On December 9, 2025, the cryptocurrency market experienced narrow fluctuations amidst "extreme fear." Bitcoin struggled above a key support level, while Ethereum showed relative resilience. The market narrative has shifted from internal drivers to external macroeconomic factors, with all eyes focused on Federal Reserve Chairman Powell's statements, which will set the tone for the market over the next 24-48 hours. Meanwhile, the Commodity Futures Trading Commission (CFTC) on Monday launched a pilot program allowing select digital assets, BTC. Major publicly traded HYPE token holder Hyperliquid Strategies (ticker PURR) is the latest digital asset treasury (DAT) to roll out a stock repurchase program. Investors hoping for South Korea to join the spot crypto ETF wave this year face disappointing news with recent reports confirming that regulatory approval for these investment vehicles is now effectively off the table for 2024.

Crypto Market Overview

BTC (-1.27% | Current Price: $90,075.07)

Bitcoin's price is currently stalled near $90,500. From a technical perspective, $90,000 is a critical support area that cannot be breached. It's not only an important psychological level but also close to key moving averages derived from the uptrend that began in early 2025. A break below this level could open the door to a decline towards $80,000 or even $70,000. On-chain data and the derivatives market reveal the current risk landscape. Recent Bitcoin ETF flows show net outflows, for example, nearly $200 million in outflows on December 5th alone, indicating that some institutional investors are choosing to take profits or hedge their positions ahead of potential events.

On December 8th, Bitcoin exchange-traded funds (ETFs) registered an outflow of $89.2 million, with Fidelity's FBTC saw an outflow of $39.4 million.

ETH (-0.39% | Current Price: $3,102.04)

Unlike Bitcoin, which is entirely tied to macroeconomic factors, Ethereum is demonstrating greater resilience based on its own fundamentals. The price has stabilized around $3,100, and several analysts point out that a multi-year accumulation base may be forming at this level. From a technical perspective, the daily Relative Strength Index (RSI) has rebounded from the oversold region and broken through the downtrend line. Historical data shows that when this pattern occurs, Ethereum subsequently experiences a minimum mid-term gain of 45%.

