On November 18th, the cryptocurrency sector is undergoing significant stress. Bitcoin has given up its year-to-date gains, triggering widespread liquidations and negative market sentiment. Meanwhile, Decentralized exchange (DEX) aggregator 1inch has introduced Aqua, a new liquidity protocol designed to let DeFi applications share the same capital base across multiple strategies without compromising user custody. The US spot Bitcoin exchange-traded funds (ETFs) recorded a weekly outflow of staggering $1.11 billion from November 10 to 14. Ethereum founder Vitalik Buterin gave a live look at Kohaku, a suite of privacy-preserving crypto tools to enhance privacy and security in the Ethereum ecosystem.

Crypto Market Overview

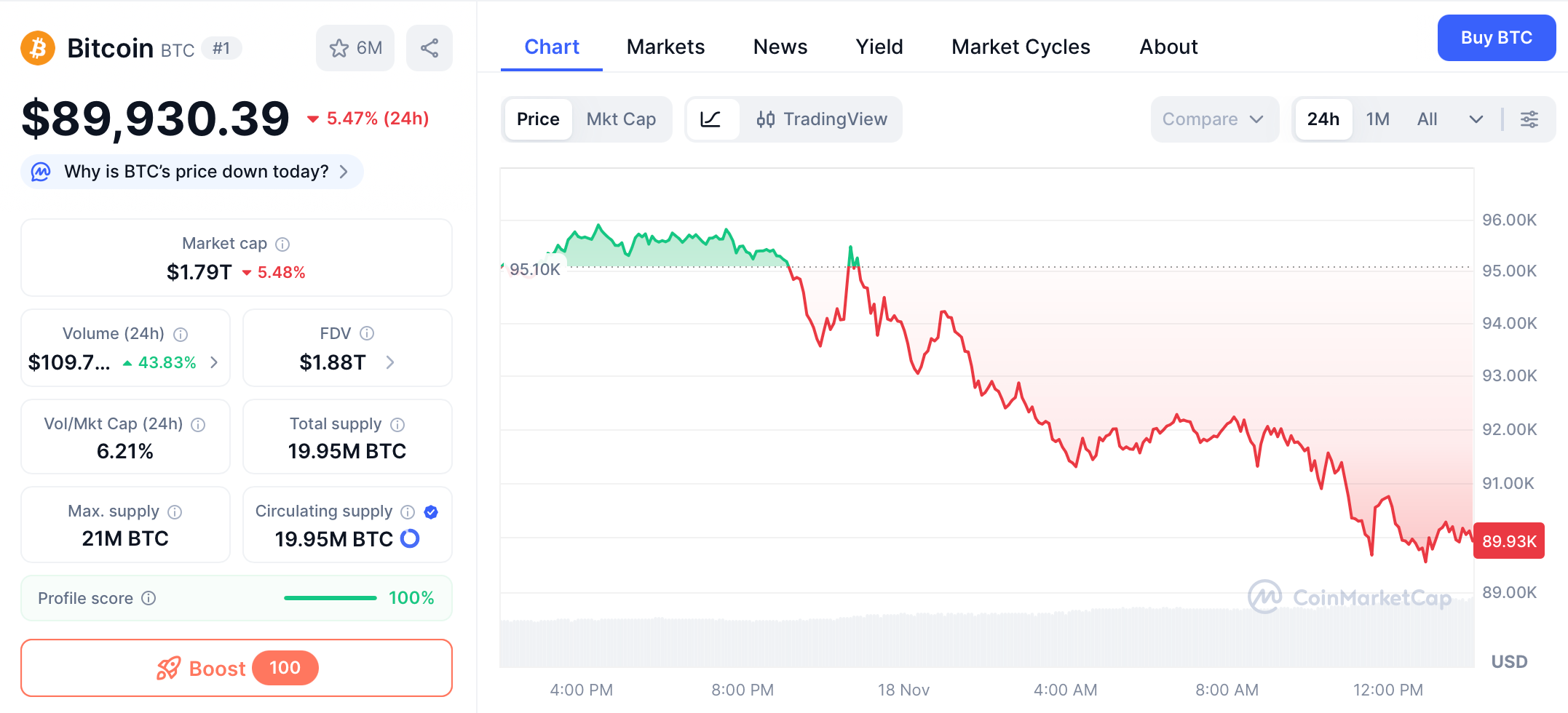

BTC (-5.44% | Current Price: $89,929.78)

