This week, BTC fell back after hitting a record high, affected by PPI data and the Federal Reserve minutes, from $124,500 to below $114,000, which is a significant drop during the week; ETH prices failed to break through the previous high, falling from nearly $4,700 to below $4,300. ETF funds had strong inflows but are now flowing out. American Bitcoin, a cryptocurrency mining company linked to the Trump family, is reportedly looking to acquire at least one publicly listed company in Asia to further its Bitcoin; The Hong Kong Securities and Futures Commission (SFC) has raised red flags following increased trading activity around stablecoins. In a surprising turn for the markets, the U.S. Producer Price Index (PPI) for July rose by 0.9%, far exceeding expectations. SharpLink Gaming (SBET), said it bought 143,593 ETH last week, bringing total holdings above $3 billion.

Market Overview

BTC: Bitcoin experienced a volatile week by dropping 6.7%, influenced significantly by macroeconomic events. The week began with BTC testing support around $117,000 after a pullback from its all-time high of $124,500, driven by higher-than-expected U.S. PPI data which dampened risk appetite. Bulls attempted to regain control, pushing prices toward $120,800, but resistance near $124,600–126,800 limited upward momentum. On August 21, BTC faced renewed selling pressure after the Fed meeting minutes, briefly dipping below $114,000. Despite this, institutional interest remained strong, with analysts highlighting $117,000 as a critical support level. BTC closed the week with resilience, though macro uncertainties persisted.

ETH: Ethereum mirrored BTC’s volatility, with prices fluctuating between $4,375 and $4,477 during the week. ETH initially surged toward $4,790, nearing its historical high of $4,869, but profit-taking triggered a drop below $4,500 on August 14. Key support levels were tested at $4,386 (SuperTrend indicator) and $4,094 (breakout level), while resistance remained strong at $4,750–$4,869. The Fed’s hawkish tone on August 21 pushed ETH below $4,300 briefly.

Altcoins: The Crypto Fear & Greed Index currently stands at 50 (Neutral), reflecting a balanced yet cautious market sentiment following a week of notable volatility. While major cryptocurrencies consolidated after recent swings, several altcoins demonstrated strong outperformance.

ETF: Bitcoin ETFs experienced significant outflows between August 20th and 21st, totaling $1.3 billion over three days. On August 20th, the ETH ETF experienced a sharp decline, with a single-day outflow of $197 million, the second-highest single-day outflow on record. Fidelity and Grayscale were the issuers with the largest outflows. Furthermore, on-chain data shows that over 900,000 ETH are currently awaiting redemption, with the waiting time stretching to a record 15 days and 18 hours, creating additional potential selling pressure in the market.

Macro Data: Global markets experienced mixed signals during this period. China's August Loan Prime Rate (LPR) remained unchanged for the third consecutive month, with the 1-year rate at 3.0% and the 5-year rate at 3.5%, aligning with market expectations and reflecting a stable monetary policy stance. U.S. stock markets saw divergent performance. The S&P 500 barely edged up 0.03% to a record 6,468.54 on August 14th, but later faced pressure. By August 20th, the S&P 500 fell 0.24% to 6,395.78, marking its fourth consecutive day of decline. The Dow Jones Industrial Average was nearly flat (up a mere 0.04% to 44,938.31 on Aug 20th), while the Nasdaq Composite declined 0.67% to 21,172.86, weighed down by tech stocks like Apple (-1.97%), Amazon (-1.84%), and Tesla (-1.64%).

Stablecoins: The current market cap of stablecoins is $278.01 billion, with a 7 days gain of 1.60%.

