P 500 gained 0.69%, standing at 6,812.61 points; the Dow Jones Industrial Average increased 0.67% to 47,427.12 points, and the Nasdaq Composite gained 0.82% to 23,214.69 points. The price of gold is $4,157.44, up 0.25%, at 4:00 UTC, November 28th.

Trending Tokens

SQD Subsquid (+67.66%, Circulating Market Cap: $92.77 Million)

SQD is trading at $0.09913, up approximately 67.66% in the past 24 hours. Subsquid Network is an innovative decentralized data lake and query engine designed to offer developers performant and permissionless access to data, aiming to build a neutral and open internet rooted in Web3 principles. Secured by ZK proofs, the Subsquid network boasts a modular architecture that enables exceptional scalability and developer convenience optimized for blockchain indexing, dApp development, and analytics. SQD broke above 23.6% Fibonacci retracement level ($0.100) and holds a bullish MACD crossover. The 7-day RSI (69.56) nears overbought territory but hasn’t hit extreme levels. In this case, short-term traders are chasing the breakout, amplified by low liquidity (turnover ratio 0.792) and immediate resistance lies at the 38.2% Fib level ($0.0898), while a close below $0.100 could trigger profit-taking.

TURBO Turbo (+24.58%, Circulating Market Cap: $138.64 Million)

TURBO is trading at $0.002008, up approximately 24.58% in the past 24 hours. This first ever memecoin created by AI. Turbo Token began as a bold experiment in cryptocurrency creation. Inspired by the power of artificial intelligence, the project's founder turned to GPT-4 with a simple challenge: create the next great meme coin. The price broke above 23.6% Fibonacci retracement ($0.0022356) and 7-day EMA ($0.0016935), while the MACD histogram turned positive (+0.00006272) for the first time since mid-October. Traders are reacting to bullish chart patterns, though the RSI(7) at 75.39 suggests overextension. A close above $0.002517 (swing high) could target $0.002841 (127.2% extension).

RECALL Recall (+17.19%, Circulating Market Cap: $25.43 Million)

RECALL is trading at $0.1266, up approximately 17.19% in the past 24 hours. Recall is a decentralized skill market where communities fund, rank, and discover AI solutions that meet their needs. Recall creates transparent, verifiable reputation infrastructure for the AI agent economy through economic coordination and performance-based evaluation. Recall’s Ethereum Paper Trading Arena (launched Nov 18) offers a 40,000 $RECALL prize pool, incentivizing users to stake tokens and predict AI agent performance. The competition temporarily reduces sell pressure by locking tokens in staking contracts. However, the 30-day price decline (-69%) suggests many airdrop recipients may still sell on rallies.

Market News

UK Proposes ‘No Gain, No Loss’ Tax Rule for DeFi in 'Major Win' for Users

The U.K. government is working on a new tax framework that could give decentralized finance (DeFi) users a break. Under proposals published this week, HM Revenue and Customs (HMRC) signaled support for a “no gain, no loss” (NGNL) approach to crypto lending and liquidity pool arrangements.

Under the current system, when a DeFi user deposits funds into a protocol, even if to monetize those funds or take out a loan against them, the move could be treated as a disposal and trigger capital gains tax. The move could defer capital gains tax until there is a true economic disposal.

In practical terms, this could mean that users who deposit crypto into lending protocols, or who contribute tokens to automated market makers (AMMs), would no longer be taxed at the point of deposit. Instead, tax would apply when they eventually sell or trade assets in a way that realizes a gain or loss.

HMRC’s new approach would also apply to complex multi-token arrangements used in decentralized protocols. In these cases, if users receive more tokens back than they deposited, the gain would be taxed. If they get fewer, it would be treated as a loss. Still, the model isn’t final. The government continues to consult with tax professionals and DeFi developers to fine-tune the scope and mechanics of the rules. A total of 32 formal responses were submitted, with input from major industry players like Aave, Binance, Deloitte, and CryptoUK. Most respondents supported a shift to NGNL, citing administrative burdens and uncertainty under the existing regime.

