On December 16th, 2025, the cryptocurrency market was shrouded in an atmosphere of intense caution. Bitcoin fell below the key psychological level of $86,000 for the first time in two weeks, while Ethereum once again approached the $3,000 mark, setting the stage for a crucial battle between bulls and bears that would determine the short-term direction of the market. Despite the Federal Reserve having previously ended quantitative tightening and injected liquidity into the market, weak overall liquidity and a significant decline in risk appetite seemed to temporarily outweigh the positive effects of macroeconomic policies. Meanwhile, BNB dropped over 3% in the past 24 hours, falling to $850, undercutting key support zones and erasing earlier session gains. PayPal is launching the PYUSD Savings Vault on decentralized lending platform Spark, introducing a new way for its stablecoin users to earn yield on their holdings. Ripple is planning to launch its RLUSD stablecoin on Layer 2 blockchains next year with the help of Wormhole.

Crypto Market Overview

BTC (-4.00% | Current Price: $85,790.25)

Bitcoin is currently at a critical technical juncture. After retesting the $88,000 support area, the price saw a slight rebound to around $89,500, but the overall trend remains weak. More concerningly, the price has fallen below $86,000 today, indicating that bearish forces are prevailing in the short term. One positive signal to watch is the potential "bullish divergence" on the daily chart: the price is forming lower lows near the support level, while the Relative Strength Index (RSI) is forming higher lows. This typically suggests that selling pressure is weakening and a momentum shift is possible.

Currently, there is a significant "supply zone" above Bitcoin, concentrated between $92,000 and $94,000, which has repeatedly prevented price increases. Furthermore, order flow data (Cumulative Delta) shows that aggressive selling continues to dominate the market, and the decrease in open interest also indicates that some leveraged funds are withdrawing. Therefore, Bitcoin's short-term path is clear: it needs to consistently hold above $94,000 to strengthen the bullish structure; conversely, a break below $88,000 could open the door to a deeper decline towards the $80,000-$85,000 support zone.

On December 15th, Bitcoin exchange-traded funds (ETFs) registered a total net outflow of $357.6 million, with Fidelity's FBTC saw an inflow of $230.4 million.

ETH (-5.84% | Current Price: $2,940.59)

Ethereum's performance today reflects broader challenges seen in Bitcoin, with a more pronounced decline. ETH decreased by 5.84%, falling to $2,940, which is the lowest level since early December—amid a decline in monthly revenue to $600 million. This development raises concerns regarding the viability of layer-2 (L2) scalability solutions. This marks the third consecutive month of decline in the 2024-2025 bear cycle, surpassing the persistence observed during the 2018-2019 downturn based on monthly data.

In terms of price action, ETH is currently trading within a narrow range around $3,000 following a significant pullback from recent highs of $3,500 in November. The recent breach below the $3,000 support level indicates increased vulnerability to further downside. The daily MACD histogram reflects intensifying bearish momentum, and trading volume increased by 20% during the decline, suggesting capitulation rather than accumulation. On the institutional front, BitMine's substantial ETH holdings—currently 3.97 million tokens valued at approximately $12.2 billion, approaching 5% of the circulating supply—offer a bullish signal. However, the 30% quarter-over-quarter decline in L2 revenue raises questions about the long-term sustainability of this strategic positioning.

On December 15th, ETH ETFs experienced a total net outflow of $85.7 million, with Fidelity's FETH saw an outflow of $11.0 million.

Altcoins

The market experienced a broad decline today, but with significant internal structural divergence. The DePIN (Decentralized Physical Infrastructure) sector led the decline, falling nearly 6%, with representative tokens such as

Filecoin (FIL) and

Render (RENDER) experiencing significant losses. Layer 2, DeFi, and Meme sectors also saw general declines of 3%-5%. The Fear and Greed Index is currently at 21, approaching a state of "extreme fear," and the average over the past 30 days is only around 18. This indicates that pessimistic sentiment has continued to spread and deepen. Historically, this is often a signal accompanying the formation of a temporary market bottom, but it does not guarantee an immediate reversal.

Macro Data

Macro headwinds are a predominant concern: Today's retail sales data, which has been rescheduled from September due to funding issues, could influence Federal Reserve expectations regarding interest rate increases in January 2026. Strong data may put downward pressure on risk assets such as cryptocurrencies, while weaker figures could reinforce expectations for rate cuts. The Federal Reserve's December reduction to a target range of 3.5-3.75% revealed vulnerabilities in Bitcoin's role as an inflation hedge, as yields increased following the announcement, according to Investing.com. Upcoming events from December 16-18, including employment reports and international policy decisions, will test cryptocurrencies' sensitivity; Bitcoin's trajectory remains dependent on a delicate macroeconomic balance. Grayscale's 2026 outlook anticipates cyclical downturns but remains optimistic about the potential for increased institutional adoption in the future.

On December 15th, the S&P 500 dropped 0.16%, standing at 6,816.51 points; the Dow Jones Industrial Average fell 0.09% to 48,416.56 points, and the Nasdaq Composite fell 0.59% to 23,057.41 points. The price of gold is $4,285.09 up 0.36%, at 4:00 UTC, December 16th.