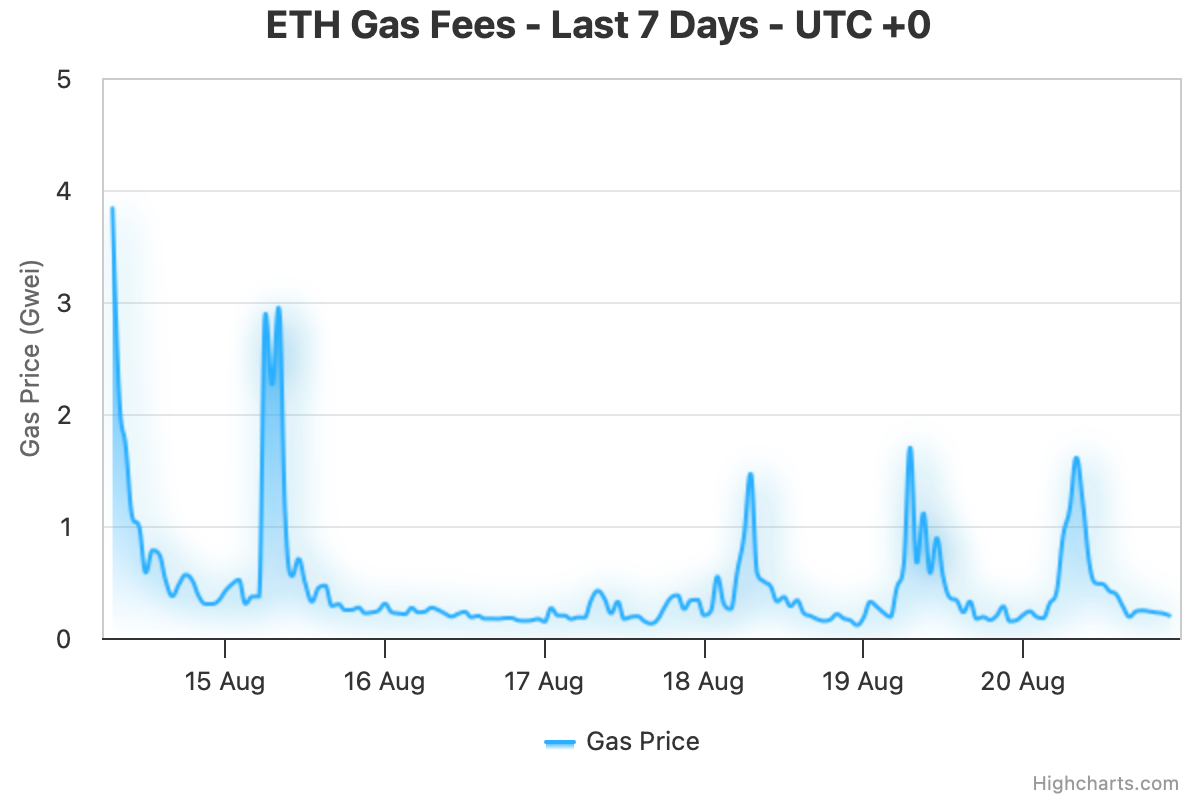

Gas Fees: Ethereum network gas fees are lower this week, with average fees reaching 0.38 GWEI on August 21.

Gas Price. Source: MilkRoad

Top Categories

This week, the cryptocurrency market experienced a downtrend, with a notable decline in investor optimism. According to Coingecko data, only a few categories—Oracle, Cross-chain Communication, Privacy—saw gained over the past 7 days, rising by 5.4%, 3.4%, and 2.4% respectively.

Oracle

Oracles are used by protocols in their smart contracts in order to obtain external data. This allows the closed-off blockchain environment to communicate with data points on the outside world. For example, a protocol offering synthetic Nasdaq-listed stock on

blockchain will need to pull external data from the stock market. With an oracle, the protocol will be able to do so. Over the past 7 days, the Oracle sector rose 5.4%, with

API3 gaining 98.5% and

LINKgaining 6.7%.

Cross-chain Communication

Cross-chain communication refers to the ability of different blockchains to interact and exchange data or assets with each other without relying on a central intermediary. It allows for seamless transfer of information and tokens between otherwise isolated blockchain networks, enhancing interoperability and unlocking new possibilities for decentralized applications (dApps) and decentralized finance (DeFi). Over the past 7 days, the sector rose 3.4%, with

LINK gaining 6.7%.

Privacy

Privacy coins are cryptocurrencies which allow users to conduct transactions privately and anonymously. This ensures untraceable transactions and the identity of the parties involved are kept private.This is done by hiding the origin and destination of transactions. In some cases, multiple transactions are mixed together in order to make onchain analysis tougher. The privacy sector grew 2.4% in the last 7 days.