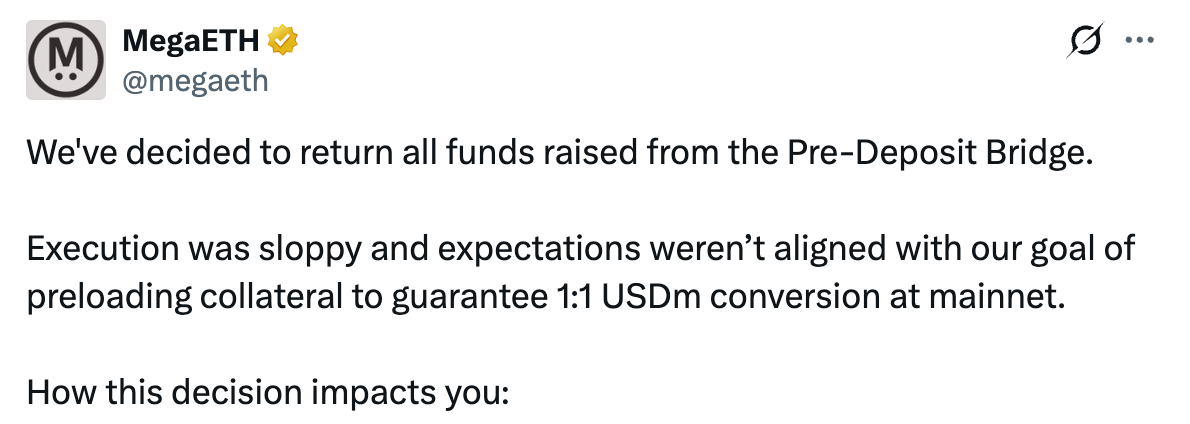

MegaETH to Return All Funds from Pre-deposit Bridge, Citing 'Sloppy' Execution

MegaETH X tweets.

MegaETH, an upcoming Ethereum Layer 2 scaling solution, announced that it has decided to return all capital raised from its Pre-Deposit Bridge.

On Tuesday, MegaETH opened its pre-deposits for USDm, the native stablecoin for blockchain. However, the event execution was marred with outages, several changes in deposit cap, and a misconfigured multisig transaction that triggered an unexpected early reopening of deposits.

The pre-deposit bridge launch for the stablecoin was scheduled for 9 a.m. ET with an initial $250 million cap. However, the event was immediately affected by an operational issue involving the third-party bridge provider, rendering the service inaccessible for approximately one hour. Following service restoration, the $250 million limit was reached in less than three minutes. MegaETH subsequently announced a decision to raise the cap to $1 billion.

Operational control failed during the cap adjustment process, where the multisig transaction queued to increase the cap was incorrectly configured with a 4-of-4 signature requirement instead of the intended 3-of-4. This mistake allowed the transaction to be executed by an external party approximately 34 minutes before the planned bridge relaunch.

The premature reopening led to deposits surpassing $400 million. The MegaETH team then attempted two cap resets, first to $400 million, and then to $500 million. After this, the team said it will no longer expand the cap to $1 billion.

Korea's Upbit Suspends Deposit And Withdrawal Service After $37M in Abnormal Activity in Solana Tokens

South Korea's leading cryptocurrency exchange Upbit announced an urgent suspension of digital asset deposits and withdrawals following the detection of irregular withdrawal activity involving certain Solana network tokens.

Dunamu's CEO, the operator of Upbit, Oh Kyung-seok, apologized for the inconvenience to users and confirmed that abnormal withdrawal behavior was detected early Thursday.

The affected tokens include DoubleZero (2Z), BONK, DOOD, Drift, HUMA, Ionet (IO), JTO, JUP, LAYER, ME, and others associated with the Solana network.

Dunamu reported that approximately 54 billion won ($37 million) worth of tokens were transferred to unauthorized wallets and assured users that the exchange will cover all losses to protect user assets fully.

The exchange said in its statement that immediate actions taken include transferring all assets to cold wallets to prevent further unauthorized transactions, initiating on-chain freezing measures in cooperation with law enforcement – including successfully freezing assets worth about 12 billion won related to the Solayer token – and conducting a thorough security audit of all digital asset transfer systems.

Upbit said it will gradually resume withdrawal services once security is confirmed and urged users to report any suspicious activity to customer support.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.