BTC broke below $90,000 support level. Source: CoinMarketCap

Bitcoin has decisively broken below the psychological $90,000 support level, trading around $89,900 as of November 18, with an intraday low touching $89,700. This represents Bitcoin's first dip below the $90,000 threshold in approximately seven months (210 days), signaling a significant technical breakdown that has triggered substantial selling pressure across the crypto ecosystem. The current price represents a dramatic decline of nearly 30% from October's all-time high of $126,199, officially cementing what market participants are calling a "Black November" for crypto

The $90,000 level served as a critical psychological support zone throughout the third quarter, with multiple successful defenses throughout September and October making its current breakdown particularly concerning bullish investors. With this support now converted to resistance, technical analysts are watching several key levels on the downside:

-

Immediate support: The next significant technical support does not emerge until the $85,000-$82,000 zone, which previously acted as strong resistance during the May-June consolidation period.

-

Critical failure level: A break below $82,000 could open the path for a test of the $75,000 psychological handle, which would represent approximately 40% correction from the highs.

-

Resistance turned support: Any recovery attempt will now face formidable resistance at $90,000, followed by additional supply zones at $95,000 and $100,000.

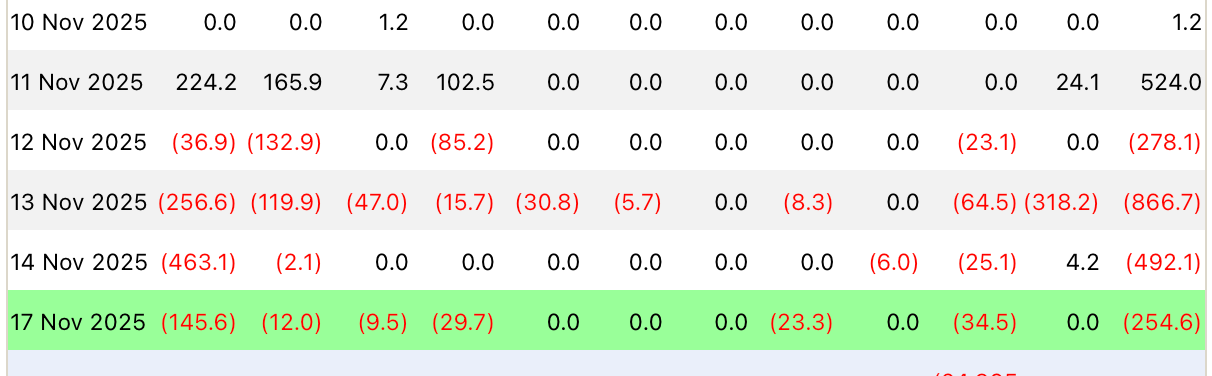

On November 17th, Bitcoin exchange-traded funds (ETFs) registered an outflow of $254.6 million. BlackRock's IBIT saw an outflow of 145.6 million and Fidelity's FBTC ETF saw an outflow of $12 million.

ETH (-0.91% | Current Price: $3169.01)

Ethereum has mirrored Bitcoin's bearish momentum, breaking below several key support levels and currently trading in a critical demand zone between $2,400 and $2,600. This area represents make-or-break support for ETH, as a failure to hold could trigger another leg down toward the $2,200 level. However, several technical indicators are flashing historically oversold signals that suggest a significant rebound potential may be building:

-

Oversold

MACD Reading: Ethereum's daily

MACD indicator has entered the -210 to -220 range, a zone that has historically coincided with major ETH market bottoms. This represents one of the most extreme oversold readings for Ethereum's momentum in several years, suggesting that selling pressure may be approaching exhaustion.

-

Deeply Oversold

RSI: The Relative Strength Index for Ethereum has also slipped deep into oversold territory, reinforcing the

MACD's suggestion that the current downtrend may be overextended. While oversold conditions can persist during strong downtrends, the confluence of multiple momentum indicators at extreme levels dramatically increases the probability of a powerful relief rally.

-

Critical Resistance Levels: Any recovery attempt would face immediate resistance at $3,000(psychological barrier), followed by more significant supply at $3,500, which previously acted as support throughout September.

