December 2025 began with dramatic market volatility. Following weeks of market sell-offs, cryptocurrencies suffered another sharp decline in early trading today, with Bitcoin briefly falling below $87,000 and ETH dropping below the $2,900 mark. Meanwhile, in November, the overall activity in the cryptocurrency market cooled significantly, with industry trading volume falling to a six-month low. Brazil’s tax authority said that crypto transactions reported under existing rules have reached between $6 billion and $8 billion per month. Grayscale Investments will debut the first-ever spot Chainlink ETF this week.

Crypto Market Overview

BTC (-5.25% | Current Price: $86,284.06)

Bitcoin closed at $90,360 in November, marking its weakest November performance since 2018, with a monthly decline of 17.55%. This downward trend continued on December 1st, with the market opening in negative territory and decreasing by over 5% at one point, falling below $86,000. This volatility resulted in significant leveraged liquidations, further intensifying market uncertainty. Renowned trader Peter Brandt indicated that Bitcoin's price could drop below $70,000, with key support at the mid-$40,000 level. Analyst James Wynn suggests the market is experiencing a phase of "anxiety and denial," with an initial target price of $67,000, and potentially further declines into the $40,000 to $50,000 range. Economic analyst Timothy Peterson's analysis demonstrates that current Bitcoin price movements have a 98% correlation with the monthly charts of the 2022 bear market, implying that a genuine recovery may not occur until the first quarter of next year. Additionally, analyst Aylo from a historical cycle perspective notes that Bitcoin typically retraces to the 200-week moving average (currently around $63,000 to $65,000) after reaching a peak, and suggests that factors such as miners shifting toward AI may contribute to ongoing downward pressure.

On November 28th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $71.4 million, with BlackRock's IBIT saw an outflow of $113.7 million.

ETH (-5.73% | Current Price: $2,831.27)

ETH is fluctuating between $2,600 and $3,000. A break below $2,600 could lead to a drop toward $2,000, while a move above $3,000 could target $3,300-$3,400. The market faces additional selling pressure from approximately 1.5 million ETH scheduled to be unstaked by end-December.

On November 28th, ETH ETFs experienced a total net inflow of $76.6 million, with BlackRock's ETHA saw an inflow of $68.3 million.

Altcoins

Most major altcoins declined, market sentiment deteriorated across the board, and investor sentiment was predominantly "neutral." The Fear & Greed Index was 20 today, in the extreme fear zone, indicating that market risk appetite remains low.

Macro Data

Macroeconomic uncertainty is the main headwind currently facing the market. Venture capital (VC) firms point out that the continued correction in the crypto market is driven by both the "10.11" mass liquidation event and a tighter macroeconomic environment. Cooling expectations for short-term interest rate cuts, sticky inflation, and escalating geopolitical risks have put overall pressure on risk assets over the past two months.

Today's sharp market volatility may be related to an unconfirmed market rumor regarding Federal Reserve Chairman Powell. Meanwhile, US President Trump has stated that he has decided on the next Fed Chair, and the market expects his nominee to be more inclined to push for interest rate cuts. The US economic data in the coming week will be crucial in shaping expectations for the Fed's interest rate path.

On the regulatory front, the People's Bank of China convened a multi-department meeting on November 29th, reiterating its crackdown on virtual currencies and defining stablecoins for the first time as a form of virtual currency with risks of money laundering and illegal fundraising.

On November 28th, the S&P 500 gained 0.54%, standing at 6,849.09 points; the Dow Jones Industrial Average increased 0.61% to 47,716.42 points, and the Nasdaq Composite gained 0.65% to 23,365.69 points. The price of gold is $4,240.98, up 0.52%, at 4:00 UTC, December 1st.

Trending Tokens

TNSR Tensor (+24.56%, Circulating Market Cap: $64.02 Million)

TNSR is trading at $0.1386, up approximately 24.56% in the past 24 hours. Tensor (TNSR) stands out as a pivotal player in the cryptocurrency landscape, particularly within the Solana blockchain ecosystem. At its core, Tensor is a foundation that empowers community-led governance over its protocols, fostering the growth of the Tensor DAO and the broader Tensor ecosystem. This foundation supports both Tensor and Vector protocols, which are essential trading infrastructures for NFTs on Solana and tokens across multiple chains. On November 21, the Tensor Foundation announced a realignment of incentives, directing 100% of marketplace fees to the TNSR treasury (previously 50%). Simultaneously, 21.6% of unvested tokens (founders + Labs) were burned, and vested tokens were relocked for 3 years. This resulted in reduced sell pressure: Burning ~22% of supply (≈172M TNSR) tightens liquidity, while lockups delay potential founder dumps.

