This week, Bitcoin (BTC) recorded a modest drop of 0.03%, facing resistance and consolidating at higher levels, while Ethereum (ETH) surged by 3.55%, experienced a jump and slight drop afterwards. Bitcoin's annual transaction volume surpassed Visa for the first time, reaching $20 trillion. Active loan scale of Ethereum Lending Protocols reaches $30 billion, hitting a historical high. The Bitcoin Layer 2 project Merlin initiated its 2.0 upgrade, aiming to create a "yield-generating, tradable" BTC. White House released AI Action Plan: "Winning the Race: America's AI Action Plan".

Key Updates

-

Merlin 2.0 upgrade officially released, aiming to create “interest-bearing and tradable” BTC

-

White House Releases AI Action Plan: "Winning the Race: America's AI Action Plan"

-

Goldman Sachs and Bank of New York Mellon jointly launched tokenization solution for money market funds

-

Ethereum lending scale exceeds $30 billion, reaching an all-time high

-

Bitcoin’s annual transaction volume surpasses Visa for the first time, moving towards a global value settlement network

Market Overview

-

BTC — This week, BTC rose 0.03%. BTC price fluctuated between $117,300 and $119,995, showing an overall trend of decline followed by recovery. From July 17 to 20, the price gradually fell from $119,289 to a low of $117,300, then saw a significant rise on July 22, breaking through $119,000. However, on July 23, the price slightly retreated to $118,754, indicating some selling pressure at higher levels. In the short term, the market may continue to test the $120,000 resistance level.

-

ETH — This week, ETH surged 3.55%, outperforming the average gain of altcoins. ETH demonstrated a robust upward trend over the past 7 days, with the price climbing from $3,368 on July 17 to $3,765 on July 22, showing strong market confidence. Although the price slightly retreated to $3,746 on July 23, the overall trend remains bullish with active trading volume. In the short term, Ethereum may continue to challenge resistance levels above $3,800, with market sentiment remaining optimistic.

-

Altcoins — This week, mainstream altcoins generally showed an upward trend. The median price change for the top 100 cryptocurrencies by market cap was 3.40%. CFX was the best-performing token this week, with a gain of 75.22% over the past 7 days.

-

ETF & Derivatives — On the ETF front, BTC ETFs have seen net outflows in the past 3 days, due to BTC consolidating around $120,000 and declining 7-day returns. ETH ETFs, however, have experienced 14 consecutive days of net inflows, as ETH has led altcoin gains over the past 7 days, with its price briefly breaking $3,800. In the futures market, over the past 24 hours, BTC and ETH contracts saw liquidations of $67.14 million and $149 million.

-

Macro Data — The initial estimate for the U.S. One-year inflation expectation in July is 4.4%, lower than the market expectation of 5.0%. This data reflects consumers’ expectations of easing inflationary pressures, potentially allowing more flexibility for Federal Reserve monetary policy adjustments.

-

Stablecoins — The total market capitalization of stablecoins increased to $269.8 billion, indicating further inflow of off-chain funds.

Top Sectors This Week

The cryptocurrency industry continued to rise this week, with market sentiment remaining optimistic and most mainstream altcoin sectors gaining. According to Coingecko data, Liquid Staking Protocol, Stablecoin Protocol, and RWA Protocol sectors all showed upward trends this week, rising 51.3%, 13.8%, and 8.2% respectively over the past 7 days.

Liquid Staking Protocol

Liquid Staking Tokens (LSTs) are tokenized representations of staked assets in Proof-of-Stake (PoS) blockchains. They allow users to earn staking rewards while maintaining liquidity and flexibility to use their assets in other DeFi applications. Essentially, instead of locking up tokens in a traditional staking pool, users receive an LST (like stETH in Lido) that can be traded or used in other DeFi protocols. This sector rose 51.3% over the past 7 days, with Sceptre Staked FLR, Cronos zkEVM CRO and Lista DAO gaining 19.4%, 13.3% and 8.7% respectively.