On November 17th, ETH ETFs experienced a total net outflow of $182.7 million, including an outflow of $193.0 million from BlackRock's ETHA.

Altcoins

The current Crypto Fear & Greed Index has plummeted to a mere 15/100, indicating "Extreme Fear" and marking the lowest reading since February. This dramatic sentiment shift comes despite Bitcoin's price remaining substantially above historical levels, suggesting potential market overshooting to the downside.

The altcoin market has experienced even more severe losses than Bitcoin, with the MarketVector Digital Assets 100 Small-Cap Index plunging to its lowest level since 2020.

Macro Data

Cryptocurrencies have increasingly correlated with traditional risk assets, particularly technology stocks, throughout 2025. This relationship has magnified the impact of macroeconomic developments on crypto markets:

Market expectations for a third Fed rate cut in December have cooled dramatically as inflation indicators remain above the 2% target. This represents a significant psychological blow to risk assets that had priced in continued monetary accommodation.

The significant decline in AI-related technology stocks has created a correlated downdraft in cryptocurrency markets, as investors view both asset classes as part of the same "high-risk technology" basket.

On November 17th, the S&P 500 fell 0.92%, standing at 6,672.41 points; the Dow Jones Industrial Average dropped 1.18% to 46,590.24 points, and the Nasdaq Composite fell 0.84% to 22,708.08 points.

Trending Tokens

RESOLV Resolv (+24.86%, Circulating Market Cap: $70.14 Million)

RESOLV is trading at $0.2208, up approximately 24.86% in the past 24 hours. Resolv is a decentralized stablecoin protocol offering a delta-neutral stablecoin (USR) backed by ETH/BTC and an insurance liquidity pool (RLP), governed by the $RESOLV token to align incentives across its ecosystem. RESOLV broke above the critical $0.18 resistance (now support) with RSI7 at 78.5 – typically overbought but sustainable in strong uptrends. The MACD histogram turned positive for the first time since October 2025. Traders are chasing momentum, targeting the 200% Fibonacci extension at $0.4018. However, the 24h volume dropped 55% to $121.7M, which is a declining volume during rallies often precedes corrections.

MINA MINA (+15.09%, Circulating Market Cap: $187.41 Million)

MINA is trading at $0.1483, up approximately 15.09% in the past 24 hours. Mina Protocol is a minimal “succinct blockchain” built to curtail computational requirements in order to run DApps more efficiently. Mina has been described as the world’s lightest blockchain since its size is designed to remain constant despite growth in usage. Furthermore, it remains balanced in terms of security and decentralization. The project was rebranded from Coda Protocol to Mina in October 2020. Mina’s community will vote on December 8–15 for the Mesa Upgrade, proposing faster block times, higher zkApp limits, and enhanced developer flexibility. A snapshot for voter eligibility occurs on November 22, incentivizing accumulation. Decentralized governance milestones often trigger speculative buying, as upgrades aim to boost network utility and attract developers. Historical data shows MINA rallies 20–30% ahead of major protocol votes.

ICP Internet Computer (+13.22%, Circulating Market Cap: $3.04 Billion)

ICP is trading at $0.2354, up approximately 22.01% in the past 24 hours. The Internet Computer is a decentralized cloud blockchain that hosts full-stack applications, websites, and enterprise systems fully onchain, where they benefit from the extraordinary security and resilience offered by blockchain technology. A core goal of the Internet Computer is to evolve into a “self-writing cloud”, where AI builds sophisticated applications based on natural language prompts. Caffeine AI is the Internet Computer’s native tool for enabling application development via conversation with AI. Sharp drops to $4.69 triggered $1.88M in long liquidations on Nov 17 (Coindesk), followed by short-covering as price rebounded. Forced selling amplified the dip, but subsequent buybacks accelerated the recovery. High volatility (30d: 82.86% price change) persists, reflecting ICP’s speculative nature.

