Ethena Labs has emerged as one of the most innovative

decentralized finance (DeFi)

protocols in the cryptocurrency space. Launched in 2024, it has rapidly grown to become the

third-largest stablecoin

by market capitalization, with its USDe stablecoin reaching a remarkable

$12 billion in market cap

within just 10 months of launch. What sets Ethena apart is its unique approach to

synthetic dollar creation

through a delta-neutral trading strategy that leverages

crypto derivatives

to maintain price stability while generating yield for holders.

The protocol's native token, ENA, has garnered significant attention from both

retail investors

and

crypto whales

, with its market capitalization reaching approximately

$4.1 billion

and ranking as the 31st largest cryptocurrency by market cap. This article provides a comprehensive analysis of Ethena's ecosystem, tokenomics, price predictions, and the unique role of its USDe stablecoin in the broader DeFi landscape.

Ethena Protocol Overview

Ethena is a

synthetic dollar protocol built on Ethereum that provides

crypto-native solutions for saving, transacting, and trading without relying on traditional banking infrastructure. The protocol's flagship product, USDe, is a

collateralized stablecoin that maintains its peg through a sophisticated

delta-hedging strategy involving both spot assets and short positions in perpetual futures contracts.

The protocol has achieved remarkable milestones in a relatively short time:

-

Fastest stablecoin to reach $5 billion in supply

-

$12 billion+ in annualized revenue as of December 2024

-

Second-fastest crypto startup to reach $100 million in revenue, after Pump.fun

-

Highest revenue per employee among stablecoin protocols

Ethena's ecosystem comprises several key components including

USDe (the core stablecoin),

sUSDe(staked USDe for yield generation),

iUSDe (institutional compliant version), and

USDtb (a separate tokenized treasury product backed by BlackRock's BUIDL).

USDe: The Engine of Ethena's Ecosystem

At the heart of Ethena's ecosystem is USDe, a

synthetic dollar that combines collateralization with

funding rate arbitrage to maintain price stability while generating yield. Unlike traditional algorithmic stablecoins, USDe employs a

delta-neutral strategy where collateral assets are used to open equivalent short positions on perpetual contracts, effectively hedging against price volatility.

The protocol has recently expanded its

acceptable asset framework for backing USDe, with BNB being the first token approved under this new framework. XRP and HYPE have also met the criteria and are strong candidates for future support. This diversification of collateral assets enhances the stability and scalability of USDe.

USDe's growth has been extraordinary, with its market capitalization approaching

$12 billion, making it the third-largest stablecoin behind only USDT and USDC. This rapid adoption is attributed to its

unique value proposition of providing yield in both bullish and market conditions through its innovative mechanism.