Stablecoin Protocol

A stablecoin protocol is a system designed to create and manage stablecoins, which are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar. These protocols ensure stability through various mechanisms, such as maintaining reserves of the pegged asset, using algorithms to adjust supply, or employing a combination of both. This sector rose 13.8% over the past 7 days, with Spark SPK, Pinto PINTO and Ethena ENA gaining 285.4%, 131.9%, and 19.3% respectively.

RWA Protocol

RWA Protocol tokenizes real-world assets (such as real estate, bonds, etc.) through blockchain technology, significantly enhancing asset liquidity and accessibility, and building a bridge between traditional finance and the digital economy. Its core value lies in enabling digital management and trading of assets through smart contracts, lowering investment thresholds and increasing transparency. This sector rose 8.2% over the past 7 days, with Centrifuge and Ondo gaining 11.9% and 9.7% respectively.

Focus of the Week

White House Releases AI Action Plan: "Winning the Race: America's AI Action Plan"

On July 23rd, the White House released its strategic action plan on AI, “Winning the Race: America’s AI Action Plan” (the AI Action Plan), which is designed to secure U.S. global leadership in AI with a strategic focus on maintaining a competitive edge over China. The AI Action Plan is grounded in several guiding principles. First, the AI Action Plan emphasizes empowering American workers through AI-enabled job creation and industry breakthroughs, such as in medicine and manufacturing, with the aim of raising the standard of living and creating high-paying jobs. Second, the Trump administration is focused on eliminating what it deems to be ideological bias and social engineering from federally supported AI tools, insisting that AI systems must be designed to “pursue objective truth,” particularly as they shape how Americans access and interpret information. Finally, the AI Action Plan stresses the importance of defending against AI misuse, theft and emerging risks to ensure that advanced technologies are not exploited by malicious actors.

Merlin 2.0 Upgrade Officially Released, Aiming to Create “Yield-Generating and Tradable” BTC

Hester Peirce, a Republican SEC Commissioner, stated in a recent panel discussion that a physical subscription and redemption mechanism for crypto ETFs “will definitely happen at some point,” with related applications currently under review. Several firms, including BlackRock, have submitted proposals to the SEC to shift Bitcoin ETFs from cash-based to physical redemption models. In January, Nasdaq filed a 19b-4 form on behalf of BlackRock to advance this change, followed by similar moves from other firms. Peirce noted significant corporate interest in the physical mechanism.

The introduction of physical redemption will align Bitcoin ETFs more closely with traditional financial products, reducing the “alternative asset” label for cryptocurrencies. This will enable more direct and efficient institutional participation, significantly boosting crypto’s legitimacy and credibility in mainstream finance. Increased institutional involvement and regulatory scrutiny will drive greater transparency and compliance, enhancing the industry’s reputation and strengthening cryptocurrencies’ influence in the global financial system.

Crypto Prediction Market Polymarket Weighs Launching Its Own Stablecoin

Polymarket, the cryptocurrency-powered prediction market that recently attained a billion dollar valuation, is deciding whether to introduce its own customized stablecoin, or accept a revenue sharing deal with Circle based on the amount of USDC held on the platform, according to a person familiar with the plans. Polymarket’s motivation to create its own stablecoin is simply to own the yield-generating reserves that back the large amount of Circle’s USDC dollar-pegged token used to make bets on the popular betting platform, the person said.

A Polymarket representative said no decision has yet been made on the stablecoin question. Legislation around stablecoins passed in the U.S. last week makes issuing a stablecoin all the more attractive a business proposition for both crypto native firms and more traditional finance players alike who may be eyeing the success of stablecoin-issuing giants Tether and Circle.

Goldman Sachs and BNY Mellon Jointly Launch Tokenization Solution for Money Market Funds

Goldman Sachs and BNY Mellon have partnered to launch a blockchain-based tokenization solution for money market funds. BNY Mellon clients can now invest in tokenized money market funds through Goldman Sachs’ platform, with holdings recorded on-chain. The initiative has attracted participation from major asset managers such as BlackRock, Fidelity, and Federated Hermes, aiming to build a real-time, low-friction digital financial infrastructure.

