The cryptocurrency landscape witnessed an unprecedented social experiment in 2025 as ZORA, a once-niche NFT platform, transformed into a viral SocialFi powerhouse by turning social media interactions into tradable assets. ZORA's native token, $ZORA, has delivered one of the most explosive performances in crypto history—soaring 1,573% monthly to reach a $478 million market capitalization by mid-August 2025—while simultaneously igniting fierce debates about the value proposition of creator economies and meme coins. This metamorphosis stems from ZORA's radical proposition: every social media post becomes an automatically minted ERC-20 token ("Content Coin"), every creator profile generates a "Creator Coin," and all transactions funnel liquidity toward the $ZORA token through deliberate pairing mechanisms. The platform's integration with Coinbase's Base App and controversial marketing tactics have propelled it beyond Solana in new token launches, with over 2.06 million tokens created since inception and 47,743 tokens minted in a single day during its August surge. Yet beneath the euphoria lies a complex web of technological innovation, speculative frenzy, and unanswered questions about sustainability in an ecosystem where "attention economics" meets blockchain-enabled tokenization.

Project Overview

ZORA operates as a dual-layer ecosystem combining a consumer-facing social application with an underlying blockchain infrastructure optimized for media. The social application functions as a hybrid between Instagram and a token launchpad, where every user post automatically generates a fixed-supply ERC-20 token (typically 1 billion units) called a "Content Coin," with creators receiving an initial allocation of 10 million tokens (1%) at creation. These Content Coins pair directly with "Creator Coins", which are profile-level tokens unique to each user that themselves form liquidity pools against the native $ZORA token. This cascading pairing structure (Content Coin → Creator Coin → $ZORA) creates a closed-loop economy where viral content theoretically drives value upward through the token layers, with a 3% transaction fee distributed to creators, traders, and the platform. The technological backbone is Zora Network, an Ethereum Layer-2 built using Optimism's OP Stack that reduces gas fees to $0.001 per transaction, enabling microtransactions impractical on the mainnet. This infrastructure supports over 240,000 collectors and 61,800 creators as of March 2025, with activity migrating toward tokenized social interactions rather than traditional NFT art.

