The decentralized finance (DeFi) derivatives market has witnessed remarkable innovation and growth, with Hyperliquid emerging as a standout protocol. As a fully on-chain order book exchange for perpetual futures, Hyperliquid has achieved significant trading volume and user adoption. However, its rise has also been punctuated by dramatic events, such as the recent XPL incident where a whale manipulated the market, causing a 200% price spike and liquidating over $17 million in short positions, resulting in a collective profit of $46 million for the orchestrators. This article explores Hyperliquid's technology, its unique value proposition, the challenges it faces, and its future potential.

What Is Hyperliquid (HYPE)?

Hyperliquid is a decentralized perpetual futures exchange operating on its own custom-built Layer 1 blockchain, HyperLiquid L1. Founded by Jeff Yan, a former quant trader at Hudson River Trading (HRT) and International Physics Olympiad medalist, Hyperliquid was designed to bridge the gap between the trust risks of centralized exchanges (CEXs) and the experiential shortcomings of decentralized exchanges (DEXs). Its native token, HYPE, serves as the ecosystem's governance and utility token, with a total supply of 1 billion. The project is notable for its community-centric approach, having rejected venture capital funding and instead allocated 70% of its tokens to users. As of February 2025, Hyperliquid's market capitalization was approximately $8.92 billion.

How Hyperliquid Works

Hyperliquid operates on a high-performance L1 blockchain utilizing a proprietary consensus algorithm called HyperBFT. This enables the platform to handle up to 200,000 orders per second, ensuring real-time trade execution, order matching, and liquidation, all recorded transparently on-chain. Unlike many DEXs that rely on Automated Market Makers (AMMs), Hyperliquid employs a traditional order book system. This allows traders to place buy and sell orders for various assets, mirroring the experience of CEXs but with on-chain settlement.

The platform supports both cross-margin and isolated margin trading. Its decentralized clearinghouse manages user margin balances and positions. For pricing, Hyperliquid uses a decentralized oracle system where validators update spot prices from major exchanges every three seconds, ensuring accuracy and reducing manipulation risk for funding rates, margin calculations, and liquidation.

Key Features of Hyperliquid

Hyperliquid offers several features that differentiate it from competitors:

High Throughput and Low Latency: The HyperBFT consensus algorithm enables sub-second finality and supports up to 200,000 transactions per second (TPS), providing a trading experience comparable to CEXs.

Variety of Order Types: Traders can use market, limit, stop-market, stop-limit, scale, and TWAP (Time-Weighted Average Price) orders.

Hyperliquid Vaults: These allow users, including DAOs, institutions, and individuals, to deposit funds and share in trading profits. Vault creators earn 10% of total profits (except protocol vaults).

The HLP Protocol Vault: This is a community-owned vault that participates in market making and the liquidation process, earning a share of trading fees. It has a four-day deposit lock-up period.

Zero Gas Fees: Most transactions on Hyperliquid are gas-free for users, enhancing accessibility.

Deflationary HYPE Tokenomics: A remarkable 97% of protocol fees are used for automated buybacks and burns of HYPE tokens. This hyper-deflationary mechanism has already destroyed 28.5 million HYPE tokens (worth $1.3 billion as of July 2025), reducing circulating supply and creating scarcity.

Explosive Growth and the Dark Side: Whale Trades and Manipulation

Hyperliquid has experienced phenomenal growth since its launch. It quickly became a major player in the on-chain derivatives space, capturing approximately 80% of the market share and achieving daily trading volumes exceeding $5.5 billion. Its monthly protocol revenue reached a record $86.6 million in July 2025. This growth is attributed to its user-centric model, high-performance technology, and attractive tokenomics that reward users.

