The Web3 world received sobering news on November 17, 2025, when

DappRadar

, one of the most prominent and respected data analytics platforms in the cryptocurrency space, announced it would be shutting down after seven years of operation. Founded in 2018, the platform had become synonymous with

decentralized application data

and blockchain metrics, serving as a critical resource for developers, investors, and researchers navigating the often-opaqueworld of DApps. The announcement, delivered via social media and email from founders Skirmantas Januškas and Dragos Dunica, cited a "

financially unsustainable environment

" as the primary reason for the closure, sending the platform's native

RADAR token plummeting approximately 30%

within hours.

The shuttering of such an established industry pillar represents more than just the failure of a single company; it serves as a

cautionary tale for the entire crypto analytics sector

. For years, DappRadar provided invaluable insights into DApp ecosystems across more than 90 blockchains, offering real-time data on DeFi, NFTs, and gaming projects that were frequently cited by major financial and media institutions, including Bloomberg, Forbes, and the BBC. Its demise signals a critical moment of reflection for an industry grappling with the challenges of building sustainable business models around decentralized data.

The Announcement and Immediate Impact

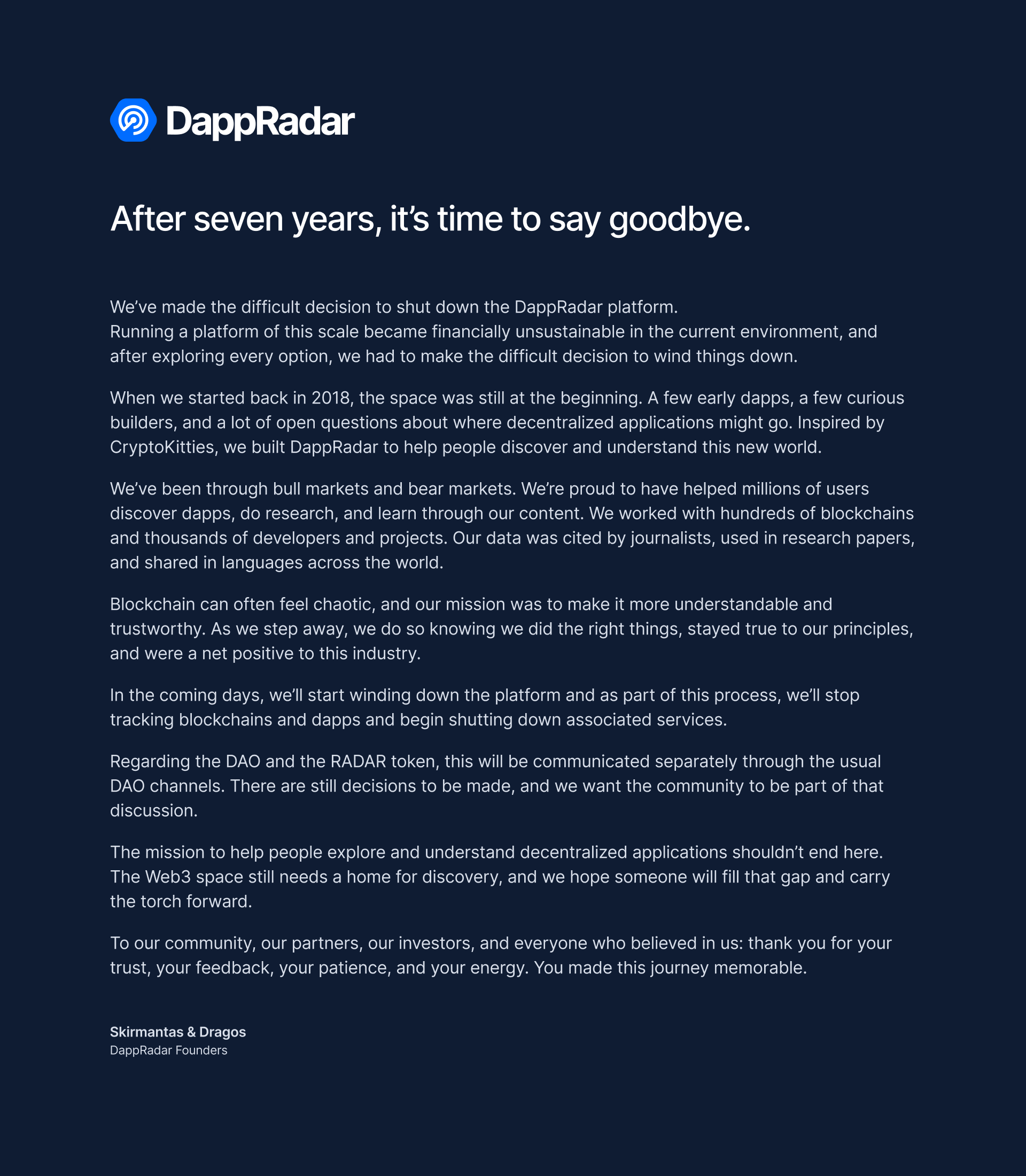

The Goodbye announcement. Source: DappRadar X account

In a straightforward yet somber announcement, DappRadar's founders revealed they would gradually wind down the platform's operations "in the coming days," ultimately stopping all tracking of blockchains and DApps. They acknowledged having explored various options to keep the platform afloat but concluded that "

operating a platform of this scale has become a significant financial challenge under the current economic circumstances". The message conveyed a sense of finality, marking the end of a seven-year journey that began during the nascent stages of the DApp ecosystem.