This blockchain-based money market fund tokenization solution marks a significant advancement in the integration of traditional finance and blockchain technology. Its importance lies in leveraging digitized holding records and real-time transaction mechanisms to significantly enhance investment efficiency and transparency, offering clients a more convenient and cost-effective financial service experience. The participation of top-tier asset managers reflects the market’s broad recognition of blockchain’s potential in financial applications. Moving forward, this solution is expected to drive more traditional financial institutions to accelerate blockchain adoption, fostering an efficient, decentralized digital financial ecosystem. This will further bridge the gap between traditional markets and emerging technologies, creating broader opportunities for digital transformation in the global asset management industry.

Key Market Data Highlights

Ethereum ETFs See $296.5 Million Inflow in a Day, Bitcoin ETFs Face $131.4 Million Outflow

Investor sentiment in the US digital asset market is shifting, with Ethereum exchange-traded funds (ETFs) attracting fresh inflows while Bitcoin-based products face outflows.

According to data from SoSo Value, US-listed Ethereum ETFs saw a combined inflow of $296.5 million on July 21, marking one of the asset class’s strongest single-day performances. Fidelity’s FETH led the inflows with $127 million, followed by BlackRock’s ETHA at $102 million, and Grayscale’s ETHE at $55 million. Bitwise’s ETHW rounded out the group with an additional $13.1 million.

These inflows mark the twelfth consecutive day of net positive flows for Ethereum ETFs, with more than $3.5 billion entering these products. Notably, five of the ten most significant daily inflows since their launch have occurred in the past two weeks alone. Additionally, trading volumes for Ethereum ETFs have reached new highs relative to native ETH spot volumes on centralized exchanges, surpassing levels seen at launch. This trend suggests growing market confidence in Ethereum-based investment vehicles, possibly influenced by renewed institutional interest in the digital asset.

Active Loan Scale of Ethereum Lending Protocols Reaches $30 billion, Reaching Historic High

According to data from Token Terminal, as of July 2025, the total active loan volume of lending protocols in the Ethereum ecosystem has exceeded $30 billion, nearly a tenfold increase from less than $3 billion at the beginning of 2023. This rapidly rising curve not only reflects the recovery of DeFi lending activities but also indicates that on-chain capital utilization and leverage preference are continuously improving. Especially against the backdrop of recovering market risk appetite and steady upward movement of ETH prices, users are more inclined to collateralize assets for leveraged operations or liquidity cycling.

Behind this growth, on one hand, it has benefited from the improved liquidity of staked assets driven by the LRT (Liquid Staking Derivatives) narrative, with assets like stETH and rsETH widely used in lending protocols, promoting capital circulation and leverage strategy adoption. On the other hand, leveraged structures derived from lending protocols such as Aave, Morpho Blue, and Ethena Labs have continuously increased capital utilization efficiency. Additionally, institutional-grade funds are intervening through composite strategies like “EigenLayer”, Instadapp, and Gearbox, making Ethereum the main battlefield for on-chain leverage and yield strategies. Overall, this trend signifies that Ethereum is transitioning from an “asset settlement platform” to an “on-chain leverage and yield strategy center”.

Bitcoin Annual Transaction Volume Surpasses Visa for the First Time, Moving Towards a Global Value Settlement Network

Data from Sygnum, a regulated digital asset bank, shows that by mid-2025, Bitcoin network’s annual transaction volume has reached $20 trillion, surpassing Visa’s settlement scale of $13 trillion in the same period for the first time, highlighting its potential as a global value transfer infrastructure. Bitcoin is not only approaching traditional financial giants in transaction volume but also completing cross-border large-sum settlements in a trustless manner, with its decentralization, security, and censorship-resistant characteristics increasingly favored by institutions and high-net-worth users. This trend also reflects that despite price volatility, Bitcoin is transitioning from a speculative asset to an efficient value exchange tool.

