The decentralized perpetual futures (Perp DEX) landscape, once dominated by a single player, is now a fierce battleground of architectural philosophies and business models. At the forefront of this evolution stands Lighter, a project that has rapidly ascended from a closed beta to a top-tier contender by making a radical bet: zero trading fees and cryptographically verifiable fairness. As of late 2025, Lighter commands a significant portion of the Perp DEX market, frequently surpassing $10 billion in daily trading volume and challenging established leaders like Hyperliquid.

The project's momentum is culminating in one of the most anticipated events in the crypto ecosystem: its Token Generation Event (TGE). All signs, from founder comments to market prediction platforms, point toward a launch by the end of 2025, potentially aligning with the Christmas holiday period. This imminent TGE is not merely a liquidity event; it is the culmination of Lighter's unique strategy to reshape trust and efficiency in on-chain derivatives. Backed by a recent $68 million funding round from elite investors like Founders Fund and Ribbit Capital at a $1.5 billion valuation, Lighter has positioned itself not as another clone, but as a fundamental rethink of how a decentralized exchange should operate.

This article delves into the core of the Lighter phenomenon. It will explore the technical architecture that enables its "don't trust, verify" promise, analyze the strategic advantages of its Ethereum-aligned L2 approach, and contrast it with the application-chain model of its primary competitor, Hyperliquid. Finally, it will assess the market dynamics surrounding the upcoming TGE, the associated token economics, and the project's potential trajectory in the increasingly competitive world of on-chain finance.

What is Lighter?

Lighter is a decentralized perpetual futures exchange built as a zk-Rollup on Ethereum Layer 2. Its fundamental proposition challenges the status quo: it offers zero maker and taker fees for retail traders while guaranteeing that every order match, trade, and liquidation is cryptographically fair and verifiable. This dual promise of cost efficiency and transparent integrity addresses two persistent pain points in DeFi: the high cost of frequent trading and the inherent trust users must place in centralized sequencers or opaque matching engines.

Founded by Vladimir Novakovski, a former engineer at Citadel, Lighter's philosophy stems from a desire to build a "trust layer" for finance. The team, which includes veterans from both high-frequency trading and AI, pivoted back to crypto with the goal of creating a transparent, fair, and high-performance financial primitive. Unlike many projects that begin with token incentives, Lighter focused first on building sophisticated technology, undergoing an eight-month private testnet phase to refine its systems before a public mainnet launch in October 2025.

The protocol's business model ingeniously separates revenue from retail trading fees. Instead of charging users, Lighter generates revenue from its Liquidity Provider Pool (LLP), which acts as the counterparty to trades. LLP profits come from trader losses (when the majority of traders are wrong), funding rates, and liquidation fees. This model allows Lighter to offer free trading to attract volume and liquidity, while creating a sustainable yield source for capital providers. For professional market makers and institutions requiring ultra-low latency, Lighter offers a paid, zero-latency execution channel, creating a cross-subsidized ecosystem where retail benefits from free, slightly delayed execution, and pros pay for speed.

Technical Architecture: Zero-Knowledge Proofs

Lighter's most significant technological differentiator is its deep integration of zero-knowledge (ZK) proofs into the core exchange mechanics. This goes beyond using ZK-Rollups for scaling; Lighter encodes the very rules of the exchange into ZK circuits.

The system is architecturally divided for optimal performance and security. A central sequencercollects and orders transactions based on a strict First-In-First-Out (FIFO) basis, minimizing the potential for manipulative ordering. The heart of the innovation lies in the prover network, which generates a ZK-SNARK proof for every batch of operations. This proof verifies that all order matching and liquidations were executed correctly according to the hard-coded price-time priority rule, leaving no room for a malicious sequencer to reorder or censor transactions for profit. All state data and these validity proofs are then anchored to the Ethereum mainnet, inheriting its security guarantees.

