Over the past week, the crypto market has experienced a significant correction during the review period, with total market capitalization declining substantially from recent highs. Extreme fear has dominated investor sentiment, pushing the Crypto Fear & Greed Index to remarkable lows of 20-29, indicating one of the most pessimistic market environments since 2023. Bitcoin's failure to maintain the psychologically crucial $100,000 support level has triggered widespread deleveraging across the sector, while Ethereum faces strong resistance clusters around $3,500. Meanwhile, As most anticipated, the Federal Open Market Committee (FOMC) lowered the benchmark federal funds rate by 25 basis points to a range between 4% and 3.75%. Multiple Ethereum whales have significantly increased their holdings by acquiring 394,682 ETH worth $1.37 billion over the past three days. Monad is set to launch its upcoming Layer 1 blockchain and native token on Nov. 24, at 9 a.m. ET.

Market Overview

BTC

: Bitcoin faced downward pressure this week,

falling 6.77% to $103,345. Bitcoin has confirmed a significant downturn during the review period, establishing a new lower price range with critical tests at the $98,000-$99,000 support zone. Current price action represents approximately a 20% decline from all-time highs above $126,000, with Bitcoin establishing a series of lower highs and lower lows that indicate a structural shift in market dynamics. The breach of the short-term holder cost basis around $113,000 has historically preceded mid-term bearish phases, suggesting further potential downside before stabilization occurs.

Bitcoin is currently testing the $98,000-$99,000 support zone, which represents the 75th percentile cost basis according to Glassnode's on-chain analysis. This level previously provided support during the June Middle Eastern conflict-induced fear, and a breach could trigger further liquidation cascades toward $95,000, where the next significant liquidity cluster resides.

ETH

: Ethereum fell 13.57% to $3390. Ethereum has mirrored Bitcoin's bearish momentum, breaking below the crucial $3,500 support level and establishing a new lower trading range between $3,050 and $3,500. The ETH/USD pair recently found temporary support at $3,058 before attempting a recovery wave that now faces significant resistance between $3,350 and $3,500. Initial support forms near $3,260, with major support at the recent swing low of $3,058. A breach below $3,050 would likely trigger further downside toward the psychologically significant $3,000 level, potentially accelerating selling pressure

Altcoins: The Crypto Fear & Greed Index plunged to remarkable lows between 20-29 during the review period, reflecting overwhelming fear among market participants. The reading of 20 recorded on November 5 represents the lowest level in approximately 200 days and marks only the third time since the index's 2023 launch that it has entered the "extreme fear" territory

The altcoin market has experienced substantial pressure throughout October, with many tokens recording significant declines due to massive deleveraging in derivatives markets. However, recent analysis suggests potential stabilization zones are forming that could support a short-term recovery in November. The Altcoin Index remains below the critical 50 threshold, standing at 23, indicating that sustained altcoin season conditions have not yet materialized. However, historical patterns show that altcoin seasons often begin around November, providing seasonal optimism despite current weak sentiment.

OTHERS/BTC Chart Analysis: This chart, which tracks the value of all altcoins outside the top 10 against Bitcoin, declined sharply from above 0.14 in September to below 0.12 in October but has now entered what analysts term a "stabilization phase." This suggests altcoins may be establishing a base from which recovery could emerge.

ETF: The ETF landscape continues to evolve rapidly, with October 28th marking a significant milestone as the first US altcoin ETFs officially launched, covering Solana, Litecoin, and Hedera . This expansion beyond Bitcoin and Ethereum represents a potential game-changer for institutional accessibility to altcoins.

The pipeline for additional crypto ETFs remains substantial, with reports indicating 155 additional altcoin ETFs awaiting regulatory approval, covering 35 different digital assets . This includes 23 Solana-specific ETFs in the approval queue, signaling strong institutional interest in diversifying beyond the two largest cryptocurrencies.

Macro Data: The Federal Reserve implemented its second rate cut of 2025 on October 30, lowering the federal funds rate target range to 3.75%-4.00%. Paradoxically, this typically bullish development failed to support crypto markets, instead triggering additional selling pressure as investors had likely priced in the expectation beforehand.

-

Nasdaq has proposed trading "equal equity" tokenized securities through the Depository Trust Company (DTC), enabling asset tokenization while preventing pricing fragmentation and credit risk. This represents significant progress in bridging traditional and crypto finance.

-

Stablecoin Regulation: The Federal Reserve plans to introduce a "simplified version master account" that could allow non-banking institutions including stablecoin issuers direct access to its payment system. This "open but guarded" regulatory approach could significantly reshape the stablecoin landscape.

