As new blockchains emerge annually, a significant challenge has been enabling communication between them. Hyperlane is an initiative designed to address this issue by facilitating connections and information sharing among blockchains — all without depending on a central authority or intermediary. Whether it involves data transmission or token transfers, Hyperlane simplifies cross-chain communication, making it more efficient, quicker, and adaptable.

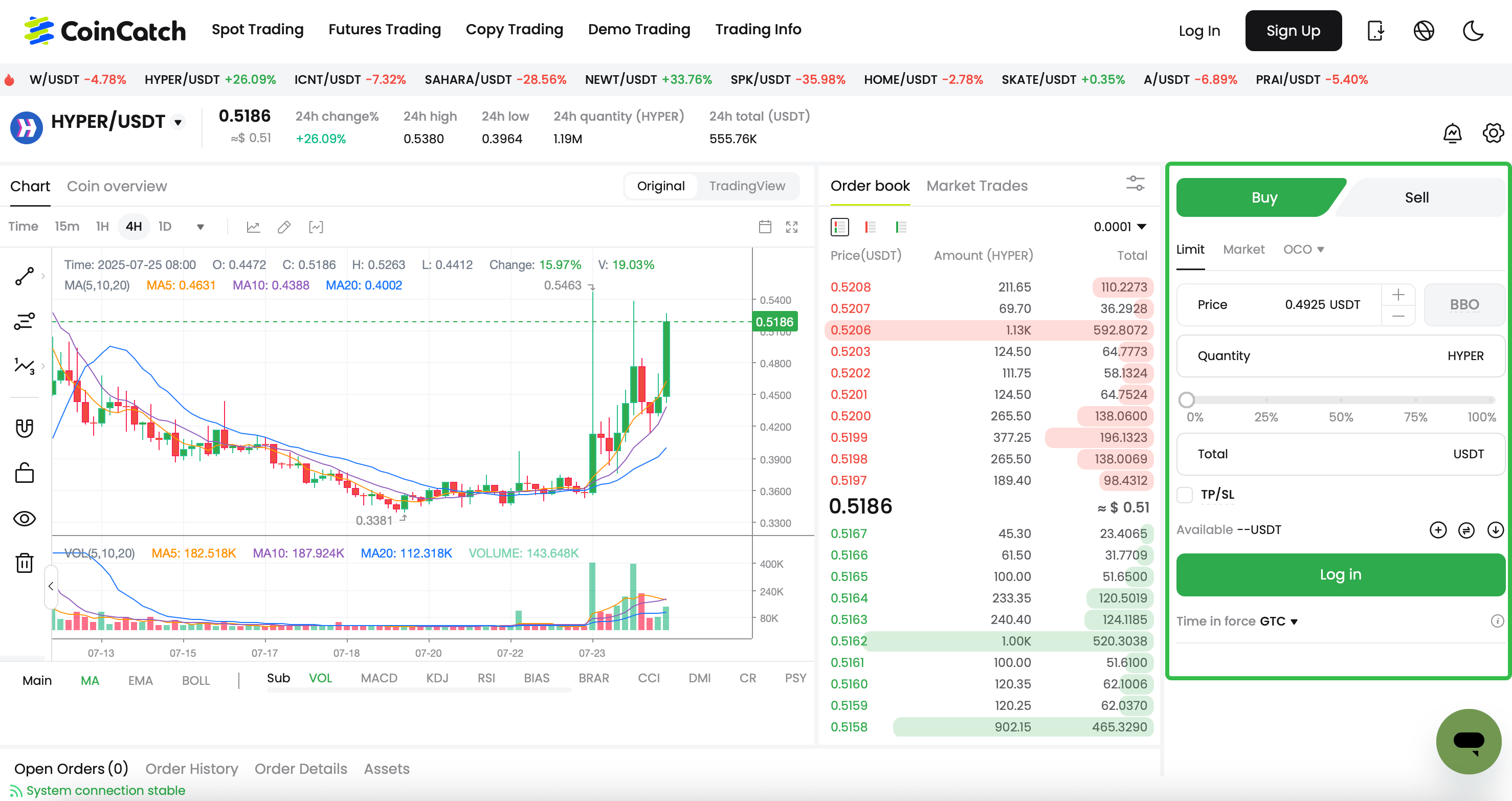

HYPER Price (July 25th). From: CoinCatch

What is HYPER?