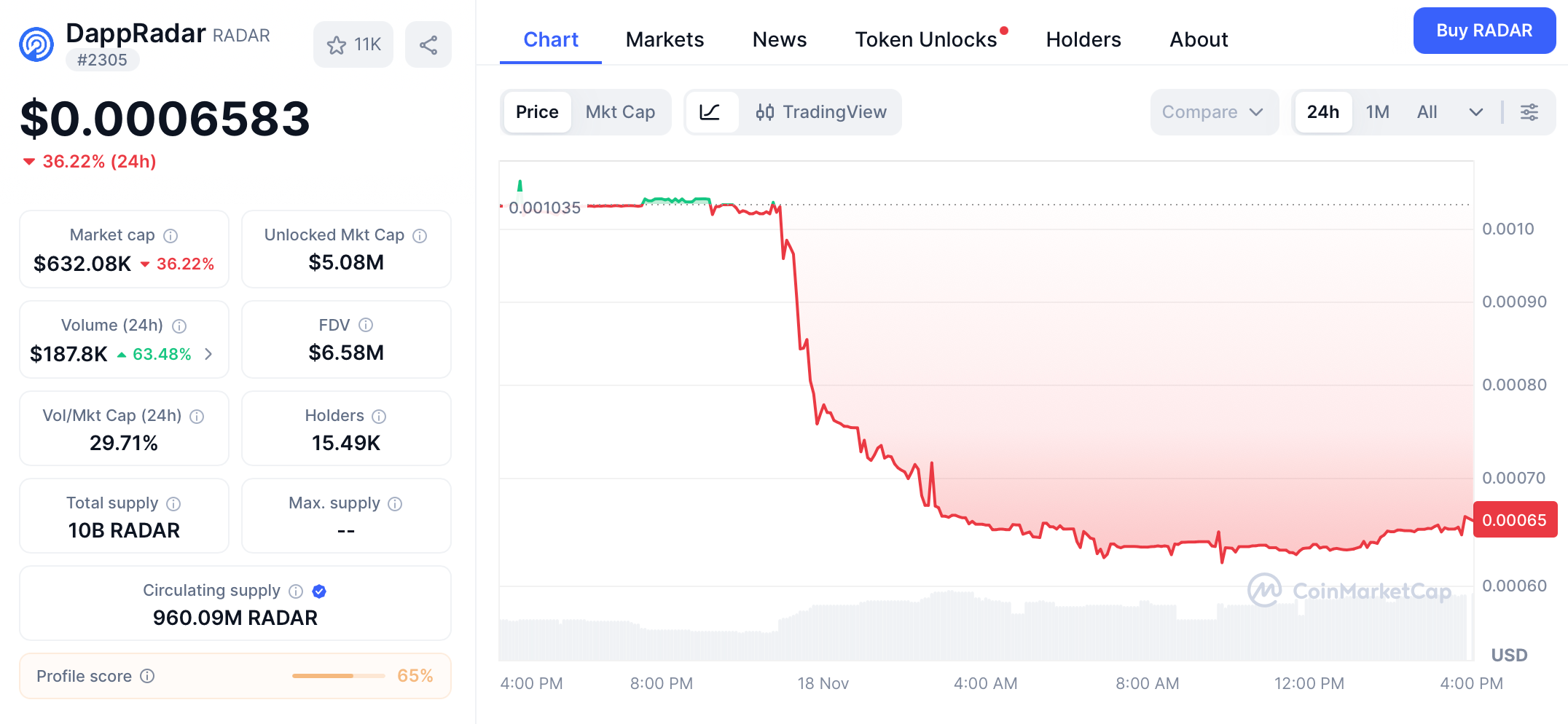

RADAR price chart. Source: CoinMarketCap

The market's reaction was swift and severe. Following the announcement, the platform's native

RADAR token experienced an immediate crash, dropping about 30% to approximately $0.00072 according to data from Nansen.This sharp decline highlighted the inherent vulnerability of token-dependent business models in the crypto space, where platform performance and token value remain inextricably linked. The company stated that it would issue a separate communication regarding the future of both the RADAR token and its decentralized autonomous organization (DAO), leaving token holders in a state of uncertainty about their investments.

A Look Back: DappRadar's Rise to Prominence

To understand the significance of DappRadar's closure, one must appreciate its journey from a humble startup to an

industry cornerstone. Launched in 2018, it was often described as the "crypto winter" when skepticism about blockchain's future ran high, DappRadar filled a critical void by providing comprehensive, reliable data on decentralized applications. Inspired by the early potential demonstrated by projects like CryptoKitties, founders Januškas and Dragos set out to create a platform that would help people "explore and understand this new world" of DApps.

What set DappRadar apart in its early days was its

unmatched comprehensiveness. Before the emergence of specialized competitors like Nansen, Arkham, and DefiLlama, DappRadar served as the essential gateway website that virtually every dApp needed to be listed on to gain visibility. This positioning gave it unparalleled data completeness and credibility, making it the go-to resource for everyone from retail investors to academic researchers. At its peak, the platform boasted millions of users, and its data was referenced in research papers and news articles across multiple languages worldwide.