This architecture delivers what Lighter terms "verifiable matching and verifiable liquidation". For users, it means they can cryptographically verify that their trade was executed fairly, a powerful feature in a space plagued by maximal extractable value (MEV). Furthermore, Lighter incorporates a critical safety feature called the "escape hatch". If the sequencer were to fail or act maliciously, users can independently generate a ZK proof of their account state from data published on Ethereum and withdraw their funds directly through a mainnet contract. This trust-minimized safety net is a structural advantage over isolated Layer 1 application chains, which cannot offer such a direct recourse to a higher-security layer.

Universal Cross Margin

Before a system can unify external capital, it must first prove its own integrity. Lighter's core architecture is engineered from first principles to deliver performance without sacrificing verifiability. The protocol operates as a ZK-rollup, a design that elegantly separates the functions of execution and verification. A centralized Sequencer is responsible for low-latency, first-in-first-out transaction ordering, providing the high-frequency performance that traders expect . However, its power is strictly limited; it merely determines the order, while execution validity is enforced elsewhere. Every state transition—every order placement, cancellation, trade, and liquidation—is processed by a Prover service that generates cryptographic proofs of correctness using

specialized ZK circuits (custom ZK circuits), built in-house.

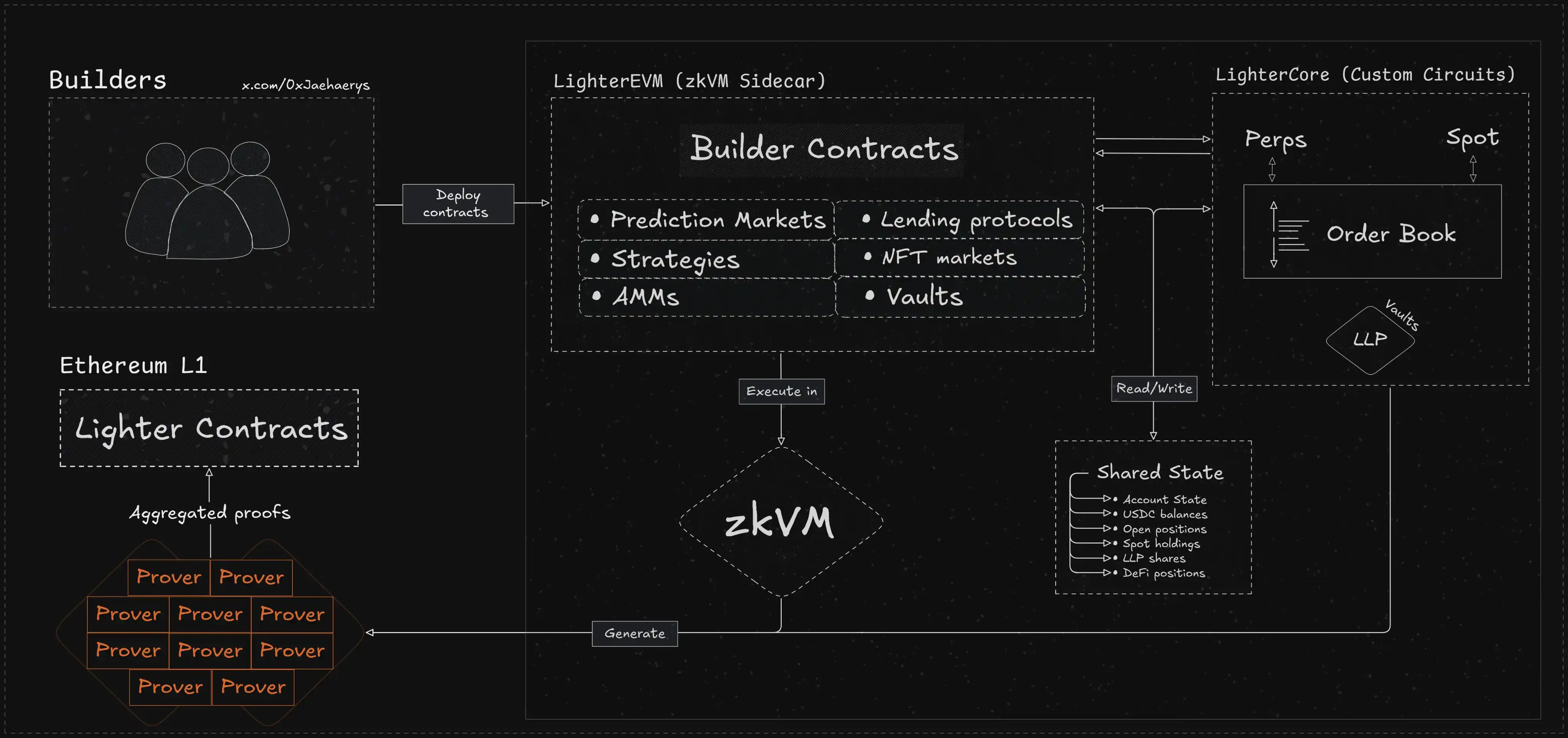

Current architecture

At the heart of this proving system is the

Order Book Tree, a novel, purpose-built data structure detailed in the Lighter whitepaper . Unlike generic Merkle trees that can be inefficient for order book operations , the Order Book Tree is a hybrid structure that encodes price-time priority directly into its leaf indices . This allows the matching engine to find and execute against the highest-priority order with optimal efficiency (requiring only a single leaf access), making the crucial task of proving the fairness of the entire matching process computationally feasible at scale .

This entire system is anchored to Ethereum by a crucial security mechanism: the

Escape Hatch . Lighter periodically publishes compressed state data, sufficient for users to reconstruct their individual account state, to Ethereum as data blobs . Should the Sequencer ever go offline or attempt to censor users by failing to process priority requests submitted on L1 within a deadline, the system enters an emergency mode . In this state, users can use the on-chain data to generate a ZK proof of their account's value and withdraw their assets directly from the L1 smart contracts, completely bypassing the L2 operator . This provides an unconditional guarantee of self-custody that standalone L1s, which are their own final arbiters, cannot offer .

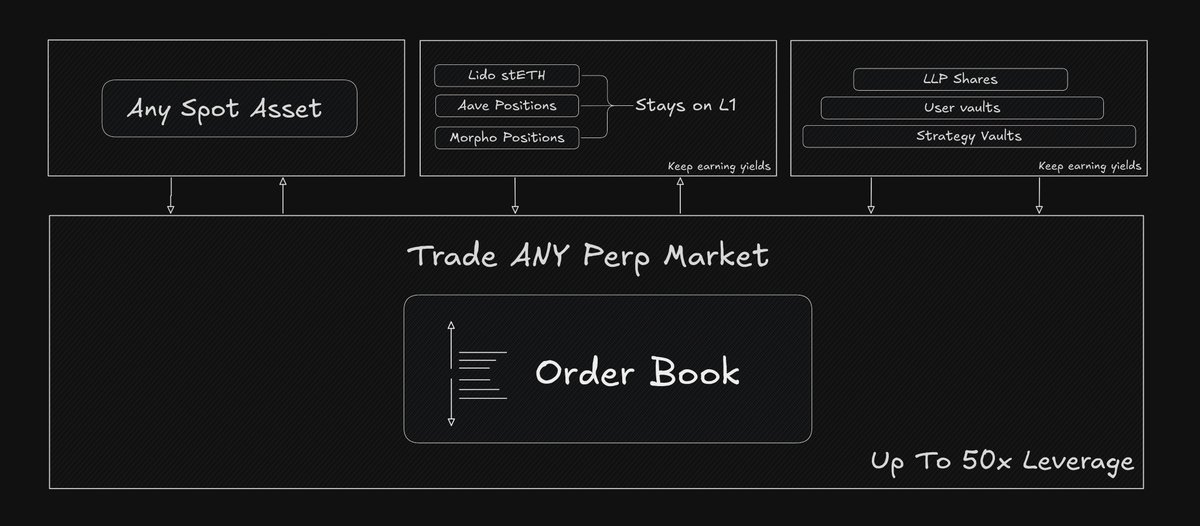

With this foundation of verifiable security, Lighter is poised to introduce its next evolution in capital efficiency:

