In August 2025, BitMine Immersion Technologies (BMNR) stunned financial markets by amassing 1.15 million Ethereum (ETH) worth $4.96 billion, making it the world’s largest corporate holder of ETH and the third-largest crypto treasury after MicroStrategy and Marathon Digital. Led by veteran investor Tom Lee, the company aims to control 5% of all circulating Ethereum through a historic $24.5 billion equity-raising program. This aggressive pivot from Bitcoin mining to Ethereum treasury management mirrors MicroStrategy’s Bitcoin playbook but targets Ethereum’s unique potential in staking, DeFi, and institutional finance. As crypto markets surge, BitMine’s gamble could accelerate Ethereum’s mainstream adoption or expose critical risks in corporate crypto strategies.

From Bitcoin Miner to Ethereum Powerhouse

BitMine began as a conventional Bitcoin mining firm with operations in Texas and Trinidad. In 2025, under the new Chairman Thomas Lee (founder of Fundstrat), it radically shifted strategy: mining became secondary to building an Ethereum-based treasury. Lee’s vision centers on Ethereum’s dual utility as a yield-generating asset (via staking) and a foundation for decentralized finance.

The company’s first major move was a $250 million private placement in June 2025, selling shares at $4.50 to investors like Founders Fund and Pantera to fund initial ETH purchases. By early August, it held 833,000 ETH ($29B). Then came the bombshell: an SEC filing to expand its "at-the-market" (ATM) equity program by $20 billion, enabling it to issue new shares on-demand. Combined with existing capacity, BitMine now wields a $24.5 billion war chest exclusively for Ethereum accumulation.

Market Performance and Trends

Market Spotlights: The $20 Billion Catalyst

On August 12, BitMine’s SEC filing for its expanded ATM program ignited immediate market reactions:

-

Ethereum surged 5% to $4,400, nearing its 2021 all-time high

-

ARK Invest and Galaxy Digital backed the raise, signaling institutional confidence

-

South Korean retail investors poured $259M into BMNR since July

Analysts attribute ETH’s rally to "BitMine effect" psychology: its purchasing power could tighten supply amid rising DeFi and stablecoin demand. As Matthew Sigel, Head of Digital Assets Research at VanEck, noted: "BitMine’s $20B filing could trigger a supply shock. We’ve never seen a public company target 5% of a major crypto’s circulation".

