The term "ETH treasury" has evolved beyond its original meaning of project-controlled development funds to represent a

strategic corporate and institutional reserve asset

. This transformation accelerated dramatically in 2025 as publicly traded companies, investment funds, and financial institutions allocated substantial portions of their balance sheets to Ethereum. Unlike speculative retail holdings, ETH treasuries signify

long-term institutional conviction

in Ethereum's dual value proposition: as a

productive collateral asset

through staking yields and as

foundational infrastructure

for the expanding digital economy. Fueled by regulatory milestones like spot ETF approvals and technological advances enhancing Ethereum's utility, this movement has locked over $35 billion worth of ETH in corporate treasuries alone, fundamentally altering Ethereum's supply dynamics and investment thesis. This article examines the drivers, impacts, and future trajectory of this transformative shift.

Definition of Ethereum Treasuries

An Ethereum treasury can be defined as the reserve of ETH held by an entity, which can range from a company, a decentralized autonomous organization (DAO), an investment fund, to even a government - related body in some cases. Entities build Ethereum treasuries for multiple reasons. For corporations, it could be a form of asset diversification. Just as companies hold a mix of stocks, bonds, and cash in their traditional treasuries, they are now adding ETH to the portfolio. Some firms also use Ethereum for operational purposes within the blockchain - based economy, such as paying for decentralized application (dApp) development or participating in decentralized finance (DeFi) activities.

For DAOs, Ethereum treasuries are crucial for funding their operations, development of new features, and community initiatives. These treasuries are often managed through on - chain governance mechanisms, where token holders vote on how the funds should be allocated. Investment funds, on the other hand, may hold Ethereum in their treasuries to provide exposure to the cryptocurrency market for their investors, either through direct holding or by including it in the basket of assets for a cryptocurrency - related fund.

