PAX Gold (PAXG) represents a pivotal innovation at the intersection of traditional finance and the cryptocurrency ecosystem, offering a blockchain-based representation of physical gold. Launched in 2019 by the regulated trust company Paxos, PAXG has steadily grown into a formidable force within the tokenized commodities market, boasting a market capitalization that surpassed $1.36 billion by November 2025 . Each PAXG token is backed by one fine troy ounce of a London Good Delivery gold bar, stored in professional vaults like Brink's, and regulated by the New York State Department of Financial Services (NYDFS) . This synthesis of gold's timeless value with blockchain's efficiency offers investors a novel tool for portfolio diversification, operational 24/7 across a globally accessible network. As of mid-November 2025, PAXG continues to demonstrate robust performance, with its price reaching new all-time highs, reflecting sustained demand for gold-backed digital assets in a climate of economic uncertainty . This analysis explores the mechanics, value proposition, and growing ecosystem of PAXG, examining its potential to redefine gold investment for the digital age.

What is PAX Gold (PAXG)?

PAX Gold (PAXG) is a regulated digital asset that tokenizes physical

gold, launched in 2019 by Paxos Trust Company. The core premise of PAXG is straightforward: each token represents direct ownership of one fine troy ounce of a London Good Delivery (LBMA-certified) gold bar stored in professional vaults. Unlike traditional paper gold investments like

ETFs, which represent a claim on a financial instrument, PAXG holders have a beneficial ownership interest in the specific, allocated physical gold bars held in custody. This model is designed to merge the stability and historical value preservation of gold with the transparency, divisibility, and accessibility of cryptocurrency.

The project was conceived to solve long-standing challenges associated with physical gold ownership, including high storage costs, logistical inefficiencies, and high minimum investment thresholds. By digitizing gold ownership on the Ethereum blockchain as an ERC-20 token, Paxos enabled investors to buy, sell, or transfer fractional ownership of physical gold with unprecedented ease and for fractions of the traditional cost. PAXG's significance is further amplified by its regulatory standing. As the first regulated gold-backed token, it operates under the oversight of the NYDFS, providing a layer of institutional credibility and consumer protection that is rare in the crypto asset space. This combination of tangible asset backing, technological innovation, and regulatory compliance positions PAXG not merely as a cryptocurrency but as a new, digitized form of gold ownership for the modern era.

The Technical Mechanism Behind PAXG

PAXG operates on a foundation of blockchain technology and rigorous physical auditing. The system is architected to ensure a transparent, 1:1 relationship between the tokens in circulation and the physical gold held in reserve. Technically, PAXG exists as an ERC-20 token on the Ethereum blockchain, leveraging the network's security and extensive decentralized ecosystem. This allows PAXG to be stored in any compatible Ethereum wallet, traded on supporting exchanges, and integrated into various DeFi applications, all while representing ownership of a physical asset.

The integrity of the PAXG system is maintained through several key mechanisms. Firstly, the physical gold backing the tokens is held in custody by Paxos Trust Company, which is subject to regular, independent audits by firms like KPMG to verify that the gold reserves match the total token supply. This monthly attestation provides a crucial check on the system's solvency. Secondly, the token's smart contract functionality allows for a high degree of transparency and user control. Users interact with the system using public-key cryptography, where a private key (like a password) authorizes transactions, and a public key (like an account number) verifies asset ownership, ensuring security and pseudonymity. Furthermore, Paxos provides a public tool that allows any user to verify the serial numbers, purity, and storage location of the gold bars backing their specific tokens, a feature that is unparalleled in traditional gold investment vehicles. This multi-layered technical and audit framework is designed to build trust by ensuring that the digital token is a faithful and redeemable representation of physical gold.

Why PAXG Demands Attention?

PAXG has garnered significant attention for its unique value proposition that addresses multiple investor needs. Its growth trajectory underscores this appeal; by November 2025, the number of PAXG holders had grown to 62,277, with a circulating supply of over 333,000 tokens, indicating expanding adoption. One of its most compelling attributes is its role as a 24/7 tradable gold proxy. Traditional gold markets have fixed operating hours, but PAXG trades around the clock on global cryptocurrency exchanges, allowing investors to react to market-moving events at any time. This has led some traders to refer to PAXG as an important reference price for "dark hours gold quotes" when traditional markets are closed.

