The Ethereum Layer 2 (L2) landscape is fiercely competitive, with projects striving to solve the blockchain trilemma of scalability, security, and decentralization. Linea (LINEA), developed by Consensys (the company behind MetaMask and Infura), has emerged as a significant player. Since its mainnet launch in July 2023 and its much-anticipated token generation event (TGE) on September 10, 2025, Linea has garnered attention for its unique Ethereum-aligned approach and community-focused tokenomics. Unlike many L2s, Linea allocated 85% of its total token supply to ecosystem growth, with no allocations to venture capital or insiders. This article explores the Linea ecosystem, its innovative technology, the role of its LINEA token, and its potential future trajectory.

What Is LINEA?

Linea is an Ethereum Layer 2 scaling solution built as a zkEVM (zero-knowledge Ethereum Virtual Machine) rollup. It is designed to scale Ethereum by processing transactions off-chain and submitting cryptographic proofs (zk-proofs) to the Ethereum mainnet for validation. This approach significantly reduces transaction costs and increases throughput while maintaining the security of Ethereum Layer 1.

A key differentiator for Linea is its EVM equivalence. This allows developers to deploy existing Ethereum smart contracts and decentralized applications (dApps) to Linea without any code modifications, making migration seamless and fostering a familiar development environment. The project is developed and incubated by Consensys, a leading blockchain software company founded by Ethereum co-founder Joseph Lubin, which provides it with considerable credibility and technical expertise.

What's the Feature?

Linea incorporates several innovative features that contribute to its growing prominence in the L2 space.

EVM Equivalence and Developer Tools: Linea's full EVM equivalence ensures compatibility with the entire Ethereum toolstack, including MetaMask and Infura. This lowers the barrier to entry for developers and accelerates dApp deployment.

Dual-Burn Tokenomics Model: Linea features a unique economic model designed to create value for both Ethereum and LINEA token holders. The model allocates 20% of gas fees (paid in ETH) to be burned, contributing to Ethereum's deflationary pressure. The remaining 80% of transaction fees are used to buy back and burn LINEA tokens from the open market, creating a deflationary supply dynamic for the LINEA token itself.

ETH as the Gas Token: In a notable departure from some other L2s, Linea uses ETH, not LINEA, for gas fees. This reinforces Ethereum's monetary role and simplifies the user experience for those already familiar with Ethereum.

Strategic Integrations: Benefiting from its Consensys lineage, Linea offers native integrations with products like MetaMask and Infura. This provides developers and enterprises with robust, institutional-grade infrastructure.

Overview of LINEA Tokens

What Is LINEA?

The LINEA token is the native token of the Linea network. However, unlike many other L2 native tokens, LINEA is not used to pay for network transaction fees (gas fees are paid in ETH). Instead, its primary purpose is to incentivize and facilitate ecosystem growth. It functions as a tool for economic coordination, rewarding actual use and participation in the network's development.