Institutional Adoption Accelerations

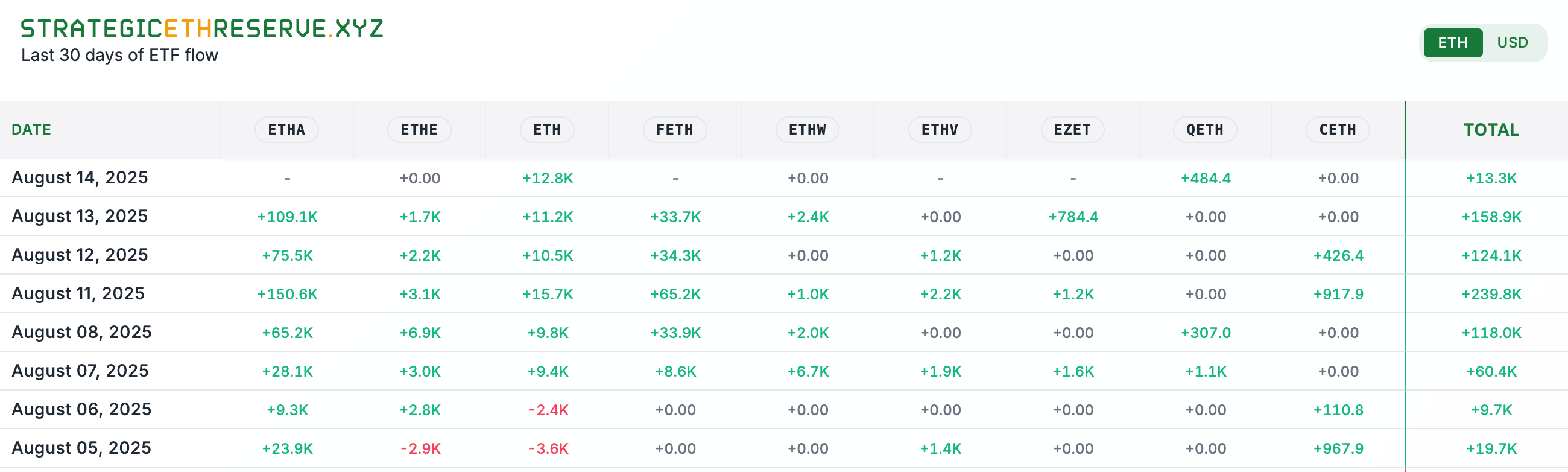

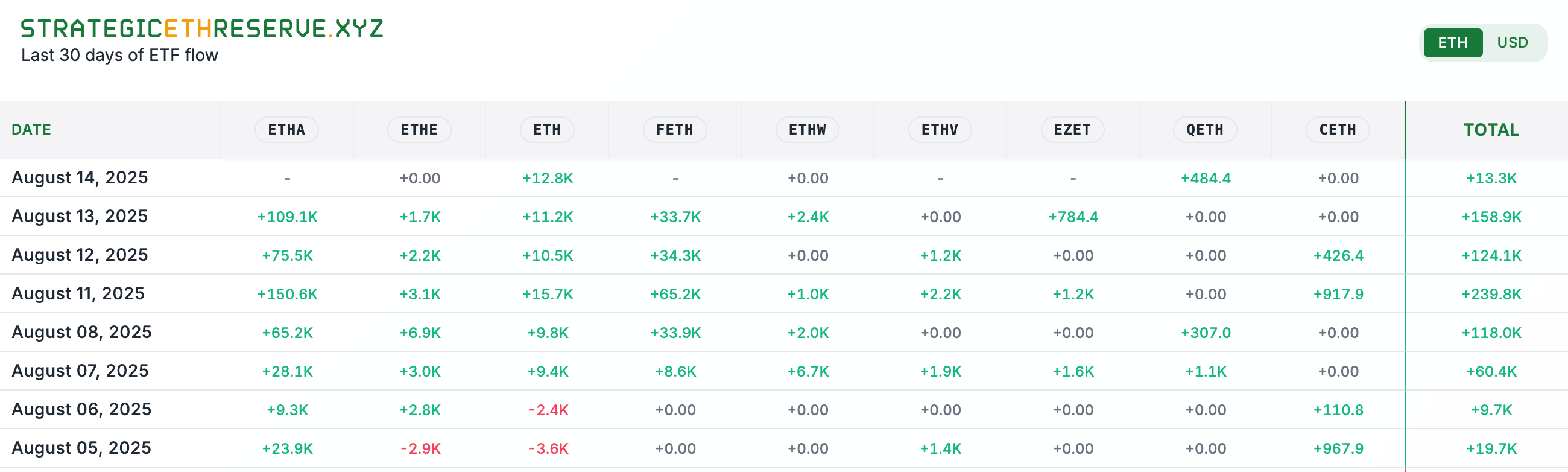

The defining narrative of 2025 is the unprecedented institutional accumulation of Ethereum. Data from Strategic ETH Reserve.xyz reveals that

institutional investors and corporate treasuries collectively hold 8.28% of Ethereum's total supply, a dramatic leap from just 3% in early April 2025. This seismic shift comprises two major components:

Ethereum spot ETFs, which alone command approximately 5.22% of circulating supply (6.45 million ETH), and

corporate treasury holdings, which account for 2.93% (3.57 million ETH). BlackRock's ETHA and Fidelity's Ethereum Fund emerged as dominant ETF players, while companies like Bitmine Immersion Tech, SharpLink Gaming, and the newly public ETHZilla backed by Peter Thiel's investment spearheaded corporate adoption. These entities publicly cite Ethereum's

inflation-hedging properties,

portfolio diversification benefits, and

alignment with technological innovation as core motivations.

The velocity of accumulation underscores a fundamental repricing of institutional risk perception. When MicroStrategy pioneered corporate Bitcoin holdings years ago, it faced intense skepticism. Ethereum's corporate adoption, however, coincides with clearer regulatory frameworks, mature custodial solutions, and tangible yield generation through staking, currently providing

3–4% annual returns. Standard Chartered projects corporates could hold

10% of Ethereum's total supply by 2026, suggesting this reallocation remains in its early stages. The "Ether Machine" project exemplifies this institutionalization, preparing for a Q4 2025 Nasdaq listing with plans to raise over

$1.6 billion and hold more than

400,000 ETH as its core reserve asset.