Another critical advantage is accessibility and fractional ownership. PAXG dramatically lowers the barrier to entry for gold investment. Investors can purchase a fraction of a token, representing a fraction of an ounce of gold, with minimum investments as low as 0.0001 ounces, making it feasible for retail investors to gain exposure to gold with very small amounts of capital. This is coupled with a substantial reduction in costs, as PAXG eliminates typical expenses associated with physical gold, such as storage fees, insurance, and high transaction premiums, which can often range from 2% to 3% in the physical market. The token also serves as a potent tool for portfolio diversification and hedging. As a digital asset with the core properties of gold, it offers a haven during periods of market volatility and inflation, a function validated by its price surge to $4,854.86 in October 2025, driven by increased demand for gold-backed assets. This blend of traditional safe-haven characteristics with modern financial technology makes PAXG a uniquely attractive asset for a broad spectrum of investors.

What Is PAXG Token, and What Are Its Utilities?

PAX Gold (PAXG) is an ERC-20 token on the Ethereum blockchain, issued by Paxos, utilizing a standard protocol that allows for easy integration with Ethereum-supporting exchanges and wallet applications. This approach offers numerous benefits including the security and availability of the Ethereum network, publicly verifiable token supply, broad adoption across various crypto stakeholders, reduced dependency on single authorities due to decentralization, and access to a global market.

The PAX Gold (PAXG) token offers several utilities, including:

Gold Ownership: PAXG allows anyone to easily acquire gold by buying PAXG tokens on the Ethereum exchange that can be redeemed for physical gold.

Redeemability: PAXG tokens can be redeemed for Gold. To redeem a PAXG token for gold, the holder must have a sufficient amount of PAXG tokens equivalent to at least one fine troy ounce of gold. They can then initiate the redemption process through Paxos, which involves verifying their identity and completing the necessary KYC.

Tokenized Gold: PAXG token is the tokenized version of physical gold on the Ethereum blockchain.

Integration with Digital Platform: PAXG makes it possible for gold to be traded on digital platforms like centralized and decentralized exchange.

Investment Option and Portfolio Diversification: The PAXG token is an investment option for investors who want to invest in gold, and it also helps to diversify an investor's portfolio.

Tokenomics of PAX Gold

The tokenomics of PAXG are uniquely straightforward and asset-backed, distinguishing it from algorithmic or utility-based cryptocurrencies. The core principle of its design is a direct and verifiable 1:1 peg to physical gold. The total supply of PAXG is not predetermined by a smart contract but is instead a function of market demand; new tokens are minted when investors deposit physical gold with Paxos or purchase tokens through authorized channels, and tokens are burned when holders redeem them for physical bullion . This creates an elastic supply that directly mirrors the amount of gold held in custody.

