Plasma is a layer 1 blockchain designed for seamless, low-cost

stablecoin payments

, enabling fast, fee-free cross-border transactions backed by stable currencies, such as the US dollar. Unlike general-purpose blockchains with high fees and limited scalability, Plasma optimizes for stablecoins, powering trading and everyday crypto spending.

In this article, we will break down what Plasma is all about, its standout features, how it works under the hood, and why it could revolutionize global payments. We'll also discuss its native token, XPL. By the end, you'll see how Plasma fits into the bigger stablecoin story and why it's worth keeping an eye on.

What is Plasma (XPL)?

Plasma is a fast layer 1 blockchain designed for transferring stablecoins globally without the typical headaches. Think of it as a highway built specifically for delivery trucks, efficient, reliable, and optimized for heavy loads. Its main goal? To make stablecoin transactions smooth, affordable, and safe, whether you're sending a few bucks to family overseas or handling big business deals.

What gives Plasma tokens their edge is the support from industry heavyweights. Investors such as Founders Fund, Framework, and Bitfinex have thrown their weight behind it, and it has strong ties to Tether, the company behind USDT, the largest stablecoin in the market. Unlike general-purpose chains like Ethereum or Solana, which juggle NFTs, DeFi, and other applications, Plasma focuses on stablecoins. That means every bit of its design, from the code to economics, is fine-tuned for high-volume payments that need to be quick and cheap.

The native token, XPL, plays a key role here. It's what fuels transactions on the network, rewards those who keep it running securely, and will eventually let holders have a say in how things evolve.

How Plasma Works & Core Features

Plasma's engineering design focuses on speed, low cost, and stability in digital dollar transfers. At its core is a new consensus mechanism called PlasmaBFT, a Proof-of-Stake (PoS) system designed for the fast and secure processing of high-frequency stablecoin transactions.

One of Plasma's most compelling promises is zero-fee USDT transfers. At launch, users will be able to transfer Tether USDT on-chain for free through the Plasma dashboard, without incurring transaction fees. This feature significantly lowers the barriers to cross-border payments and everyday transfers, and distinguishes Plasma from publicly available first-tier chains like Ethereum, where gas fees often fluctuate.

Stablecoin-Native Contracts

Zero-Fee USDT Transfers: Plasma’s paymaster contracts handle fees, allowing users to transfer USDT without incurring gas fees.

Custom Gas Tokens: Users can pay gas in USDT, BTC, or other tokens, in addition to using XPL for fees.

Confidential Payments (under development): A module for privacy-preserving stablecoin transfers is being built, enabling confidential payrolls, settlements, and treasury transactions.

EVM Compatibility

Plasma is fully Ethereum-compatible, meaning developers can deploy dApps and smart contracts without changing their code. Tools like Hardhat, Foundry, and MetaMask work out of the box.

Native Bitcoin Bridge

Plasma (XPL) integrates a trust-minimized Bitcoin bridge, enabling BTC to be securely transferred into

Plasma’s EVMenvironment without requiring custodians. This enables BTC-backed stablecoins and cross-asset financial applications.

Integrated Infrastructure

Developers gain access to card issuance, on- and off-ramps, and compliance tools through third-party providers. This makes Plasma an end-to-end solution for financial applications.

XPL Token: Powering the Plasma Ecosystem

The XPL token is central to Plasma’s design.