ZORA Tokenomics

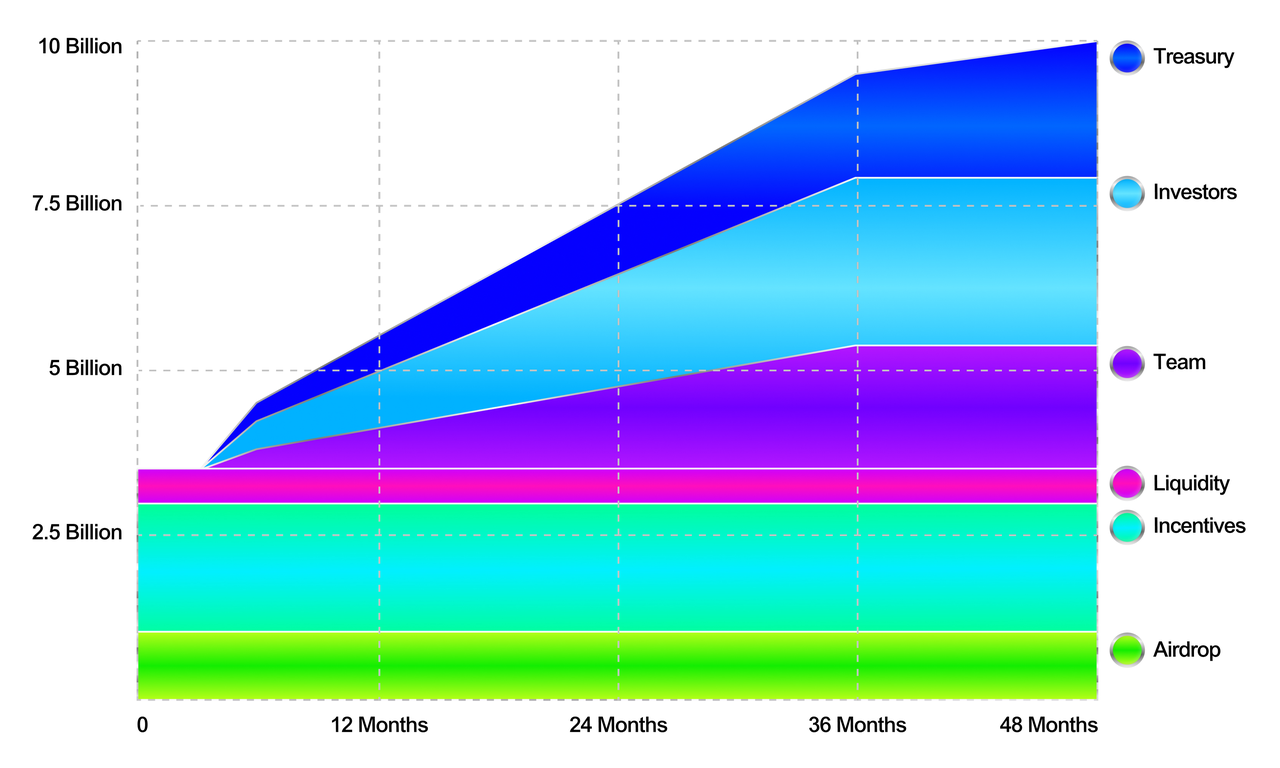

$ZORA intends to launch with a total supply of 10,000,000,000 on Base.

Initial allocation and unlock information is planned as follows:

| Category |

Description |

Unlock Schedule |

| Incentives |

Allocated for future grants, public goods, hackathons, usage rewards and other types of incentives. Distribution of these incentives will be determined over time by the team. |

Not subject to lockup restrictions |

| Airdrop |

Initial distribution of $ZORA to the Zora community including creators, collectors, developers, and the broader community that contributed to the creation of the Zora brand. Tokens will be airdropped to eligible addresses. |

Not subject to lockup restrictions |

| Liquidity |

Allocated for liquidity provisioning as needed with exchanges and market makers. |

Not subject to lockup restrictions |

| Treasury |

Allocated to the company to align the company with the community for dedicated and continued support of the brand and further proliferation. |

Unlocks monthly over 48 months starting six months after TGE. |

| Team |

Allocated to the current and future team creating the Zora brand within the crypto creator economy. |

Unlocks monthly over 36 months starting six months after TGE. |

| Investors |

Allocated to certain investors that supported the team with advice, guidance, and recommendations for the development of Zora. |

Unlocks monthly over 36 months starting six months after TGE. |

Token unlock schedule:

$ZORA is for fun only and does not entitle its holders to any governance rights or a claim on any equity ownership in Zora or its products.

Ecosystem Frameworks & Integrations

Zora’s open ecosystem fosters seamless integration across chains, tools, and services:

Scalable Layer-2 Network on OP Stack

Zora Network delivers near-instant, low-fee transactions — powering fast, cost-efficient media creation and trading.

Seamless Cross-Chain Bridges

Owlto Finance and Orbiter integrations enable effortless asset transfers between Ethereum, Zora Network, Base, and any EVM-compatible chain.

Universal Wallet Compatibility

MetaMask, WalletConnect and all standard Web3 adapters plug in directly, providing a frictionless onboarding experience for newcomers and power users alike.

Interactive On-Chain Experiences

Formo-powered NFT forms, surveys and polls unlock new use cases — from decentralized voting and event RSVPs to gamified content interactions.

Strategic Third-Party Integrations

Collaborations with Layer3 for quests, Base for L2 support, and Farcaster for social-graph connectivity enrich the ecosystem’s reach and engagement.

Next-Gen Developer Toolkit

Upcoming SDK upgrades — including JavaScript libraries, CLI tools and plugin modules — will empower builders to create robust, feature-rich dApps across Zora.

Core Applications

NFT Minting Protocol

Permissionless creation and curation of NFTs with community-driven value determination. Creators can customize metadata schemas, set flexible royalty splits, and leverage batch-minting tools to optimize gas costs and streamline large-scale drops. Advanced mint controls — like time-locked reveals and whitelist gating — help projects manage scarcity and engagement.

Content Coins

Launch unique ERC-20 tokens tied to any media asset or project, enabling direct monetization and fractional ownership. Content Coins support customizable supply models, vesting schedules, and staking incentives, so creators can reward early supporters, govern content distribution, and integrate tokens seamlessly into websites or social feeds.