Universal Cross Margin. This feature will transcend the protocol's current single-collateral (USDC) model, enabling traders to use a diverse portfolio of assets as collateral for their perpetuals positions. This includes not only base L1 assets like ETH and WBTC, but also more complex

tokenized positions from the broader DeFi ecosystem, such as Liquid Staking Tokens (LSTs) like stETH, or even representations of Liquidity Provider (LP) shares or lending protocol positions. As Novakovski explained, the key innovation is the ability to use

any asset that's kind of in the Ethereum ecosystem... natively used as collateral for Lighter, allowing users

to

keep those assets and trade. And then... If you get liquidated, then only then are those assets touched.

This activates dormant assets without forcing users to sell existing positions or trust risky cross-chain bridges.

-

LST: A trader holds stETH on Ethereum L1, earning staking yield . Instead of selling the stETH, they lock it in Lighter's L1 smart contract and use it as collateral to trade SOL/USDC perps on Lighter L2, while continuing to earn the stETH staking yield . This turns a passive, yield-bearing asset into active trading capital.

-

Composability with Lending: A trader has a position in a lending protocol like Aave on L1 (e.g., aUSDC) . Lighter's UCM could allow this position (or its tokenized representation) to be used as collateral. This would enable the trader to earn lending yield while simultaneously using that capital for margin trading on Lighter L2 .

-

Tokenized Pools for L1: Conversely, composability works both ways. A Lighter public pool (like LLP or a custom strategy pool) could potentially be tokenized into an ERC-20 token representing shares. This token could then exist on Ethereum L1 and be used in other DeFi protocols, such as being deposited into Aave as collateral.

The technical implementation relies on integrating these external assets into Lighter's state verification. The L1 asset (or tokenized DeFi position) will be locked in Lighter's dedicated Ethereum smart contracts]. The status of these locked assets is registered within Lighter's State Tree, becoming

part of the L2 state represented under the overall state root. Crucially, Lighter's

existing custom ZK circuits will be extended to incorporate and prove operations involving these additional asset types, ensuring that all actions related to this collateral are verifiable. The ZK proofs generated attest to the validity of the

entire L2 state transition, including the state of the locked L1 assets, and are subsequently verified by the smart contracts on Ethereum L1.

This architecture provides a robust mechanism for liquidations involving L1 collateral. If a position on Lighter becomes undercollateralized, the liquidation occurs within the L2 state transition. The ZK proof generated for this transition serves as an immutable, cryptographic authorization for the L1 contract to seize the necessary portion of the locked L1 collateral upon verification on Ethereum.

-

Liquidation Example (with LST): A trader uses locked stETH on L1 as collateral for a BTC long on Lighter L2. BTC price drops sharply, making the position undercollateralized. Liquidation occurs on L2. The Prover service generates a ZK proof of this state transition. The proof is submitted to L1. Lighter's L1 smart contract verifies the proof. Upon successful verification, the L1 contract gains the right to seize a portion of the locked stETH to cover the losses . Note that maximum leverage will likely be lower when using more volatile collateral like LSTs compared to USDC .

This creates an atomic, cross-layer settlement guarantee without relying on external oracles or bridges for the core security mechanism. It transforms a historically complex and trust-based process into a trustless, verifiable one, significantly enhancing capital efficiency and positioning Lighter as a potential capital-agnostic margin layer for the Ethereum ecosystem.

LighterEVM and the Modular Advantage

While its core matching engine is a custom-built ZK circuit optimized for speed, Lighter also envisions a rich ecosystem of decentralized applications. This is enabled through LighterEVM, a parallel execution environment for general-purpose smart contracts.