Trending Tokens

ACE Fusionist (+22.15%, Circulating Market Cap: $22.97 Million)

ACE is trading at $0.2754, up approximately 22.15% in the past 24 hours. Fusionist is an AAA game that we have developed independently. The client utilizes the Unity engine, with the rendering segment employing the HDRP (High Definition Render Pipeline) to achieve AAA visual effects. The networking segment adopts real-time synchronization technology (KCP + flatbuffer protocol), and all computation results are determined by the backend to ensure there's no possibility of cheating. ACE broke above its 7-day SMA ($0.25) and 30-day EMA ($0.25) with RSI14 at 59.57 – neutral but trending upward. Volume surged 1,380% to $99.7M, confirming buyer conviction. The move invalidated ACE’s 2025 downtrend, but RSI nearing 70 warns of overbought risks. Key support now at $0.24 (50% Fibonacci retracement).

SWARMS Swarms (+8.63%, Circulating Market Cap: $14.61 Million)

SWARMS is trading at $0.01460, up approximately 8.63% in the past 24 hours. Swarms tackles limitations of single AI agents by enabling teams of specialized agents to collaborate. Use cases span automated research, enterprise data processing, and decentralized decision-making. For example, its "SenateSwarm" simulates legislative debates using 100+ agents, while medical swarms analyze patient data across hospitals. The platform aims to democratize access to advanced AI by decentralizing agent deployment and monetization. SWARMS broke above the critical 78.6% Fibonacci retracement level ($0.013071) with a bullish MACD crossover (histogram +0.0001533). The 7-day RSI (67.33) shows room for upside before overbought territory. Technical traders likely interpreted this as a breakout signal, triggering buy orders. The MACD’s upward momentum suggests short-term bullish sentiment could persist if the price holds above $0.013.

ENSO Enso (+9.06%, Circulating Market Cap: $14.67 Million)

ENSO is trading at $0.7129, up approximately 9.06% in the past 24 hours. Enso brings every blockchain together in a single, unified network. The single point of access for all blockchain development, where developers can read, write, and interact with any Smart Contract on any chain from a single integration. Empowering developers to build composable applications for millions of users across Web2 and Web3. Secured by validators and upgraded with governance. Enso’s API became the default toolset for Monad’s November 24 mainnet launch, enabling instant DeFi app deployment. This positions Enso as critical infrastructure for high-throughput chains.

Monad’s focus on low-latency DeFi aligns with Enso’s cross-chain automation strengths. Developers can now bypass months of integration work, increasing ENSO’s utility demand. The partnership also signals Enso’s role in future L1 launches.