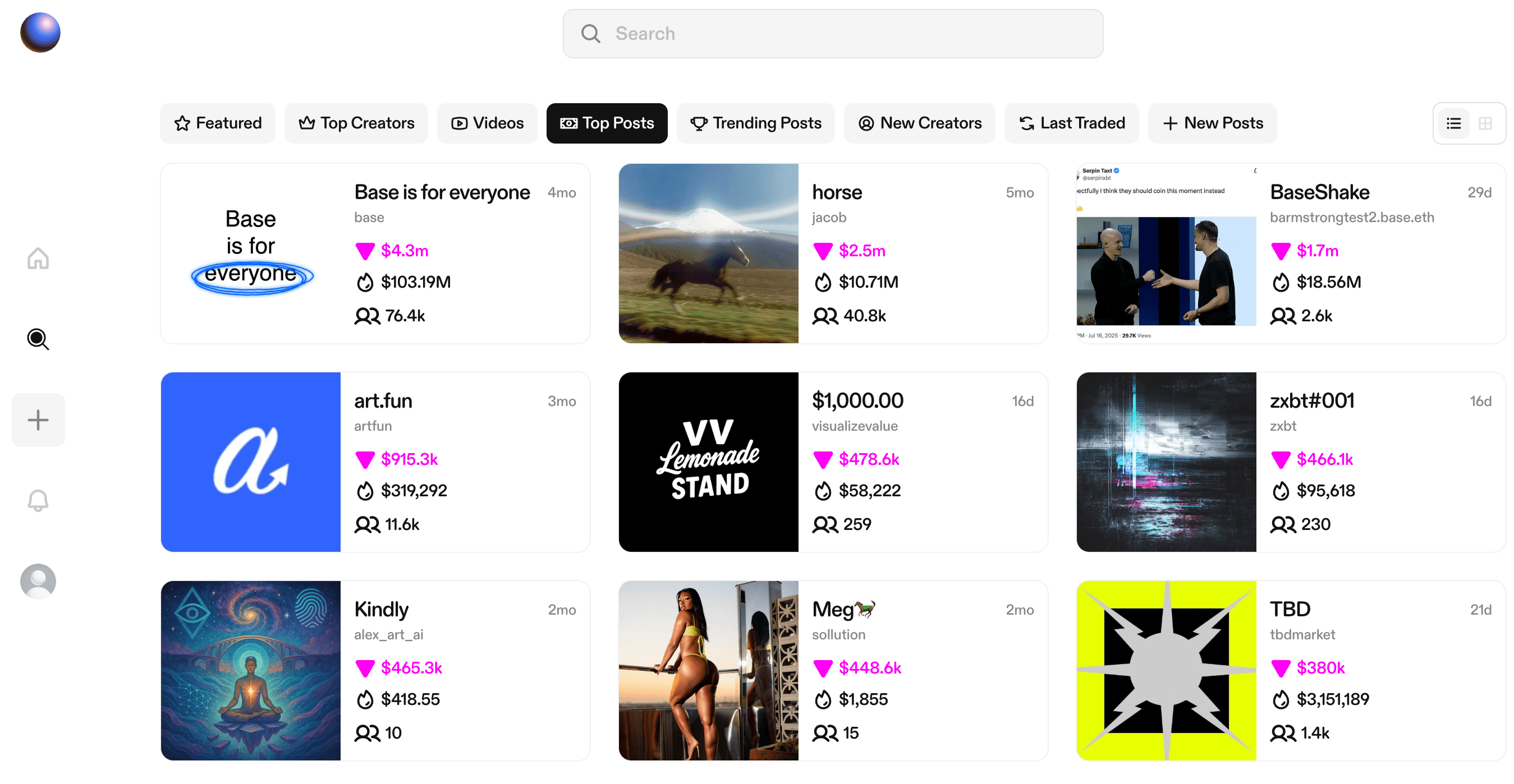

Marketplace Dashboard

User-friendly interfaces for browsing, buying, and selling on-chain media. Features include advanced search and filtering by creator, collection, or price range; real-time price charts and floor tracking; wishlist and alert notifications; and one-click listings with preset royalty and auction configurations.

