The blockchain landscape is witnessing a paradigm shift where privacy has evolved from a niche feature to a foundational necessity. Horizen (ZEN), a project established in 2017, has positioned itself at the forefront of this transition by leveraging zero-knowledge proofs (zk-SNARKs) to deliver scalable, privacy-first solutions. In 2025, Horizen embarked on its most ambitious upgrade yet: migrating from an independent blockchain to a dedicated privacy appchain on

Base

, an Ethereum Layer 2 network. This strategic pivot aims to combine Horizen’s privacy expertise with Base’s robust ecosystem, low fees, and extensive user base. The migration, completed in July 2025, has already catalyzed a 150% year-over-year growth in active addresses, highlighting surging adoption. This article explores ZEN’s technology, tokenomics, use cases, and market trajectory, providing a holistic view of its potential in the evolving crypto space.

What is Horizen (ZEN)?

Horizen began as ZenCash in 2017, focusing primarily on privacy-oriented transactions. In 2018, it rebranded toHorizen, expanding its vision from a

privacy coin to a comprehensive

ecosystem supporting decentralized applications (dApps), sidechains, and cross-chain interoperability. The project’s core mission is to enable

secure, scalable, and privacy-preserving blockchain interactions through its flagship innovation, Zendoo—a cross-chain protocol that facilitates communication between distinct blockchain networks.

The native token, ZEN, powers this ecosystem. With a fixed supply of 21 million tokens (mirroring

Bitcoin’s scarcity model), ZEN is used for governance, staking, and paying for privacy services. The recent migration to Base as an ERC-20 token has further enhanced its utility by integrating it into Ethereum’s DeFi landscape.

How Does ZEN Work? The Technology Behind the Privacy Focus

Horizen’s technical architecture revolves around three pillars:

Zendoo Cross-Chain Protocol: Unlike conventional bridges, Zendoo uses a decentralized verification system to enable trustless communication between Horizen and external blockchains. It allows developers to deploy custom sidechains for specific use cases (e.g., supply chain tracking or private DeFi) while maintaining security via the Horizen mainchain.

Zero-Knowledge Proofs (zk-SNARKs): Horizen integrates zk-SNARKs to validate transactions without revealing sensitive data. This technology ensures that users can prove ownership or compliance without exposing transaction details, making it ideal for enterprises and privacy-conscious individuals.

EVM Optimization for ZK Applications: Horizen 2.0 introduces a customized Ethereum Virtual Machine (EVM) optimized for zero-knowledge applications. This upgrade significantly improves the efficiency of proof generation and verification, reducing costs and latency for developers building privacy-focused dApps.

The migration to Base leverages these technologies while addressing scalability. By operating as a Layer 3 appchain, Horizen benefits from Base’s high throughput and Ethereum’s security, achieving transaction fees as low as

$0.001 per transfer.

Why ZEN Stands Out: Key Features and Use Cases

Horizen’s unique value proposition lies in its dual emphasis on

privacy and compliance, enabling applications across diverse sectors:

Private DeFi: Horizen 2.0 supports confidential transactions in decentralized exchanges and lending protocols. For instance, its "dark pool" implementation allows institutional traders to execute large orders without revealing strategies.

Supply Chain Management: Enterprises can use Horizen’s sidechains to track goods while preserving commercial confidentiality. Each participant (e.g., suppliers or regulators) accesses only authorized data.

Secure Communication and Data Storage: The platform enables encrypted messaging and file storage, with zk-SNARKs verifying data integrity without disclosure.

NFTs and Gaming: Horizen’s low fees and privacy features empower creators to develop NFT marketplaces and games where user identities and transaction histories remain protected.

Horizen’s growing ecosystem bolsters these use cases. Since migrating to Base, active addresses have surpassed 500,000, and quarterly transaction volume has surged by 33.3%.

Tokenomics: Sustainable Growth and Incentives

Horizen’s tokenomics underwent a major overhaul in 2025 with the approval of

ZenIP 42407 and 42409. Key changes include:

Fixed Supply and Strategic Reallocation: The total supply remains capped at 21 million ZEN. Previously unissued tokens (5 million ZEN) were reallocated to critical initiatives like the

ZEN Sustainability Fund (40%), which supports long-term ecosystem growth, and

incentive pools (15%) for developers and users.

Staking Rewards and Governance: Collators and delegators (network validators) receive 40% of token emissions, incentivizing participation in securing the network. ZEN holders also wield governance rights, voting on ecosystem upgrades.

Buyback Mechanism: A portion of platform fees is used to repurchase ZEN from the market, creating perpetual buy pressure and enhancing token value.

Gradual Emissions Reduction: Unlike Bitcoin’s abrupt halving events, ZEN employs a smooth emissiondecline to avoid market shocks and ensure network stability.

These measures align tokenholder incentives with Horizen’s long-term vision, fostering sustainable adoption.

Recent Developments and News

Successful Migration to Base: On July 23, 2025, Horizen completed its transition to Base, converting ZEN into an ERC-20 token. The move reduced transaction fees by 99% and enabled seamless integration with DeFi protocols like Uniswap.

Partnerships and Institutional Adoption: The project secured a

$289 million contract with a defense agency in November 2025, highlighting institutional confidence in its privacy solutions.

zkVerify Integration: Horizen 2.0 incorporated zkVerify—a tool capable of processing billions of proofs annually to streamline zero-knowledge application development.

Exchange Listings: ZEN was listed on major exchanges in November 2025, boosting liquidity and accessibility.