-

Global CBDC Developments: The European Central Bank is more actively considering public blockchain technology in its digital euro roadmap to counter potential dollar stablecoin dominance. China is similarly exploring upgrades to its digital yuan measurement framework to enhance money creation capability and market activity.

Stablecoins: The total market capitalization of stablecoins was $313.8 billion, a slight decrease of 0.35% from the previous day. Overall trading volume fell to approximately $179.3 billion, a drop of about 38.6%, indicating a slowdown in short-term market liquidity.

Gas Fees: Gas fees on the Ethereum network have decreased this week, with the average daily gas fee as of November 6th being 0.315 Gwei.

Weekly Trending Sectors & Opportunities

AI + Crypto Convergence

The intersection of artificial intelligence and cryptocurrency represents one of the most promising emerging narratives. Despite recent market turmoil, projects combining AI capabilities with blockchain infrastructure continue attracting developer attention and venture funding. This convergence aims to address critical issues in AI development including data provenance, model transparency, and computational resource allocation.

Real World Assets (RWA) Tokenization

The RWA sector has demonstrated remarkable growth with market capitalization increasing 34.8%to $338 billion in Q3 2025, driven primarily by private credit and U.S. Treasury tokenization. This category represents one of the most concrete use cases for blockchain technology in traditional finance, offering improved efficiency, transparency, and accessibility to previously illiquid assets.

Layer-2 Scaling Solutions

Ethereum and multiple main chains have seen Layer-2 technologies enter an "implementation acceleration phase" during the 2024-2025 period. Technologies including optimistic Rollups, zk-Rollups, and dedicated L2 solutions are making significant progress in interoperability, compliance, and developer-friendly features despite the challenging market conditions.

Despite the challenging market environment, several altcoin sectors and individual tokens have demonstrated notable performance or promising technical setups:

Privacy Coins: ZEC (Zcash) has shown remarkable strength with price increases of up to 6x in recent weeks, though technical analysis now suggests potential for a 30% correction to the $260-$270 support zone in November. The privacy coin sector appears to be benefiting from technological upgrades and renewed demand for transaction privacy.

High-Yield Opportunities: Solana's staking ETF offers approximately 5% yield, attracting institutional interest seeking returns in a declining market. Projects like Pendle, which combines TVL growth with revenue generation, have reached significant milestones including $1 billion in Total Value Locked.

ETF-Driven Opportunities: With over 90 altcoin ETF applications currently under SEC review, tokens with clear regulatory pathways stand to benefit. XRP ETFs potentially launching in November 2025 represent particular catalysts for that asset, while Ethereum continues benefiting from Q3 ETF inflows totaling $9.6 billion.

Weekly Market Focus

Fed Cuts Rates by Quarter Point as Shutdown Data Blackout Clouds Outlook

As most anticipated, the Federal Open Market Committee (FOMC) lowered the benchmark federal funds rate by 25 basis points to a range between 4% and 3.75%.

"Available indicators suggest that economic activity has been expanding at a moderate pace," the committee said Wednesday in a statement. "Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated." The rate cut passed by a 10–2 vote. Governor Stephen Miran again dissented, favoring a steeper half-point reduction to counter softening conditions, while Kansas City Fed President Jeffrey Schmid opposed any cut, preferring to hold rates steady.

The Federal Reserve also said it will halt balance sheet reduction on Dec. 1. The inclusion of the words "available indicators" is notable, as the U.S. government shut down one month ago, which has led to a pause in various economic data releases, such as weekly jobs reports. Fed Chairman Jerome Powell addressed as much during Wednesday's press conference.

Lower interest rates typically make traditional investments less attractive, leading many investors to seek higher returns through alternative assets such as cryptocurrencies. Today will shed light on whether politics or data is in the driving seat, according to Nic Puckrin, investment analyst and co-founder of The Coin Bureau. While volatility may reign supreme in the short term, Puckrin says the long-term investment case for Bitcoin and other risk assets remains intact.

Monad Unveils Airdrop and Public Mainnet Date

Monad is set to launch its upcoming Layer 1 blockchain and native token on Nov. 24, at 9 a.m. ET. The public network launch and community airdrop are among the most anticipated events in crypto this year.

The Monad Foundation opened a token claim portal from mid-October until Monday, Nov. 3, providing users a view into their MON allocations and connecting their wallets. Monad’s chosen wallet partner, Privy, experienced "degraded performance" the morning the claims portal opened, signalling the intense interest in the token launch.

