The decentralized finance (DeFi) landscape in 2025 is witnessing a paradigm shift, moving beyond the limitations of early protocols to deliver institutional-grade performance. At the forefront of this transformation is

Hyperliquid (HYPE)

, a decentralized perpetual trading platform that has rapidly emerged as a dominant force. With a core team of just

11 people

, Hyperliquid has achieved staggering growth, processing a record

$330 billion in monthly trading volume

and briefly surpassing traditional finance giant Robinhood. Its ability to combine the speed and efficiency of centralized exchanges with the transparency and self-custody of DeFi has positioned it as a project to watch. This article explores the Hyperliquid ecosystem, its innovative technology, the role of its HYPE token, and its potential future trajectory.

What Is Hyperliquid?

Hyperliquid is a

decentralized exchange (DEX) specifically built for trading perpetual futures contracts. It operates on its own

custom-built Layer 1 (L1) blockchain, which is meticulously optimized for high-frequency trading and derivatives. Unlike many earlier DEXs that relied on Automated Market Makers (AMMs), Hyperliquid utilizes a central limit order book that is entirely on-chain, ensuring full transparency and verifiability of every trade.

The platform's architecture is a key differentiator. It consists of two main components that work in tandem under a single consensus mechanism, HyperBFT:

-

HyperCore: This is the engine of the exchange, handling the on-chain order book, margin, matching, and settlement of perpetual contracts.

-

HyperEVM: An EVM-compatible smart contract layer that shares consensus with HyperCore. It allows developers to build and deploy general-purpose applications that can natively interact with the exchange's state and liquidity.

This technical foundation enables Hyperliquid to offer a trading experience rivaling top centralized exchanges, with a median transaction latency of just

0.2 seconds and the capacity to handle up to

200,000 orders per second.

What's the Feature?

Several innovative features have been instrumental in Hyperliquid's rise to dominance in the decentralized perpetual market, which it commands

70-80% of.

Unmatched Speed and Performance: Hyperliquid's custom L1 blockchain, with its HyperBFT consensus, is the cornerstone of its performance. It achieves

sub-second finality (0.2 seconds median latency) and can process up to

200,000 orders per second. This high throughput is essential for supporting high-frequency trading strategies and providing a seamless user experience.

Transparent On-Chain Order Book: All trading operations—order submission, matching, and settlement—occur on-chain. This provides traders with

verifiable transparency, a significant advantage over the opaque off-chain order books used by some hybrid exchanges. It reduces the risk of manipulation and builds trust among users.

The Hyperliquidity Provider (HLP) Vault: The HLP mechanism is a cornerstone of Hyperliquid's liquidity and ecosystem. Users can deposit funds into these protocol-managed vaults, which provide liquidity for trading and act as the counterparty for perpetual swaps. In return, depositors earn a share of the trading fees and the vault's performance. This model has created a powerful flywheel effect, attracting significant capital to the platform.

Novel Token Listing via Dutch Auctions: Hyperliquid has replaced the often opaque token listing processes of traditional exchanges with a transparent, market-driven

Dutch auction system. A new listing slot is auctioned approximately every 31 hours, creating a scarcity-driven model that has attracted significant interest from various projects.

USDH Stablecoin Initiative: A major recent development is Hyperliquid's move to launch its own native stablecoin,

USDH. This initiative aims to replace the platform's current reliance on the externally issued USDC stablecoin. With over

$5.5 billion in USDC deposits on the platform, issuing USDH would allow Hyperliquid to capture the substantial yield generated from these reserves and recycle it back into its own ecosystem, creating a closed-loop financial system. Native Markets recently won a competitive governance auction to be the issuer of USDH.

Overview of HYPE Tokens

What Is HYPE?

HYPE is the

native utility and governance token of the Hyperliquid network. It is integral to the platform's operation and ecosystem incentives. The token was initially distributed through a massive

genesis airdrop in November 2024 to approximately 94,000 early user wallets, with an average distribution worth between $45,000 and $50,000 per participant. This generous and broad distribution helped align incentives with a large user base from the outset.

HYPE Tokenomics

HYPE has a

genesis total supply of 1 billion tokens. A significant portion,

38% (380 million HYPE), is reportedly reserved for future growth incentives. The tokenomics model is designed to create a sustainable flywheel effect that benefits active participants.

A critical mechanism is the

Assistance Fund. An impressive

93% of all protocol fees are allocated to this fund, which uses the revenue to

buy back and burn HYPE tokens from the open market. This creates deflationary pressure on the token's supply. The remaining

7% of fees are distributed to the HLP vaults, incentivizing liquidity providers.