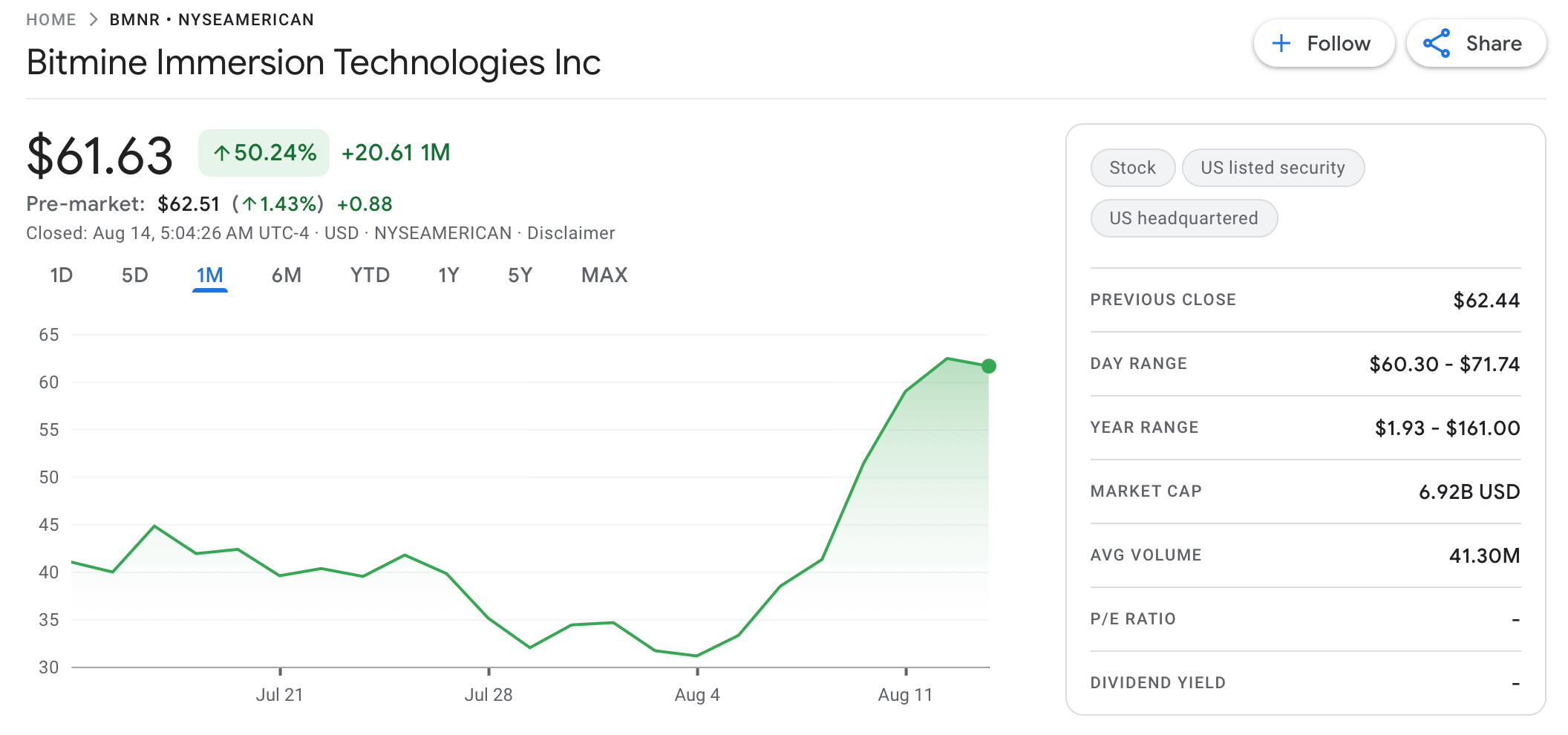

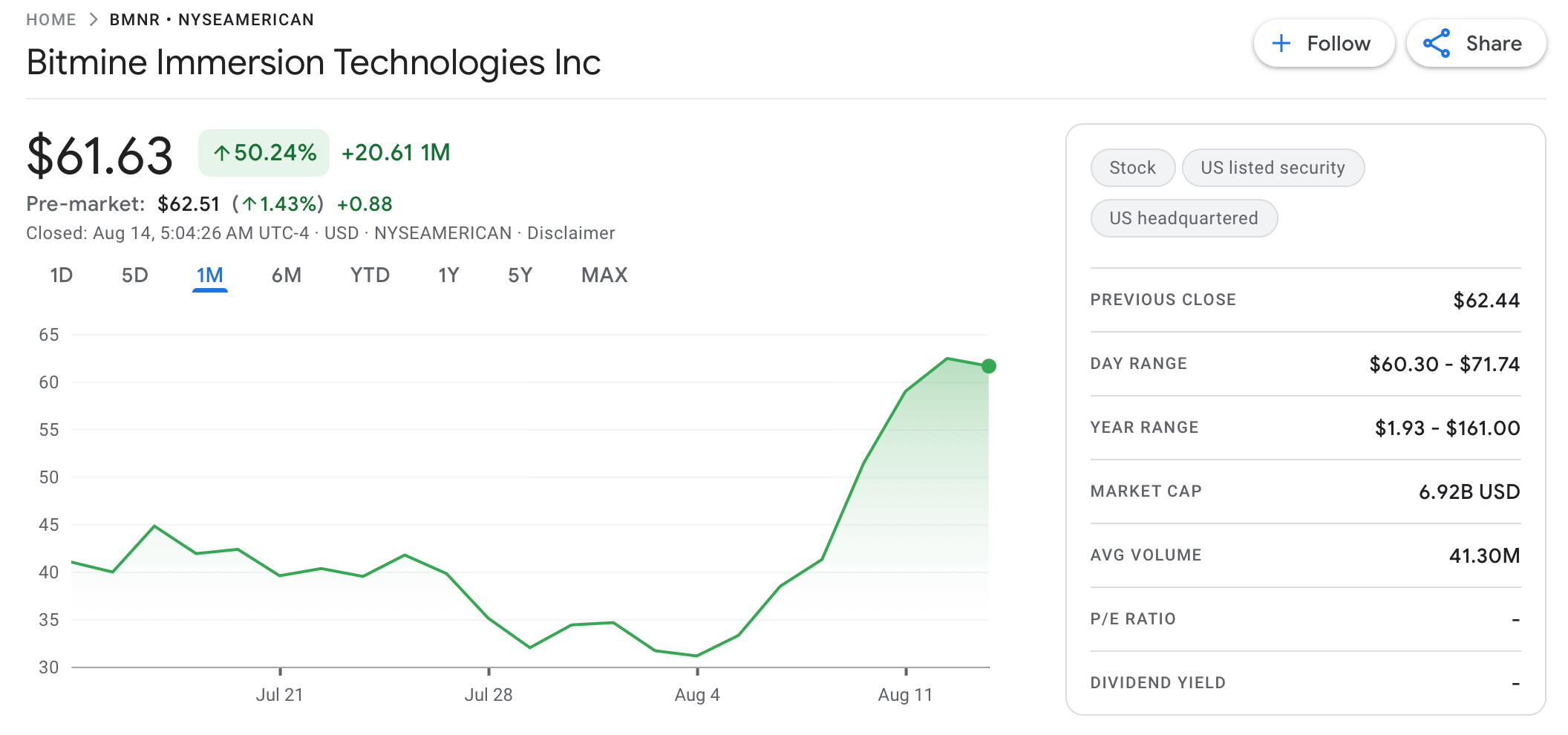

Stock Price Movements

BitMine's stock price has been on a roller - coaster ride. Before the announcement of its major Ethereum investment push and the appointment of Tom Lee as chairman on June 30, 2025, the company's share price was relatively stable. However, since then, it has seen massive gains. As of August 2025, its share price was up roughly 1,360%. After the latest announcement of the $20 billion stock sale to buy more Ethereum, the stock initially surged even further. For example, on August 12, 2025, it was up 4.4% as of 12:40 p.m. ET, and earlier in the trading session, it had been up as much as 11.9%. By August, the stock had soared from around $4.27 at the close of June to over $50, marking a 1,100% increase in just over a month. At press time, data from Google Finance showed it trading near $60, and on August 13, 2025, it rallied 5.9% to close at $62.44, with more than 128 million shares changing hands, nearly five times the company's three-month average.

Correlation with Ethereum's Price

The performance of BitMine's stock is closely tied to the price of Ethereum. As Ethereum's price has been on an upward trajectory, BitMine's stock has benefited. Ethereum recently went above $4,000 for the first time since 2021, driven in part by public companies, including BitMine, adding coins to their balance sheets. When Ethereum's price rises, BitMine's Ethereum holdings increase in value, which in turn boosts the company's overall valuation. This positive correlation has been a significant driver of BitMine's stock price performance in recent months.

Buying Frenzy: How Markets Are Reacting

Retail Mania Meets Institutional Stampede

BitMine’s rise has become a proxy for Ethereum exposure. Institutions, meanwhile, pursue three strategies:

Direct ETH purchases: Coinbase added 100,000 ETH ($500M) to its corporate treasury

Equity investments: Hedge funds buy BMNR stock for leveraged ETH exposure

Staking partnerships: Firms like SharpLink Gaming use BitMine’s advisory services to optimize yields

The Dilution Debate

BitMine’s stock dip highlights investor anxiety. Issuing $24.5B in new shares could dilute existing holders by 30%. Critics argue the company is overleveraging its balance sheet for a volatile asset. Lee counters that "ETH’s staking rewards and appreciation potential will outpace dilution".

The South Korean Investor Craze

South Korean retail investors have been making waves in the market with their intense focus on BitMine shares. Since early July 2025, they have collectively purchased a net worth of $259 million worth of BitMine stock. Data compiled by Strategic Eth Reserve.xyz, as reported by the Korea Securities Depository, shows that BitMine has become the most purchased foreign security during this period.