Price Analysis and Market Performance

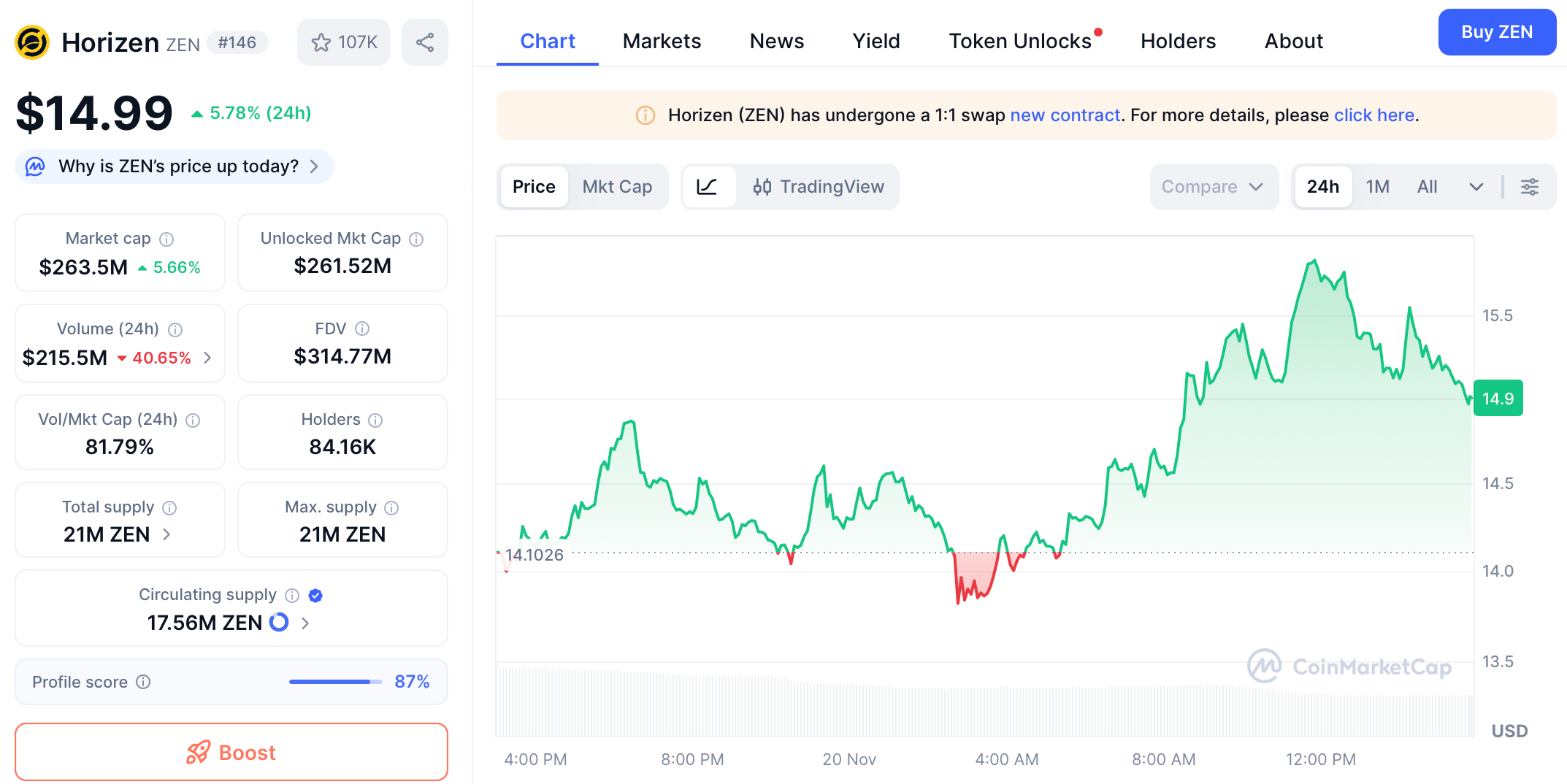

ZEN has demonstrated remarkable resilience in 2025. After migrating to Base, its price rose from

$7.32 in June to $14.9 in November 20th , buoyed by surging demand. Technical indicators suggest strong momentum:

Market Cap and Trading Volume: As of November 2025, ZEN’s market capitalization reached

$263 million, with 24-hour trading volume exceeding

$215 million.

On-Chain Metrics: Active addresses grew 150% year-over-year, while transaction volume hit

120 million ZEN in November alone.

Wallet Distribution: The concentration of ZEN held by the top 100 wallets decreased from 45% to 30%, signaling healthier decentralization.

Analysts attribute this performance to Horizen’s niche in privacy-focused DeFi and strategic Base integration.

Is ZEN a Good Investment?

ZEN presents a compelling case for investors seeking exposure to the privacy sector. Strengths include:

Technological Edge: Its optimized ZK-EVM and cross-chain capabilities are ahead of many competitors.

Ecosystem Growth: The Base migration has unlocked new DeFi opportunities, driving user adoption.

Sustainable Tokenomics: Buybacks, staking rewards, and controlled emissions support long-term value.

However, risks persist. Regulatory scrutiny of privacy coins could impact adoption, and the project faces competition from networks like Monero and Zcash. Investors should monitor Horizen’s ability to balance privacy with compliance.

Conclusion

Horizen’s transformation from a standalone privacy chain to a base-based app chain marks a pivotal step in making privacy accessible and scalable. By combining zero-knowledge proofs with Ethereum’s vibrant ecosystem, ZEN is poised to become a cornerstone of confidential DeFi, enterprise solutions, and user-centric applications. While challenges remain, its strong tokenomics, technological innovation, and growing institutional interest position it as a project to watch. As the demand for privacy intensifies, Horizen’s vision of a secure, interoperable blockchain future appears increasingly within reach.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.