Tokenomics and Supply Dynamics

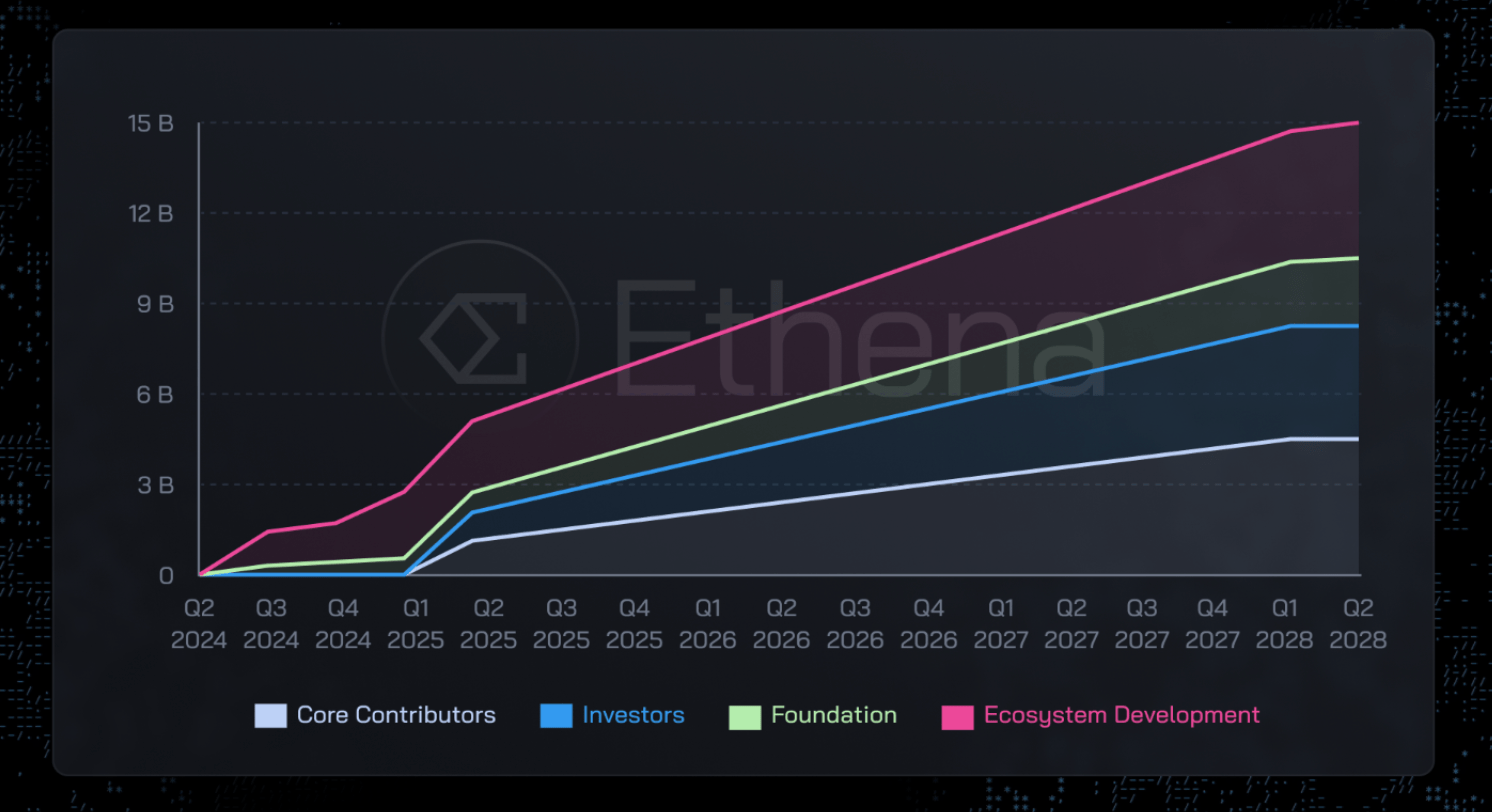

ENA operates with a

total supply of 15 billion tokens, of which approximately

6.62 billion (44.15%) are currently in circulation. The tokenomics model is designed to encourage

long-term participation and ecosystem growth while managing inflationary pressures.

A significant aspect of ENA's tokenomics is the substantial difference between

reported circulating supply figures. While official sources indicate 6.62 billion tokens in circulation, self-reported data suggests only 1.48 billion (9.85%), indicating a possible token lock-up mechanism or vesting plan. This discrepancy suggests significant portions of the supply may be locked in

vesting contracts or

staking mechanisms.

The protocol maintains a healthy

TVL ratio of 0.33, indicating efficient capital utilization relative to market capitalization. With a

Total Value Locked (TVL) of $12.36 billion, Ethena demonstrates strong ecosystem commitment and investor confidence.

Price Analysis and Technical Indicators

ENA's price action has shown significant volatility with a generally bullish long-term trend. Currently trading at approximately

$0.62, the token has experienced a slight correction of

-1.54% in the past 24 hours. However, it has demonstrated impressive

medium-term growth with a

142.86% increase over the past 60 days and a

59.23% gainover the past quarter.

Technical analysis reveals key

support and resistance levels:

Resistance levels: $0.8361 and $1.4046

Support levels: $0.5285 and $0.3296

The

Relative Strength Index (RSI) is currently at 42.9, indicating bearish momentum in the short term but not yet oversold conditions. The

MACD indicator remains below its signal line, suggesting continued downward pressure in the near term.

Whale activity has been particularly notable, with large investors purchasing

over 32 million ENA tokens in a single day and more than

$24 million worth of ENA leaving exchanges in 48 hours. This accumulation by major players suggests confidence in ENA's long-term prospects despite short-term price corrections.

Significant Whale Activity and Market Influence

Large-scale investors have been actively accumulating ENA tokens, demonstrating strong conviction in the protocol's future. On-chain data reveals that whales purchased over

1 billion ENA tokens in recent days, representing a substantial portion of the circulating supply.

This aggressive accumulation has been accompanied by significant

liquidity outflows from exchanges, with more than

$24 million worth of ENA tokens moving off trading platforms in a 48-hour period. Such movements typically indicate investors are moving tokens to long-term storage rather than actively trading them, reducing selling pressure on the market.

The concentration of holdings in wallets containing

between 1 million and 10 million tokens has increased noticeably, suggesting that sophisticated investors are positioning themselves for potential future price appreciation. This whale activity has sparked speculation about whether the current price level represents an attractive accumulation zone despite short-term bearish technical indicators.

Fundraising and Financial Backing

Ethena has secured substantial financial backing from prominent investors. The protocol raised

$100 million in a private ENA token sale with participation from

Fidelity Investments' F-Prime Capital and

Franklin Templeton. This significant fundraising achievement demonstrates strong institutional confidence in Ethena's vision and technology.