Reasons for the Buying Spree

South Korean investors are known for their appetite for high-growth opportunities, especially in the cryptocurrency sector. BitMine's dual identity as a Nasdaq-listed entity and a prominent player in the cryptocurrency space, with its significant bitcoin mining operations and now substantial Ethereum holdings, likely appeals to these investors. The company's listing on a major exchange provides a level of transparency and regulatory oversight that reassures investors. Additionally, the ease of access through established brokerage platforms in South Korea has facilitated this substantial inflow of funds. The investors are not only betting on BitMine's current operations but also on the future potential of the cryptocurrency market, with BitMine being a vehicle to gain exposure to this emerging asset class.

Legal and Regulatory Minefields

The SEC’s Shadow

BitMine’s ATM program operates under SEC Rule 415, permitting gradual share sales. However, regulators scrutinize two risks:

Global Fractures

While the U.S. moves toward clarity, the EU’s MiCA framework imposes strict licensing for crypto treasuries. BitMine’s Trinidad mining operations face carbon-tax pressures.

Chairman Lee proactively lobbies for "regulatory sandboxes," arguing algorithmic overcollateralization (e.g., 150% ETH reserves) mitigates risks better than traditional banking buffers.

Conclusion

BitMine Immersion Technologies has emerged as a significant player in the cryptocurrency market, with its aggressive Ethereum accumulation strategy, growing influence among investors, and substantial market presence. The company's plans to raise a massive amount of capital through stock sales to further expand its Ethereum holdings and other operations have put it in the spotlight. The enthusiasm from South Korean investors and the strong performance of its stock, closely tied to Ethereum's price, demonstrate the market's confidence in BitMine's vision.

However, as with any company in the cryptocurrency space, BitMine faces regulatory challenges. Navigating the complex and evolving regulatory landscape will be crucial for its long-term success. If it can continue to execute its strategies effectively while complying with regulations, BitMine has the potential to play an even more significant role in the future of the cryptocurrency market. Whether it will achieve its goal of securing 5% of Ethereum's total supply and how it will fare in the face of regulatory changes remains to be seen, but it is undoubtedly a company that both investors and market observers will be keeping a close eye on.

References

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.