The design philosophy here is one of horizontal scaling and isolation. Lighter's core transaction engine (LighterCore) runs on its custom ZK circuit for ultimate efficiency in order book operations. In parallel, general smart contracts run on LighterEVM, which is based on a zkVM. This separation ensures that congestion from a popular lending protocol or NFT marketplace built on LighterEVM cannot slow down the core perpetuals trading engine, which is a problem that can plague monolithic chains where all activities compete for the same block space.

However, these two layers are not siloed. They are atomically composable, meaning a smart contract on LighterEVM can read the state of the order book on LighterCore and execute a hedging trade within the same transaction. This opens the door for sophisticated, automated structured products like options vaults or delta-neutral strategies that can react instantly to market conditions on the primary venue.

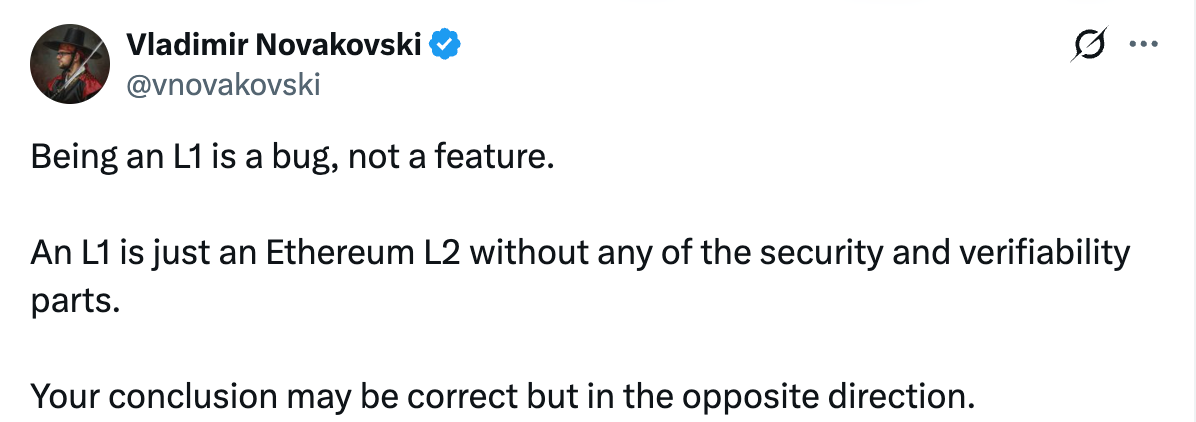

This modular, Ethereum-aligned approach is central to Lighter's long-term thesis. The founder has publicly criticized the isolated Layer 1 model, calling "

L1 a bug". The argument is that by building as an Ethereum L2, Lighter's success is structurally tied to and amplified by Ethereum's own roadmap improvements in data availability (e.g., DankSharding) and proof aggregation. Rather than competing against the entire Ethereum development community, Lighter rides its coattails, automatically becoming faster and cheaper as the base layer evolves.

Comparative Analysis: Lighter vs. Hyperliquid

The competition between Lighter and Hyperliquid represents the defining architectural debate in the Perp DEX space: modular Ethereum L2 versus monolithic application-specific L1.

Technical and Philosophical Divergence Hyperliquid's strength is its performance-oriented, integrated stack. It is a bespoke Layer 1 blockchain where the matching engine is written directly into the consensus mechanism, enabling phenomenal throughput and sub-second finality. This "performance paradigm" delivers a centralized exchange-like experience. However, this comes with trade-offs. Its ecosystem, HyperEVM, operates on the same consensus, risking congestion. Security and bridge integrity also rely on its own validator set, which has shown elements of centralization in crisis events.

Lighter takes the opposite, modular approach. It leverages Ethereum for security and data availability and focuses its innovation on a specialized execution layer. Its "fairness paradigm" prioritizes verifiable correctness over raw throughput, though it still achieves high performance (supporting 650k TPS). Its "escape hatch" provides a crypto-economically secure withdrawal path independent of Lighter's own operators.

