The Bitcoin mining industry is currently navigating one of its most challenging periods in recent history. With Bitcoin's price declining below $90,000 and network hash rate reaching record highs, miner profitability has been severely compressed. According to recent data, the 7-day average revenue for Bitcoin miners has dropped by 35%, from $60 million to $40 million over the past two months. This perfect storm of declining revenue and rising costs has pushed many mining operations to their financial limits, forcing strategic shifts across the industry. Yet, amid these challenges, a fascinating story of adaptation and survival emerges that reveals the fundamental economics of securing the Bitcoin network and the divergent strategies miners are employing to stay operational.

The Miner Squeeze: Unpacking the Economic Logic

Bitcoin mining operates on a straightforward financial principle: miners receive fixed protocol revenues while facing variable real-world expenses. When market volatility strikes, they're the first to feel the pressure on their balance sheets.

The revenue side of the equation is fixed and coded into Bitcoin's protocol. Each block carries a reward of 3.125 BTC, with an average block time of 10 minutes, resulting in approximately 144 blocks daily. This translates to roughly 450 BTC in daily mining production across the network. Over 30 days, global Bitcoin miners collectively mine approximately 13,500 BTC, valued at about $1.2 billion at current prices around $88,000. When distributed across the record 1,078 EH/s hash rate, this translates to just

3.6 cents per day for each TH/s of computing power, which is the entire economic foundation supporting Bitcoin's $1.7 trillion network.

On the cost side, electricity remains the critical variable. The break-even point for miners depends largely on their power expenses and equipment efficiency. Modern miners like the S21 class (consuming 17 joules per terahash) with access to cheap electricity can still operate profitably. However, older equipment like the S19 class barely breaks even with electricity costs at $0.06 per kWh, any increase in network difficulty, Bitcoin price decline, or power rate surge further deteriorates their economics.

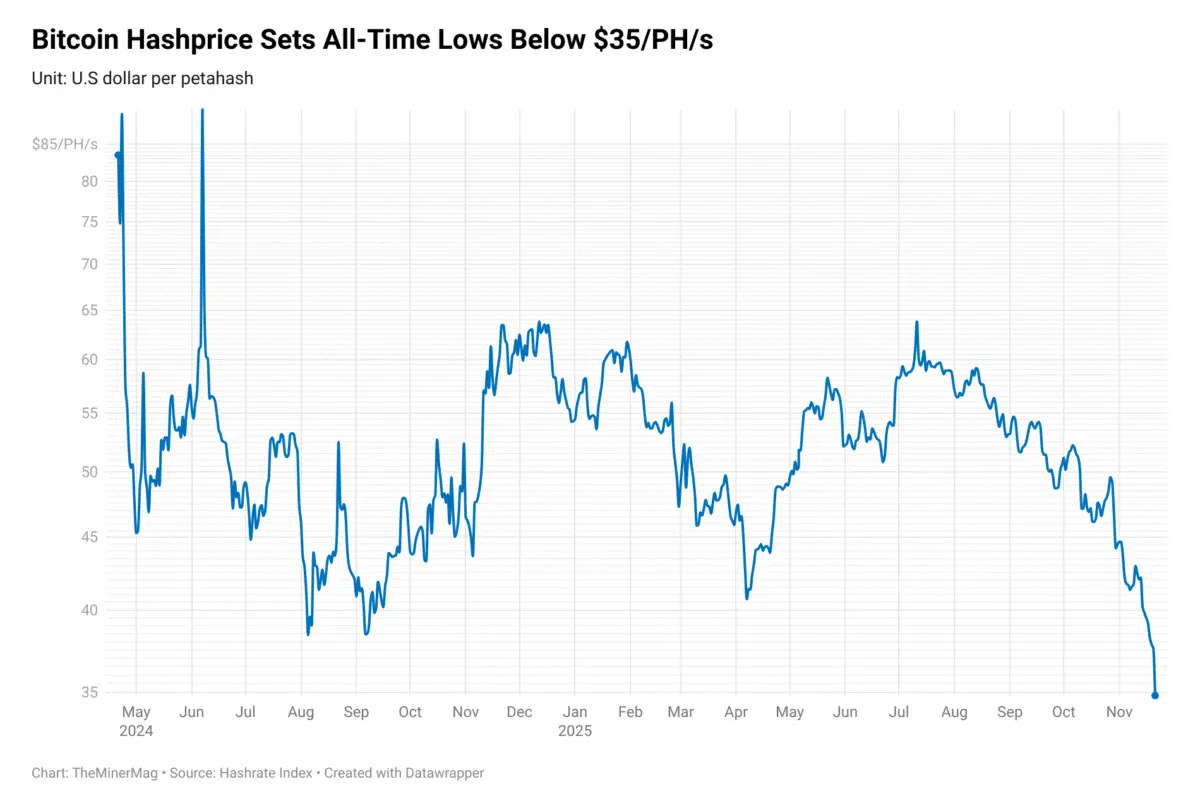

Bitcoin hash price. Source: TheMinerMag

The profitability squeeze has become increasingly severe. Bitcoin's hash price, mining revenue per unit of computing power, recently fell to multi-month lows around $35 per PH/s, creating what analysts describe as a classic "margin compression" scenario. With mining rewards cut in half since the last halving event and transaction fees contributing less than 1% to total revenue, miners are facing their tightest profit margins in years.

