The Ethereum blockchain, despite its widespread adoption and robust ecosystem, has long grappled with scalability challenges. High transaction fees and network congestion during peak periods have necessitated the development of Layer-2 scaling solutions. Among these,

ZKsync

has emerged as a

prominent zero-knowledge rollup protocol

, gaining significant attention to its

technical innovations

and recently proposed

transformative economic model

. In early November 2025, ZKsync captured headlines as its native token, ZK, witnessed a price surge of over 60% in a week, fueled both by a coveted endorsement from Ethereum co-founder Vitalik Buterin and a groundbreaking proposal to overhaul its token economics. This article explores ZKsync's technology, its new economic paradigm, and its potential to reshape the Layer-2 landscape.

What is ZKsync?

ZKsync is a

proof-secured network of chains that utilizes zero-knowledge rollups (

ZK-rollups) to scale the Ethereum blockchain effectively. It functions as a Layer-2 protocol, meaning it processes transactions off-chain before bundling them and submitting a cryptographic proof back to the Ethereum mainnet. This architecture allows ZKsync to offer users

drastically lower transaction fees and

higher throughput while maintaining the security guarantees of

Ethereum.

The network has seen substantial real-world adoption, having processed

over 700 million transactions and securing more than

$4 billion in value across its ecosystem. It is designed to be compatible with the Ethereum Virtual Machine (EVM), enabling developers to deploy existing smart contracts with minimal modifications. Furthermore, ZKsync uniquely caters to both public and private use cases, integrating privacy and compliance features that make it suitable for institutional adoption, from tokenizing real-world assets to executing private financial transactions.

The Technology Behind ZKsync: How It Works

The core of ZKsync's operation relies on

zero-knowledge proofs

(ZKPs), specifically a type called

zk-SNARKs. Here is a simplified breakdown of the process:

Transaction Batching: Numerous transactions are compiled and processed off-chain on ZKsync's own chain.

Proof Generation: A cryptographic proof, known as a

validity proof, is generated. This proof attests to the correctness of all the batched transactions without revealing their underlying data.

On-Chain Finalization: This single, compact proof is then submitted to the Ethereum mainnet. The Ethereum network verifies this proof, thereby finalizing all the transactions in the batch simultaneously.

This process is the key to ZKsync's efficiency. By moving the computationally heavy work off-chain and only submitting a small proof to Ethereum, it

reduces the data load on the mainnet, leading to lower fees and faster settlement. Finality on Ethereum is achieved within minutes, while users experience near-instant confirmations on the ZKsync layer itself.

The network also employs a

high-performance sequencer to order transactions efficiently. With the recent Atlas upgrade, ZKsync is targeting a theoretical throughput of up to

30,000 transactions per second (TPS), a figure that dwarfs Ethereum's native capacity and even many competing Layer-2 solutions.

Why ZKsync is Gaining Attention

ZKsync is currently in the spotlight for several compelling reasons that blend technological progress with economic innovation.

First, the project received a

significant endorsement from Vitalik Buterin. On November 1, 2025, the Ethereum co-founder publicly praised a ZKsync post, calling the project's work "underrated and valuable". This vote of confidence from a leading figure in the crypto space immediately drew widespread attention and liquidity to the ZK token, triggering a sharp price increase.

Second, the completion of the

Atlas upgrade has significantly strengthened ZKsync's fundamental value proposition. This upgrade introduced a more powerful sequencer, full Ethereum compatibility, and Airbender, a component for faster confirmations and cross-chain settlement. By positioning Atlas for enterprise and institutional use cases like payments and tokenized assets, ZKsync has provided traders and developers with a clearer utility narrative.

However, the most transformative recent development is the

proposed overhaul of its token economics. ZKsync's founder, Alex Gluchowski, has put forward a plan to transition the ZK token from a pure governance tool to a token with tangible

"economic utility" and value capture mechanisms. This shift aims to create a self-sustaining economic loop for the network, directly linking the token's value to the network's usage and growth.

ZK Tokenomics: From Governance to Value Capture

The proposed tokenomics redesign marks a pivotal evolution for the ZK token. Initially, its primary function was governance, allowing holders to vote on protocol decisions. The new proposal envisions a much more robust role for the token, fundamentally tying its value to the network's financial health.

