This week, BTC exceeded $124,000, achieving a new all-time high; ETH increased by 12.02%, and leading altcoins experienced notable gains. BitMine Immersion is aiming to raise $20 billion to enhance its ETH portfolio, reflecting ongoing long-term optimism among institutional investors regarding ETH. The total cryptocurrency market capitalization reached a historic $4.21 trillion, with BTC’s market cap exceeding that of Alphabet Inc., positioning it as the fifth largest in the world. Base achieved over $2 billion in single-day DEX trading volume.

Market Overview

BTC: BTC increased by 3.61% this week. Initially, prices hovered around $120,000 before steadily rising in the following sessions. On August 12, BTC experienced a significant drop from approximately $124,000 to below $118,000, coinciding with a surge in trading volumes, indicating profit-taking activity. However, bulls swiftly regained control, and on August 14, BTC broke through to new highs, achieving a price of $124,497. As of the latest update, BTC was trading at $123,516.61, maintaining robust momentum.

ETH: ETH experienced a 12.02% increase this week. The price stabilized around $4,220 at the beginning of the week, encountered a short period of selling, and then surged on August 12 with an intraday rise of approximately 8.7%, surpassing the $4,600 threshold. Ongoing positive sentiment drove ETH to reach a local high of $4,783—only about 3% below its all-time peak. Strong trading volumes suggest active capital movement. Currently, ETH is priced at $4,750.92, indicating significant breakout potential.

Altcoins: The fear and greed index is now at 68. Major alcoins have seen a huge jump. In the last week, within the top 100 cryptocurrency assets, LDO surged by 60.34%, PENDLE increased by 40.06%, and ADA experienced a rise of 33.33%, capturing significant market interest.

ETF: Bitcoin ETFs saw 6 straight days of inflows ($1.1B total); Ethereum ETFs hit a $1.02B single-day record.

Macro Data: U.S. Treasury Secretary Scott Besant openly supported a more assertive 50-basis-point reduction and indicated that additional easing could be on the horizon. This prompted a worldwide rally, with U.S. stocks—especially the S&P 500, Nasdaq, and Dow—reaching new highs.

Stablecoins: The current market cap of stablecoins is $269.5 billion, with USD1 and USDE contributing significantly to the growing market interest.

Gas Fees: Ethereum network gas fees are higher this week, with average fees reaching 0.649 Gwei on August 14.

Top Categories

This week, the cryptocurrency market experienced a volatile downtrend, with a notable decline in investor optimism. Several altcoin sectors trended downward. According to Coingecko data, only a few categories—Oracle, RWA Protocol, and Proof of Stake (PoS)—saw gained over the past 7 days, rising by 38.3%, 33.3%, and 4.4% respectively.

Oracle

Oracles are used by protocols in their smart contracts in order to obtain external data. This allows the closed-off blockchain environment to communicate with data points on the outside world. For example, a protocol offering synthetic Nasdaq-listed stock on

blockchain will need to pull external data from the stock market. With an oracle, the protocol will be able to do so. Over the past 7 days, the Oracle sector rose 11.2%, with

LINK gaining 41.2%.

RWA Protocol

Real World Assets (RWA) refers to the process of taking tangible assets from the physical world and representing them as digital tokens on a blockchain. Imagine owning a small piece of a high-value office building or earning interest from a U.S. government bond, all through a crypto wallet. The RWA Protocol sector grew 10.4% in the last 7 days, with

ONDO and

POLYX going up 13.7% and 8.5%.

Proof of Stake (PoS)

Proof of Stake (PoS) is a

consensus mechanism used by blockchain networks to validate new transactions and create new blocks. Instead of relying on energy-intensive

Proof-of-Work (PoW) like Bitcoin, PoS selects validators based on the amount of cryptocurrency they "stake" or lock up as collateral. This mechanism aims to be more energy-efficient and potentially more accessible than PoW. Over the past 7 days, the sector rose 4.2%, with

ADA increasing 35.2%.

Weekly Market Focus

Bitmine Immersion Plans to Issue $20 Billion Worth of Stock to Buy More ETH

Bitmine Immersion Technologies (BMNR) stock ended Tuesday's trading session up more than 5% after ethereum (ETH-USD) rose another 6% to trade north of $4,500 and the company announced plans to sell up to another $20 billion worth of stock to increase its holdings of cryptocurrency.