Market Performance and Supply

Institutional demand has profoundly impacted Ethereum's market structure and price discovery. ETH surged to

$4,674 by mid-August 2025, nearing its all-time high of $4,892 and registering a

21% weekly gain that significantly outpaced Bitcoin's performance. This rally was structurally supported by

supply

constriction from institutional accumulation. Spot ETFs alone now absorb

3.2 times Ethereum's daily net issuance, purchasing approximately 8,400 ETH daily against post-EIP-1559 burn emissions of just 2,600 ETH. The resulting supply squeeze intensified when corporate buying sprees—like Bitmine Immersion's $24.5 million stock sale specifically for ETH acquisition, were layered atop ETF demand.

Technical indicators reflect this fundamental shift. The ETH/BTC ratio rose

18% month-to-date in August, signaling capital rotation from Bitcoin into Ethereum. Bullish MACD crossovers and sustained RSI readings above 60 confirmed strong momentum, with analysts identifying

$4,750 and

$4,869 (the all-time high) as critical near-term resistance levels 39. Polymarket traders assigned a

65% probability of ETH reaching

$5,000 by August's end, while Standard Chartered's year-end forecast ranged between

$6,000 and $7,000, contingent on successful implementation of the Fusaka upgrade. Crucially, derivatives markets showed healthier leverage than previous cycles, with August's rally liquidating

$135 million in short positions rather than excessive long leverage—a sign of more sustainable price discovery.

Regulatory Catalysts and Legal Tensions

Institutional adoption didn't occur in a regulatory vacuum. The

July 2025 passage of the GENIUS Actby the U.S. Congress established crucial protections for stablecoin issuers using permissionless blockchains like Ethereum, prohibiting license denials solely based on blockchain choice 5. This directly challenged the Federal Reserve's

Policy Statement 9(13) (January 2023), which warned that bank-issued tokens on public networks were "highly likely to be inconsistent with safe and sound banking practices". The resulting tension created regulatory uncertainty but also demonstrated growing political support for Ethereum's infrastructure role. The White House's July 2025 Digital Assets Report explicitly urged the Fed to rescind Policy 9(13), arguing regulatory bias threatened U.S. competitiveness.

Fed Chair Jerome Powell maintained caution during June 2025 Senate testimony, emphasizing "safety and soundness" over innovation despite pressure from Senator Cynthia Lummis. This ambiguity forced strategic adaptations. Circle responded by developing

Arc, an

EVM-compatible layer-1 blockchain designed for regulated stablecoin finance, bridging to public Ethereum for settlement. Stripe's rumored

Tempo blockchain, developed with Paradigm, suggests a broader trend toward compliant hybrid architectures. Crucially, the

SEC's clarification that staked ETH does not constitute a security removed a major adoption barrier for institutions, while

401(k) plans incorporating cryptoexpanded Ethereum's investor base beyond speculative traders.

Corporate Treasury Strategies and Innovative Models

Companies accumulating ETH treasuries deploy diverse strategies reflecting their risk profiles and operational needs.

SharpLink Gaming exemplified aggressive accumulation, purchasing

438,000 ETHas part of its treasury diversification strategy. Most corporations treat ETH as a

long-term strategic reserve, leveraging staking for yield while avoiding active trading. The "

productive collateral" thesis—where ETH generates staking yield while serving as collateral for decentralized finance (DeFi) activities—gained significant traction 9. This approach transforms ETH from a passive asset into an income-generating instrument integrated into corporate liquidity management.

Simultaneously, innovative projects leverage Ethereum's infrastructure to create novel treasury models.

Moonshot MAGAX (MAGAX) launched a "

Meme-to-Earn" ecosystem rewarding creators with tokens for viral content, all secured on Ethereum. This merges meme coin virality with tangible utility, demonstrating how treasuries can fund community-driven growth mechanisms. These models collectively expand Ethereum's functional utility beyond pure speculation.

Technological Upgrades and Ecosystem Expansion

Underpinning institutional adoption are critical technological advances enhancing Ethereum's scalability and efficiency. The

Pectra upgrade deployed in May 2025 introduced

account abstraction,

revised staking limits, and

fee optimizations, improving user experience but also reducing mainnet transaction fee revenue—a trade-off for greater accessibility. The forthcoming

Fusaka hard fork (scheduled for November 2025) focuses on

backend scalability enhancements and

node resilience, maintaining smart contract compatibility while optimizing Ethereum's core protocol for heavier institutional loads.

