The Ethereum blockchain, renowned for its transparency and smart contract capabilities, has long grappled with a fundamental privacy dilemma. Every transaction, wallet balance, and interaction is permanently visible on the public ledger, exposing sensitive financial data to competitors, adversaries, and surveillance. This lack of confidentiality has been a critical barrier to the mainstream adoption of decentralized finance (DeFi) and blockchain technology by institutions and privacy-conscious individuals. In this landscape, Aztec Network emerges as a pioneering force, aiming to reconcile Ethereum's open nature with the essential need for privacy. By leveraging advanced cryptographic techniques, specifically zero-knowledge proofs (ZKPs), Aztec is constructing a privacy-first Layer 2 (L2) solution that promises to unlock a new era of confidential, scalable, and compliant blockchain applications. The culmination of its seven-year journey is marked by the highly anticipated Token Generation Event (TGE) for its native AZTEC token, setting the stage for a new chapter in private, programmable finance on Ethereum.

Introduction to Aztec and Its Vision for Privacy on Ethereum

Founded in London in 2017 by Zac Williamson and Thomas Walton-Pocock, Aztec Network was established with a bold, foundational vision: "programmable privacy for everyone". The core philosophy is to build privacy not as an optional bolt-on feature but as an inherent, programmable property of the blockchain itself. While early privacy pioneers like Zcash and Monero focused on creating private native currencies, they lacked the robust smart contract functionality of Ethereum. Aztec's ambition is to bring that same level of transaction confidentiality to the entire Ethereum ecosystem to DeFi protocols, voting systems, and NFTs without forcing users to migrate to a separate, sovereign blockchain.

Aztec's initial path involved developing practical applications to demonstrate its technology. In 2021, it launched

zk.money

, a privacy application that allowed users to deposit and transfer Ethereum (ETH) confidentially. The service functioned like an enhanced, programmable version of Tornado Cash, a popular privacy mixer. Later, it introduced Aztec Connect, a software development kit (SDK) that acted as a privacy bridge, enabling users to interact with mainstream DeFi protocols like Lido, Aave, and Curve while keeping their activities and balances hidden. These products validated the demand for on-chain privacy, amassing tens of thousands of users and millions in transaction volume.

How Aztec Uses zkSNARKs for Privacy and Scalability

Aztec's technological breakthrough lies in its innovative integration of two powerful concepts: zkSNARKs and rollups, creating what it terms a "ZK-ZK Rollup".

zkSNARKs for Privacy: At its heart, Aztec employs a form of zero-knowledge proof called zkSNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). In simple terms, a zkSNARK allows one party (the prover) to prove to another (the verifier) that a statement is true without revealing any information beyond the validity of the statement itself. Aztec's implementation, based on its core "PlonK" proving system, encrypts user transactions. When a user sends funds, the network generates proof that verifies the transaction is valid (e.g., the sender has sufficient funds and authorized the payment) without disclosing the sender, recipient, or amount on the public Ethereum ledger. This is a stark contrast to standard Ethereum transactions, where all these details are public.

Rollups for Scalability: To address the high cost and low throughput of on-chain transactions, Aztec batches hundreds of private transactions off-chain into a single, succinct proof. This "rolled-up" proof is then posted to the Ethereum mainnet for final settlement. This architecture delivers a double benefit. First, it provides scalability by compressing data, reducing the load on Ethereum and, consequently, the gas fees for users. Aztec claims its method can reduce costs by up to 100 times compared to a standard private transaction executed directly on Ethereum. Second, it inherits Ethereum's security, as the integrity of all batched transactions is cryptographically guaranteed and verified on the main chain.

Applications in DeFi, Voting, and NFTs

The combination of privacy and programmability opens a vast design space for confidential applications across multiple domains:

-

Private DeFi: This is Aztec's flagship use case. Users can engage in lending, borrowing, and yield farming through protocols like Aave or Compound without exposing their entire financial portfolio or trading strategies. A corporation could manage its treasury on-chain or hedge positions without telegraphing its moves to the market. Aztec Connect was a significant step toward this vision before its strategic sunset.