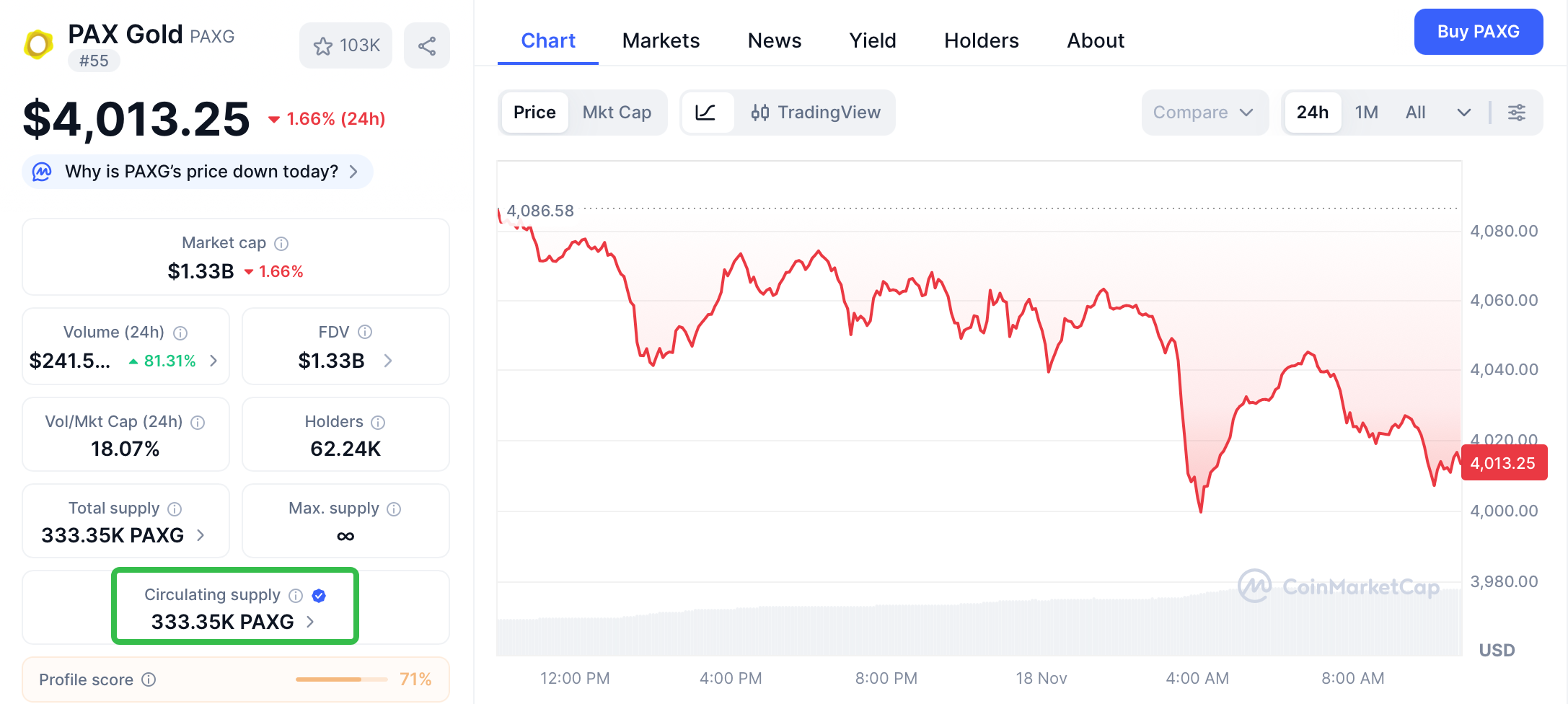

PAXG key data. Source: CoinMarketCap

As of November 15, 2025, the circulating supply of PAXG was reported to be 333,354.594 tokens, with the maximum supply being infinite, as it is contingent on the amount of gold held in reserve. The market capitalization has correspondingly surged, breaking $1.33 billion, reflecting both the appreciation of gold's price and an increase in tokenized gold holdings.