Market News

1inch Unveils Protocol Letting Multiple DeFi Strategies Share the Same Capital

Decentralized exchange (DEX) aggregator 1inch has introduced Aqua, a new liquidity protocol designed to let DeFi applications share the same capital base across multiple strategies without compromising user custody. Developers can now access the Aqua software development kit (SDK), libraries and documentation on GitHub, with a full front end set to arrive in early 2026

Aqua introduces what 1inch calls a “shared liquidity layer,” allowing capital from a single wallet to back several trading strategies at once. Typically, users must choose one strategy, locking their funds into a specific smart contract. With Aqua, those same assets remain in the user’s wallet, and strategies only tap into them when trades are executed.

In practical terms, a liquidity provider could authorize their tokens for multiple strategies, like automated market makers (AMMs), stable swap pools or custom logic, all at the same time. Each strategy operates with its own rules and access limits, tracked by Aqua’s accounting system. The developer preview opens the door to early experimentation. Builders can create their own strategies or use 1inch’s partner protocol, SwapVM, to plug into pre-built ones.

This model could improve both capital efficiency — how much liquidity one wallet can provide, and utility efficiency, how many DeFi roles the same capital can play at once. Since funds are not locked in a pool, users can simultaneously provide liquidity, vote in governance, or post collateral on lending platforms.

US Spot Bitcoin ETFs Bleed $1.11B in Third Consecutive Week of Outflows

BTC ETF outflows. Source: Farside

The US spot Bitcoin exchange-traded funds (ETFs) recorded a weekly outflow of staggering $1.11 billion from November 10 to 14, marking the third consecutive week of outflows. BlackRock’s ETF IBIT bled $532.41 million, recording the largest net outflow last week. Currently, the cumulative net inflow of IBIT funds has reached $63.79 billion. Grayscale Bitcoin Mini Trust (BTC) logged a net weekly outflow of nearly $290 million, ending November 14. Meanwhile, the fund’s total historical net inflow touched $63.79 billion.

At the time of writing, the total net asset value of spot Bitcoin ETF is $125.34 billion, and the ETF’s net asset ratio is 6.67% of Bitcoin market cap.

Przemysław Kral, CEO of one of the large European crypto exchanges zondacrypto, shared his thoughts on the ongoing BTC outflows.

“We must beware of weekend liquidity, which is always thinner with fewer active traders letting each forced sale move the market more." Unsurprisingly, massive Bitcoin ETF outflows have coincided with the recent BTC price decline. ETF outflows suggest institutional demand cooling post-Trump tariff concerns.

Besides, cryptos experienced widespread liquidations, totalling $617.45 million within 24 hours. Bitcoin alone accounted for $243.56 million in liquidations, with Ethereum following at $169.06 million.

At press time, Bitcoin was trading near $95,200, representing a 0.59% decline over the last 24 hours. The total cryptocurrency market capitalization fell to $3.31 trillion, down 0.9% from previous levels.

Vitalik Buterin unveils Kohaku, a privacy-focused framework for Ethereum

On stage at Devcon, Ethereum founder Vitalik Buterin gave a live look at Kohaku, a suite of privacy-preserving crypto tools to enhance privacy and security in the Ethereum ecosystem.

The effort, led by the Ethereum Foundation and other key ecosystem stakeholders, represents Buterin’s significant embrace of privacy as a core aim for blockchain developers. “We’re in this very last mile stage,” Buterin said, noting that Ethereum “is still behind” where it could be in terms of user privacy. “It’s in this last mile stage where we need to put a lot of concerted effort into doing better. Same on the security side.”

Kohaku is an open-source initiative to enhance onchain privacy and security. It offers a modular framework of primitives to allow developers to build secure, privacy-focused wallets without relying on centralized third parties, and may evolve to include tools like mixnets for network-level anonymity and ZK-powered browsers.

At the Ethereum Cypherpunk Congress, Buterin noted that Ethereum is on a "privacy upgrade path" to provide “real-world privacy and security.”

The Kohaku Github page notes that the project is a work in progress. Today, the repository includes software packages for protocols like Railgun and Privacy Pools, which enable users to complantly obscure their funds and provide “proof of innocence.” Privacy Pools, for instance, developed by 0xbow, uses “association lists” that prevent bad actors from obscuring their funds.

