On September 26, Bitcoin (BTC) fell below the crucial psychological level of $110,000, while Ethereum (ETH) plummeted even further, falling by over 6% to below $3,900. Other major cryptocurrencies, such as Solana (SOL), also saw significant declines. These sharp declines triggered massive liquidations. In the past 24 hours,

over 260,000positions globally were liquidated, totaling

$1.202 billion , with the majority of these losses occurring in long positions. Meanwhile, WorldLibertyFinancial (WLFI) announced the initiation of a WLFI token buyback and burn program. The Plasma blockchain's mainnet Beta has officially launched, accompanied by the simultaneous listing of the XPL token on multiple exchanges. Canada's financial intelligence regulator has imposed a C$19.5 million ($14.1 million) penalty on KuCoin for failing to comply with the country's anti-money laundering and terrorist financing laws.

Crypto Market Overview

BTC (-1.92% | Current Price: $109,526.26)

Bitcoin fell 1.92% to $109,526 over the past 24h. BTC recently peaked and retreated, currently stabilizing slightly at $109,577. Short-term moving averages are converging, creating a strong bearish sentiment and increasing trading volume. If it fails to break through $110,000, it is likely to remain volatile and weak in the short term, with support levels between $109,000 and $108,600 under scrutiny. A break below this could test the previous low of $108,615.8. On September 25th, BTC ETFs saw a net outflow of $253.4 million, including $114.8 million outflow from Fidelity's FBTC.

ETH (-2.03% | Current Price: $3930.22)

Ethereum fell 2.03% over 24h. ETH continues its downward trend, currently stabilizing at $3,870. Short-term moving averages are moving in bearish territory, with increased trading volume. If it fails to hold above $3,950, it could continue to decline towards $3,800 support, with $3,700 a target. A break above $4,050 could signal a correction. ETH ETFs saw $251.2M outflows on September 25th , and Fidelity's FETH saw an outflow of 158.1 million.

Altcoins

The current Crypto Fear & Greed Index (CFI) is 32, indicating a fear-driven market. Most major altcoins were weak overall today, with slight declines, as market sentiment shifted toward caution. Affected by significant deleveraging and capital outflows this week, the global crypto market capitalization declined by approximately 3% over the past 24 hours, with both Bitcoin and Ethereum experiencing a correction, putting pressure on overall altcoin performance.

Macro Data

The final GDP figure for the second quarter of the United States was revised upward significantly to

3.8% (previous value: 3.3%), a nearly two-year high. Exceptionally strong economic data (GDP, employment) dampened the market's optimistic expectations that the Federal Reserve would quickly cut interest rates. Coupled with political uncertainty, this has led to a decline in risk appetite and a withdrawal of funds from high-risk assets such as cryptocurrencies. Gold is currently trading at $3,745.07, up 0.13%. On September 25th, the S&P 500 declined by 0.50% to 6,604.72 points; the Dow Jones Industrial Average decreased by 0.38% to 45,947.32 points, and the Nasdaq Composite decreased by 0.50% to 22,384.70 points.

Trending Tokens

SQD Subsquid (+73.19%, Circulating Market Cap: $101.89 Million)

SQD is trading at $0.1342, up approximately 73.19% in the past 24 hours. Subsquid Network is an innovative decentralized data lake and query engine designed to offer developers performant and permissionless access to data, aiming to build a neutral and open internet rooted in Web3 principles. Secured by ZK proofs, the Subsquid network boasts a modular architecture that enables exceptional scalability and developer convenience optimized for blockchain indexing, dApp development, and analytics. The public acquisition of SQD tokens by a German public company and its planned rebranding went far beyond typical community support, signaling substantial recognition from traditional finance for the SQD project and its underlying AI+blockchain narrative . This endorsement from traditional capital significantly boosted market confidence and served as the core catalyst for this recent surge.

HIPPO sudeng (+22.7%, Circulating Market Cap: $32.13 Million)

HIPPO is trading at $0.002856, up approximately 30.1% in the past 24 hours. $HIPPO is a fan-created memecoin on SUI that celebrates the adorable Su Deng, the cutest hippo in the world. Under new community-driven management, the project donates a portion of its profits to global wildlife causes, starting with Khao Kheow Open Zoo, home to Moo Deng. The most direct driving force behind today's rise comes from its unique community culture. The inspiration for the HIPPO token, a pygmy hippo named Moo Deng, celebrated its first birthday. This seemingly simple event is of great significance in the memecoin ecosystem, sparking enthusiastic celebrations in the community and widespread dissemination on social platforms. This viral effect significantly increased the token's popularity and market sentiment.

SPK Spark (+18.77%, Circulating Market Cap: $96.78 Million)

SPK is trading at $0.05574, up approximately 18.77% in the past 24 hours. Spark is an onchain capital allocator, with $3.86B deployed across DeFi, CeFi, and RWA. It unlocks capital efficiency at scale, auto-balancing allocations based on market conditions while maintaining a conservative risk profile. Project mission: Spark was created to solve DeFi’s core inefficiencies: fragmented liquidity, unstable yields, and idle stablecoin capital. SPK became tradable on Indodax (Indonesia’s largest exchange) on September 23, enabling IDR/USDT pairs. The announcement triggered a 655B IDR ($42M) trading volume surge – 38% of SPK’s market cap. This move access to Indonesia’s 280M population fueled speculative buying, amplified by local media coverage. SPK’s price ($0.056) remains 70% below its July 2025 ATH ($0.1865), attracting bargain hunters.