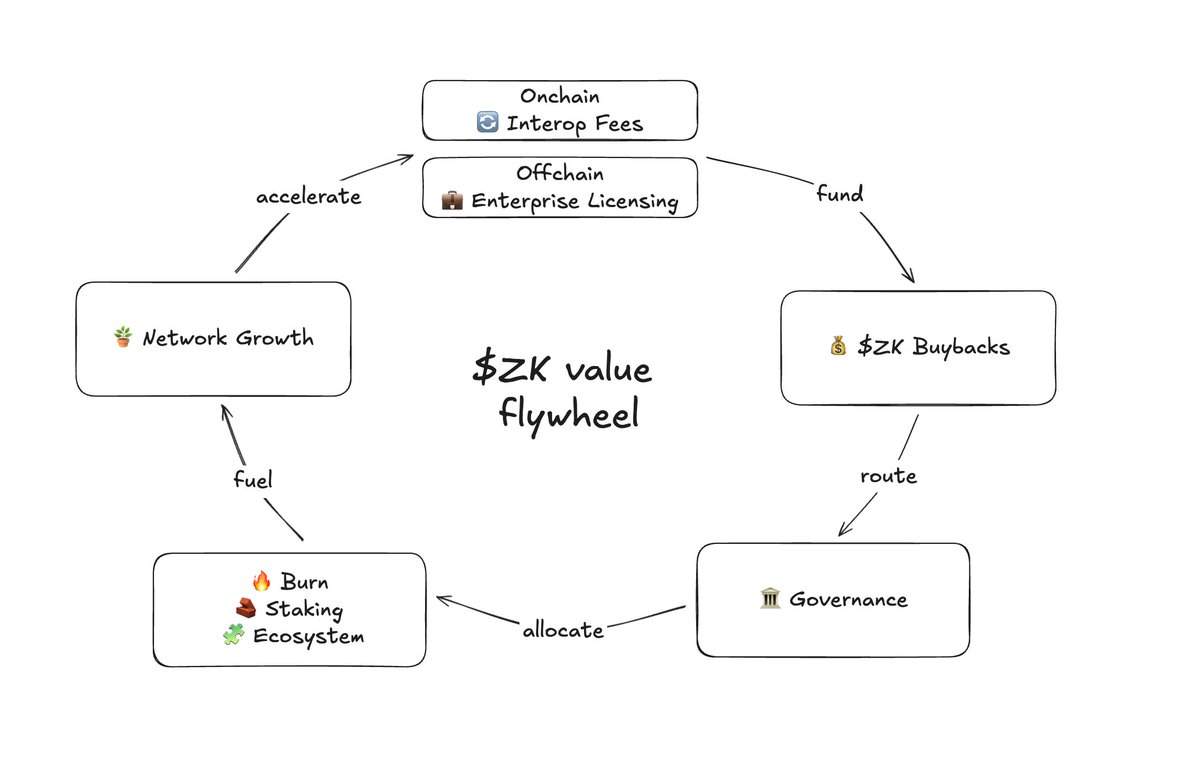

The New Economic Model

The core mechanism of the new proposal involves using

all network-generated revenue to benefit the ZK token ecosystem. This revenue will flow into a governance-controlled treasury and be allocated toward several key functions:

-

Market Buybacks and Burns: A portion of the revenue will be used to buy back ZK tokens from the open market. These purchased tokens will then be periodically burned, reducing the total circulating supply and creating deflationary pressure.

-

Staking Rewards: Another portion will fund staking rewards, offering incentives for token holders to participate in securing the network. Projections suggest these staking yields could range from

5% to 10% annually, providing a source of passive income for long-term holders.

-

Ecosystem Funding: Revenue will also be directed to grants for developers and public goods, ensuring the continuous growth and innovation of the ZKsync ecosystem.

Sources of Network Revenue

The model plans to draw value from two primary streams:

-

On-Chain Value: This includes protocol-native fees generated from core functions like interoperability, settlement, and messaging between chains.

-

Off-Chain Value: This innovative component involves licensing agreements for ZKsync's enterprise-grade software components. While the core technology remains open-source, Gluchowski argues that large enterprises using this community-built infrastructure for complex applications (e.g., treasury integrations) should contribute value back to the ecosystem through licensing fees.

