USDT (Tether) and USDC (USD Coin) are both stablecoins—cryptocurrencies intended to maintain a stable value of approximately $1, pegged to the US Dollar. While their primary functions are similar, there are important differences between the two that may influence which one is more suitable for your specific requirements. This article aims to provide a clear overview of these distinctions.

Key takeaways

-

Both USDT and USDC are stablecoins that offer a stable value linked to the US dollar, reducing market volatility.

-

USDT was launched in 2014, making it the first and most widely used stablecoin.

-

USDC, launched in 2018, is known for being more transparent and regulated.

-

USDT vs USDC? Choose USDT for liquidity and trading, or USDC for safety and compliance.

What is Stablecoin?

Stablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument. Stablecoins aim to provide an alternative to the high volatility of the most popular cryptocurrencies, including Bitcoin (BTC), which has made crypto investments less suitable for everyday transactions. Stablecoins can be categorized into three main types:

-

Fiat-backed: These stablecoins are backed by reserves of fiat currencies, such as the US dollar. USDT and USDC fall into this category.

-

Crypto-backed: These are backed by other cryptocurrencies, usually include other stablecoins and mainstream crypto assets like ETH, BTC.

-

Algorithmic: These stablecoins use algorithms and smart contracts to manage their supply, without relying on collateral.

Why Are Stablecoins So Important?

Though Bitcoin remains the most popular cryptocurrency, it tends to suffer from high volatility in its price, or exchange rate. For instance, Bitcoin's price rose from just under $5,000 in March 2020 to over $63,000 in April 2021, only to plunge almost 50% over the next two months. Intraday swings can also be wild; cryptocurrency often moves more than 10% in the span of a few hours.

All this volatility can be great for traders, but it turns routine transactions like purchases into risky speculation for the buyer and seller. Investors holding cryptocurrencies for long-term appreciation don't want to become famous for paying

10,000 Bitcoins for two pizzas. Meanwhile, most merchants don't want to end up taking a loss if the price of cryptocurrency plunges after they get paid for it.

To serve as a medium of exchange, a currency that's not legal tender must remain relatively stable, assuring those who accept it that it will retain purchasing power in the short term. Among traditional fiat currencies, daily moves of even 1% in forex trading are relatively rare.

-

Stablecoins offer a way to hedge against the extreme price swings seen in cryptocurrencies.

-

They facilitate global lower-cost payments using blockchain rails.

-

Some stablecoins offer attractive yields, making them an appealing choice for investors.

Stablecoin Regulations

Stablecoins continue to come under scrutiny by regulators, given the rapid growth of the $230 billion market and its potential to affect the broader financial system.

In October 2021, the International Organization of Securities Commissions (IOSCO) said stablecoins should be regulated as financial market infrastructure alongside payment systems and clearinghouses. Its proposed rules focus on stablecoins that are deemed systemically important by regulators, those with the potential to disrupt payment and settlement transactions.

Moreover, politicians in the U.S. have increased calls for tighter regulation of stablecoins. For instance, in November 2021, Senator Cynthia Lummis (R-Wyoming) called for regular audits of stablecoin issuers, while others backed bank-like regulations for the sector.

In 2024, Senators Lummis and Kirsten Gillibrand introduced a bill to create a regulatory framework for stablecoins. Their proposed framework would prohibit anyone from issuing a stablecoin unless they were a registered non-depository trust or a depository institution with authorization to issue them.

In Europe, under the Markets in Crypto Assets Regulation, which took effect in 2023, algorithmic stablecoins are essentially banned, and all others must have assets held in custody by a third party. Reserves must be liquid and have a 1:1 ratio of assets to coins.

What is USDT (Tether) the World's First Stablecoin?

Tether (USDT) was introduced in 2014 and is the most widely used stablecoin. It is pegged 1:1 to the US dollar, and its value is supported by a reserve of fiat currency and other assets. Although USDT has faced criticisms, particularly regarding its transparency, it remains the largest stablecoin by market capitalization.