The company's

funding history reflected early investor confidence in its model. In September 2019, DappRadar secured $2.23 million in a seed round led by Naspers, Blockchain Ventures, and Angel Invest Berlin. This was followed by a $4.94 million Series A round in May 2021 from

Blockchain.com Ventures, Prosus Ventures, and NordicNinja VC.Despite this initial vote of confidence and the platform's authoritative position, DappRadar would ultimately struggle to translate industry influence into long-term financial sustainability.

Why DappRadar Failed?

The primary reason cited for DappRadar's demise:

financial unsustainability that

belies more complex underlying issues that plagued the platform's business model. At its core, DappRadar's struggle represents a classic case of a company that excelled at providing value to the ecosystem but failed to capture sufficient value to sustain its operations.

A critical flaw lay in the platform's

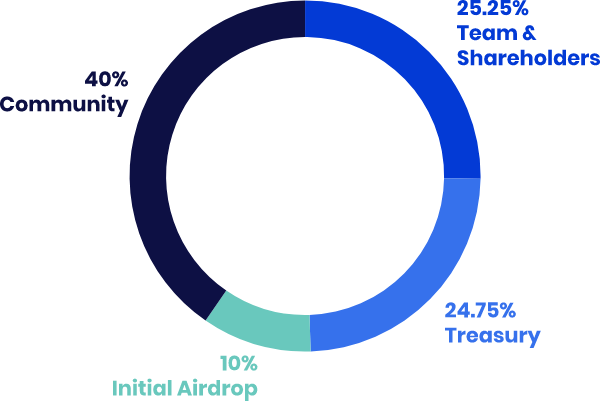

token economic model. DappRadar operated on a fixed supply of 10 billion RADAR tokens, with allocations designed to incentivize community participation and fund operations. However, the token's primary use cases are governance and platform access, which failed to generate sufficient demand to outpace supply. With no deflationary mechanisms such as token burns or buybacks, inflationary pressures gradually eroded the token's value over time. Meanwhile, the DAO treasury's 24.75% allocation, intended to fund development, became a drain on resources as market conditions deteriorated.