Mining Costs: A Tale of Two Economies

Not all miners experience the current downturn equally. The industry has effectively split into two distinct groups with different economic realities.

For large industrial-scale miners with efficient equipment, cheap power, and strong balance sheets, the current Bitcoin price of around $86,000 still generates substantial cash profit. According to Cambridge University estimates, the cash cost of mining one Bitcoin has risen to approximately $58,500. Major publicly traded companies like Marathon Digital and Riot Platforms report even lower energy costs per Bitcoin, $39,235 for Marathon and $46,324 for Riot in the third quarter of 2025. These operations maintain cash margins exceeding $40,000 per Bitcoin mined at current prices.

However, the picture changes dramatically when including non-cash expenses. Once depreciation, amortization, and stock-based compensation are factored in, the total cost of mining a single Bitcoin easily exceeds $100,000 for many operations. CoinShares estimated in December 2024 that the total mining cost was approximately $106,000 per Bitcoin, and rough calculations suggest Marathon's all-in cost exceeds $110,000 per Bitcoin.

This cost divergence creates two concurrent break-even scenarios. For well-capitalized miners with modern equipment and cheap power, daily cash flow remains positive even at $86,000 Bitcoin. But for the rest of the mining community, particularly those using older equipment or paying market electricity rates—accounting profits have become elusive. Many continue operating solely because their cash costs haven't been breached, even though they're losing money on a full cost basis.

Corporate Mining Strategies: Marathon vs. Riot

The contrasting approaches of two mining giants: Marathon Digital and Riot Platforms illustrate the strategic divergence in response to current market conditions.

Marathon Digital (MARA) has implemented a significant policy shift in response to tightening margins. After historically accumulating Bitcoin, the company announced in its Q3 2025 earnings report that it would begin selling portions of its newly mined Bitcoin to fund operations. This pivot from "pure accumulation" to "strategic realization" reflects the economic reality facing even large miners. Marathon, holding approximately 52,850 BTC as of September 30, faces substantial capital demands, approximately $243 million for property and equipment purchases, $216 million prepaid to suppliers, and $36 million for wind energy assets. Despite relatively low electricity costs of $0.04 per kWh, these financial commitments have made holding newly mined Bitcoin less attractive than selling to maintain operational flexibility.

Riot Platforms (RIOT) presents a different approach, emphasizing power management and strategic expansion. For June 2025, Riot reported producing 450 Bitcoin while maintaining holdings of 19,273 BTC. The company's innovative energy strategy includes economic curtailment and participation in ERCOT's demand response programs, generating significant power credits totaling $5.6 million in June alone, which is a 141% monthly increase. Riot's Q2 2025 performance demonstrated remarkable resilience, with net income reaching $219.5 million and adjusted EBITDA of $495.3 million. The company has also accelerated its strategic pivot toward data center operations, expanding its Corsicana facility and appointing a Chief Data Center Officer to lead this transition.

Bitcoin Reserves: The Industry's Safety Cushion

Despite economic pressures, major mining companies maintain substantial Bitcoin treasuries, providing both a safety net during downturns and potential future market supply.