The overarching goal is to establish a "self-reinforcing economic loop where adoption increases network resources, and those resources in turn enhance the network for all participants".

Use Cases and Features

ZKsync's technology opens up a wide array of use cases beyond simple payments and token transfers.

Tokenization of Real-World Assets (RWA): ZKsync is an ideal platform for issuing and settling tokenized assets like treasury bills, fund shares, and private credit. Its ability to provide user-level privacy and selective disclosure for regulatory compliance is a critical feature for institutional players.

Identity and Compliance: The network can execute KYC/AML checks and integrate custom identity verification systems. This facilitates streamlined, gas-less onboarding processes, making it easier for traditional businesses to interact with decentralized applications.

Programmable Capital Markets: Institutions can run private order flows, atomically coordinate collateral across different systems, and capture Maximum Extractable Value (MEV) according to their own rules.

Cross-Border Settlement: ZKsync enables near-instant, cryptographically secured settlement across borders with hops between connected chains taking about one second and finality on Ethereum within minutes. This eliminates the need for trusted third parties in international transactions.

Launching Custom Chains: Through the ZK Stack, developers and enterprises can build their own customized, high-performance chains based on ZKsync's technology. These chains can be self-hosted or run as a managed service, all while being connected to global liquidity within the ZKsync ecosystem.

Is ZK a Good Investment?

Evaluating the investment potential of ZK requires a balanced consideration of its opportunities and risks.

The Bull Case:

The new tokenomic model creates a direct value accrual mechanism. If the network sees significant adoption and generates substantial revenue from fees and licensing, the

buyback-and-burn program could create sustained deflationary pressure on the token supply. Coupled with attractive staking yields, this offers a compelling proposition for long-term holders. Furthermore, ZKsync's focus on enterprise adoption and high-throughput applications like tokenized assets positions it in a high-growth niche within the broader crypto market. The recent technical upgrades and high-profile endorsements add to its credibility and momentum.

The Risks and Challenges:

The success of this new economic model is

contingent on sustained network growth. If transaction volumes stagnate or enterprise licensing deals fail to materialize, the anticipated revenue streams could underperform, dampening the deflationary effect and staking rewards. As with any cryptocurrency, ZK is subject to

high market volatility and broader macroeconomic factors. The Layer-2 space is also intensely competitive, with rivals like Arbitrum and Optimism continuously evolving. Lastly, while ZKsync's privacy features are a strength, they could also attract increased regulatory scrutiny, posing a potential future risk.

Recent Hot News and Price Analysis

The first week of November 2025 has been exceptionally eventful for ZKsync. The convergence of Buterin's endorsement, the underlying strength from the Atlas upgrade, and the exciting tokenomics proposal ignited a powerful rally. The ZK token surged by over 60% in a week, with some reports noting a staggering

170% increase from its late-October lows.

From a technical analysis perspective, after this sharp rally, the price consolidated and established a key support level around

$0.048. This consolidation above a previous higher low suggests that buyers maintain control of the short-term momentum. For the bullish momentum to continue, holding this support level is critical. A decisive break above

$0.067could signal renewed strength and open the path toward retesting the recent highs around $0.075. Conversely, a breakdown below the $0.045 support level could indicate a deeper pullback is imminent.

Conclusion

ZKsync stands at a fascinating juncture. It is more than just another Layer-2 scaling solution; it is a ambitious project aiming to bridge the gap between the decentralized world of Ethereum and the stringent requirements of institutional finance. Its core technology, based on zero-knowledge proofs, provides the scalability and privacy necessary for this mission.

The proposed shift in its tokenomics is a radical and innovative experiment in creating a truly self-sustaining blockchain economy. By directly linking the ZK token's value to network usage and revenue, ZKsync is attempting to solve the crucial challenge of economic sustainability in decentralized networks. While the model's long-term success depends on execution and adoption, it has undoubtedly set a new standard for value capture in the Layer-2 ecosystem. For the broader Ethereum community, ZKsync's progress represents a significant step toward a more scalable, private, and economically viable decentralized future.

References

ChainCatcher. (2025, November 4).

The founder of ZKsync has released a proposal for the ZK token update, stating that all network revenue will be used to buy back and burn ZK tokens. Retrieved from

https://www.chaincatcher.com/en/article/2217380

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.