The airdrop was designed to reward thousands of early members of the Monad ecosystem, as well as approximately 225,000 verifiable onchain users. This includes "significant" users of DEXs like Hyperliquid and Uniswap, lending protocols like Aave, Euler, and Morpho, and memecoin launchpads like Pump.fun and Virtuals, among many other protocols. Longtime holders of about a dozen NFT projects and DAO governance participants will also be rewarded, according to Monad.

"We want members of the Monad Community to be significant stakeholders in the network because we believe in their future influence and potential to shape the course of both Monad and crypto in general," the Monad Foundation wrote in October. "We believe that we are surrounded by giants who have already shaped Monad substantially and who will go on to transform all crypto."

Balancer Released a Preliminary Report on the Attack, Revealing That a Rounding Logic Error Was Exploited

Balancer disclosed in its initial incident report that its Balancer V2 composable stable pools were attacked on multiple chains on November 4th, including Ethereum, Base, Avalanche, Polygon, and Arbitrum. The vulnerability stems from a rounding error in the scaling function of the EXACT_OUT transaction path during batch swaps. When the scaling factor contains non-integer values (such as exchange rate parameters included in the calculation), the system defaults to rounding down, allowing attackers to manipulate pool balances and withdraw funds using this precision error. This incident only affected Balancer V2 composable stable pools; Balancer V3 and other pool types were unaffected. The issue is concentrated on the calculation functions of older versions of architecture.

Following the incident, the Balancer team, along with security partners and the white-hat community, quickly implemented countermeasures, including the Hypernative automatic suspension mechanism, asset freezing, and white-hat intervention under the SEAL framework. These measures effectively prevented the vulnerability from spreading further and recovered some assets. StakeWise has successfully recovered approximately 73.5% of the stolen osETH, and the BitFinding and Base MEV bot teams have also assisted in recovering some funds. Currently, Balancer is working with security organizations such as SEAL and zeroShadow on cross-chain tracing and fund recovery, and will publish the final loss and recovery results in a full technical review report. This incident revealed security vulnerabilities in bulk exchange and precision control logic, and also highlighted the importance of multi-party collaborative mechanisms in decentralized protocols when dealing with complex attacks.

Key Market Data Highlights

U.S. Government Shutdown Stretches to Record 36 Days, Continues Risk of Derailing Crypto Bill

The U.S. government shutdown is now the longest on record, breaking the previous 35-day record on Wednesday as lawmakers continue to be at an impasse over funding the federal budget — an impasse that may be strengthened by Tuesday night's sweeping win for Democrats in an off-year election.

Expectations had been growing that Democrats might give in on their demands and vote to fund the government as soon as this week or early next week without winning concessions in their effort to address healthcare premiums that rose this month. But Tuesday's election may further delay any dealmaking between elected officials. People following the process told CoinDesk, pointing to the amount of support Democrats received above polling expectations. And this delay, by extension, may further push out additional work on crypto market structure legislation.

The longer the shutdown lasts, the slimmer the chances of market structure legislation moving through Congress become. Summer Mersinger, the CEO of the Blockchain Association, said Wednesday that the lengthening shutdown means it was becoming more likely that this bill will be moved to 2026.

Many of the government experts in this arena have been furloughed during the shutdown, leaving fewer people capable of actually crafting the legislative language, people have said.

Patrick Witt, the White House's executive director of the President's Council of Advisors for Digital Assets, told an audience at Ripple's Swell conference Wednesday that President Donald Trump still wants to see a final market structure bill on his desk by the end of 2025.

Robinhood’s Crypto Trading Revenue Soared 339% in Q3 as Company Tops Street Earnings Estimates

Robinhood (HOOD) on Wednesday reported a 339% year-over-year increase in third-quarter crypto trading revenue, extending momentum from earlier this year as the trading app leans deeper into digital assets and global markets. The company handled $80 billion in crypto trading volume during the quarter, posting $268 million in crypto-related revenue, up from $61 million in the same quarter last year. Adjusted earnings per share (EPS) came in at $0.61 against Street estimates for $0.53; total net revenue reached $1.27 billion versus forecasts for $1.21 billion.

“Q3 was another strong quarter of profitable growth, and we continued to diversify our business, adding two more business lines — Prediction Markets and Bitstamp — that are generating approximately $100 million or more in annualized revenues,” said CFO Jason Warnick. “And Q4 is off to a strong start in October, with record monthly trading volumes across equities, options, prediction markets, and futures, and new highs for margin balances.”