DYM Dymension (+9.47%, Circulating Market Cap: $39.94 Million)

DYM is trading at $0.09609, up approximately 9.47% in the past 24 hours. Crypto apps are in dire need of ease of use and economic sustainability. Recently, rollups have shown a simple business model that works, fees minus base layer costs equals their profit. As a result, a surge of L2s were deployed each with its own custom implementation, multi-sig bridge, and security assumptions. This led to a fragmented, unsecure, and chaotic user experience diminishing the advantages of rollups and modular blockchains. DYM’s price broke above a descending trendline on the daily chart, supported by a bullish MACD crossover and RSI recovering from oversold levels (45.91). The 30-day SMA ($0.0939) now acts as support, with resistance near $0.10. Technical traders interpret this as a trend reversal, especially after DYM underperformed the market for weeks. The 413% spike in 24h volume ($52M) signals renewed interest.

IOST IOST (+4.32%, Circulating Market Cap: $63.19 Million)

IOST is trading at $0.002140, up approximately 4.32% in the past 24 hours. IOST operates as a multichain infrastructure specialized in Real World Asset (RWA) tokenization and Web3 payment solutions. Built on seven years of blockchain development with over 930 million processed transactions, IOST now bridges traditional finance with decentralized systems across multiple blockchain networks. IOST’s

$3M buyback has removed ~1.4B tokens from circulation as of November 2025, reducing sell pressure. With 29.5B tokens circulating, the program shrinks supply by 4.7% annually if sustained, creating artificial scarcity amid stable demand.

Market News

Crypto Exchange Volume Drops to $1.6 Trillion in November, Lowest Since June

In November, the overall activity in the cryptocurrency market cooled significantly, with industry trading volume falling to a six-month low. According to data from The Block, the global cryptocurrency spot market turnover for the month was only $1.59 trillion, a sharp drop of 26.7% from $2.17 trillion in October, marking the lowest level since July. Following the rapid decline in market enthusiasm after October's surge, trading momentum on centralized exchanges weakened significantly, volatility narrowed, and the market entered a sideways phase dominated by profit-taking and a wait-and-see attitude.

Decentralized exchanges (DEXs) are also struggling to withstand downward pressure. Total DEX trading volume in November was only $397.78 billion, a significant drop from $568.43 billion in the previous month, also marking a recent low. Overall, the data reflects that, in the absence of new funds and strong catalysts, short-term liquidity in the crypto market is contracting.

The sharp contraction in trading volume in November essentially reflects the crypto market entering a "momentum exhaustion phase" after its strong rebound in October. The lack of sustained catalysts led to the withdrawal of speculative capital and a return to conservative liquidity levels. The simultaneous decline in spot and DEX trading volumes indicates not only a decrease in trading activity but also a significant weakening of spontaneous on-chain behavior, which aligns with declining volatility and shrinking risk appetite. From a cyclical perspective, this type of "volume depletion" often represents a transitional phase before the market chooses a direction: on the one hand, maintaining low volatility but high uncertainty; on the other hand, funds are concentrated on awaiting potential new catalysts at the policy, macro, or project levels. If new narratives or incremental funds enter the market subsequently, trading volume may become the first indicator of a recovery.

Stablecoins Drive 90% of Brazil’s Crypto Volume, Tax Authority Data Shows

Brazil’s crypto market is moving billions of dollars a month, and regulators are taking notice.

In a technical presentation at the Blockchain Conference Brasil, Flavio Correa Prado, an auditor at Brazil’s tax authority, the Receita Federal, revealed that crypto transactions reported under existing rules have reached between $6 billion and $8 billion per month.

If current trends continue, that figure could rise to $9 billion monthly by 2030, he said. Most of that volume comes from stablecoins like USDT and USDC, which now account for up to 90% of all reported transactions in some months. Bitcoin, once dominant, has become a secondary player as the country adopts stablecoins.

This shift toward stablecoins and the scale of the volumes is driving a major change in how Brazil tracks crypto assets. Receita Federal is set to replace its existing crypto reporting rule (known as IN 1.888) with a new system called DeCripto, starting July 2025.

The premature reopening led to deposits surpassing $400 million. The MegaETH team then attempted two cap resets, first to $400 million, and then to $500 million. After this, the team said it will no longer expand the cap to $1 billion.