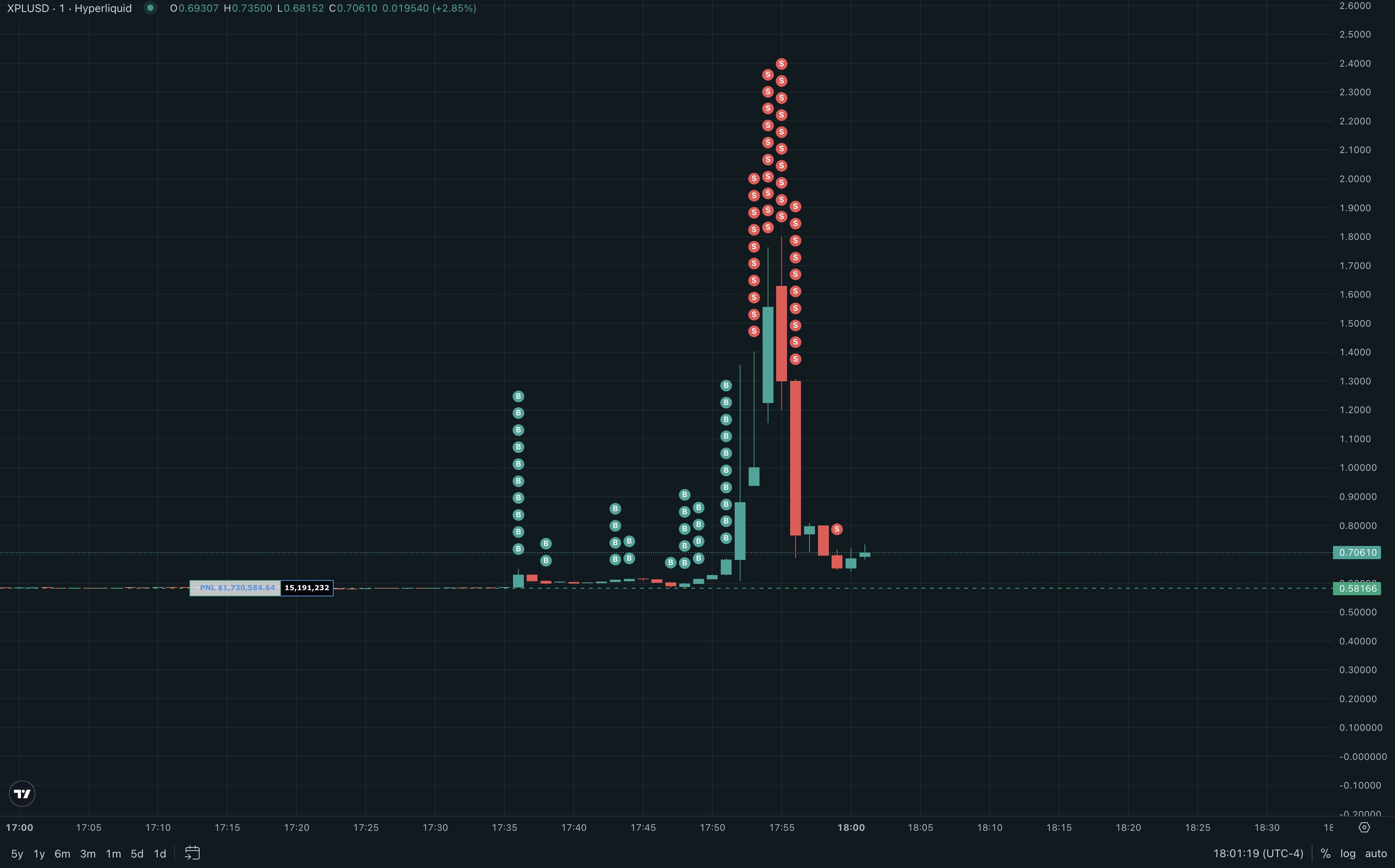

However, this rapid expansion and the design of its markets have also made it susceptible to whale manipulation and extreme volatility events. The recent incident involving the XPL perpetual contract is a prime example. On the eve of the XPL token's official listing, one or more whales deposited $16 million USDC and placed large buy orders for XPL/USD perpetuals on Hyperliquid. This rapidly exhausted the order book's liquidity, causing the price to skyrocket from around $0.58 to $1.80 within minutes and a 200% increase. This rapid price surge triggered the liquidation of over $17 million worth of short positions.

The whale(s) then partially closed their positions, instantly realizing profits of approximately $16 million while still holding a substantial long position. In total, four addresses collectively profited over $46 million from this event. This incident highlighted the risks associated with low-liquidity markets and high leverage on decentralized platforms, where large players can significantly impact prices and cause cascading liquidations.