Market News

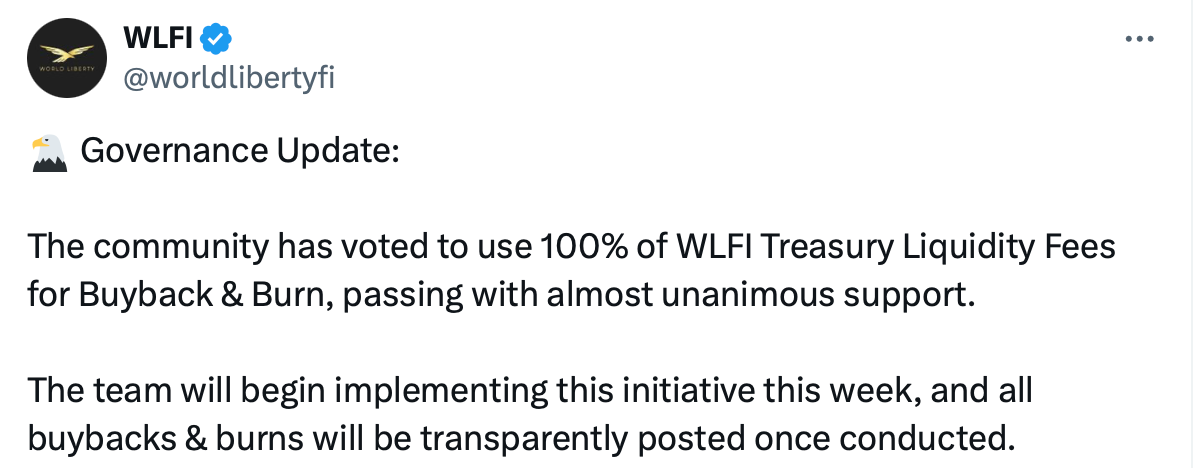

WLFI Will Begin Its Buyback Program This Week

This week, WorldLibertyFinancial (WLFI) is making headlines with a significant move: the initiation of a WLFI token buyback and burn program. This development is poised to create a ripple effect on the project and its community.

WorldLibertyFinancial (WLFI) recently announced on X that it will begin buying back and burning its native tokens. This isn’t just an arbitrary decision; it’s a strategic move following the unanimous passage of a governance proposal. The core of this initiative involves allocating all protocol-owned liquidity fees specifically for this purpose. These are funds generated by the WLFI protocol itself, often from transaction fees or other operational activities. Instead of being used for other purposes, they are now dedicated to reducing token supply.

The commitment to a transparent WLFI token buyback process means that details will be openly shared, fostering trust and accountability within the community.

The implementation of a WLFI token buyback strategy is not an isolated event; it reflects a broader evolution in the DeFi space. Many projects are moving towards sustainable economic models that reward long-term holders and reduce inflationary pressures. Token buybacks, often funded by protocol revenue, are a key component of these strategies.

Source: @worldlibertyfi X account

Plasma Launches Mainnet and XPL Token

The Plasma blockchain's mainnet Beta has officially launched, accompanied by the simultaneous listing of the XPL token on multiple exchanges. On its first day, XPL's market capitalization surpassed $2.4 billion, with its price surging by over 50%. Notably, all users who participated in the pre-deposit program received an airdrop of 9,304 XPL tokens, equivalent to approximately $8,390 at current prices, even if they did not actually purchase XPL during the ICO. This generous distribution model significantly boosted community participation and garnered significant interest in Plasma during its initial launch. Furthermore, Plasma also launched its native banking and card services for the Plasma One stablecoin, supporting zero-fee USDT transfers (limited to base stablecoin transfers), enhancing payment and usage scenarios.

Leveraging Tether's funding and ecosystem support, Plasma boasts significant scale and liquidity from the outset, making it a natural attraction for DeFi projects. The generosity of its airdrops not only enhances the returns experienced by early users but also strengthens community cohesion. In the short term, XPL is expected to become a hotspot for investment; in the long term, its success depends on whether Plasma can establish differentiated advantages in cross-chain payments, stablecoin liquidation, and community governance.

Crypto Exchange KuCoin Appeals $14 Million Penalty from Canadian Regulator Over AML Violations

Canada's financial intelligence regulator has imposed a C$19.5 million ($14.1 million) administrative monetary penalty on crypto exchange KuCoin for failing to comply with the country's anti-money laundering and terrorist financing laws. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) announced on Thursday the penalty imposed against Peken Global Ltd., KuCoin's operating entity, on July 28, 2025.

Specifically, the regulator found that the firm failed to register in Canada as a foreign money services business, neglected to report large cryptocurrency transactions exceeding C$10,000, and did not file suspicious transaction reports.

KuCoin swiftly challenged the penalty, stating that it had filed an appeal with the Federal Court of Canada. In a statement released on Thursday, KuCoin said that it "respects the decision-making process and remains committed to regulatory compliance and transparency," but disputed FINTRAC's classification of KuCoin as a foreign money services business and called the penalty "excessive and punitive." "We disagree with this decision on both substantive and procedural grounds, and we have pursued legal avenues by submitting an appeal before the Federal Court of Canada to ensure a fair outcome for KuCoin," KuCoin CEO BC Wong said in a post on X.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.