-

Private Voting and Governance: DAOs (Decentralized Autonomous Organizations) can conduct truly anonymous voting on proposals or funding decisions. This prevents whale dominance through vote-buying or coercion and ensures each member votes according to their genuine beliefs without fear of social reprisal.

-

Confidential NFTs and Digital Assets: Artists can sell limited-edition digital art to a list of verified collectors without revealing the identities of the buyers or the final sale price. Similarly, confidential real-world asset (RWA) tokenization, such as private property deeds or corporate bonds, becomes feasible, protecting the sensitive financial information of all parties involved.

Bridging Privacy and Regulatory Compliance

Privacy in crypto often finds itself at odds with regulatory frameworks designed to prevent money laundering and terrorist financing (AML/CFT). Aztec's approach aims to navigate this complex landscape by enabling selective disclosure. While transactions are private by default, users can generate a zero-knowledge proof to demonstrate compliance with specific rules to a designated authority, such as an auditor or regulator, without revealing any other transaction details. This concept, sometimes called "privacy with accountability," is central to making confidential blockchain systems compatible with real-world legal requirements. The project's recent decision to require KYC (Know Your Customer) verification for participants in its token sale, while controversial among some community members, reflects a pragmatic approach to launching in the current regulatory environment.

Details of the AZTEC Token Sale (TGE)

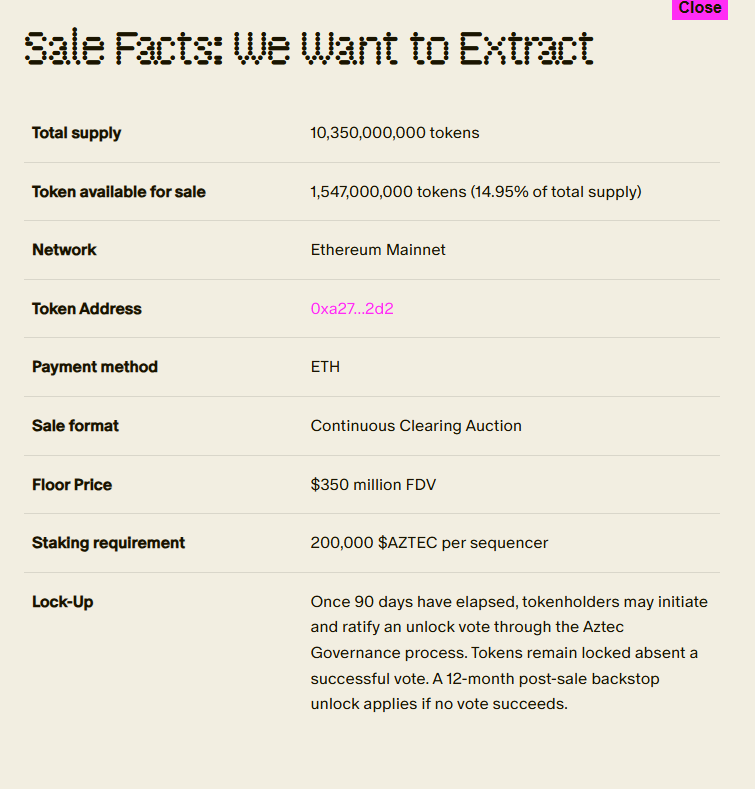

After years of development and community anticipation, Aztec initiated its token generation process in late 2025. The AZTEC token sale was structured as a multi-phase event, notably choosing a public sale model over a free community airdrop, a decision that sparked significant discussion.

Sale Structure and Mechanism: The sale consisted of a Genesis Sequencer sale (for network operators) followed by an open public auction from December 2 to December 6, 2025. Aztec made history by being the first project to utilize Uniswap v4's new Continuous Clearance Auction (CCA) mechanism for its public sale, aiming for transparent, on-chain price discovery. To participate, users were required to complete KYC and mint a non-transferable "Soulbound" NFT, emphasizing a commitment to compliance.