HYPER is the native Token of the Hyperlane protocol, which is a permissionless, modular cross-chain communication protocol that allows developers to send messages, transfer tokens, and even call smart contracts across different blockchains. As the core asset of this ecosystem, HYPER is used to incentivize validators, enhance security, and promote network governance.

As Hyperlane’s multi-chain layout matures, the market attention on HYPE continues to rise, making it one of the important tokens in the current cross-chain field.

How Does Hyperlane Work?

At its core, Hyperlane is an

interoperability protocol — a system that helps different

blockchains interact. Hyperlane lets developers send messages, move assets, and even trigger smart contracts across different chains.

What makes Hyperlane stand out is its permissionless and modular design. You can deploy it on any blockchain (a Layer 1, rollup, or app-chain) and customize the security settings to fit your app. No gatekeepers. No approvals.

The Core Functions and Roles of HYPER

Staking: To ensure the security of cross-chain messages, the network requires a group of validators to verify the source and content of the messages. These validators must stake HYPE to participate in network operations and receive rewards based on their workload and performance.

Economic Incentives: Users of the Hyperlane ecosystem, such as validators, message relayers, and bridge operators, can earn HYPER rewards through staking or participating in the operation of the protocol, creating a positive economic cycle.

Governance Voting: HYPER holders can participate in governance voting for the Hyperlane protocol to decide on key parameters such as ISM (Inter-chain Security Module) configuration, support for new chains, new features, and more.

Protocol fee payment: In the future, some advanced features or customized services may require payment in HYPER as a fee or service charge, increasing the utility of the Token.

