On September 16, the cryptocurrency market is exhibiting cautious optimism, with both Bitcoin (BTC) and Ethereum (ETH) showing slight price decreases. Bitcoin is trading at around $115,797.22 (-0.12%), while Ethereum is at $4,506.64 (-2.34%). The overall market capitalization is reported to be around $4 trillion. Meanwhile, Base is reportedly "beginning to explore" launching a native token, which is a reversal from Coinbase's previous stance; pump.fun's protocol revenue has surpassed Hyperliquid's at $3.12 million in the last 24 hours, according to Defillama data; PayPal announced it will expand its peer-to-peer payment service to include cryptocurrency transfers.

Crypto Market Overview

BTC (-0.12% | Current Price: $115,797.22)

After a brief surge, BTC prices retreated and are currently fluctuating around $115,000. The intraday high reached $116,740, but subsequently retreated under pressure, indicating a short-term consolidation trend at a high level. Overall, bullish momentum has weakened. If the $116,000 mark cannot be effectively broken, the price may fluctuate between $114,000 and $116,000. The market is focused on whether it can stabilize below and build momentum for another upward move. On September 15th, BTC ETFs saw a net inflow of $259 million, including $261 million into BlackRock's IBIT and $7.5 million into Fidelity's FBTC, indicating that institutional funds are increasing their Bitcoin holdings and strengthening their allocation to the asset.

ETH (-2.34% | Current Price: $4,506.64)

ETH performed relatively weakly today, with prices quickly retreating after hitting $4,660 and currently trading around $4,500. While it has found support between $4,480 and $4,500 on a number of occasions in the short term, overall downward pressure remains substantial. A subsequent resurgence above $4,550 could alleviate the downward trend; conversely, a break below $4,480 could trigger a test of lower levels. On September 15th, ETH ETFs saw a net inflow of $359 million, with BlackRock ETHA receiving $363 million and Fidelity FETH receiving $1.35 million in outflows.

Altcoins

Altcoins are experiencing mixed but largely positive signals, with institutional interest driving momentum, especially in Solana (

SOL), and regulatory developments impacting market sentiment. While overall crypto market volatility is low, certain altcoins are showing significant gains and losses. The Fear and Greed Index, at 50, remained within normal range, indicating that market sentiment had eased relative to previous overheating.

Macro Data

Central bank decisions are dominating the macroeconomic landscape this week, particularly the Federal Reserve's (Fed) meeting. The market is pricing in a high probability of a 25 basis point interest rate cut by the Fed, lowering the target range to 4.00%–4.25%. This is influenced by a weakening labor market and cooling inflation data, although some inflation concerns persist. Gold is experiencing a multi-faceted rally, reaching a record high on Monday, September 15, 2025, closing at $3,720 per ounce. Futures contracts for December delivery also closed higher at $3,721.20. On September 15, the S&P 500 rose 0.78% to 6,615.28 points; the Dow Jones Industrial Average rose 0.11% to 45,883.45 points; and the Nasdaq Composite Index rose 0.94% to 22,348.75 points.

Trending Tokens

ZORA ZORA (+21.47%, Circulating Market Cap: $257.3 Million)

ZORA is trading at $0.07805, up approximately 21.47% in the past 24 hours. ZORA is an onchain social network that transforms social media interactions into tradable assets, enabling creators to monetize content through tokenization and decentralized markets. ZORA tokenizes social media activity: every post becomes an ERC-20 token (1 billion supply) linked to a creator’s profile coin. As engagement grows, both the post token and creator coin gain value, traded via Uniswap pools. Creators earn 1% of every trade in $ZORA (Zora), aligning incentives between content creation and financial rewards. ZORA broke above the $0.095 rounded-bottom pattern target, but the 4-hour RSI hit 72 – its highest since May 2025. While the MACD histogram remains positive (+0.0000545), weakening momentum and $0.143 Fibonacci extension resistance suggest consolidation ahead. Historical data shows 60-70% corrections after similar RSI peaks.