The company now has a market capitalization of $126 billion, putting it above rivals like Coinbase (COIN), which reported strong earnings last week. The strong results follow a string of moves to deepen Robinhood’s crypto footprint. Earlier this year, the firm acquired Bitstamp, expanding its regulatory presence and user base in more than 50 countries.

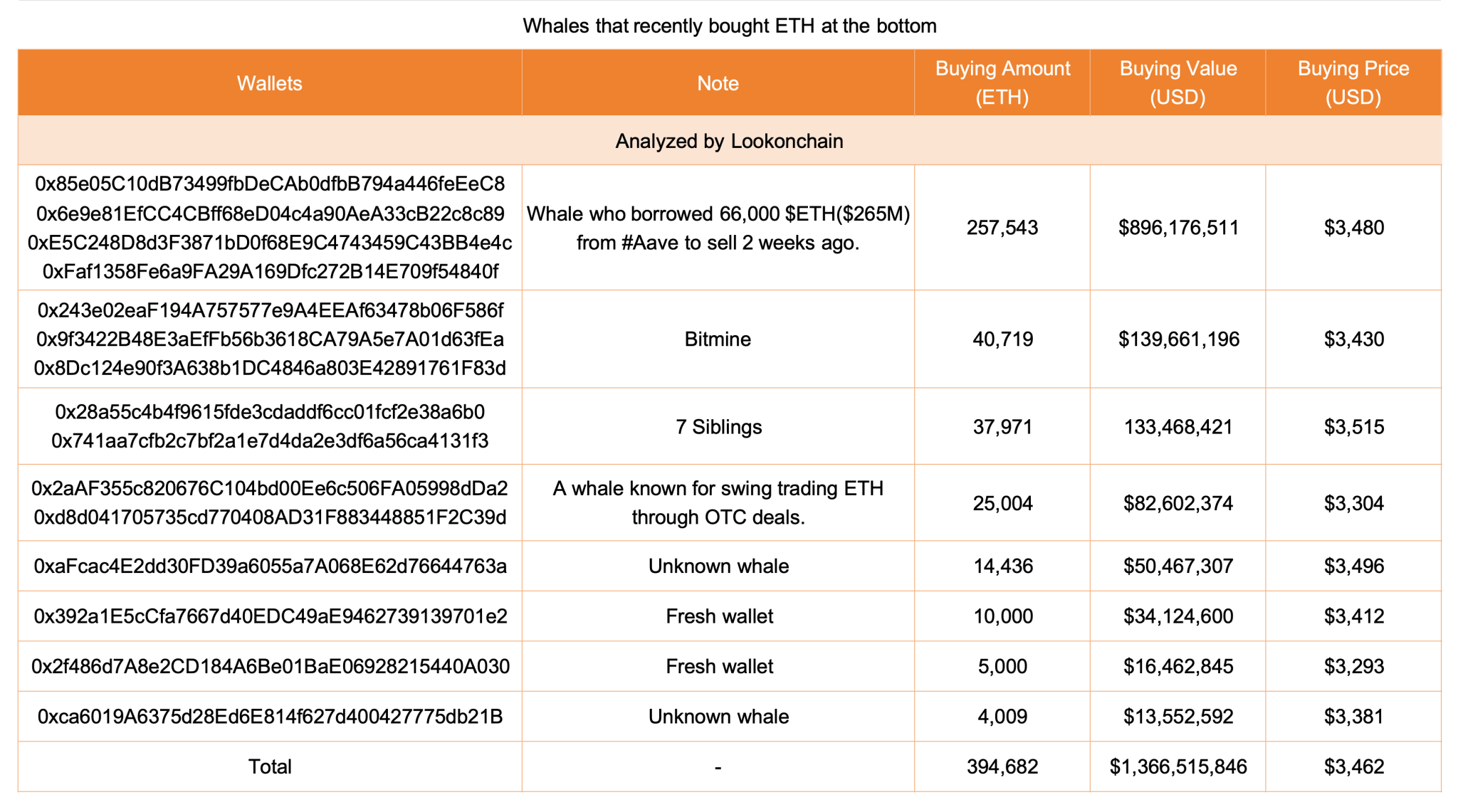

Ethereum Whales Snap Nearly 400K ETH in Three Days. Total Purchases Exceed $1.37B

Source: Lookonchain

Multiple Ethereum whales have significantly increased their holdings by acquiring 394,682 ETH worth $1.37 billion over the past three days. According to on-chain data, the strategic accumulation suggests a strong bullish momentum in Ethereum’s long-term potential, despite current market fluctuations.