The platform also suffered from what some analysts have described as being "

overly crypto-native" while neglecting commercial realities. DappRadar maintained a steadfast focus on tracking long-tail sectors and projects across Web3, avoiding more speculative trends like meme coins that might have driven traffic and revenue. While this approach preserved the platform's reputation for authoritative data, it limited its appeal to broader audiences who were chasingmarket trends.

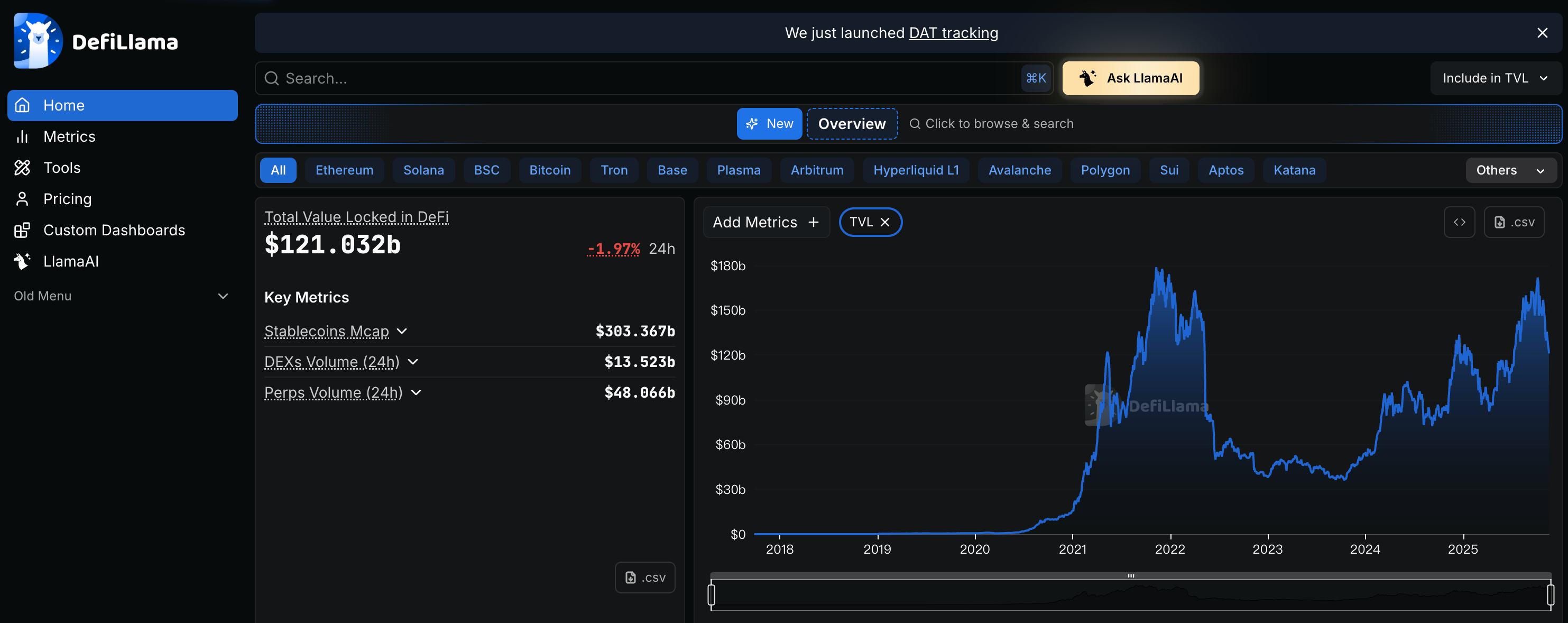

DefiLlama homepage.

Additionally, DappRadar faced intensifying

competitive pressure from specialized platforms that carved out specific niches in the analytics space.