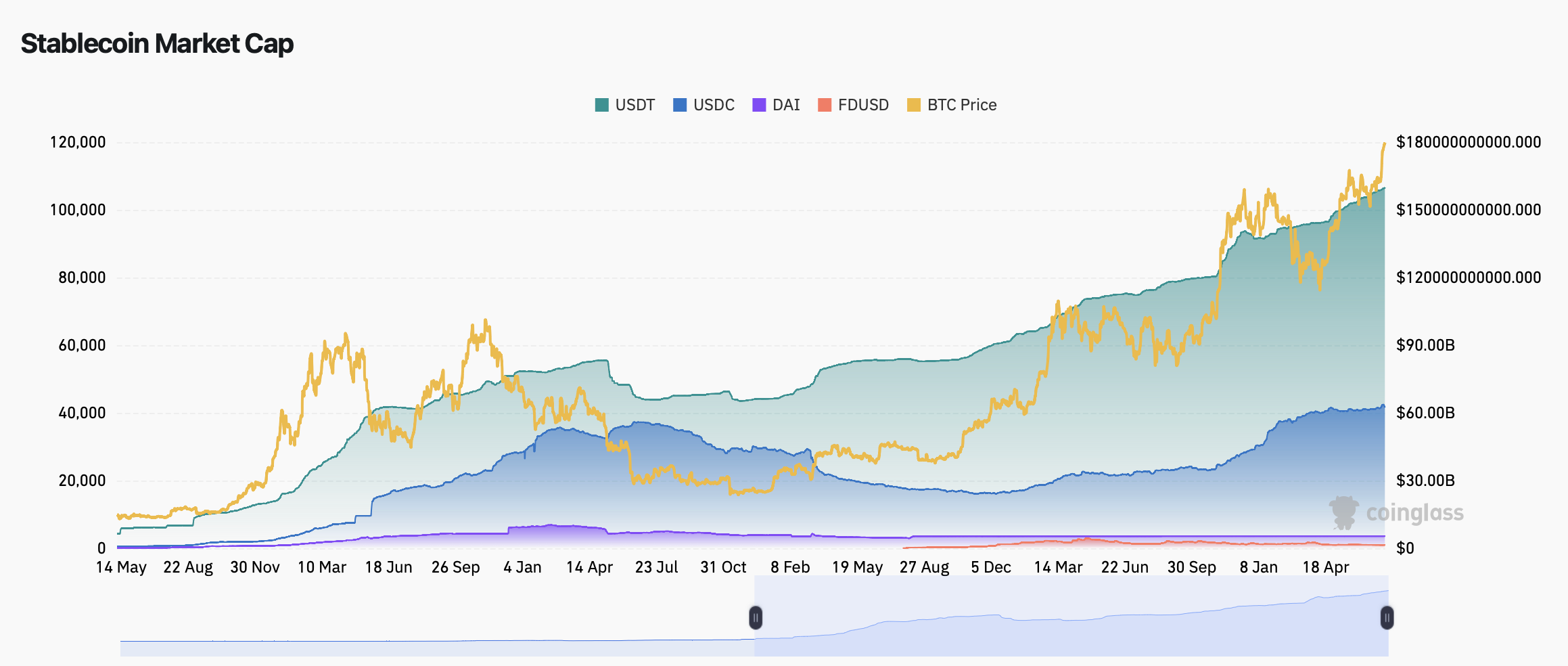

The current market capitalization of USDT is $160,016,749,629.68 and is ranked #4 on CoinMarketCap (as of July 16, 2025).

USDT is the biggest stablecoin in terms of market cap

Key features of USDT

Price Stability:

USDT maintains a 1:1 peg with the US dollar, meaning one USDT is intended to be equivalent to one US dollar. This stability helps protect users from the volatility often associated with other cryptocurrencies, providing a reliable store of value.

Accessibility:

USDT is widely available on numerous cryptocurrency exchanges and is supported by most major platforms. It can be easily traded, converted to other cryptocurrencies, and used for various transactions.

Transaction Efficiency:

USDT transactions are generally faster and cheaper compared to traditional banking systems. This efficiency makes it a suitable option for cross-border payments and remittances, particularly where traditional methods may be slow or expensive.

Versatility:

USDT is used as a trading pair on many cryptocurrency exchanges, allowing users to quickly convert between different cryptocurrencies without needing to convert to fiat currency. It also serves as a convenient way to store value and make payments within the cryptocurrency space.

Multi-chain Support:

USDT is available on various blockchain networks, including Ethereum, Tron, and Solana. This multi-chain support allows users to choose the network that best suits their needs in terms of transaction fees and speed.

Bridge Between Fiat and Crypto:

USDT acts as a bridge between traditional fiat currencies and the cryptocurrency market, providing a stable asset that can be used to enter or exit positions in volatile markets.

How USDT works

When a user sends USD to Tether’s bank account, an equivalent amount of USDT is created using a smart contract. The USD is held in reserve, users can redeem their USDT for USD whenever they wish, and Tether burns the tokens while releasing the corresponding amount of USD from the reserves to the user's bank account.

What is USDC?