LINEA Tokenomics

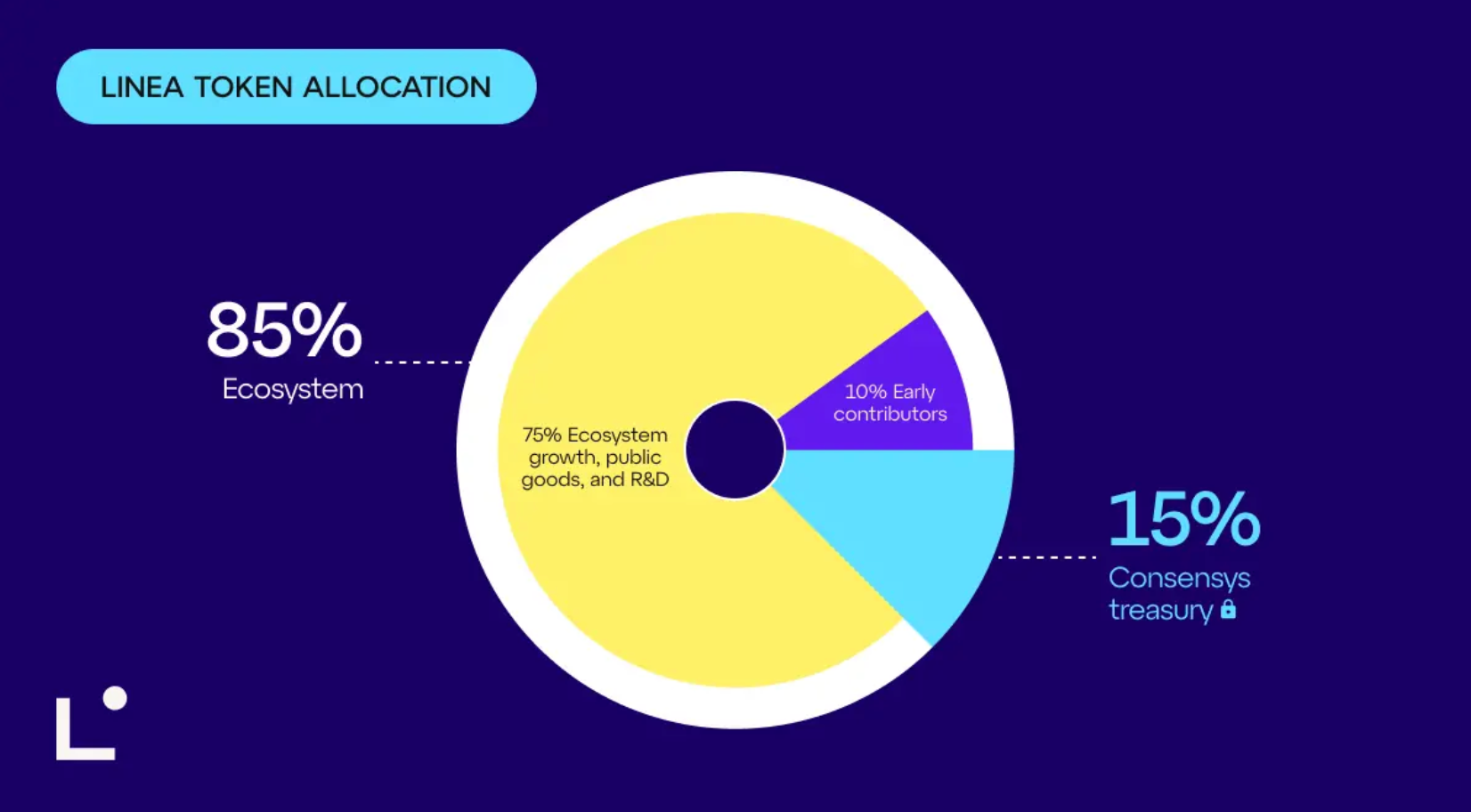

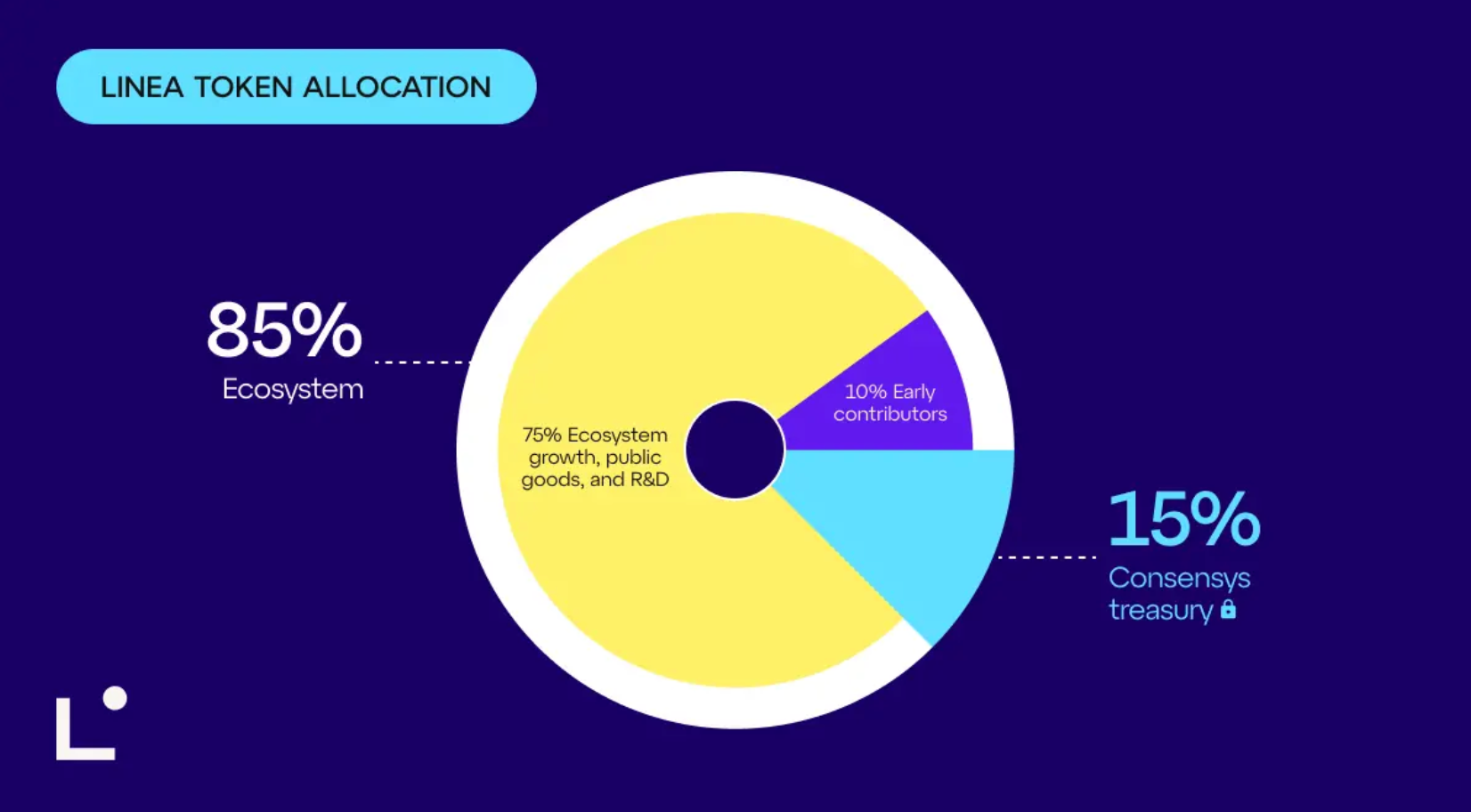

Linea’s total token supply is 72,009,990,000 LINEA, which is 1,000 times the initial circulating supply of ETH. Its allocation echoes Ethereum’s genesis distribution to signal long-term alignment with the broader ecosystem: 85% of the supply is dedicated to the ecosystem, with the remaining 15% allocated to the Consensys treasury. See below for a more detailed breakdown.

-

Ecosystem Growth (85%): The vast majority of tokens are allocated to the ecosystem. This includes:

-

Ecosystem Fund (75%): Managed by the Linea Consortium, these funds are dedicated to long-term development, grants, liquidity initiatives, and public goods, with unlocks scheduled over a decade.

-

Early Contributors (10%): This portion rewards early active users and developers. It includes the 9.36 billion LINEA airdropped to approximately 749,000 eligible wallets based on chain-on activity metrics like LXP (Linea Voyage XP), and 1% for strategic builders. These tokens were fully unlocked at TGE.

-

Consensys Treasury (15%): This allocation is held by Consensys and is subject to a five-year lock-up period, demonstrating a commitment to the project's long-term success.

Circulating Supply at TGE

At TGE, approximately 22% of the total token supply (15.8B LINEA) will be circulating. This includes the early contributor airdrop, ecosystem activation programs, and liquidity provisioning allocations. All other categories remain locked or vest over time.

Price Prediction

Price predictions for LINEA vary, reflecting the inherent volatility of crypto assets and different analytical perspectives. It's crucial to treat these forecasts with caution.

Short-Term (2025): Following its TGE, LINEA's price experienced significant volatility. After initial trading, the token was reported to be trading around $0.0237, with other sources noting a price of $0.02648 and $0.0315 in mid-September 2025. Some technical analyses suggest that if the token can sustain a price above $0.032, it could target the $0.038–$0.042 range by the end of 2025. Key support levels to watch are around $0.028–$0.030.

Long-Term (2026-2030): Some predictive models suggest a gradual appreciation potential if broader market conditions are favorable and adoption metrics improve. Targets based on technical analysis include an average of $0.040 in 2026, $0.045 in 2027, and potentially reaching $0.060 by 2030, with a potential high of $0.085 in a bullish scenario.

These predictions depend heavily on several factors, including the successful execution of Linea's ecosystem incentives, the effectiveness of its deflationary dual-burn mechanism, overall L2 adoption rates, and broader cryptocurrency market sentiment.