DefiLlama dominated DeFi analytics, while other platforms offered more targeted insights into specific sectors. Despite its comprehensive coverage, DappRadar found itself unable to compete with these specialized competitors in their respective domains. The platform's attempt to monetize through premium APIs and advertising ultimately proved insufficient to cover the escalating costs of indexing and maintaining multi-chain data, which is a particular challenge as the Web3 ecosystem expanded across numerous blockchain networks.

Industry Implications and the Sustainability Question

DappRadar's closure raises fundamental questions about the

viability of crypto analytics as a business category. The company's fate illustrates the persistent challenge that many Web3 tooling products face: delivering high value while struggling to establish sustainable revenue models. As one commentary noted, "'High Value, Low Fee' is a problem that Web3 tooling products have not yet solved".

The contrast between DappRadar's struggle and the relative success of

tokenless platforms like CoinGecko and Glassnode is particularly instructive. These platforms have typically relied on more traditional revenue streams such as subscriptions and enterprise clients, allowing them to avoid the volatility of token-dependent models while maintaining consistent data quality. This divergence suggests that for analytics platforms, a pure-play token model may be inherently less stable than conventional software-as-a-service approaches.

The shutdown also leaves a

significant void in the DApp ecosystem, particularly for comprehensive tracking across less prominent blockchain projects. DappRadar's commitment to covering emerging sectors like AI-driven DApps—which it reported were gaining significant traction before its closure—provided valuable visibility for innovative projects that might otherwise go unnoticed. With this platform gone, developers and investors may struggle to find equally comprehensive alternatives for tracking the entire DApp landscape.

Lessons for the Web3 Ecosystem

DappRadar's story offers several crucial

lessons for the broader Web3 industry, particularly for projects considering token-based business models. First, it underscores the importance of establishing a clear, non-replaceable token utility that extends beyond speculative value. Tokens must serve essential functions within their ecosystems, whether for accessing premium features, governance, or specific services, to maintain sustainable demand.

Second, the collapse highlights the danger of

fixed supply tokenomics without adequate deflationary mechanisms. As the AInvest analysis noted, "Fixed supply models without deflationary mechanisms risk long-term devaluation," especially when compared to models like KlimaDAO, which tokenizes carbon credits with real-world demand drivers. Sustainable token economies must carefully balance supply and demand dynamics, particularly during market downturns.

Third, DappRadar's experience demonstrates that

authoritative data alone cannot guarantee business success in crypto space. While the platform earned respect for its comprehensive tracking and reporting, even noting in its final announcement that "our mission was to make it more understandable and more trustworthy", this reputation failed to translate into sufficient revenue. Web3 projects must therefore balance excellence in their core offerings with robust commercial strategies from the outset.

Finally, the closure serves as a reminder that the

crypto market remains exceptionally challenging for infrastructure projects. Despite raising nearly $7.2 million across two funding rounds and operating for seven years through multiple market cycles, DappRadar ultimately could not achieve financial sustainability. This suggests that even well-established, reputable projects are not immune to the sector's fundamental business model challenges.

Conclusion

The shutdown of DappRadar marks the end of a significant chapter in Web3's evolution. For seven years, the platform served as a

trusted compass for navigating the rapidly expanding world of decentralized applications, providing the data and insights that helped legitimize the sector in the eyes of many institutional observers. Its demise represents more than just the failure of a single company—it signals a

pivot point for the entire crypto analytics industry, forcing a reevaluation of how such services can be sustainably built and maintained.

The lessons from DappRadar's collapse are particularly relevant as the Web3 space continues to mature. The platform's experience suggests that

token-driven business models face particular challenges in the analytics sector, where traditional subscription-based approaches may offer more stability. It also highlights the tension between comprehensive, authoritative data collection and the commercial imperatives of running a sustainable business—a balance that even well-established players have struggled to maintain.

As the industry processes this development, DappRadar's own words in its final communication seem especially poignant: "The mission of helping people explore and understand decentralized applications should not stop here. The Web3 field still needs a lighthouse for exploration, and we look forward to someone taking up the torch and continuing to move forward". The challenge for the ecosystem now is to build upon DappRadar's legacy while developing more resilient business models that can withstand market volatility and provide long-term value to users and operators alike.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.