Business Model and User Experience Their fee structures reveal different target users. Hyperliquid uses a volume-tiered fee schedule, which primarily benefits large institutions. Lighter's zero-fee model for standard accounts is a powerful magnet for retail and high-frequency traders, making it the unequivocally cheaper option for most sub-$100,000 transactions. Lighter's model of charging professional firms for low-latency access while providing free, slightly delayed execution to retail creates a unique market dynamic.

Liquidity and Ecosystem Strategy Hyperliquid has aggressively expanded its market suite through community proposals (HIPs), allowing external teams to launch new perpetual contracts. This has fostered ecosystem growth but has also led to liquidity fragmentation, where the same asset can be traded on multiple front-ends with separate liquidity pools.

Lighter, supported by traditional finance giants like Citadel and Robinhood, appears to be pursuing a more unified, institution-friendly model. It is developing "bridge-less cross-chain" technology, allowing assets like stETH or LP tokens locked on Ethereum mainnet to be used as collateral on Lighter without a separate bridge, maximizing capital efficiency and tapping directly into Ethereum's deep liquidity. Furthermore, Lighter offers transaction privacy for large positions, a critical feature for institutional players unwilling to expose their strategies on-chain, which Hyperliquid's transparent ledger does.

The TGE Timing, Tokenomics, and Community Frenzy

The anticipation for Lighter's TGE has become a self-reinforcing catalyst for its growth. Evidence strongly suggests a launch is imminent before the end of 2025.

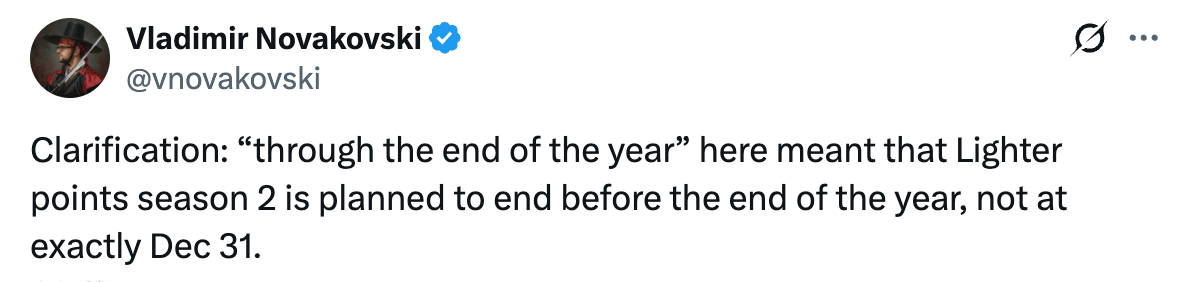

Timing and Signals

Lighter's CEO has stated that the ongoing "Season 2" points campaign will continue until the TGE and end "before the end of the year, but not on December 31st". He has also hinted on social media that "the holidays will be lit this year". Prediction markets like Polymarket reflect high confidence, with shares betting on a year-end TGE trading at prices implying an 89% probability. Notably, addresses linked to the Lighter team have purchased a significant volume of "YES" shares on this market, and Coinbase has added LIGHTER to its listing roadmap—both strong institutional signals.

Token Economics and Distribution The proposed tokenomics are heavily community-centric. A full 50% of the total token supply is allocated to the community. Within this, 25-30% of the entire supply is reserved for airdrops for users of Seasons 1 and 2, rewarding early testers and current participants. This generous allocation is a primary driver behind the platform's explosive trading volumes, as users actively "farm" points expected to convert into tokens.

The token (expected to be named LITER) is designed for utility within the Lighter ecosystem. Planned uses include granting access to exclusive liquidity pools, providing fee discounts for market makers, and enabling governance and staking functions.

Market Impact and "Airdrop Farming" This airdrop expectation has profoundly shaped Lighter's metrics. Its volume-to-open-interest (OI) ratio is exceptionally high (often above 8:1), a classic indicator of incentivized, high-turnover trading rather than organic, long-term position holding. While this demonstrates successful bootstrapping, it raises the critical post-TGE question: will this volume sustain once the immediate airdrop incentive is removed? Lighter's ability to transition from "incentive-driven" to "organic volume" will be the ultimate test of its product-market fit and the stickiness of its zero-fee, verifiable fairness value proposition.