How to Manage Risk Effectively on Hyperliquid

While Hyperliquid offers advanced trading features and potential rewards, users must actively manage risks:

Exercise Caution with High Leverage: In markets with low liquidity (e.g., low-market-cap tokens), avoid using excessive leverage (e.g., over 10x) to prevent instant liquidation during volatile swings.

Monitor On-Chain Whale Activity: Use blockchain analytics tools like Lookonchain or Nansen to track large wallet movements and potential market manipulation attempts.

Understand Vault Risks: If participating in HLP or other vaults for yield, be aware that these can incur significant losses during extreme market events despite earning fees.

Utilize Risk Management Tools: Always use stop-loss orders and carefully manage position sizes. Hyperliquid offers various order types like stop-loss and take-profit to help automate this.

Stay Informed on Market Conditions: Be especially cautious around events like new token listings, which often experience lower liquidity and higher volatility.

Diversify: Avoid concentrating too much capital on a single asset or platform. Hyperliquid's isolated margin mode can help isolate risk to specific positions.

Recent News and Developments

Following the XPL incident, Hyperliquid announced two new protocol-level safeguards to be included in its next network upgrade:

Mark Price Hard Cap: This will limit the mark price of assets on its platform to no more than 10 times the 8-hour Exponential Moving Average (EMA), providing a clear risk boundary for over-collateralized short positions.

Integration of External Market Data: The mark price formula will now incorporate data from external perpetual futures markets (e.g., Binance's XPL market) for the same asset, enhancing price signal robustness in low-liquidity environments and reducing manipulation risks.

Beyond these risk controls, Hyperliquid continues to expand. It has integrated native USDC via Circle's Cross-Chain Transfer Protocol (CCTP v2), streamlining cross-chain transactions. Its HyperEVM, an EVM-compatible smart contract layer, has seen growing adoption with 175 projects deployed and its Total Value Locked (TVL) entering the top ten among L1 blockchains.

Fundraising and Financial Backing

Hyperliquid stands out for its unconventional approach to funding. Unlike most startups, it has been entirely self-funded and rejected venture capital investment. The team believes this preserves the community-led nature of the project and prevents large, centralized ownership by VCs. This philosophy extends to its token distribution, where 31% of HYPE tokens were airdropped to approximately 94,000 early users in a "Genesis Airdrop". The project generates substantial revenue from its trading fees, reporting an estimated annual revenue of $1.127 billion with a core team of just 11 people—making it one of the most efficient companies globally by revenue per employee.

Conclusion

Hyperliquid represents a significant technological achievement in the DeFi derivatives space. Its high-throughput, on-chain order book, zero-gas fee model, and community-focused tokenomics have fueled rapid growth and established it as a dominant force. The deflationary mechanism of the HYPE token, driven by burning 97% of fees, creates a compelling value-accrual model for holders.

However, the recent XPL manipulation event underscores the inherent risks in decentralized, permissionless trading platforms, particularly in low-liquidity markets. While Hyperliquid's proposed new safeguards are a step towards mitigating such risks, the incident serves as a stark reminder to users about the critical importance of risk management, caution with leverage, and awareness of whale activity.

As Hyperliquid continues to evolve—expanding its ecosystem with HyperEVM, integrating with traditional finance through stablecoins, and enhancing its protocol safeguards—it remains a powerful yet complex platform that embodies both the immense potential and the ongoing challenges of the DeFi revolution.

References

Park, W. (2025, August 27). Hyperliquid's HYPE Token: A Deflationary Powerhouse in the DeFi Derivatives Revolution. AInvest. https://www.ainvest.com/news/hyperliquid-hype-token-deflationary-powerhouse-defi-derivatives-revolution-2508/

Gate.io. (2025, August 26). XPL Shockingly Sees $17 Million Liquidation Wave Before Listing! Hyperliquid Introduces Two New Safeguards to Respond. https://www.gate.com/post/status/13351328

BlockByte. (2025, August 26). Hyperliquid's HYPE Token: A 126x Bull Case Driven by Stablecoin Market Domination. AInvest. https://www.ainvest.com/news/hyperliquid-hype-token-126x-bull-case-driven-stablecoin-market-domination-2508/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.