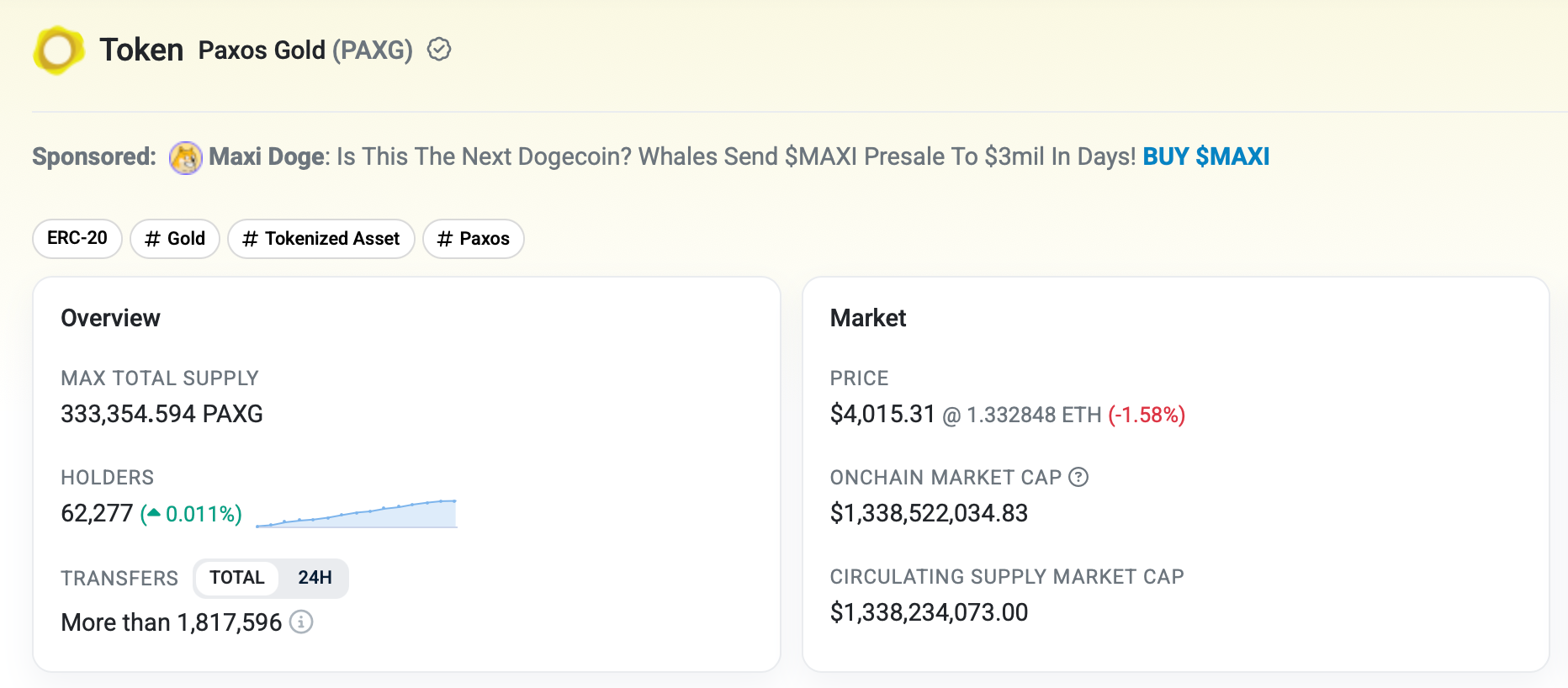

Pax Gold metrics on chain. Source: Etherscan

Key on-chain metrics reveal a thriving ecosystem: the network sees a daily transaction volume of approximately $6.22 million, and the number of active addresses has grown to 62,24K, indicating robust user engagement and network health. The price of PAXG is designed to track the spot price of gold, with market arbitrage mechanisms keeping its market price closely aligned. If the price of PAXG significantly deviates from the underlying gold value, arbitrageurs can mint new tokens (if PAXG is expensive) or redeem them for physical gold (if PAXG is cheap), thereby pushing the price back toward its peg. This economic model ensures price stability and integrity relative to the commodity it represents.

Use Cases and Features

PAXG's utility extends far beyond a simple digital store of value, finding application across both traditional and decentralized finance. Its primary use case is as a high-efficiency digital gold investment. Investors can gain exposure to the price of gold without the logistical headaches of physical ownership, and they can do so with smaller amounts of capital and lower fees than traditional gold ETFs or bullion dealers offer.

A rapidly growing application for PAXG is within the Decentralized Finance (DeFi) ecosystem. As an ERC-20 token, PAXG can be used as collateral in various DeFi protocols for lending, borrowing, and yield farming . This allows holders to put their otherwise idle gold holdings to work, generating a yield on a traditionally non-yield-bearing asset. Furthermore, PAXG introduces a new dimension of liquidity and transactional utility to gold. It can be instantly transferred to anyone, anywhere in the world with an Ethereum address, facilitating fast and low-cost settlements. This makes it potentially useful for cross-border payments and as a stable medium of exchange underpinned by a real asset . The feature of physical redeemability remains a cornerstone of its value proposition. While subject to Paxos's procedures and minimums, the ability to convert digital PAXG tokens into physical gold bars provides a tangible link to the commodity and acts as a fundamental anchor for the token's value, distinguishing it from purely synthetic gold products . This diverse range of applications positions PAXG as a versatile financial instrument.