FDV Expectations and Post-TGE Trajectory

Estimating Lighter's Fully Diluted Valuation (FDV) at TGE involves analyzing its current valuation, competitive positioning, and market sentiment.

The $1.5 Billion Baseline The clearest benchmark is its latest private market valuation of $1.5 billion, established during the $68 million raise in November 2025. This provides a strong anchor, suggesting that sophisticated institutional investors priced the underlying business at this level prior to any public token liquidity.

Comparative Market Analysis Comparing Lighter to its publicly traded rival, Hyperliquid (HYPE), reveals interesting dynamics. As of late 2025, Hyperliquid often holds a higher open interest (a measure of committed capital), indicating stronger persistent liquidity. However, Lighter frequently surpasses it in raw trading volume. Analysts have pointed out that Lighter appears to trade at a "valuation discount"relative to Hyperliquid when comparing metrics like volume/TVL multiples, suggesting room for FDV expansion if it can close the credibility gap.

Growth Levers and Risks

Key factors that could drive FDV growth post-TGE include:

-

Successful Launch of Spot Trading: Planned for late 2025/early 2026, this will expand Lighter's market from pure derivatives to a full exchange, capturing new user flows and fee streams.

-

Ecosystem Expansion via LighterEVM: The growth of a native DeFi ecosystem could create powerful network effects and lock in liquidity.

-

Institutional Adoption: The "Iron Triangle" of potential collaboration between Citadel (liquidity), Lighter (execution), and Robinhood (user access) is a potent narrative that could legitimize the platform for major capital.

-

Sustaining Volume Post-Airdrop: The single largest risk is a dramatic drop in activity after the TGE, which could undermine liquidity, increase slippage, and trigger a negative feedback loop. Lighter's ability to retain users through its core product appeal will be crucial.

Given these factors, a successful TGE could see Lighter's FDV stabilize near or above its $1.5 billion private valuation in the short term, with significant potential for re-rating upwards if it demonstrates sustainable organic growth and executes its roadmap, particularly in capturing institutional flows and expanding into spot markets.

Conclusion

Lighter enters its TGE not as a mere imitator, but as a formidable innovator with a distinct vision for the future of on-chain finance. Its radical zero-fee model and its foundational commitment to cryptographically verifiable fairness via ZK proofs carve out a unique and compelling position in the Perp DEX arena. Its strategic choice to build as a modular Ethereum L2, rather than an isolated L1, aligns it with the broader industry trend towards modularity and allows it to leverage Ethereum's security and ongoing innovation.

The impending token launch is a pivotal moment that will transition Lighter from a venture-backed startup to a publicly accountable crypto-economic protocol. The generous airdrop has successfully bootstrapped remarkable liquidity, but the post-TGE landscape will reveal the true strength of its value proposition. The core challenge will be transforming airdrop farmers into loyal users.

Ultimately, the competition between Lighter and Hyperliquid is beneficial for the entire DeFi ecosystem, pushing the boundaries of performance, cost, and user sovereignty. As the war for derivatives volume intensifies, Lighter, with its institutional backing, technological sophistication, and user-centric model, is powerfully equipped not just to compete, but to define a new standard for trust and efficiency in decentralized markets. Its journey from a concept of verifiable fairness to a top-tier exchange will be one of the defining narratives in the next chapter of decentralized finance.

Reference:

@vnovakovski. (n.d.). [Tweet]. X. https://x.com/vnovakovski/status/1975900397777895753

Lighter. (n.d.). Technical architecture: Lighter Core. Lighter. https://docs.lighter.xyz/about-lighter/technical-architecture-lighter-core

@vnovakovski. (n.d.). [Tweet]. X. https://x.com/vnovakovski/status/1974609195568959616

@0xJaehaerys. (n.d.). [Tweet]. X. https://x.com/0xJaehaerys/status/1983251296095482338?s=20

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.