Market News

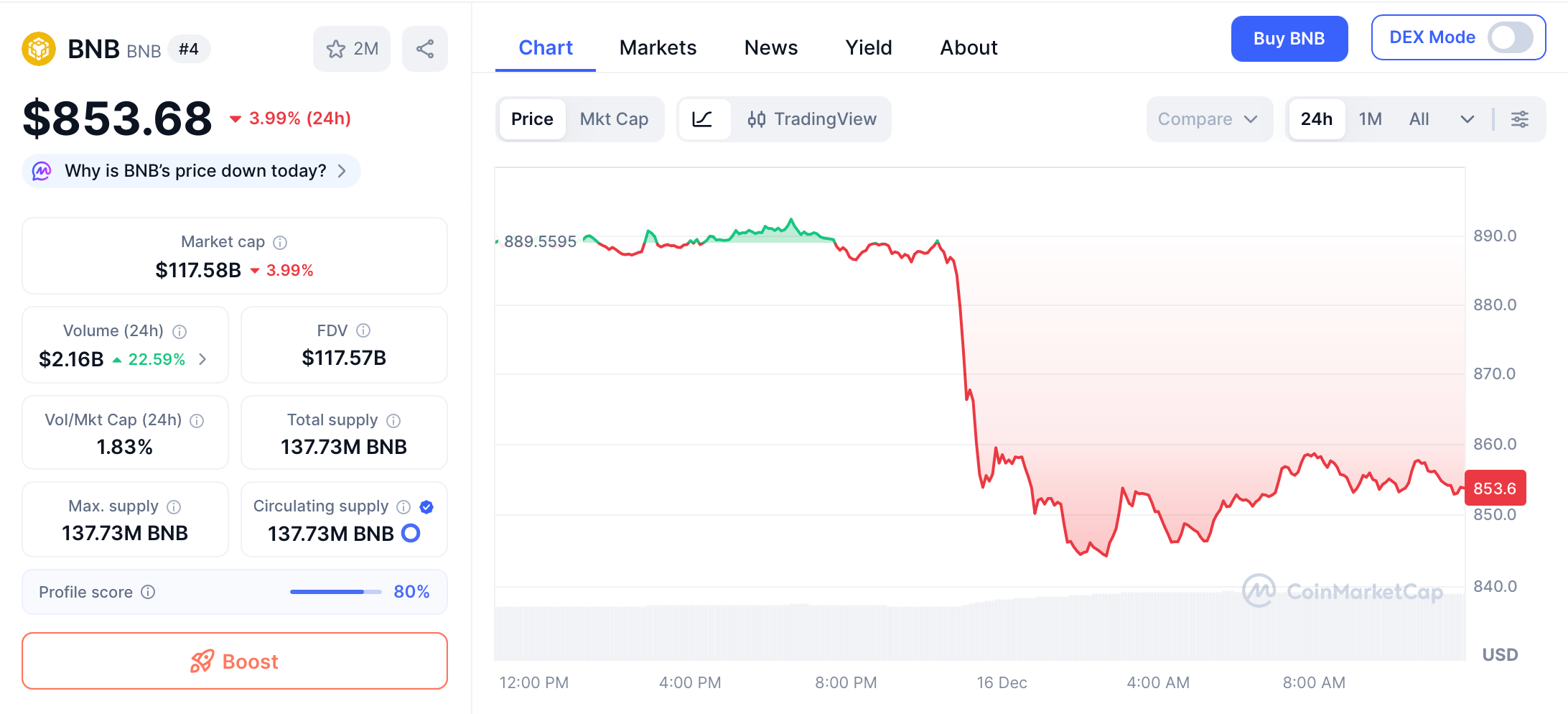

BNB Falls Below Key Support as Crypto Market Cap Slips Toward $3 Trillion

BNB dropped over 3% in the past 24 hours, falling to $850, undercutting key support zones and erasing earlier session gains.

BNB price. Source: CoinMarketCap

The move comes despite a brief technical breakout attempt near $888 and signs of accumulation during overnight trading hours, according to CoinDesk Research's technical analysis data model.

BNB spent most of the day consolidating between $885 and $888, building a tight range pattern supported by rising lows and increased volume early in the session. A breakout above the $888 technical pivot signaled potential bullish momentum. But that push failed to hold as trading activity thinned and broader market pressure returned. As the wider crypto market dropped, with bitcoin and ether registering 24-hour losses of 2.8% and 3.6%, respectively, BNB dropped as well.

The decline appeared technical rather than tied to any BNB-specific negative news.

The dip has seen the wider cryptocurrency market drop below the $3 trillion capitalization while 24-hour trading volume saw a major spike to $115.82 billion, according to CMC data.

PayPal Launches PYUSD Savings Vault on Spark Amid Push to Grow Stablecoin Deposits to $1 Billion

PayPal is launching the PYUSD Savings Vault on decentralized lending platform Spark, introducing a new way for its stablecoin users to earn yield on their holdings. The Spark website advertises a 4.25% APY for the vault — equivalent to the returns expected on other stablecoin vaults for the largest centralized stablecoins USDC and USDT, as well as Spark’s native USDS token, which is issued by parent organization

SKY.

Yield for the PYUSD Savings Vault is “anchored” to the Sky Savings Rate, which is funded by Sky Protocol's revenue, according to Spark’s documentation. Sky earns revenue on stability fees from overcollateralized loans, investments in real-world assets, and via liquidity provisioning in its first and largest subDAO, Spark.

Spark, launched in 2024, is a DeFi lending and liquidity protocol that offers a range of yield-generating stablecoin Savings vaults and the SparkLend decentralized money market, an Aave v3 fork that allows users to take out overcollateralized stablecoin loans by depositing crypto.

PYUSD was integrated into SparkLend in September, enabling users to supply and borrow the stablecoin. PayPal and Spark said at the time they wanted to grow deposits to $1 billion, after seeing about a fifth of that amount deposited within the first 24 hours.

There is currently nearly $150 million PYUSD supplied, earning about 2.11%, and about $67 million borrowed, according to Spark’s figures.

Ripple Taps Wormhole to Expand RLUSD to Layer 2 Chains Like Base and Optimism

Ripple is planning to launch its RLUSD stablecoin on Layer 2 blockchains next year with the help of Wormhole, the company said on Monday. Ripple has tapped Wormhole and its Native Token Transfers (NTT) token standard to test RLUSD on Optimism, Base, Ink, and Unichain and plans to officially launch on the new blockchains next year, pending regulatory approval.

RLUSD, which launched last December on XRP Ledger (XRPL) and Ethereum, has a total supply of over $1 billion, according to CoinGecko data. This isn’t Ripple’s first tie-in with the cross-chain interoperability provider. In June, the company expanded XRP Ledger’s multichain interoperability through an integration with Wormhole.

Ripple's broader strategy to position XRPL as an integral component of onchain, institutional finance. The company appears to be on the path to secure added regulatory certainty, as last week the U.S. Office of the Comptroller of the Currency (OCC) said it had conditionally approved a national trust bank charter for Ripple National Trust Bank.

If Ripple can secure the final approval from the OCC, it will "provide RLUSD with both state and Federal oversight — a dual regulatory structure that no stablecoin currently holds," the company said.

In November, Ripple raised $500 million at a $40 billion valuation, in a round led by investors from Fortress and affiliates of Citadel Securities, and joined by Galaxy Digital, Pantera, Brevan Howard, and Marshall Wace.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.