Latest News

Linea has been at the center of several significant recent developments:

Token Generation Event (TGE) and Airdrop (September 2025): Linea conducted one of the largest Layer 2 airdrops, distributing 9.36 billion LINEA tokens to approximately 749,000 eligible wallets based on prior network interaction and LXP metrics. The claim window is open for 90 days.

Technical Challenges at Launch: The TGE was not without issues. Linea's main sequencer experienced a performance glitch that halted block production for about an hour shortly before the launch. Once fixed, the network resumed normal operations. The claiming process also saw periods of high gas fees on Ethereum due to high demand.

Exchange Listings: Following the TGE, the LINEA token was listed on several major cryptocurrency exchanges, increasing its accessibility to a broader range of traders and investors.

Joseph Lubin's Reward Hint: Consensys founder Joseph Lubin hinted at an exciting prospect for LINEA holders. He suggested that holding a certain amount of LINEA in a MetaMask wallet for a specific duration could unlock additional rewards, potentially in the form of other tokens from Consensys or ecosystem partners in the future. This has sparked speculation about a potential future MetaMask token ($MASK).

Conclusion

Linea presents a compelling and unique approach within the Ethereum Layer 2 ecosystem. Its technical foundation as a zkEVM rollup with full EVM equivalence, combined with strong backing from Consensys, provides a solid base for development and adoption. Its community-first tokenomics, which excludes VC allocations and directs the vast majority of tokens toward ecosystem growth, is a significant differentiator aimed at fostering long-term, sustainable development.

The innovative dual-burn mechanism aligns incentives between the Linea network, its token holders, and the Ethereum mainnet by creating deflationary pressure on both ETH and LINEA. However, challenges remain, including intense competition from other L2s, the need to increase user adoptionand daily active addresses from recent lows, and the current limited direct utility of the LINEA token itself (as it is not used for gas fees).

Overall, Linea's strategy of positioning itself as an extension of Ethereum rather than a competitor, its commitment to ecosystem development, and its integration with the broader Consensys product suite make it a project with significant potential. Its success will ultimately depend on its ability to execute its roadmap, attract developers and users to its platform, and navigate the evolving competitive and regulatory landscape. If successful, Linea could become a major hub for Ethereum-centric innovation and scalability.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.