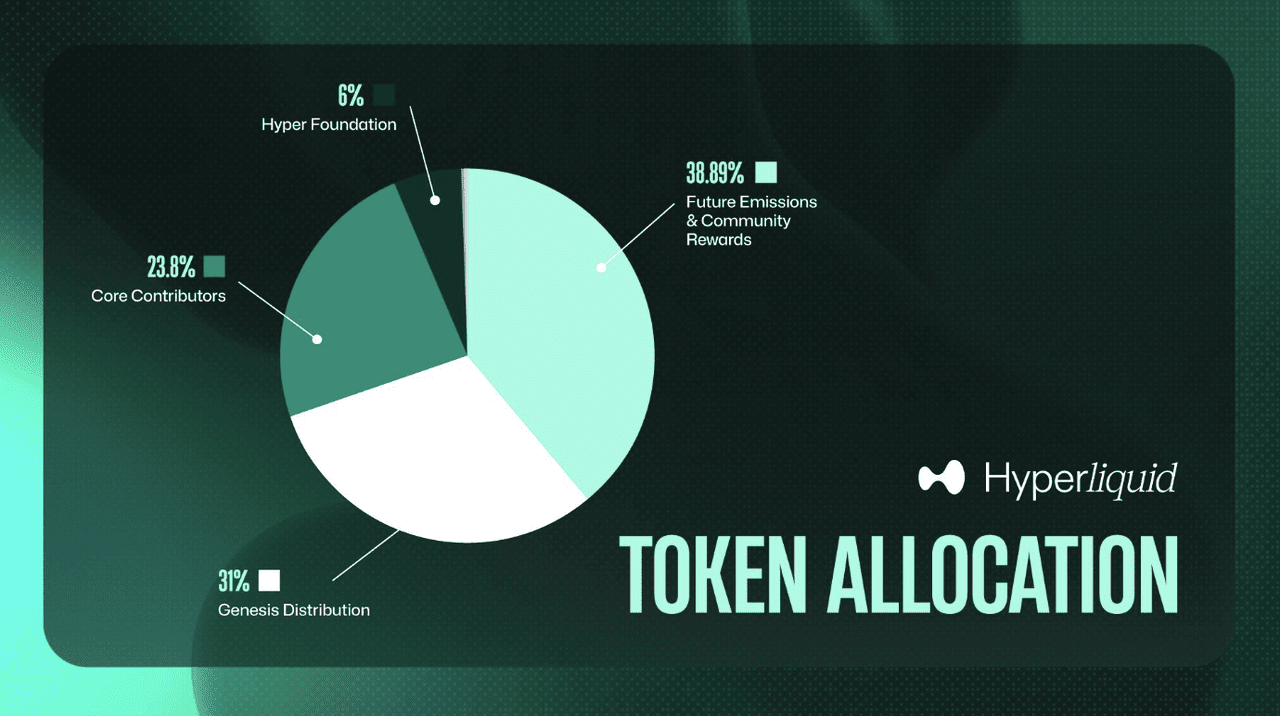

HYPE Allocation

• 38.89% reserved for future emissions and community rewards

• 31.00% distributed at genesis (November 29, 2024)

• 23.80% allocated to current and future core contributor

• 6.00% assigned to the Hyper Foundation budget

• 0.30% set aside for community grants

• 0.012% allocated via HIP-2 governance proposal

HYPE is used for:

Paying transaction fees on the network.

Staking in the HyperBFT proof-of-stake consensus mechanism to secure the network.

Governance, allowing holders to vote on key protocol decisions and improvements.

Price Prediction

Price predictions for HYPE vary widely, reflecting the inherent volatility of crypto assets and differing analytical perspectives.

Short-Term (2025): Some analytical models, like those from CoinCodex, suggest a potential year-end average price target around

$41.15, representing a potential ROI of nearly

23% from levels around that forecast period. It's crucial to note that short-term technical analysis in September 2025 indicated some potential for a retracement towards

$25-$50 support levels after a significant price advance.

Long-Term (Bullish Case): Extremely optimistic forecasts have been voiced by prominent figures. BitMEX co-founder Arthur Hayes has projected that HYPE could reach

$5,000 per token, building on earlier forecasts of

126x gains within three years. These predictions are based on Hyperliquid's potential to continue capturing market share from giants like Binance and its strong fundamental revenue generation.

Latest News

Hyperliquid has been at the center of several significant recent developments:

Record-Breaking Trading and Revenue: In August 2025, Hyperliquid generated a record

$106 million in revenue, a 23% increase from July, driven by nearly

$400 billion in perpetual contract trading volume.

USDH Stablecoin and Native Markets Win: The selection of

Native Markets to issue the USDH stablecoin after a competitive auction against heavyweights like Paxos and Ethena is a major milestone. USDH is expected to enter testing shortly, aiming to capture value within the Hyperliquid ecosystem.

Phantom Wallet Integration: A key partnership with

Phantom Wallet has significantly boosted user adoption. Reports indicate this integration brought in

26.6 billion in trading volume and approximately

20,900 new usersshortly after going live.

Institutional Recognition: The platform's growth has attracted institutional interest.

21Shareslaunched an exchange-traded product (ETP) tied to Hyperliquid on the Swiss SIX exchange, lending it credibility in traditional finance circles.

Conclusion

Hyperliquid has undeniably established itself as a

formidable disruptor in the DeFi derivatives space. Its technical prowess, demonstrated by its high-speed, custom L1 blockchain and fully on-chain order book, provides a

compelling alternative to both traditional centralized exchanges and slower, first-generation DEXs. Features like the HLP vaults and Dutch auction listings foster a strong, community-aligned ecosystem.

The introduction of the

USDH stablecoin represents a strategic move to create a more self-sustaining economic loop within its ecosystem. Furthermore, the tokenomic model that directs

93% of fees to buybacks demonstrates a strong commitment to valuing the HYPE token.

However, challenges remain. The impending

large token unlock poses a significant test for HYPE's price stability. Questions surrounding

validator decentralization and the constant evolution of

competitive threats are persistent risks.

In conclusion, Hyperliquid's blend of cutting-edge technology, innovative economic models, and impressive traction makes it a project with significant potential. Its success will ultimately hinge on its ability to navigate the challenges ahead, continue innovating, and solidify its position in the increasingly competitive world of on-chain finance. If it succeeds, it could fundamentally reshape how derivatives trading occurs in the decentralized digital asset world.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.