PRAI Privasea AI (+11.09%, Circulating Market Cap: $4.54 Million)

PRAI is trading at $0.01872, up approximately 11.09% in the past 24 hours. Privasea AI (PRAI) is a privacy-focused blockchain project combining confidential AI computation with Proof-of-Humanity verification to secure sensitive data in Web3 applications. The Altcoin Season Index rose to 70 (up 25% weekly), reflecting capital rotation into smaller projects. PRAI’s 24h volume surged 39.6% to $7.8M, outpacing the broader crypto market’s 0.2% decline. AI narratives are resurging, but PRAI’s -88% yearly drop highlights persistent volatility risks. High turnover (1.7x) suggests speculative trading dominates.

AWE AWE (+8.37%, Circulating Market Cap: $145.03 Million)

PRAI is trading at $0.07466, up approximately 8.37% in the past 24 hours. AWE Network is opening the portal to Autonomous Worlds where AI Agents collaborate, adapt and evolve. The Autonomous Worlds Engine (AWE) is a modular framework enabling the creation of self-sustaining worlds for scalable agent-agent and human-agent collaboration. AWE’s August updates highlighted: 10.2K daily active users and 1.6M $AWE locked in its Autonomous Worlds ecosystem and partnership with Coinbase Dev for a NYC Hackathon track (AWE Network).Growing adoption of its AI-driven "worlds" platform validates use cases, but the 24h price move likely prices in older news. Recent social volume (e.g., AMAs) may have reignited retail interest.

Market News

Coinbase-Incubated Base Network 'Beginning to Explore' Native token

Base, the Ethereum-based Layer network incubated by Coinbase, is reportedly "beginning to explore" launching a native token, Base creator Jesse Pollak said at a live-streamed conference on Monday, a reversal from Coinbase's previous stance.

Coinbase representatives had consistently said there were no plans to issue a token for Base, which currently uses ETH as its gas token. The project said it has "no definitive plans to share at this time" regarding a potential token. "Base is a bridge, not an island," Pollak said onstage at BaseCamp, in Stowe, Vermont, discussing how he is aiming to increasingly connect Base to the wider Ethereum ecosystem.

The move comes months after the Ink Foundation, which is shepherding development of the Kraken-incubated Ink L2, disclosed plans to create a non-governmental utility token called INK. Both Base and Ink are part of Optimism's Superchain ecosystem. "When Base launched, our priority was clear: To build a secure, low-cost, developer-friendly chain and ecosystem. Launching a token wasn’t necessary to reach those goals, and we wanted to focus on the core product," the team wrote in a blog on Monday.