Image Credit: Zora Platform

Creator Profiles

An on-chain identity system linking content to authors across the Zora Network. Profiles support enriched metadata (bio, links, social handles), follow and fan-badge mechanics, reputation scores based on on-chain activity, and integrated analytics dashboards to track engagement and secondary market performance.

Open-Source SDK & API

Comprehensive developer toolkit for integrating Zora’s protocol into custom dApps. Includes JavaScript and REST/GraphQL libraries, CLI modules for rapid project scaffolding, sample repositories, and detailed documentation covering minting, token launches, marketplace interactions, and cross-chain bridging.

Recent Developments and Market Performance

August 2025 marked a watershed moment for ZORA as its token price catapulted to an all-time high of $0.145 on August 12, representing a 50% single-day surge and 1,355% monthly gain, dwarfing broader crypto market returns. This parabolic move was ignited by two strategic integrations: first, the July 16 rebranding of Coinbase Wallet into the Base App, which embedded ZORA's token minting and trading functionalities directly into its interface, enabling one-click creation of Content and Creator Coins. Second, Binance's July 25 launch of ZORA/USDT perpetual futures with 50x leverage, attracting derivatives traders seeking amplified exposure. On-chain metrics reveal astonishing adoption curves: daily created coins exploded to 62,400, unique creators surged to 27,800, and daily trades ballooned to 249,800, all representing multi-fold increases from June levels 3. Crucially, exchange balances declined 7.71% to 4.58 billion tokens while spot net flows turned negative (-$1.5 million), signaling accumulation by whales who increased holdings from $29 million to $33.97 million (16.6%) within a week. Technical indicators flashed overbought signals with RSI peaking at 74, yet Chaikin Money Flow remained positive (0.09), confirming underlying demand strength even at elevated valuations.

Industry Reception and Ideological Divide

The crypto industry remains polarized over ZORA's legitimacy, with prominent blockchain founders engaging in public debates about its fundamental value proposition. Proponents, including Base lead developer Jesse Pollak, champion ZORA as the vanguard of "onchain culture," arguing that its tokenization model democratizes creator monetization beyond platform-controlled advertising revenues. This camp highlights ZORA's disruption of traditional social media economics, where platforms capture most value generated by creators; in contrast, ZORA's automated royalty distribution(typically 1-1.5% per Content Coin transaction) channels value directly to creators. Detractors, however, dismiss creator tokens as "digitized garbage" lacking intrinsic value, pointing to incidents like the "Base is for everyone" controversy in April 2025. During this event, an official Base post on Zora generated a Content Coin that skyrocketed to a $17 million market cap before crashing 90% within minutes, raising accusations of ecosystem-sanctioned pump-and-dump schemes. Critics also question the sustainability of token creation velocity, noting that speculative token minting rather than genuine content engagement, may be driving activity, as evidenced by Polymarket traders pricing a 38% probability of 30% price corrections within weeks during the August peak

.

Market Trends

ZORA's ascent reflects broader trends in SocialFi convergence, where decentralized social platforms integrate DeFi mechanics to monetize engagement. Its most significant competitive achievement has been surpassing Solana-based platforms in new token creation, with Zora generating 61,000+ creator coins in the first week of August compared to Solana leaders Pump.fun and LetsBonk. This growth is fueled by a self-reinforcing speculative flywheel: token price appreciation attracts creators, whose content minting requires $ZORA purchases for gas and liquidity provisioning, thereby increasing token demand and price, which in turn attracts more creators. Unlike predecessors like FriendTech that monetized social graphs through key-based access, ZORA's content-centric model enables micro-monetization of individual posts, expanding potential revenue streams. The platform's revenue trajectory validates this approach: daily fees surged from $500 to $53,000 between July and August 2025 as trading volumes hit $15.3 billion, though sustainability concerns linger given the correlation between volume and token speculation rather than content consumption. With Virtuals-like price patterns observed, referencing a 2024 SocialFi project that gained 400% before collapsing—traders anticipate either continued exponential growth or violent mean reversion.