Is PAXG a Good Investment?

Evaluating PAXG as an investment requires a balanced consideration of its unique advantages against its inherent risks. On the positive side, PAXG offers a compelling blend of gold's historical stability and blockchain's efficiency. It provides a robust hedge against inflation and market downturns, a characteristic that became evident during its 57.10% price appreciation over the year leading to October 2025. Its regulated nature and regular audits provide a level of transparency and security that is often absent in crypto space.

However, potential investors must be acutely aware of the risks. Unlike physical gold in your possession, PAXG carries counterparty risk. Its value is dependent on the continued solvency, integrity, and regulatory compliance of Paxos Trust Company. Although the gold is held in segregated accounts, a failure at the custodian level could impact token holders. Another significant risk is market and liquidity risk. Despite growing adoption, PAXG is still traded primarily on crypto exchanges. In October 2025, the token experienced a severe "flash crash" and decoupling from the gold price, attributed to a liquidity crunch on exchanges, which led to massive liquidations and highlighted its vulnerability to market microstructure issues in the crypto world. PAXG is also not immune to the broader volatility of the cryptocurrency market. During sharp downturns in the crypto sector, PAXG's price has been observed to correlate temporarily, despite its gold backing, demonstrating that it is not a perfect safe haven. Therefore, while PAXG is an innovative and powerful tool, it is best suited for investors who understand and are comfortable with this specific risk profile, viewing it as a digital commodity with distinct advantages and challenges compared to its physical counterpart.

Recent Developments and Price Analysis

The PAXG ecosystem has witnessed significant developments and notable price action in recent months. A major institutional endorsement came in May 2025, when Coinbase announced the addition of PAXG to its listing roadmap, a move that significantly enhances the token's visibility, accessibility, and legitimacy for a vast user base . This integration into one of the world's largest and most compliant cryptocurrency exchanges marks a critical step in PAXG's journey toward mainstream adoption.

From a price performance perspective, PAXG has reflected the strong bullish trend in the global gold market. The token achieved a record high of $4,854.86 on October 16, 2025, driven by a surge in demand for gold-backed digital assets . This performance is part of a longer-term upward trajectory; over the past year, PAXG delivered an impressive return of 57.10%, with its price rising from $4,312.69 in October 2025 to new highs in the following weeks . Analysts attribute this strength to a combination of factors, including persistent geopolitical tensions, global inflationary pressures, and a growing appreciation for the unique value proposition of tokenized

real-world assets (RWAs) . Despite its general tracking of gold's price, PAXG's trajectory is not without volatility. The previously mentioned flash crash in October 2025 serves as a stark reminder that its price on secondary markets can temporarily and sharply deviate from its net asset value due to liquidity issues, creating both risks and opportunities for traders . Overall, the prevailing market sentiment for PAXG remains optimistic, supported by solid fundamentals in the gold market and its expanding utility within the digital asset space.

Conclusion

PAX Gold (PAXG) has firmly established itself as a pioneering force in the convergence of traditional finance and the digital asset economy. By seamlessly tokenizing physical gold on the Ethereum blockchain, it successfully addresses long-standing inefficiencies in gold ownership while unlocking new possibilities for liquidity, divisibility, and application in decentralized finance. Its regulated status, coupled with transparent auditing and physical redeemability, provides a foundational layer of trust that is crucial for both institutional and retail adoption. While it is not without risks—including counterparty dependency and crypto-market liquidity shocks, its core value proposition as a modern, accessible, and efficient conduit for gold exposure is undeniable.

The future of PAXG appears intrinsically linked to the broader adoption of tokenized real-world assets. As institutional interest in this asset class grows and platforms like Coinbase facilitate easier access, PAXG is well-positioned to solidify its role as a leading digital gold standard. It represents more than just a cryptocurrency; it is a fundamental bridge connecting the timeless value of a millennia-old asset with the transformative potential of blockchain technology. For investors seeking a pragmatic hedge in an uncertain economic landscape or simply a more efficient way to hold gold, PAXG offers a compelling and innovative solution that is likely to play an increasingly important role in the portfolios of the future.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.