Pump.fun Surpasses Hyperliquid in 24-Hour Revenue

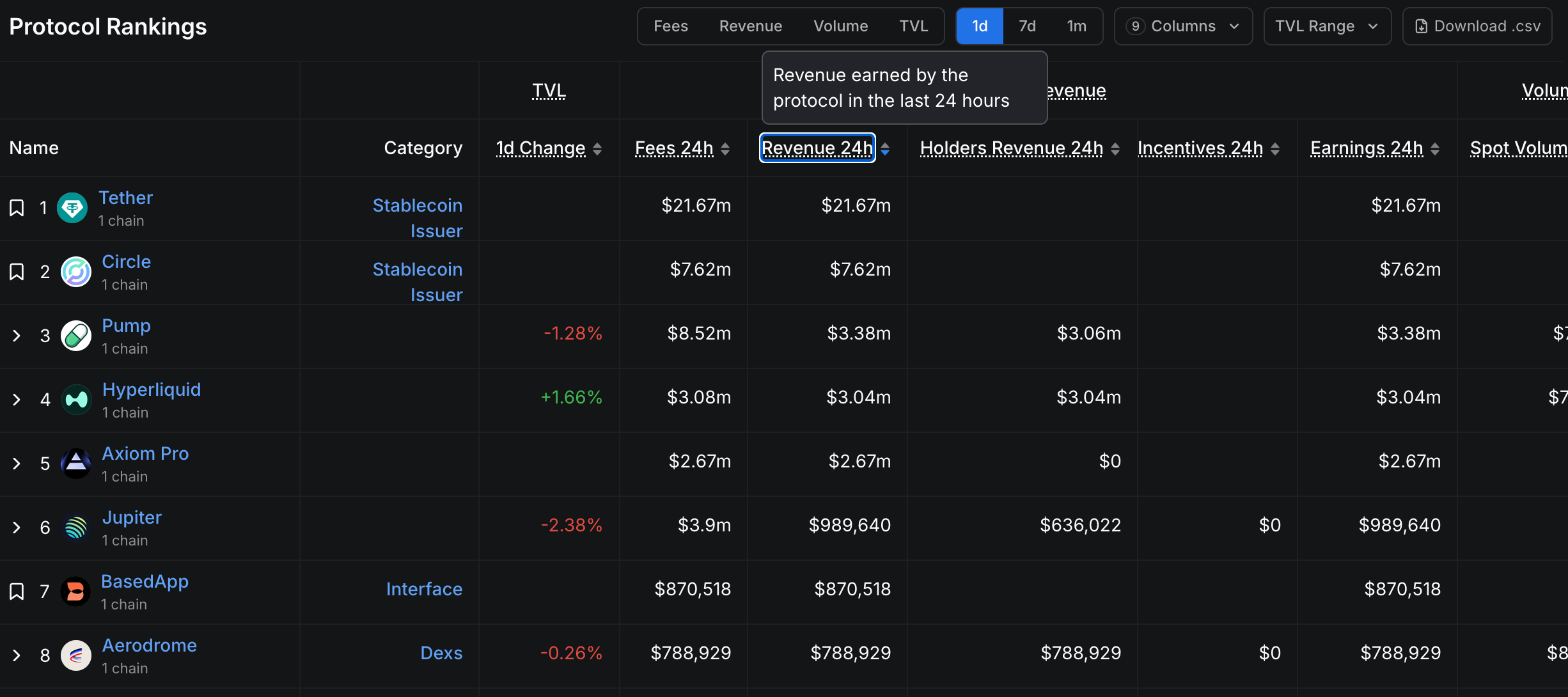

24 Hours Revenue Ranking. Source: DefiLlama

pump.fun's protocol revenue has surpassed Hyperliquid's at $3.12 million in the last 24 hours, according to Defillama data. This is lower than Tether's $21.7 million and Circle's $7.62 million during the same period. pump.fun's revenue is higher than Hyperliquid's $2.48 million, indicating its growing popularity and success in the market.

Pump.fun has achieved a significant milestone in the cryptocurrency market, as its protocol revenue has surpassed that of Hyperliquid in the past 24 hours. According to DefiLlama data, pump.fun generated $3.12 million in revenue within the last 24 hours Native Markets team wins Hyperliquid USDH stablecoin bid, eyes test phase ‘within days’. This figure is notable as it exceeds Hyperliquid's revenue of $2.48 million during the same period, indicating a growing trend in pump.fun's popularity and success.

While pump.fun's revenue is lower than that of Tether ($21.7 million) and Circle ($7.62 million) in the same period, it still signifies a substantial increase in its market presence. This performance underscores pump.fun's ability to attract users and generate significant revenue, positioning it as a notable player in the crypto ecosystem.

Hyperliquid, on the other hand, has been in the news for its USDH stablecoin bid, which was recently awarded to Native Markets. The USDH stablecoin is expected to be launched on Hyperliquid's HyperEVM network, potentially posing a threat to USDC. The currently dominant dollar-backed stablecoin on the platform pump.fun's protocol revenue in the last 24 hours has surpassed Hyperliquid.

PayPal Adding Crypto to Peer-to-Peer Payments, Allowing Direct Transfer of BTC, ETH, Others

PayPal announced it will expand its peer-to-peer payment service to include cryptocurrency transfers. Users will soon be able to send digital assets like Bitcoin (BTC), Ethereum (ETH), and the company's own USD stablecoin, PYUSD, directly between PayPal and Venmo, with interoperability with more crypto wallets gradually becoming available. PayPal also launched a new "PayPal Links" feature, allowing users to generate personalized transfer links and share them via SMS, chat, or email, significantly streamlining the payment process.

This upgrade not only strengthens PayPal's presence in the crypto payments space but also offers tax benefits to users. The company has confirmed that personal cryptocurrency transfers (such as gifts or reimbursements) will not trigger IRS 1099-K reporting requirements, maintaining tax-free status. As PayPal advances its "PayPal World" interoperability initiative and expands its crypto payment network globally, this move is expected to further increase user payment volume and solidify its leading position in the digital currency payments market.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.