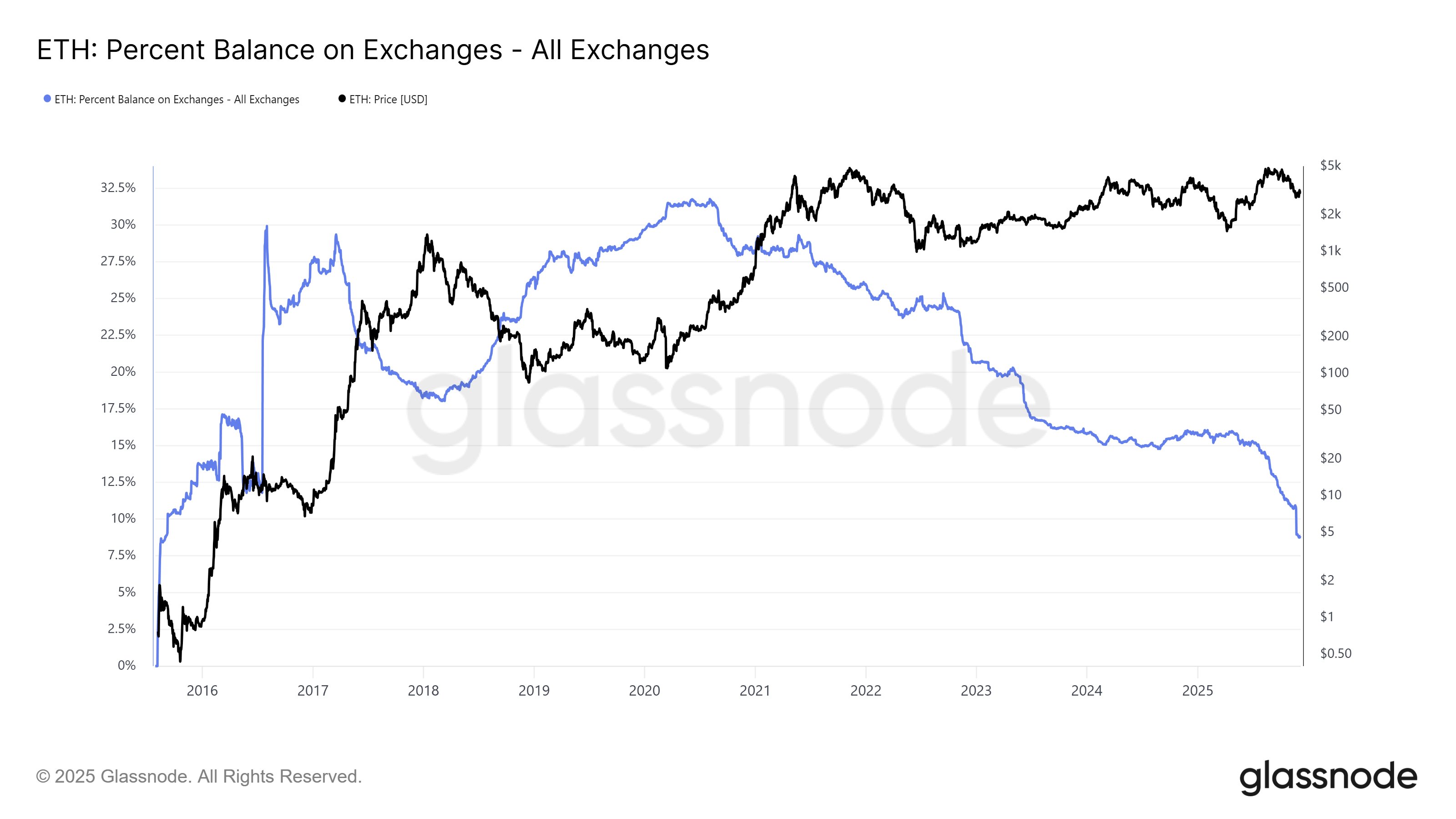

Ratio of ETH held on centralised exchanges. Source: Glassnode

On-chain data provides even stronger supporting evidence. According to Glassnode data, only 8.7%-8.9% of circulating ETH is currently held on centralized exchanges, a multi-year low. Meanwhile, over 40% of ETH is locked in staking contracts, Layer 2 bridges, or institutional custody products. This extreme "low exchange supply" phenomenon means that the supply of readily available ETH for sale is dwindling, and any concentrated buying pressure could quickly drive up the price. Furthermore, thanks to the Dencun upgrade, Ethereum mainnet gas fees have remained at historically low levels for an extended period (e.g., the average Gwei price decreased from 72 in 2024 to 2.7), significantly reducing user interaction costs and laying the foundation for ecosystem recovery.

On December 8th, ETH ETFs experienced a total net outflow of $11.8 million.

Altcoins

This uncertainty has suppressed market sentiment to rock bottom. The cryptocurrency fear and greed index has fallen to 25, placing it in the "fear" zone. This pessimism is typical of the market's reaction to a significant correction (Bitcoin has fallen 30% from its high) and the face of immense uncertainty. History shows that this extreme sentiment is often a necessary condition for the market to form a short-term bottom or even a reversal, but it also means that any rebound before uncertainty is resolved is likely to be fragile and unsustainable.

Macro Data

The market path in the next 24-48 hours will depend almost entirely on the outcome of the Federal Reserve's decision.

-

Dovish Scenario (Best-Case) : The Federal Reserve cuts interest rates by 25 basis points, and the dot plot suggests room for multiple rate cuts in 2026. Powell's speech downplays inflation concerns. This would be seen as a major positive, potentially stimulating Bitcoin to quickly break through the $95,000-$100,000 resistance zone, and driving Ethereum to break through $3,200 towards $3,500, while simultaneously revitalizing the entire altcoin market.