Regulatory Ambiguity and Compliance Challenges

Operating at the intersection of social media, creator economies, and cryptocurrency, ZORA navigates multiple regulatory gray zones. Its classification remains ambiguous: the SEC's 2024 clarification that staked ETH does not constitute a security offers partial precedent, but creator tokens could face scrutiny as potential unregistered securities if deemed investment contracts. Zora Labs preemptively labeled $ZORA a "pure memecoin for entertainment" without governance rights or utility claims, potentially shielding it under the same regulatory tolerance afforded to Dogecoin. However, the platform's 3% transaction fee structure and royalty distribution mechanisms create additional compliance complexity, particularly regarding money transmitter licensing and tax reporting obligations for creators globally. The April 2025 "Base is for everyone" incident further highlighted market manipulation risks, with Coinbase (Base's operator) distancing itself from the token's volatility despite platform involvement. As global regulators increase SocialFi scrutiny—particularly the European Banking Authority's proposed MiCAR amendments targeting "social tokens"—ZORA's borderless model may require jurisdictional adaptations or geofencing.

Risks and Sustainability Concerns

ZORA's hypergrowth masks significant vulnerabilities across technical, economic, and behavioral dimensions. Tokenomics imbalances loom large: with 26.1% of $ZORA supply allocated to investors and 18.9% to the team, unlock events beginning October 2025 could flood markets with 4.5 billion tokens (45% of total supply), potentially triggering severe sell pressure. Derivatives markets amplify volatility risks: despite spot accumulation, negative funding rates and long/short ratios below 1 indicate bearish leverage positioning that could force cascading liquidations during pullbacks. The platform's core engagement metric—daily created tokens—shows signs of speculative inflation, where users mint low-effort content to capture potential airdrops rather than building genuine communities. Technically, the automated smart contract architecture for Content Coin minting remains unaudited for edge cases, creating potential vectors for sybil attacks or token impersonation scams. Perhaps most fundamentally, ZORA faces a product-market fit paradox: its growth depends on speculative token trading, yet sustainable creator monetization requires non-speculative content engagement—objectives currently at odds based on transaction data showing minimal organic content consumption relative to token flipping activity.

Future Trajectory

ZORA stands at a critical juncture where it could evolve toward sustainable SocialFi infrastructure or devolve into a speculative artifact. Bullish scenarios envision 10x user growth through 2026 as creator monetization superiority attracts Instagram and TikTok influencers, with price targets reaching $0.40-$0.60 based on comparable social token valuations relative to daily active users. Protocol upgrades like Lineal2 integration (enabling ETH-denominated staking) and cross-chain expansionscould further solidify utility. Bearish catalysts include the October 2025 unlock cliff, potential regulatory actions against creator tokens, or user attrition should speculative returns diminish. The most probable outcome involves bifurcation: ZORA's token may stabilize as a volatile but persistent SocialFi blue chip, while the underlying platform either achieves mainstream creator adoption beyond crypto natives or recedes into a niche for degen content farmers. Critical watchpoints include the creator retention rate post-token unlock, fee sustainability during bear markets, and evolution of secondary markets for Content Coins currently illiquid despite their theoretical tradability. As Base ecosystem lead Jesse Pollak asserted, "If we want the future to be onchain, we have to be willing to experiment in public"—ZORA represents perhaps crypto's boldest experiment in rearchitecting human attention economics, for better or worse.

Conclusion

ZORA embodies the audacious innovation and speculative excess that defines crypto's frontier. By transforming social posts into tradable assets and creator reputations into liquid markets, it pioneers a new paradigm where attention generates immediate financial rewards—a vision attracting 27,800 daily creators and $15.3 billion trading volume despite profound unresolved questions about sustainability and value capture. The project's meteoric rise underscores a broader market shift toward SocialFi convergence, yet its dependence on token speculation rather than organic content monetization leaves its long-term viability uncertain. Regulatory scrutiny, token unlock overhangs, and emerging competitors ensure ZORA's path forward will involve violent volatility and ideological contention. Nevertheless, its core insight that blockchain can reconfigure creator economies by enabling direct value transfer between audiences and creators will likely persist regardless of ZORA's specific fate. As the boundaries between social media and financialization dissolve, ZORA serves as both a harbinger and cautionary tale for Web3's ambition to tokenize human interaction itself.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.