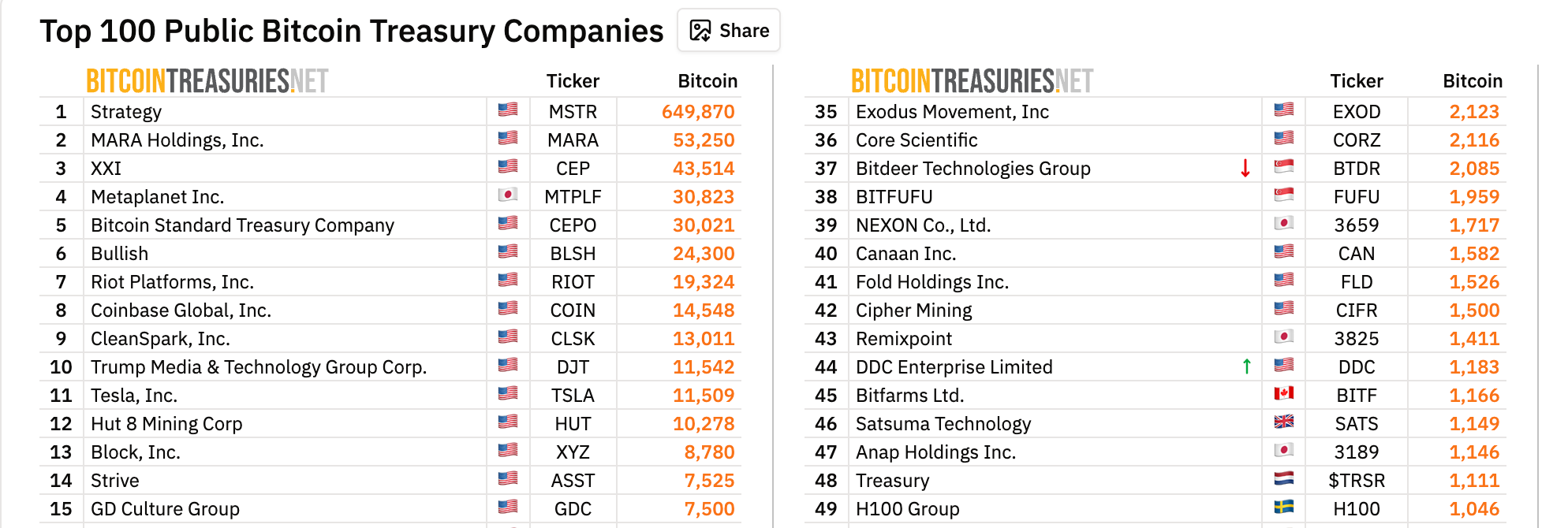

BTC holdings. Source: Bitcointreasuries

Industry leader Marathon Digital holds approximately 52,850 BTC, while Riot Platforms maintains reserves of 19,273 BTC. CleanSpark, another significant player, has increased its holdings to approximately 13,033 BTC while strategically selling portions for "active capital management".

These reserves represent both opportunity and risk for Bitcoin's market structure. On one hand, they provide mining companies with financial flexibility to weather periods of compressed profitability without needing to raise external capital. On the other hand, they represent substantial potential selling pressure should miners decide to liquidate portions of their treasury holdings.

Recent data suggests this risk may be materializing. Since October 9, approximately 51,000 BTC have moved from miner wallets to Binance, indicating increased selling activity. While not all transfers result in immediate sales, they represent increased potential supply entering the market ecosystem.

Mining's Future: Adaptation and Evolution

Facing persistent profitability challenges, Bitcoin miners are increasingly exploring strategic adaptations to secure their operational future.

The most significant trend involves diversification into artificial intelligence (AI) and high-performance computing (HPC). According to CoinShares, rising costs and declining profitability are pushing many mining operations toward AI and HPC initiatives. Bitcoin mining facilities, initially designed for cryptocurrency operations, are being repurposed for AI workloads that require similar infrastructure.

This transition comes with substantial capital requirements. Building AI-capable infrastructure can cost up to $20 million per megawatt which is significantly higher than the $700,000 to $1 million per megawatt for traditional Bitcoin mining operations. The potential rewards are substantial, as evidenced by IREN's five-year $9.7 billion contract with Microsoft, which included a 20% upfront payment alongside a $5.8 billion equipment deal with Dell.

However, these capital-intensive transitions may create short-term selling pressure on Bitcoin holdings, as companies like Marathon demonstrate that even well-capitalized miners may choose to sell Bitcoin to fund strategic shifts during periods of margin compression.

For the broader mining ecosystem, the outlook remains challenging. CoinShares projects the network hash rate could reach 1.5 Zettahash/s by mid-2026 without substantial Bitcoin price appreciation, further compressing mining margins. Only operators with access to low-cost electricity and the latest hardware are likely to maintain profitability in this environment.

Conclusion: An Industry at a Crossroads

The Bitcoin mining industry stands at a critical juncture. Current prices around $88,000 provide stability for cash-flow-positive operations but offer little room for error. The margin compression has created a bifurcated market where well-capitalized miners with efficient operations continue to thrive, while others struggle to maintain accounting profitability.

The fundamental economic logic of mining remains intact: as long as cash flow stays positive, miners continue operating. However, the strategies for maintaining that positivity are evolving rapidly. From power management innovations and strategic Bitcoin sales to diversification into AI and HPC, miners are demonstrating remarkable adaptability in the face of economic headwinds.

For the Bitcoin network, this period of pressure tests its fundamental security model. The fact that hash rate remains near all-time highs despite profitability challenges speaks to the long-term conviction of mining participants. As the industry continues to mature and evolve, the lessons learned during this downturn will likely shape mining economics and strategies for years to come.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.