Meanwhile, Bitcoin’s liquidity supply on exchanges has dropped to a nearly seven-year low, indicating that holders generally prefer long-term holding (HODL), with assets flowing to cold wallets, custodial institutions, or on-chain smart contracts. Furthermore, benefiting from ETF approval and continued institutional entry, global Bitcoin ETF holdings have exceeded $150 billion, with U.S. spot ETFs accounting for the majority. Listed companies like MicroStrategy and Tesla collectively hold over 900,000 bitcoins, estimated to be worth over $1 trillion at current market value. Overall, Bitcoin is accelerating its transformation from a “highly volatile asset” to “digital gold” and a “systemic settlement asset”, with on-chain data, fund flows, and product forms simultaneously moving towards a more mature asset evolution stage.

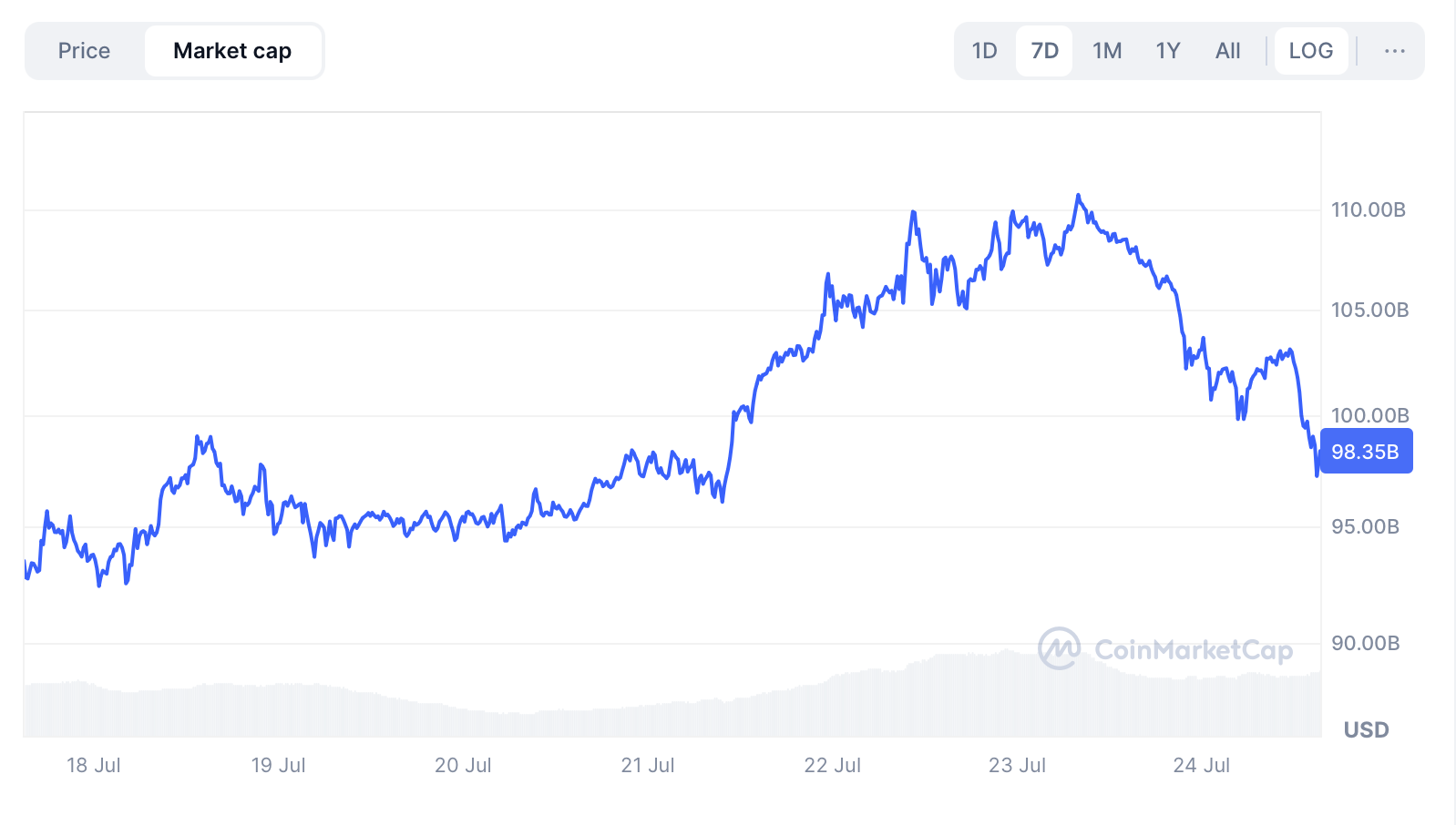

Solana Market Cap Surges Past $100 Billion as DeFi Ecosystem TVL Also Spikes above $10 Billion

Solana’s market cap has climbed back above the $100 billion threshold, driven by a broader crypto market recovery that is lifting the value of major altcoins.

As of July 21, data from CoinMarketCap shows Solana’s market cap surged by over 7% in the past 24 hours, reaching approximately $104 billion, its highest point since January. This follows a notable price increase that pushed SOL to a six-month high of $194.

Solana Market Cap Source: CoinMarketCap

The recent price surge has also invigorated Solana’s DeFi ecosystem. According to DeFiLlama data, the total value locked (TVL) across Solana-based protocols now exceeds $10 billion. This is the highest level recorded since January and reflects renewed interest in the network’s DeFi offerings. The growth is also visible in decentralized exchange (DEX) activity. Solana-based DEX platforms processed $23 billion in trading volume over the past week, a nearly 22% increase compared to the previous week.

CoinCatch Weekly Events:

Zero Fee Trading LIVE: Catch the BTC/USDT Swing!