Bitmine, whose board is led by investor Tom Lee, announced Monday that its holdings of ETH stood at $4.96 billion, or a little over 1.15 million tokens, meaning the company owns roughly 1% of all tokens in circulation.

The company's goal is to eventually acquire 5% of the world's outstanding ETH tokens. Monday's news pushed the stock up more than 14%. The stock is up over 750% this year.

Grayscale Moves Toward Spot Cardano and Hedera ETFs with New Filings

Grayscale Investments has registered two new statutory trusts for Cardano and Hedera, signaling it may be preparing to launch spot exchange-traded funds for both assets.

The filings, dated Aug. 12, list the entities as the Grayscale Cardano Trust ETF and the Grayscale Hedera Trust ETF, both organized as general statutory trusts.

The registrations appear on Delaware’s official corporate records portal and follow a pattern the asset manager has used before when preparing for ETF launches. Similar filings have often preceded S-1 submissions to the US SEC, a required step before a fund can begin trading.

Earlier this year, the SEC acknowledged NYSE Arca’s 19b-4 form for Grayscale’s proposed spot Cardano ETF and Nasdaq’s form for a Hedera ETF. Those acknowledgments marked the first stage in the regulatory review process.

Trump Signs Executive Order to Allow Crypto in 401(k) Plans

President Trump says he wants to democratize retirement by allowing 401(k)s to invest in so-called alternative investments, or strategies outside stocks and other traditional investments, such as private equity and cryptocurrencies.

The executive order signed by Mr. Trump on Thursday would open the door to higher-risk investments landing in your 401(k). It could also potentially serve as a game changer for the $5 trillion private equity industry, which for years has wanted to gain access to America's retirement plans.

The move has the potential to shake up the typically staid menu of investment choices provided to workers through their employer-sponsored defined-contribution plans, which include 401(k)s and 403(b)s, with the latter aimed at teachers. The change might appeal to some savers, given that alternative investments can provide protection from market swings while also providing the potential for outsized returns. But there are several catches to be aware of, experts say.

Key Market Data Highlights

Crypto Market Cap Sets New Record at $4.21 Trillion; Bitcoin Market Cap Surpasses Alphabet, Ranks Fifth Globally

August 14, 2025, will mark a historic day in the crypto market. Bitcoin surged past $123,600 on Binance, breaking the previous record set on July 14. Its market capitalization soared to $2.46 trillion, a 24-hour increase of 2.83%. Meanwhile, Ethereum reached $4,783, just shy of its all-time peak of $4,868. The total cryptocurrency market capitalization surpassed $4.26 trillion for the first time, setting a new all-time high. Data shows that Bitcoin's market capitalization surpassed Google's parent company, Alphabet, reaching $2.458 trillion, making it the fifth-largest global asset.

This surge, occurring against the backdrop of growing expectations of a Federal Reserve rate cut, a surge in Wall Street capital, and surging short-selling pressure, marks a new phase in the integration of crypto assets with the traditional financial system.

The July U.S. CPI data served as the core trigger for this rally. Data showed that inflation remained flat month-over-month, but rose 2.7% year-over-year, below the expected 2.8%. Core CPI rose only 0.2% month-over-month, significantly lower than June's 0.3%. Following the release of the data, the CME Fed Watch tool indicated a 93.7% probability of a September rate cut, and a 64.4% probability of a 50 basis point cut in October. This expectation triggered a two-day decline in the US dollar index, breaking below 98 to 97.75. The 10-year US Treasury yield also fell to 4.245%, signaling a clear easing of global liquidity. The three major US stock indices rose collectively, with the Dow Jones Industrial Average up 1.04%, the S&P 500 up 0.32%, and the Nasdaq up 0.14%. Both the S&P and Nasdaq set new record closing highs. European stock markets followed suit, with Germany's DAX 30 up 0.67% and the UK's FTSE 100 up 0.19%. Asian markets also responded, with the Hang Seng Index breaking through 25,000 points and the Shanghai Composite Index reaching a nearly four-year high.

This macroeconomic environment is driving capital from low-yielding assets to the highly volatile crypto market, with the positive correlation between Bitcoin and US stocks reaching a historical peak.