More recently, Ethena ecosystem infrastructure company

StablecoinX announced plans to go public on Nasdaq through a

SPAC merger with TLGY Acquisition Corp.. The combined entity will form what's being described as "the first pureplay treasury company" focused on ENA tokens. The deal includes

$360 million in committed PIPE financing, with

$260 million of cash earmarked for purchasing ENA tokens from the Ethena Foundation.

As part of this arrangement, the Ethena Foundation committed to purchasing

$5 million worth of ENA tokens daily for six weeks following the announcement, creating consistent buying pressure on the market. StablecoinX has agreed to hold purchased ENA tokens for multiple years without selling, lending, or otherwise disposing of them without permission from the Ethena Foundation.

Price Predictions and Future Outlook

Analysts have presented various

price forecasts for ENA based on technical analysis and ecosystem developments. For 2025, projections suggest a potential trading range between

$0.8361 and $1.4046, with possibilities of exceeding $5 in the event of a strong altcoin season.

Long-term predictions extend further:

2026: Between $1 and $7

2027: Between $7 and $12

2028: Between $1 and $5

2029: Between $5 and $10

2030: Between $10 and $30

These projections must be considered in the context of Ethena's

ecosystem development and broader

market conditions. The protocol's expansion into traditional finance through iUSDe, the launch of the Converge settlement layer, and integration with Telegram's TON blockchain could all drive increased adoption and value appreciation for ENA.

Critical to ENA's price trajectory will be its ability to maintain its

competitive yield on USDe amidst potential Federal Reserve rate cuts. Ethena's co-founder has described ENA as "the most levered asset to falling interest rates," suggesting significant upside potential in a declining rate environment.

Expanding Ecosystem: Converge, Ethereal, and Traditional Finance Integration

Ethena is rapidly expanding beyond its core stablecoin product into a comprehensive

financial ecosystem. A key development is

Converge, a settlement network for traditional finance and digital assets developed in partnership with tokenization platform Securitize. This blockchain will use

USDe and USDtb as gas tokens and be secured by ENA stakers, aiming to become the convergence point for TradFi and DeFi.

The ecosystem is also launching

Ethereal, a

decentralized exchange supporting spot and perpetual trading with USDe as the base currency. The platform has already attracted

$700 million in TVLduring its testnet phase and has committed to airdropping

15% of its tokens to ENA stakers.

Perhaps most significantly, Ethena is making substantial inroads into

traditional finance through iUSDe—a compliant version of sUSDe with transfer restrictions designed for institutional adoption. This product allows traditional financial entities to gain exposure to crypto-native yields through regulated structures, potentially opening the door to massive institutional capital flows.

Conclusion

Ethena represents one of the most innovative projects in the

DeFi space, successfully creating a

synthetic dollar that generates yield regardless of market conditions through its unique

delta-hedging mechanism. With USDe rapidly growing to become the

third-largest stablecoin and expanding into traditional finance through iUSDe, the protocol is well-positioned for continued growth.

The ENA token serves as both a

governance token and value accrual mechanism within this ecosystem, with significant

whale accumulation suggesting strong confidence from sophisticated investors. While short-term price action shows some weakness, the medium to long-term outlook remains bullish based on

ecosystem development and

expansion plans.

Critical factors to monitor include Ethena's ability to maintain attractive yields amid changing interest rate environments, successful execution of its TradFi integration plans, and broader adoption of USDe across both CeFi and DeFi venues. With

strong institutional backing, a

clear development roadmap, and

innovative products, Ethena has established itself as a fundamental protocol in the cryptocurrency ecosystem that could play a significant role in bridging traditional finance with decentralized applications.

References

Ethena. (n.d.). Tokenomics. Retrieved from https://docs.ethena.fi/ena/tokenomics

Ethena. (n.d.). How USDe Works. Retrieved from https://docs.ethena.fi/how-usde-works

InvestX. (2025, August). Ethena (ENA) Price Predictions: Will It Hit $5 by 2025?. Retrieved from https://investx.fr/en/crypto-news/ethena-ena-price-predictions-will-reach-5-dollars-2025/

MEXC. (2025, August) XRP and HYPE Added to Ethena's Asset List for USDe Backing. (2025). Retrieved from https://www.mexc.co/en-IN/news/xrp-and-hype-added-to-ethenas-asset-list-for-usde-backing/72277

Gate. (2025, August) What Is the Current Market Overview of Ethena (ENA) With $4.1B Market Cap and 323 Trading Pairs in August 2025?. Retrieved from https://www.gate.com/post/status/13336569

Ainvest. (2025, August) Whales and the Fed: The Unseen Forces Shaping ENA's Fate. (2025). Retrieved from https://www.ainvest.com/news/whales-fed-unseen-forces-shaping-ena-fate-2508/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.