We've all witnessed Bitcoin make history – that ATH moment was truly monumental! 🚀 To honor this milestone, we're launching a BTC Zero-Fee Trading Event – because every chapter of crypto's revolution deserves celebration.

Now as markets evolve, stay agile with fee-free BTC/USDT trades. Let's navigate the journey ahead together. Onward to the next breakthrough! ✨

Event Period: From July 21, 2025, 06:00:00 to August 4, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Altseason on the Horizon: Register for 5 Million USDT; Trade & Score Exclusive Altcoins Airdrop!

📅 Event Time: 2025.7.24 - 2025.7.30 (UTC+8)

🎊 New User Benefits: 100% Share 5,000,000 USDT

Event rules: Complete registration AND reach

1,000 USDT futures trading volume during event → randomly receive $1,000, $500, or $100 position voucher (guaranteed).

Total Prize Pool:

5,000,000 USDT

💸 Altcoin Season Up Front: Trade to Claim ETH, XRP

Event rules: During the event period, engage in

futures trading to sequentially unlock corresponding rewards.

Rewards stack cumulatively:

Reach

50,000 USDT volume → Claim

50 USDT position voucher (1,000 participants cap)

Reach

200,000 USDT volume → Claim

150 USDT position voucher (500 participants cap)

Reach

2,000,000 USDT volume → Claim

10 XRP (100 participants cap)

Reach

10,000,000 USDT volume → Claim

0.1 ETH (10 participants cap)

🎁 Surprise Gift: Trade to Win Gold Bars

Event rules: Users reaching 1,000,000 USDT futures volume qualify for ranking.

Top 3 by trading volume win

$1,000 Real Gold Bar.

Next Week Token Unlocks

According to Tokenomist, the following major token unlocks are coming up in the next 7 days (2025.7.25 - 2025.7.30):

SIGN will unlock tokens worth approximately $12.40 million in the next 7 days, accounting for 12.50% of the circulating supply.

JUP will unlock tokens worth approximately $31.18 million in the next 7 days, accounting for 1.78% of the circulating supply.

KMNO will unlock approximately $13.81 million worth of tokens in the next 7 days, accounting for 9.62% of the circulating supply.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.