During a demo of a Kohaku wallet on Nov. 16, a user was able to shield publicly visible funds using a Railgun integration. The idea is to bring default opt-in privacy for any Ethereum-connected wallet, like MetaMask and Rainbow. In addition to Buterin’s increasingly vocal embrace of privacy as a fundamental right, the Ethereum Foundation has doubled down on its privacy R&D goals. Last month, the Ethereum Foundation launched the Privacy Cluster, a 47-member team of researchers, engineers, and cryptographers focused on making privacy a “first-class property” of Ethereum.

Further, in September, the Ethereum Foundation's Privacy & Scaling Explorations team rebranded to the Privacy Stewards of Ethereum, signifying its shift from speculative exploration of new tech to solving concrete problems. The team hopes to make headway into features like “private voting” and confidential DeFi.

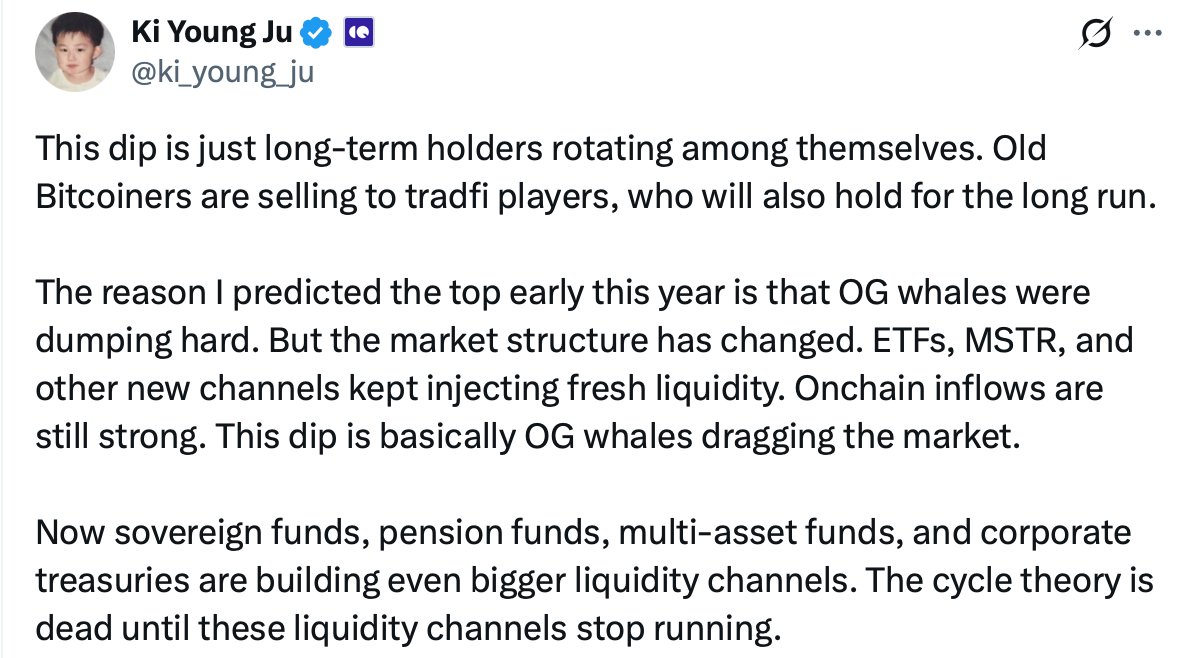

Current Decline Primarily Due to a Change of Hands Among Established Whales

Source: Ki Young Ju X account

Ki Young Ju, CEO of CryptoQuant, stated in an article on the X platform that the current market correction is mainly due to a change of hands among long-term holders. Early Bitcoin holders are selling their holdings to traditional financial institutions, which also tend to hold for the long term. He had predicted earlier this year that BTC had reached a temporary top because "OG whales" were selling off heavily at the time. However, ETFs, Strategies, and various new funding channels continue to bring in incremental liquidity, and on-chain funding inflows remain strong. Therefore, he believes the current market structure has changed.

The current price decline is more due to a few established players reducing their holdings, thus dragging down the market, rather than a deterioration in market fundamentals. Therefore, it does not change the long-term upward structure. Currently, sovereign wealth funds, pension funds, multi-asset funds, and corporate finance departments are building larger liquidity channels. Until these funding channels continue to flow in, traditional cycle theories have become ineffective. Bitcoin's ability to absorb funding will be stronger in the future, and the market is expected to continue exhibiting characteristics of an "institutional bull market."

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.