Community Focus and Outcome: Prioritizing its community, Aztec granted over 300,000 whitelist spots to early network contributors, including testnet node operators and users of

zk.money

and Aztec Connect. The sale concluded successfully, raising a total of 19,476 ETH, with half reportedly coming from the Aztec community itself. A total of 16,741 unique users participated.

The TGE Timeline: The official Token Generation Event (TGE), which will make the tokens transferable, is set to be triggered by an on-chain governance vote. According to the latest official announcement, this could happen as early as February 11, 2026. Notably, at the TGE, 100% of the tokens purchased in the sale will be immediately unlocked and freely transferable.

Tokenomics and Governance of the AZTEC Token

The AZTEC token is designed as the economic and governance backbone of the Aztec network, with a total genesis supply of 103.5 billion tokens.

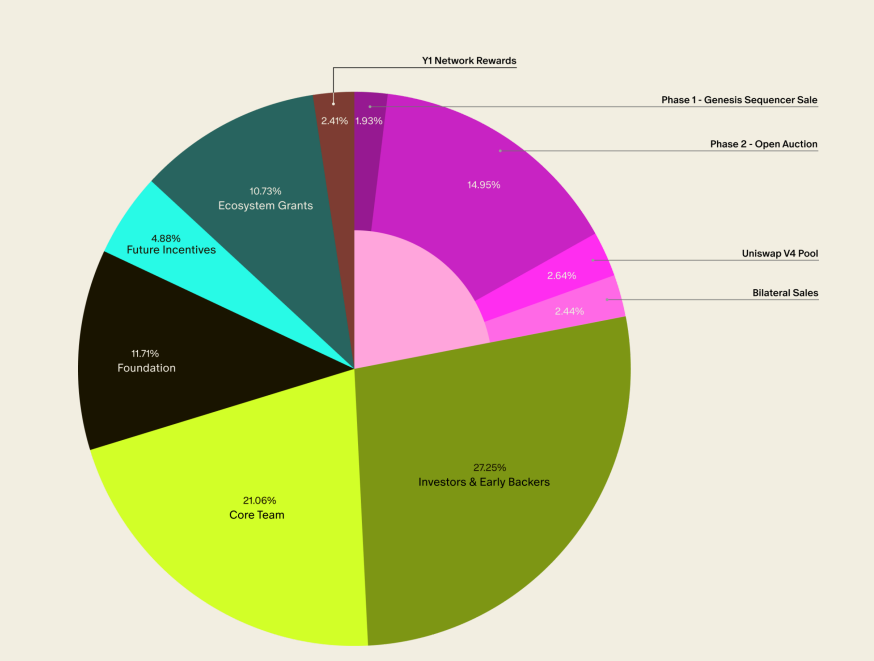

Token Allocation: The distribution is as follows: 27.26% for investors and early supporters, 21.06% for the core team, 11.71% for the Aztec Foundation, 10.73% for ecosystem grants, 4.89% for future incentives, 2.41% for first-year network rewards, and 21.96% (approximately 22.73 billion tokens) allocated to token sale events.

Primary Utilities: The AZTEC token serves three core functions: 1) Sequencer Staking:Operators must stake AZTEC to run nodes that process and batch transactions, securing the network. 2) Network Governance: Token holders can propose and vote on key protocol upgrades, parameter changes, and treasury management. 3) Fee Payment: AZTEC can be used to pay for transaction fees within the network, though it is expected to support fee payment in any asset.

Inflation and Unlock Schedule: The network will have an annual inflation cap of 20%, subject to governance decisions. A major point of community scrutiny has been the lock-up periods. Tokens from the Genesis Sequencer sale and the public auction are subject to a 12-month lock, with the public sale tokens eligible for an early unlock vote after 90 days.

Aztec's Funding and Notable Investors

Aztec's vision has attracted substantial backing from the most prestigious names in cryptocurrency venture capital. Public records indicate the project has raised over $119 million across four funding rounds between 2018 and 2022. Its investor list is a who's who of the industry, including Paradigm, Andreessen Horowitz (a16z), and Coinbase Ventures. Notably, Ethereum co-founder Vitalik Buterin is also a personal investor, lending significant credibility to its technical approach. The $100 million B-round led by a16z in particular underscored institutional conviction in privacy as a critical, investable infrastructure layer for Web3.