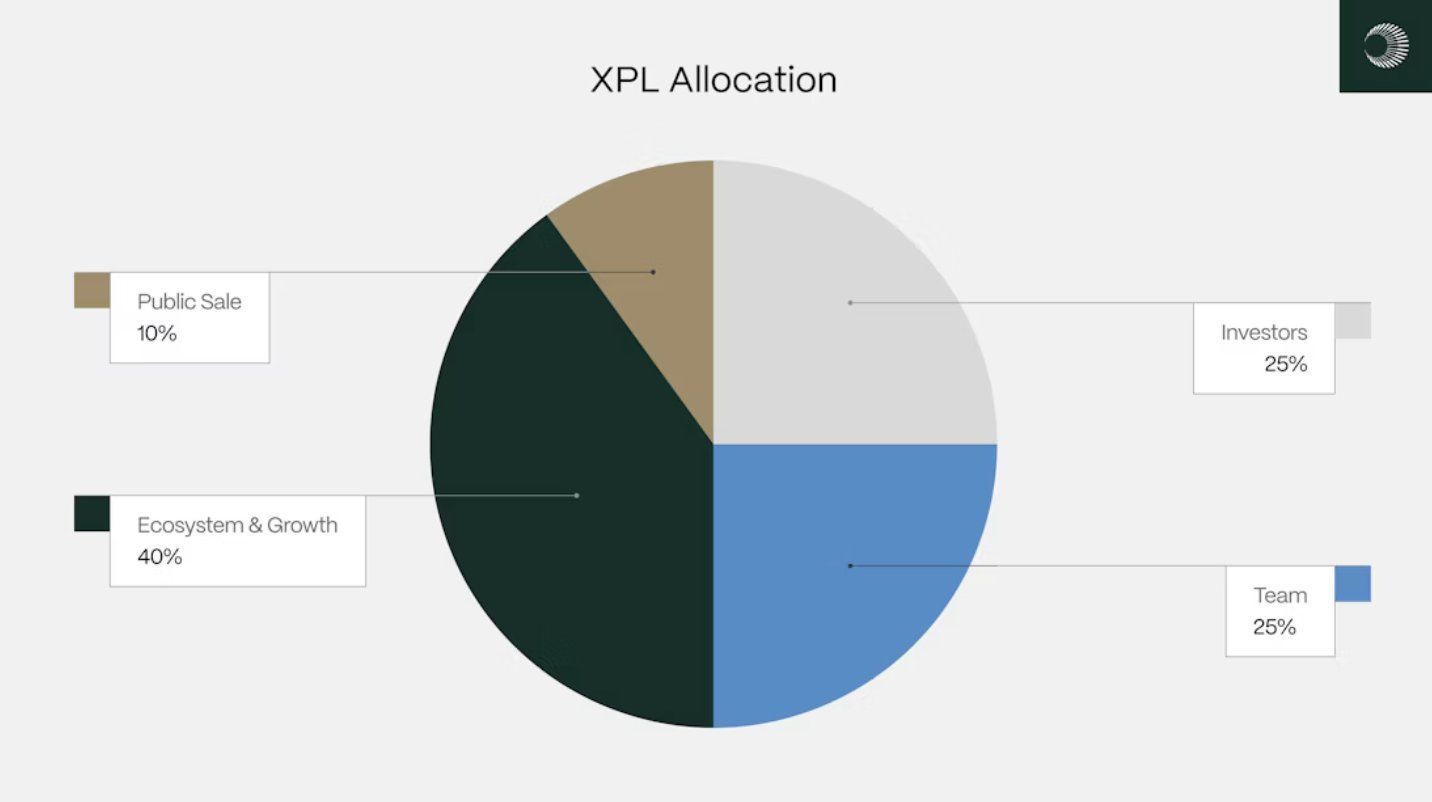

Tokenomics

Initial Supply: 10 billion XPL.

Public Sale: 10% (1 billion XPL) allocated for public participants. Purchases in the U.S. remain locked until July 28, 2026.

Ecosystem & Growth: 40% (4 billion XPL) dedicated to incentives, partnerships, and liquidity support.

Team & Investors: 25% each (2.5 billion XPL), subject to vesting schedules.

Validator Rewards and Inflation

Rewards begin with 5% annual inflation, gradually decreasing to 3% over time.

Plasma follows the EIP-1559 fee-burning model to balance emissions and reduce long-term inflation.

Staking and Delegation

Validators stake XPL to secure the network.

Delegation will allow XPL holders to stake indirectly and earn rewards.

The Plasma Mainnet Beta Launch

On September 25, 2025, the blockchain ecosystem welcomed Plasma, a project that entered the market with substantial backing and ambitious goals. Conceived as a specialized Layer-1 blockchain for stablecoin transactions, Plasma's mainnet beta launch was accompanied by the distribution of its native token, XPL . The project is strategically supported by Tether, the issuer of USDT, and Bitfinex, providing it with a level of institutional credibility rarely seen at launch .

The core promise of Plasma is to address the inefficiencies of existing networks like Ethereum by offering fee-free transfers of stablecoins like USDT and supporting up to 1,000 transactions per second (TPS) . This focus on cost and scalability is aimed directly at high-frequency trading and payment use cases. At launch, Plasma was positioned to become the eighth-largest blockchain by stablecoin liquidity from day one, boasting over $2 billion in Total Value Locked (TVL) and integrations with more than 100 DeFi protocols, including major names like Aave and Ethena .

The XPL token has a total supply of 10 billion units and serves multiple functions within the network, including securing the network through validator staking, enabling governance, and incentivizing application developers and users . The initial fully diluted valuation (FDV) was estimated to be between $500 million and $4.5 billion, reflecting high market interest . A significant aspect of the launch was the distribution of 27.5 million XPL tokens to reward early community members, though tokens for U.S. participants were delayed due to regulatory compliance until July 2026 . This major infrastructure launch provides a new foundation upon which DeFi applications, including Perp DEXs, can build.

Conclusion

The launch of Plasma's mainnet and the sustained dominance of Perp DEXs mark a critical inflection point for decentralized finance. We are moving into an era where specialized infrastructure and sophisticated financial applications are merging to create a viable alternative to the traditional financial system. The success of projects like Aster and edgeX proves that decentralized platforms can not only attract users but also generate substantial, real-world revenue.

For the broader cryptocurrency market, this trend signifies a profound shift towards a more open, accessible, and transparent financial ecosystem. The "Perp DEX era," as proclaimed by CZ, is more than a passing trend; it is a fundamental restructuring of how trading occurs, empowering users and pushing the boundaries of what is possible in decentralized finance. While risks remain, the combination of robust infrastructure and innovative applications positions this sector as a primary engine for the next phase of crypto adoption.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.