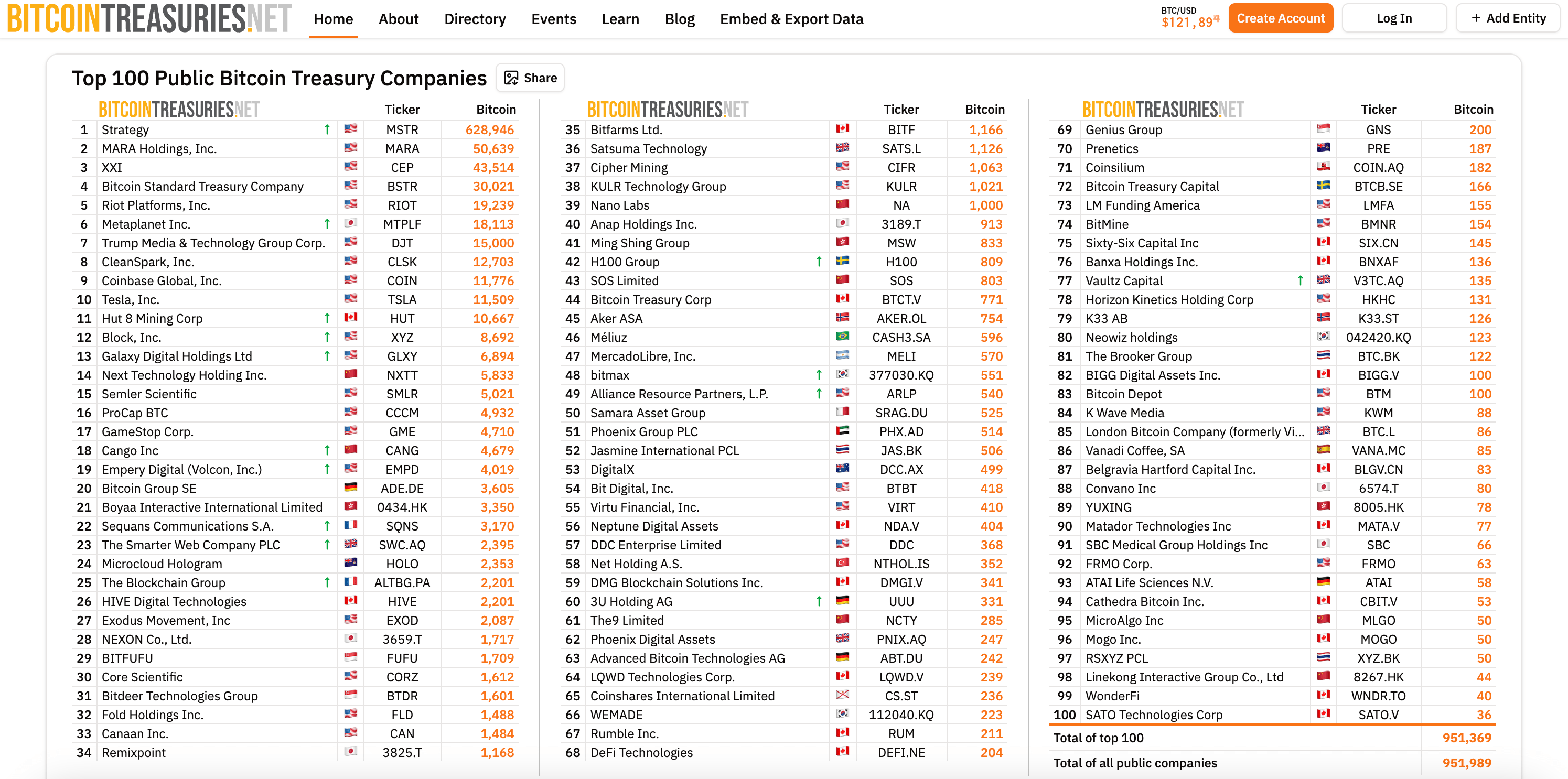

The systematic influx of institutional funds is the underlying support for this bull market. On August 7, Trump signed an executive order allowing 401(k) accounts to allocate crypto assets such as Bitcoin, activating the US pension market, which exceeds $7.3 trillion. At the corporate level, the world's top 100 listed companies already hold 951,000 bitcoins (worth $126.9 billion), with MicroStrategy holding over 628,000, or 3% of the total circulating supply.