USDC was launched in 2018 by Circle and is backed 100% by highly liquid cash or cash-equivalent assets. USDC’s value is always redeemable at a 1:1 ratio with the US dollar. It is also known for its transparency, as Circle regularly conducts third-party audits of its reserves.

The current market capitalization of USDC is $60,134,104,803 and is ranked #7 on

CoinGecko (as of March 28, 2025).

Key features of USDC

Regulatory Compliance: USDC follows strict US and EU regulatory guidelines, making it a safe and compliant choice

Multi-Blockchain Support: Available on Ethereum, Solana, and others.

Wide Adoption: Used across exchanges and DeFi platforms.

Transparency: Regular third-party audits of reserves.

How USDC works

Similar to USDT, USDC works by issuing tokens when a user deposits USD into Circle’s account. The corresponding USDC tokens are created and held in reserve, and users can redeem USDC for USD at any time.

USDT vs. USDC: Comparing Stablecoins

Adoption

Tether, launched in 2014, has enjoyed greater adoption compared to USDC, which debuted in 2018. This longer presence in the market has allowed Tether to attract a larger user base over the years.

Winner: USDT

Reserve assets & transparency

Tether has faced scrutiny and fines for misleading users about its reserves. Investigations revealed that Tether only held 27.6% of the value of its stablecoin in reserves. In contrast, USDC, despite facing its own challenges such as the Silicon Valley Bank crisis, offers monthly third-party assurances of its reserves.

Winner: USDC

Regulatory compliance

All reserves backing USDC are held with regulated financial institutions, ensuring compliance with financial regulations. While Tether claims to follow world-class standardized compliance measures, there's a lack of transparency regarding these measures.

Winner: USDC

Price

Both USDC and USDT are pegged to the value of the US dollar, maintaining a 1:1 ratio.

Winner: Tie

Redemptions

Tether's redemption service requires a minimum of 100,000 USDT ($100,000) with additional verification fees. USDC offers a simpler redemption process with a much lower minimum requirement of $100.

Winner: USDC

De-pegging incidents

Both USDT and USDC have experienced de-pegging incidents in which their value slipped below $1. However, both stablecoins managed to return to their pegged value within a short period.

Winner: Tie

Longevity

Tether has been on the market since 2014, giving it a longer history compared to USDC, which launched in 2018.

Winner: USDT

Safety and transparency

While Tether has faced criticism for its lack of transparency, USDC's parent company, Circle, has consistently provided audited reports on its reserves, offering more transparency to users.

Winner: USDC

| Category |

USDT |

USDC |

Winner |

| Adoption |

Launched in 2014; greater adoption with a larger user base over time |

Debuted in 2018; less adoption compared to USDT |

USDT |

| Reserve assets & transparency |

Faced scrutiny and fines for misleading about reserves; only 27.6% of value held in reserves |

Offers monthly third-party assurances of reserves (despite challenges like the Silicon Valley Bank crisis) |

USDC |

| Regulatory compliance |

Claims to follow world-class compliance measures but lacks transparency |

Reserves held with regulated financial institutions, ensuring compliance |

USDC |

| Price |

Pegged to the US dollar at a 1:1 ratio |

Pegged to the US dollar at a 1:1 ratio |

Tie |

| Redemptions |

Requires minimum 100,000 USDT with additional verification fees |

Simpler process with a lower minimum requirement of $100 |

USDC |

| De-pegging incidents |

Experienced de-pegging (value below $1) but returned to peg quickly |

Experienced de-pegging (value below $1) but returned to peg quickly |

Tie |

| Longevity |

On the market since 2014 (longer history) |

Launched in 2018 (shorter history than USDT) |

USDT |

| Safety and transparency |

Criticized for lack of transparency |

Parent company Circle provides consistent audited reserve reports, offering more transparency |

USDC |

Which is Better: USDC or USDT?

The choice between USDT and USDC comes down to your individual preferences and what aspects you value more. If you prefer a more widely adopted coin, USDT is the better option. If you prefer a more transparent and better-regulated coin, USDC is the better option.

Where Can I Buy USDT & USDC?

You can buy and sell USDT easily on CoinCatch via p2p market, or transactions. Here’s how:

How to buy USDT on CoinCatch:

-

Create an account on CoinCatch, or log in to your existing one;

-

-

Choose your preferred payment method and complete your purchase.

Learn more:

How to buy USDC on CoinCatch:

-

Create an account on CoinCatch, or log in to your existing one;

-

-

Choose USDC/USDT and complete your purchase.

Learn more:

References:

CoinCatch Team

Disclaimer: Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.