Weekly Market Focus

Trump-linked American Bitcoin Seeks Asia Acquisitions to Boost BTC Holdings

American Bitcoin, a cryptocurrency mining company linked to the Trump family, is reportedly looking to acquire at least one publicly listed company in Asia to further its Bitcoin.

According to a Financial Times report, American Bitcoin wants to buy a company in Japan and potentially another in Hong Kong. It aims to follow the blueprint of Strategy, which to date has accumulated 628,946 BTC worth $73.8 billion at this writing. American Bitcoin’s “ambition is to build the strongest and most efficient Bitcoin accumulation platform in the world,” the company told the Financial Times on Friday. “While we are evaluating possibilities in certain regions, we have not made any binding commitments.”

Part of an ever-growing tree of Trump family crypto businesses, American Bitcoin was founded by two of US President Donald Trump’s sons, Donald Trump, Jr. and Eric Trump. In May, the company announced its public listing via a merger with Gryphon Digital Mining, a crypto mining company listed on Nasdaq. American Bitcoin has started a Bitcoin treasury, with 215 Bitcoin as of June 10. On June 30, the company announced a $200 million raise to bolster its treasury and buy more Bitcoin mining equipment.

Hong Kong SFC Warns on Rising Stablecoin Fraud Risks After Ordinance

The Hong Kong Securities and Futures Commission (SFC) has raised red flags following increased trading activity around stablecoins. After the new Stablecoin Ordinance was enacted on August 1, market manipulation and fraudulent schemes have reportedly grown. Authorities now stress compliance while warning the public against irrational trading behavior.

The SFC and Hong Kong Monetary Authority issued a joint statement on August 18 targeting deceptive market practices. Authorities flagged trading spikes following announcements about potential stablecoin licenses. They confirmed heightened surveillance on digital asset trades and warned against manipulation. Officials reported 265 fraud complaints in the first half of 2025 tied to digital assets. This figure aligns with previous years, but concerns have grown about potential increases. As stablecoin interest surges, regulators expect more misconduct unless disciplined trading prevails. Ye Zhiheng of the SFC’s intermediaries division urged rational behavior amid license-related speculation. The new law criminalizes the promotion of unlicensed stablecoins to retail participants. Hong Kong aims to balance digital innovation with vigorous enforcement to protect its evolving crypto market.

Trump Announces Big Progress on Russia After Alaska Meeting With Putin

U.S. President Donald Trump announced "BIG PROGRESS ON RUSSIA" on his social media platform, following high-profile discussions with Russian President Vladimir Putin in Alaska. The statement, made on August 8, came amid a broader shift in the U.S. policy toward Russia, including new sanctions on crypto firms and ongoing diplomatic overtures aimed at de-escalating the conflict in Ukraine. The White House confirmed the meeting as productive but provided no immediate agreements, leaving the specifics of the "progress" unclear.

Among the key developments was a series of U.S. Treasury sanctions targeting Russian crypto exchanges, including Garantex and its successor Grinex, which were alleged to be involved in illicit activities. These measures coincided with the freezing of $27 million in Tether’s

assets and raised concerns about the use of cryptocurrencies like Bitcoin, Ethereum, and Monero in ransomware schemes. Steve Witkoff, U.S. Special Envoy, noted that Russia appeared to agree with U.S. security commitments for Ukraine akin to NATO’s Article Five, marking a significant diplomatic shift.

Trump’s emphasis on a negotiated peace deal in Ukraine contrasted with his earlier warnings of imposing tariffs on Russia if the war did not end within 50 days. While no sanctions or economic measures were announced post-meeting, his public statements highlighted a preference for long-term diplomatic solutions over short-term ceasefires. Analysts suggested that Trump’s approach reflects a broader strategy of balancing pressure with engagement, though the absence of concrete agreements has led to speculation about the true scope of the talks.

Key Market Data Highlights

U.S. Producer Price Index Surges 0.9% in July, Defying Expectations

In a surprising turn for the markets, the U.S. Producer Price Index (PPI) for July rose by 0.9%, far exceeding expectations. This data release has significant implications for monetary policy and economic forecasts, as it signals persistent inflationary pressures that could impact the Federal Reserve's upcoming policy decisions.