Layer-2 ecosystems now dominate transaction volume, with networks like

Arbitrum processing 70% of Ethereum-related transactions, drastically lowering costs and enabling complex applications previously hindered by mainnet fees. This scalability catalyzed explosive growth in decentralized finance (DeFi), where

total value locked (TVL) surged from $50 billion to $120 billion year-to-date in 2025. Critical infrastructure projects like

Chainlink (oracles),

Starknet (ZK-rollups), and

The Graph (data indexing) reported record developer activity, with The Graph experiencing

all-time highs in query volume and subgraph deployments. This flourishing infrastructure supports institutional use cases from

tokenized real-world assets (RWAs)—like BlackRock's

$2.3 billion BUIDL treasury fund—to compliant enterprise DeFi applications.

Risks and Market Challenges

Despite bullish momentum, ETH treasury strategies face significant headwinds.

Regulatory fragmentation persists, particularly regarding stablecoins. The Fed's reluctance to fully embrace Policy Statement 9(13)'s rescission creates compliance complexity for institutions issuing or transacting in dollar-backed tokens on Ethereum.

Technical execution risk looms over the Fusaka upgrade; any delays or vulnerabilities could undermine confidence in Ethereum's roadmap, potentially triggering sell-offs among momentum-driven holders.

Market structure risks also intensified with institutionalization. Though reduced circulating supply supports prices, it also increases vulnerability to

large-scale institutional liquidations. The

RSI readings above 70 in mid-August signaled overbought conditions, historically preceding corrections of

15–20%. Competition from

alternative Layer-1slike Solana remains formidable, particularly in high-throughput use cases where Ethereum's rollup-centric roadmap still faces user experience hurdles. Crucially, Ethereum's

monetary policy shift toward

deflation—with EIP-1559 destroying

5.3 million ETH since implementation and staking locking

30% of supply (36 million ETH)—creates long-term value appreciation potential but may complicate network security economics if staking yields become unsustainably low amidst high participation.

Future Trajectory and Long-Term Outlook

The convergence of technological, regulatory, and institutional trends suggests ETH treasuries will become a permanent fixture in corporate finance. Analysts project

$10,000+ ETH valuations by 2026–2030, driven by

zkEVM mainnet deployments,

RISC-V architecture upgrades, and the multi-trillion-dollar opportunity in

tokenizing real-world assets (RWAs). The Fusaka upgrade's success could trigger a

re-rating similar to Bitcoin's post-ETF valuation surge, with institutions anchoring valuations to network yield rather than pure speculation. Already,

ETH staking yields of 3–4% exceed U.S. Treasury returns, attracting capital seeking both growth and income.

Global expansion continues through initiatives like the Ethereum Foundation's

Q2 developer outreach, funding events from

Milan's Appcon to Bhutan's developer festivals. The

Lineal2 protocol (October 2025 launch) will enable

ETH-denominated staking and protocol-level burns on Layer-2s, further integrating secondary layers with Ethereum's economic security. As corporations allocate 1–5% of cash reserves to ETH, mirroring early Bitcoin treasury strategies—the resulting demand shock could reduce exchange liquidity to critical levels, potentially amplifying volatility during supply shocks, but establishing a

higher valuation floor long-term.

Conclusion

ETH treasury reserves represent more than an institutional investment trend; they signify Ethereum's maturation from a speculative crypto-asset into a

strategic component of global finance. Corporate allocations, ETF inflows, and central bank digital currency (CBDC) experiments leveraging Ethereum's tech stack collectively validate its

hybrid role as both collateral and computational platform. While regulatory skirmishes persist, particularly around stablecoin issuance, directional momentum favors deeper institutional integration. The locking of nearly

8% of ETH supply in long-term institutional holdings creates structural scarcity likely to intensify through 2026, particularly as staking participation grows and Layer-2 networks expand Ethereum's functional utility. For corporate treasurers and asset managers, ETH now presents a compelling case not merely for tactical allocation but strategic portfolio positioning, a digitally native reserve asset yielding real returns in an increasingly tokenized global economy.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.