-

Neutral Scenario (Baseline) : The Federal Reserve cuts interest rates as expected, but remains vague about the future path, emphasizing data dependence. The market may follow a "buy the rumor, sell the fact" pattern, experiencing brief fluctuations before continuing its consolidation phase, awaiting new catalysts.

-

Hawkish Scenario (Worst-Case) : The Federal Reserve cuts interest rates but clearly indicates that the rate hike cycle may be ending, or it raises its inflation forecasts. The dot plot shows fewer rate cuts in 2026 than the market expected. This would trigger market panic, and Bitcoin could very well fall below $90,000 and quickly test support at $85,000 or even lower, leading to a new round of deleveraging.

On December 8th, the S&P 500 dropped 0.35%, standing at 6,846.51 points; the Dow Jones Industrial Average fell 0.45% to 47,739.32 points, and the Nasdaq Composite dropped 0.14% to 23,545.90 points. The price of gold is $4,194.40, down 0.08%, at 4:00 UTC, December 9th.

Trending Tokens

LUNA Terra (+29.23%, Circulating Market Cap: $95.11 Million)

LUNA is trading at $0.1339, up approximately 29.23% in the past 24 hours. Terra (LUNA) is a public blockchain protocol that emerged from Terra Classic. Terra Classic is home to the algorithmic stablecoin TerraClassicUSD (UST). It's now-renamed LUNC token collateralized UST, which crashed into a bank run in May 2022. That devalued LUNA to virtually zero and caused the launch of a new chain, resulting in Terra Classic and Terra. Terraform Labs co-founder Do Kwon faces sentencing on December 11, with U.S. prosecutors seeking 12 years for fraud tied to Terra’s 2022 collapse. Markets reacted to reduced uncertainty as Kwon’s legal team agreed to a capped sentence, avoiding a prolonged trial. Sentiment improved as Kwon’s potential extradition to South Korea (post-U.S. sentence) removes a multi-year legal overhang. Investors may interpret this as a step toward resolving Terra’s legacy risks.

ALLO Allora (+19.3%, Circulating Market Cap: $38.03 Million)

ALLO is trading at $0.1895, up approximately 19.3% in the past 24 hours. Allora is an open intelligence platform designed to make artificial intelligence systems more adaptive, collaborative, and efficient. The network enables users and developers to access and contribute to a collective layer of intelligence where multiple AI models are combined, compared, and refined in real time. South Korea’s Bithumb listed ALLO/KRW trading on December 9, enabling direct purchases with Korean won. Historically, KRW pairs on major exchanges like Bithumb drive retail participation due to reduced friction. The listing expanded ALLO’s investor base, with 24h volume surging 87% to $54.3M. Korean markets often react strongly to local exchange support, as seen in past altcoin rallies. However, initial volatility is common, and the token remains 86.8% below its 30-day high.

ZEC Zcash (+14.83%, Circulating Market Cap: $1.34 Billion)

ZEC is trading at $402.98, up approximately 14.83% in the past 24 hours. Zcash is a decentralized cryptocurrency focused on

privacy and anonymity. It uses the zk-SNARK zero-knowledge proof technology that allows nodes on the network to verify transactions without revealing any sensitive information about those transactions. Phreeli, a U.S. mobile service launched December 8, uses Zcash’s zk-SNARKs to validate bills without exposing user identities. Zooko Wilcox advised on its encryption system (“Double-Blind Armadillo”), directly tying ZEC to real-world privacy adoption. The partnership validates Zcash’s core tech beyond crypto markets. With Phreeli targeting mainstream users (prepaid via credit cards or ZEC), it signals expanding use cases for shielded transactions. ZEC’s price reacted as traders priced in potential demand growth from non-crypto sectors.

Market News

CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral

The Commodity Futures Trading Commission (CFTC) on Monday launched a pilot program allowing select digital assets, BTC.

BTC, ETH and USD Coin (USDC) or other payment stablecoins — to be used as collateral in U.S. derivatives markets. The program, announced by Acting Chairman Caroline Pham, is part of a broader push to give market participants clear rules for using tokenized collateral, including tokenized versions of real-world assets like U.S. Treasuries.