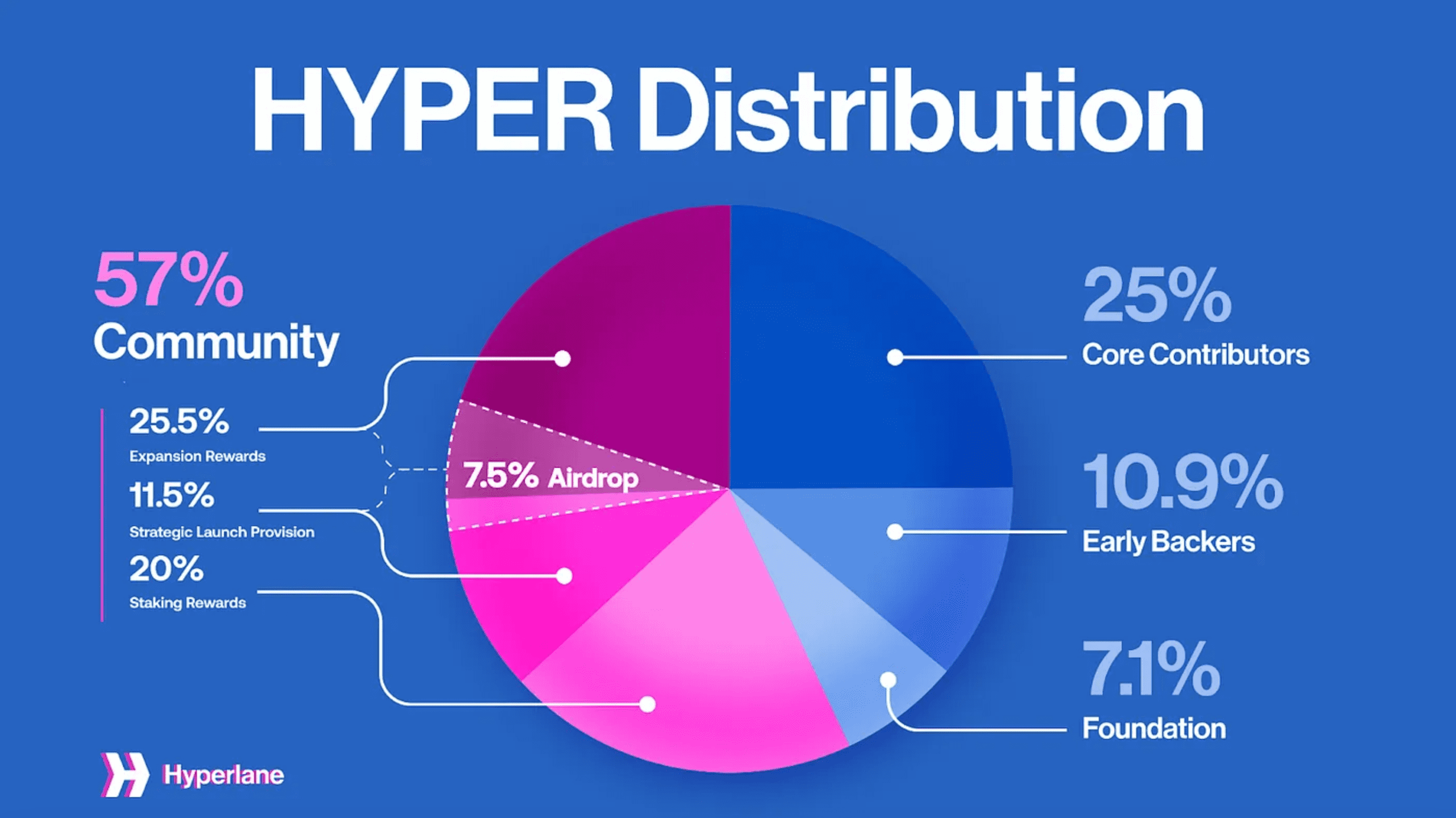

Token Allocations and Eligibility

The initial total supply of HYPER will be one billion tokens, reached in 25 years. The TGE circulating supply will be 177,700,000 HYPER.

The Expansion Drop at TGE will be 7.5% of the total supply, allocated from Expansion Rewards and the Hyperlane Foundation’s Strategic Launch Provision. The allocations noted below are all based on the total supply of HYPER.

Expansion Rewards (25.50% of total supply)

Strategic Launch Provision (11.52% of total supply)

Staking Rewards (20.00% of total supply)

Core Team (25.00% of total supply)

Hyperlane Foundation Treasury (7.11% of total supply)

Early Backers (10.87% of total supply)

Why Does HYPER Have Long-term Potential?

Core assets in the cross-chain track: Cross-chain communication is key to the interconnection of blockchains, and Hyperlane is leading in permissionless, modular design, with strong scalability.

Strong incentive mechanisms support: Validators, governors, and liquidity providers can all receive HYPER rewards by participating in the ecosystem, driving significant growth in the ecosystem.

The integration space between DeFi and NFT is vast: as Hyperlane incorporates more mainstream chains, the variety of supported assets will increasingly enrich, granting more application scenarios for HYPER.

Potential deflationary design: If the future protocol introduces a token burning mechanism (such as transaction fee buybacks and burns), it will further enhance the long-term value of HYPE.

What Should Be Noted When Investing in HYPER?

When investing in HYPERlane (HYPER), it's crucial to understand its potential for both high reward and significant risk. HYPERlane's price is influenced by various factors, including network updates, regulatory changes, and overall market sentiment. Consider a long-term investment strategy, but also be prepared for volatility. Due to the early stage of the token's unlock schedule, new token releases could impact price stability.

HYPER has risen significantly recently. Please trade cautiously and pay attention to risks.

Conclusion

HYPER is one of the rare Tokens in the cross-chain ecosystem that possesses versatility, security, and customization capabilities. For users who are optimistic about a multi-chain world and the future of interoperability, it is an asset worth long-term attention.

Reference:

CoinCatch Team

Disclaimer: Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.