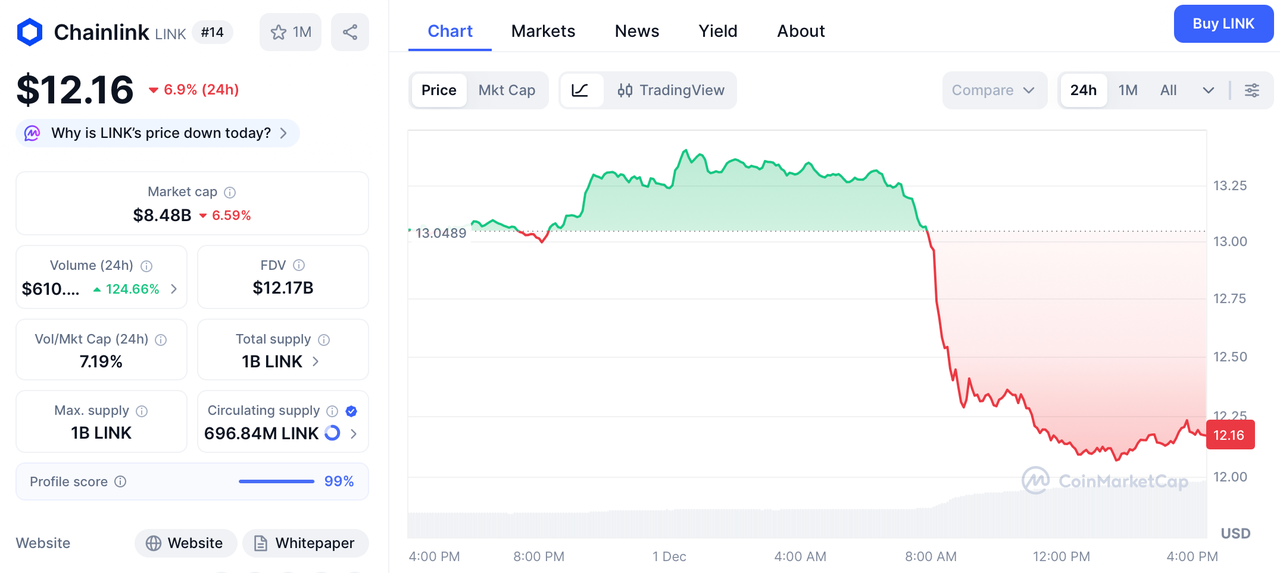

Grayscale to Convert Chainlink Trust to ETF, Debuting This Week

Grayscale Investments will debut the first-ever spot Chainlink ETF this week, converting its existing Trust product into a public trading vehicle. Nate Geraci, President of The ETF Store, confirmed the timeline Monday, signaling a major institutional on-ramp for the oracle network despite broader crypto market weakness.

Even with the ETF excitement, LINK’s price has not escaped market pressure. The token is trading near $12.11, down 7.15% in the last 24 hours. Its total market cap has slipped to $8.44 billion, but activity remains intense, with daily trading volume rising almost 95% to reach $556.7 million. This sharp increase in volume shows strong participation from both sellers reacting to market weakness and traders positioning ahead of the upcoming ETF launch.

The latest drop pushed the token directly into an important range, creating a situation where the next move becomes crucial. A firm hold above $12 could stabilize the trend, while a clear fall below this level may lead to deeper downside and a possible retest of earlier lows.

Analysts also pointed to the area around $12.81 as an early resistance level that needs to be reclaimed before confidence returns. At the moment, there is no confirmed reversal, and the price could still drift slightly lower.

Upbit said it will gradually resume withdrawal services once security is confirmed and urged users to report any suspicious activity to customer support.

Reference:

The Block (2025, November 30). Crypto exchange volume drops to $1.6 trillion in November, lowest since June. https://www.theblock.co/post/380831/crypto-exchange-volume-drops-november

CoinDesk. (2025, November 30). Stablecoins drive 90% of Brazil’s crypto volume, tax authority data shows. https://www.coindesk.com/policy/2025/11/30/stablecoins-drive-90-of-brazil-s-crypto-volume-tax-authority-data-shows

Coinedition. (2025, December 1). Grayscale to convert Chainlink trust to ETF, debuting this week. *Coinedition*. https://coinedition.com/grayscale-chainlink-etf-launch-glnk-ticker-debut/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.