The CFTC had already begun working to let stablecoins be used as collateral for certain products earlier this year.

For now, the program applies only to futures commission merchants (FCMs) that meet certain criteria. These firms can accept BTC, ETH and payment stablecoins like USDC as margin collateral for futures and swaps, but must comply with strict reporting and custody requirements. For the first three months, they must provide weekly disclosures on digital asset holdings and alert the CFTC of any issues.

In practice, this could mean a registered firm accepting bitcoin as collateral for a leveraged swap tied to commodities, while the CFTC monitors the operational risks and custody arrangements behind the scenes.

The agency also issued a no-action letter giving FCMs limited permission to hold certain digital assets in segregated customer accounts, provided they manage risks carefully. Importantly, the CFTC withdrew older guidance from 2020 that had effectively blocked the use of crypto as collateral in many cases. That advisory is now seen as outdated, especially after the passage of the GENIUS Act, which updated federal rules around digital assets.

The CFTC emphasized that its rules remain technology-neutral but said real-world tokenized assets like Treasuries must still meet enforceability, custody, and valuation standards.

HYPE Token Treasury Hyperliquid Strategies Rolls out $30 Million Stock Repurchase Program

Major publicly traded HYPE token holder Hyperliquid Strategies (ticker PURR) is the latest digital asset treasury (DAT) to roll out a stock repurchase program.

Hyperliquid Strategies’ board has authorized a program to repurchase up to $30 million worth of the company’s outstanding stock over the next 12 months, according to an announcement on Monday. The firm is far from the first to announce a willingness to support its stock price, with everyone from the largest ETH DAT BitMine supporting buybacks to Michael Saylor's Strategy launching a cash reserve to act as a liquidity buffer amid a market pullback.

Though what is perhaps unique is that the repurchase program was disclosed just days after the digital asset treasury officially launched.

Hyperliquid Strategies Inc. was formed through a merger of the publicly-traded healthtech firm Sonnet BioTherapeutics and Rorschach, a special purpose acquisition company incorporated this year with a connection to Hyperliquid-supporter and prominent crypto VC Paradigm. The merger, announced in July and expected to close in November, was delayed by two weeks after not crossing a key level of support from shareholders and was ultimately completed in Dec. 2. The Nasdaq-listed stock, which began trading under the ticker symbol PURR on Dec. 3, is down about 1.1% at the time of press to $3.64. The Block has reached out to Schamis for comment.

Somewhat unusually, Hyperliquid did not raise venture capital funding. Instead, about a third of the HYPE token supply, valued at $1.2 billion, was airdropped to early users when it debuted in late 2023. Additional tokens went to the founding team and to set up the Hyper Foundation, with none explicitly earmarked for VCs or investors.

The protocol has since grown to become the largest decentralized perps DEX by accumulated volume, according to The Block’s data, and has only seen meaningful competition in recent months via the rise of BNB Chain-based Aster and Ethereum Layer 2 Liquid.

Spot Crypto ETF Approval in South Korea Faces Stunning Delay

Investors hoping for South Korea to join the spot crypto ETF wave this year face disappointing news. Recent reports confirm that regulatory approval for these investment vehicles is now effectively off the table for 2024. The delay stems from legislative bottlenecks that have pushed digital asset institutionalization down the priority list.

According to ET News, the primary obstacle involves delays in amending the Capital Markets Act. Four related amendment bills currently sit in legislative limbo. Meanwhile, policymakers have shifted their attention to reorganizing South Korea’s Financial Services Commission and Financial Supervisory Service. They’re also focused on government measures designed to stimulate the traditional stock market.

This regulatory pivot means the institutionalization of digital assets has been deprioritized. The situation creates uncertainty for investors who anticipated South Korea following the United States in approving spot cryptocurrency ETFs. The delay highlights the complex balancing act regulators face between innovation and market stability.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.