Base DEX Trading Volume Surpasses $2 Billion Daily, On-Chain Activity Reaches New Highs

Dune Analytics reports Base’s DEX trading volume broke $2 billion in a single day for the first time, setting a new local record and highlighting its dominance in Layer 2 trading volumes and liquidity. The surge signals returning risk appetite and showcases Base’s advantage in transaction costs and speed.

Aerodrome led Base’s 24-hour DEX volume with $879 million (over 40% of the total), while Uniswap followed at $626 million. Combined, these top two protocols accounted for more than 70% of Base’s total DEX activity, indicating a strong concentration of capital in leading platforms.

This spike in trading may be driven by renewed interest in hot tokens, continued rollout of ecosystem projects, and cross-chain inflows. Thanks to low fees, Base is steadily attracting high-frequency traders and liquidity providers, deepening order books and ramping up activity. If this momentum holds, Base could continue growing its share within Ethereum’s Layer 2 ecosystem and reshape the DEX landscape.

Michael Saylor's Strategy Buys Another 155 BTC for $18 Million to Near 3% of Bitcoin's Total Supply

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 155 BTC for approximately $18 million at an average price of $116,401 per bitcoin between Aug 4 and Aug 10, according to an 8-K filing with the Securities and Exchange Commission on Monday.

Exactly five years on from its first bitcoin purchase in 2020, Strategy now holds a total of 628,946 BTC — worth around $76 billion — bought at an average price of $73,288 per bitcoin for a total cost of around $46.1 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. That's the equivalent of nearly 3% of bitcoin's total 21 million supply and implies around $30 billion of paper gains.

CoinCatch New Listings

Futures:

Spot:

Cryptocurrency:

PROVE/USDT (

Fee: Zero-fee Trading)

CoinCatch Weekly Events

New Spot Listing: Trade PROVE/USDT Spot with Zero Fees!

Event Period: From August 12, 2025, 04:00:00 to August 19, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Big Wins Ahead: 1 Million USDT Giveaway! Up to $10,000 Cashback Bonus & Apple Watch Hermès!

⏰ Event Period:

2025.8.14(UTC+8) - 2025.8.20(UTC+8)

🎊 New User Exclusive: Register for Up to $500 USDT!

During the event, register and complete the following tasks can earn up to 500 USDT:

-

New users who complete registration will receive

50 USDT bonus.

-

Deposit

100 USDT (transferred to the futuers account) to get

100

USDTbonus.

-

Trade 1,000 USDT in Futures to earn extra

100 USDT bonus.

Total Prize Pool: 1,000,000 USDT in position bonus.

💸 Up to 100% Cashback – Get Up to 10,000 USDT!

During the event, complete tasks and earn up to $10,000 in position bonus.

🎁 Surprise Gift: Win an Apple Watch Hermès

Among users who hit 1,000,000 USDT in Futures trading volume during the event, 3 lucky users will be randomly selected to receive an

Apple Watch Hermès as a surprise reward.

Competition Schedule:

Registration Period: 2025-08-12 20:00 (UTC+8) - 2025-08-25 20:00 (UTC+8)

Competition Period: 2025-08-12 20:00 (UTC+8) - 2025-08-26 20:00 (UTC+8)

Competition Prize Pool

The prize pool depends on the number of participants. The reward amount will continuously expand with an increasing number of participants and can reach up to

1,000,000 USDT cash rewards. See details below:

The number of participants and corresponding prize pools:

Token Unlocks Next Week

Tokenomist data indicates that from August 15–21, 2025, several major token unlocks are scheduled. The top three are:

Avalanche (AVAX): Date: August 20, 08:00 UTC. Unlock Value: $197 million. Tokens Unlocked: 954,000 AVAX (2.41% of circulating supply)

LayerZero (ZRO): Date: August 20. Unlock Value: $43.81 million. Tokens Unlocked: 24.68M ZRO (22.2% market cap)

Kaito (KAITO): Date: August 20. Unlock Value: $19.95 million. Tokens Unlocked: 16.67M KAITO (6.91% market cap)

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.