Launch of the 'Ignition' Mainnet

Marking its evolution from a suite of applications to a full-fledged, generalized privacy rollup, Aztec launched its "Ignition" mainnet. This next-generation network shifts focus from being an application-specific bridge (

Aztec Connect

) to a decentralized, proof-of-stake L2 where developers can build their own private smart contracts. The launch of the public testnet prior to Ignition saw a surge in activity, with over 30 new applications being developed and more than 17,000 nodes connecting in a short period, signaling strong developer interest in the new platform.

Staking Mechanisms and Rewards

Staking is central to Aztec's security and operational model. Participants who stake a minimum of 200,000 AZTEC tokens can become sequencers. These sequencers are responsible for collecting user transactions, generating the zkSNARK proofs that validate the private batch, and submitting them to Ethereum. In return for this critical service, sequencers earn block rewards in AZTEC tokens, which began accruing for eligible holders immediately after the token sale concluded. This mechanism incentivizes honest participation and decentralizes the network's operation.

Adoption of the Noir Programming Language

Perhaps one of Aztec's most significant contributions to the broader blockchain ecosystem is Noir, a domain-specific language for writing zero-knowledge circuits. Noir's mission is to "democratize" zero-knowledge development by abstracting away the complex underlying cryptography. It allows developers familiar with languages like Rust to write private smart contracts without needing a PhD in cryptography. By open-sourcing Noir and fostering its independent development, Aztec is betting that a thriving developer ecosystem will be the ultimate driver of adoption for private applications, far beyond what any single company could build alone.

Comparison with Other Privacy-Focused Blockchains

Aztec occupies a distinct position in the privacy landscape:

-

vs. Zcash/Monero: These are privacy-focused Layer 1 blockchains (privacy coins). They excel at hiding transaction details for their native token but lack a general-purpose smart contract environment.

-

vs. Tornado Cash: Tornado Cash is a non-custodial privacy tool (a mixer) built

on top ofEthereum. It is application-specific and can be expensive to use. Aztec is a scalable L2 network that enables

programmableprivacy for a wide array of applications.

-

vs. Other Privacy L2s (e.g., Polygon Nightfall): Aztec is distinguished by its deep technical stack, including its own PlonK proving system and the Noir language, giving it a high degree of control and optimization for its specific privacy goals.

Risks and Challenges

Despite its promise, Aztec faces several formidable challenges:

Regulatory Uncertainty: Privacy remains a regulatory hot button. While Tornado Cash has seen some legal relief, the overarching regulatory stance on privacy-preserving protocols is still evolving and poses a persistent risk.

Community Relations: The decision to forgo an airdrop in favor of a public sale created disappointment among long-term community members and "airdrop farmers," potentially straining grassroots support.

Valuation and Adoption Pressure: With a fully diluted valuation (FDV) starting at $3.5 billion from the public sale, Aztec faces immense pressure to rapidly grow its ecosystem and total value locked (TVL) to justify its market cap. Success is not guaranteed in a competitive L2 landscape.

Technological Complexity: Building and maintaining a cutting-edge ZK-rollup stack is exceptionally difficult. Bugs in cryptographic code or proving systems can have catastrophic consequences.

Conclusion

Aztec Network stands at a pivotal moment. Its upcoming TGE represents more than just a token launch; it is the activation of a sophisticated economic system designed to power a new paradigm of private computation on Ethereum. By harnessing the power of zkSNARKs within a scalable rollup framework, Aztec offers a compelling solution to one of blockchain's most persistent trilemmas: achieving scalability, security, and privacy simultaneously. While the path ahead is fraught with technical, regulatory, and market challenges, Aztec's substantial funding, technological innovation—especially through Noir—and clear vision position it as a leading contender in the race to build a truly confidential and programmable financial future. The success of its Ignition mainnet and the growth of its developer community in the months following the TGE will be the ultimate test of whether programmable privacy can transition from a compelling vision to a widely used reality.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.