The Producer Price Index measures price changes from the perspective of sellers and is a leading indicator of consumer inflation. According to data from the Bureau of Labor Statistics, the PPI for final demand rose 0.9% in July. Historically, the PPI has shown moderate month-to-month fluctuations, but this recent spike is notable. The increase was more pronounced in the core PPI, which excludes food, energy, and trade services, rising by 0.6%. This unexpected rise suggests that inflationary pressures are more entrenched than previously believed.

Several factors contributed to the upward pressure on producer prices, including ongoing tariffs that have increased costs across the supply chain. The data suggests that businesses are beginning to pass on these costs to consumers, indicating potential future hikes in consumer prices. This trend aligns with broader economic challenges, such as supply chain disruptions and increased import costs. The implications are significant, as continued price increases could prompt the Federal Reserve to reconsider its monetary policy stance.

Circle Executives Cashed out, Selling Early After a 349% Surge in Stock Price

While investors were still scrambling to buy into this week's hot cryptocurrency IPOs, executives at stablecoin issuer Circle (CRCL.N) were already urgently reaping the company's astonishing gains since its IPO. Circle announced on Tuesday that it would sell 10 million shares at the current market price (2 million from the company and the remainder from shareholders, including CEO Jeremy Allaire), raising approximately $1.4 billion. According to sources familiar with the matter, the two-day placement was oversubscribed and expected to be priced Thursday. The company, which went public in early June, has seen its stock surge 349% year-to-date, and delivered strong quarterly earnings earlier this week. The sale occurred much earlier than expected, just two months after Circle's IPO and well before the end of the year's lockup period. However, JPMorgan Chase, the lead underwriter for the IPO and the arbitrator of the lockup waiver, did not block the sell-off. Joseph Schuster, founder of Chicago-based IPO research firm IPOX, said: "This is legitimate arbitrage, shifting risk to the public market."

SharpLink Ether Holdings Top $3.1B, Trailing BitMine in Pace of ETH Acquisition

SharpLink Gaming (SBET), the Nasdaq-listed ether (ETH) treasury firm led by Ethereum co-founder Joe Lubin, said it bought 143,593 ETH last week, bringing total holdings above $3 billion.

To finance the purchases, SharpLink raised $537 million in net proceeds during the weekend of Aug. 15. The company secured $390 million through a registered direct offering that closed Aug. 11, and an additional $146.5 million via its at-the-market issuance program.

The firm reported an average ETH purchase price of $4,648 for last week's acquisitions. That's roughly 8% higher than the asset's current price after the crypto market slid over the past few days, with ETH dropping below $4,300.

CoinCatch Weekly Event

CoinCatch Deposit Gala: 100% Cashback on Deposit! Trade and Grab Trading Bonus + PlayStation 5

📅 Event Period: August 21, 2025 (UTC+8) - August 27, 2025 (UTC+8)

💰 Event 1: 100% Cashback for Deposit, 50% More for New Users

Event Rules: Complete a deposit and receive cashback, while newly-registered users will receive an extra 50% during the event period.

| Net Deposit Amount (≥USDT) |

Cashback for Regular Users (USDT) |

Cashback for Newly-Registered Users (USDT) |

| 500 |

500 |

750 |

| 1,000 |

1,000 |

1,500 |

| 10,000 |

10,000 |

15,000 |

Note:

💸 Event 2: Trade to receive $100,000 Trading Bonus + Chance to Win a PlayStation 5

Event Rules: Users only need to complete $100,000 in futures trading volume during the event period to 100% receive a random airdrop of $5 to $100 trading bonus. There is also a chance to receive a

PlayStation 5 reward.

Prize Pool: $100,000 Trading Bonus + PlayStation 5*5

Token Unlocks Next Week

Tokenomist data indicates that from August 22–29, 2025, several major token unlocks are scheduled. Some of them are:

Artificial Superintelligence Alliance (FET): Date: August 27, 11:00 UTC. Tokens Unlocked: 2,040,000 FET (0.14% of circulating supply)

Jupiter (JUP): Date: August 28, 13:00 UTC. Tokens Unlocked: 26.85M JUP (1.78% market cap)

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.