Per the detailed analysis, the largest buyer was an address that had previously borrowed 66,000 ETH from Aave. The whale has now repurchased 257,543 ETH at approximately $3,480, for a total of $896 million. Besides, Bitmine, 7 Siblings, OTC traders and various new wallets have increased their ETH positions recently during the market correction.

Analysts are closely watching the recent massive whale accumulation, as they often precede significant market shifts. Analysts believe Ethereum could soon prepare for a strong rebound to new all-time highs, targeting up to $10,000.

Ethereum is currently trading at 3,421 at press time, a 3.72% increase over the past 24 hours. On the technical front, the momentum indicators show a bullish uptrend following recent short liquidations and institutional interest signals. With anticipation built for December’s Fusaka upgrade, ETH has also attracted strong institutional interest. For instance, the on-chain data noted that Bitmine has added 40,719 ETH, worth nearly $140 million.

Analyst Ted Pillows noted that Bitmine’s ongoing ETH buys, reportedly ranging between $200 million and $300 million weekly, may tighten supply faster.

CoinCatch New Listings

CoinCatch Weekly Event

CoinCatch Resurrection Potion: 100% Subsidy for Liquidation!

📅 Event Period: November 5, 2025 (UTC+8) – November 11, 2025 (UTC+8)

Worried about market volatility? Don't fret. Claim CoinCatch's exclusive resurrection potion 💊, covering 100% of your liquidation losses! Limited to the first 500 participants, join now!

Participation Rules:

Event 1. To be eligible for a 100% rebate on liquidation losses, users must complete the Google Form after experiencing futures liquidation between

November 5 - 11, 2025 (UTC+8). The compensation is provided as a position bonus of up to

500 USDT and

requires no user margin to open a new position.

Event 2. All users who experience futures liquidation on other exchanges between

November 5 - 11, 2025 (UTC+8), are eligible for 100% compensation of their losses. To claim this, they must upload a screenshot of the liquidation record to the designated Google Form during the event period. The compensation is provided as a position bonus of up to

500 USDT and

requires no user margin to open a new position.

New Spot Listing: Trade KITE/USDT Spot with Zero Fees!

Event Period: From November 4, 2025, 11:00:00 to November 11, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Boost Your Trade: Get 100% Airdrop + 200% Trading Bonus Cashback!

📅 Event Time: 2025.11.6(UTC+8) - 2025.11.12(UTC+8)

🚀 New User Perk: 100% Airdrop + 200% Deposit Bonus

Bonus 1: 100% Airdrop for Sign-ups

Event Rule: Simply complete your registration during the event period to receive a 100-10,000 USDT position bonus.

Total Prize Pool: 10,000,000 USDT

Bonus 2: Get 200% Trading Bonus for New Users' Deposit 🔥

Event Rule: New users who register during the event can get a 20 USDT trading bonus by completing these two simple tasks (first 200 users only):

-

Make a net deposit of at least 10 USDT and transfer it to your futures account.

-

Achieve a futures trading volume of 1,000 USDT.

💸 All Users: Deposit & Trade to Get Up to $10,000

| Net Deposit (USDT) |

Futures trading volume (USDT) |

Position Bonus (USDT) |

| 500 |

- |

100 |

| 200,000 |

200 |

| 1,000 |

- |

500 |

| 1,000,000 |

800 |

| 5,000 |

1,000,000 |

1,000 |

| 8,000,000 |

5,000 |

| 10,000 |

20,000,000 |

10,000 |

Important Notes:

-

The deposit refers to the net amount transferred to your futures account.

-

Rewards are granted based on the highest tier achieved for net deposit and trading volume during the event; rewards from different tiers cannot be stacked.

-

New user perks and all user events can be claimed simultaneously.

✨ Lucky Draw: Win 1 of 5 ROG Xbox Ally

-

Event Rule: Users who achieve a futures trading volume of 1,000,000 USDT during the event period will be entered into a random draw. Five lucky winners will each receive a

ROG Xbox Ally gaming device (valued at approximately $600).

Token Unlocks Next Week

Tokenomist data indicates that from October 31 – November 6, 2025, several major token unlocks are scheduled. Some of them are:

LINEA will unlock approximately $34.94 million worth of tokens over the next seven days, representing 16.44% of the circulating supply.

AVAX will unlock approximately $27.15 million worth of tokens over the next seven days, representing 0.33% of the circulating supply.

BB will unlock approximately $7.87 million worth of tokens over the next seven days, representing 11.67% of the circulating supply.

IO will unlock approximately $3.64 million worth of tokens over the next seven days, representing 5.56% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization—presented a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.