As 2025 draws to a close, the financial world's attention is sharply focused on the trajectory of U.S. monetary policy for the coming year. Market expectations, potential political shifts, and the relentless flow of economic data are engaged in a complex dance, shaping the outlook for interest rates in 2026. This period is uniquely significant, coinciding with the anticipated appointment of a new Federal Reserve Chair and set against a backdrop of an economy showing signs of both cooling inflation and a softening labor market. Current pricing from CME Group's FedWatch tool indicates a broad market consensus that the federal funds rate will decline from its present range to approximately 3% by the end of 2026, with the most substantial cuts likely concentrated in the first half of the year. However, this path is fraught with uncertainty. This article provides a comprehensive framework for understanding the forces at play, detailing the expected interest rate path, the Federal Open Market Committee's (FOMC) meeting schedule, the critical economic indicators guiding policy, and the consequent implications for the cryptocurrency market.

The 2026 Interest Rate Path: Expectations Amid Uncertainty

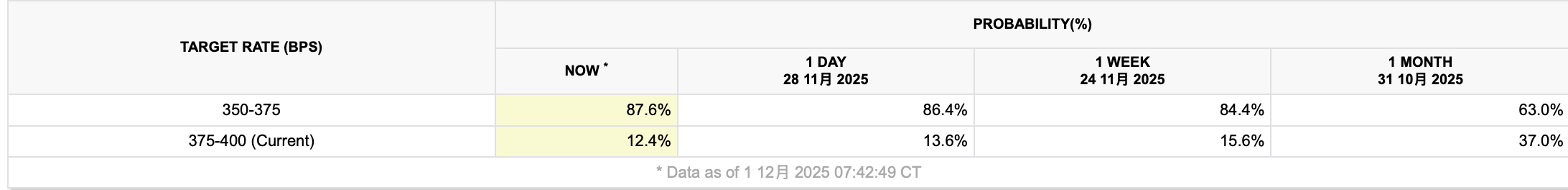

A rate forecast for December 2025. Source: CME

The baseline scenario for 2026, as derived from interest rate futures, points toward a definitive easing cycle. The consensus market expectation is for the federal funds rate to fall from the current 3.75%–4.00% range to around 3% by December 2026. Major financial institutions echo this view; for instance, Bank of America Global Research forecasts a series of cuts culminating in a final target range of 3.00%-3.25%. Analysts at UBS project an additional 50 basis points of easing by the end of the first quarter of 2026.

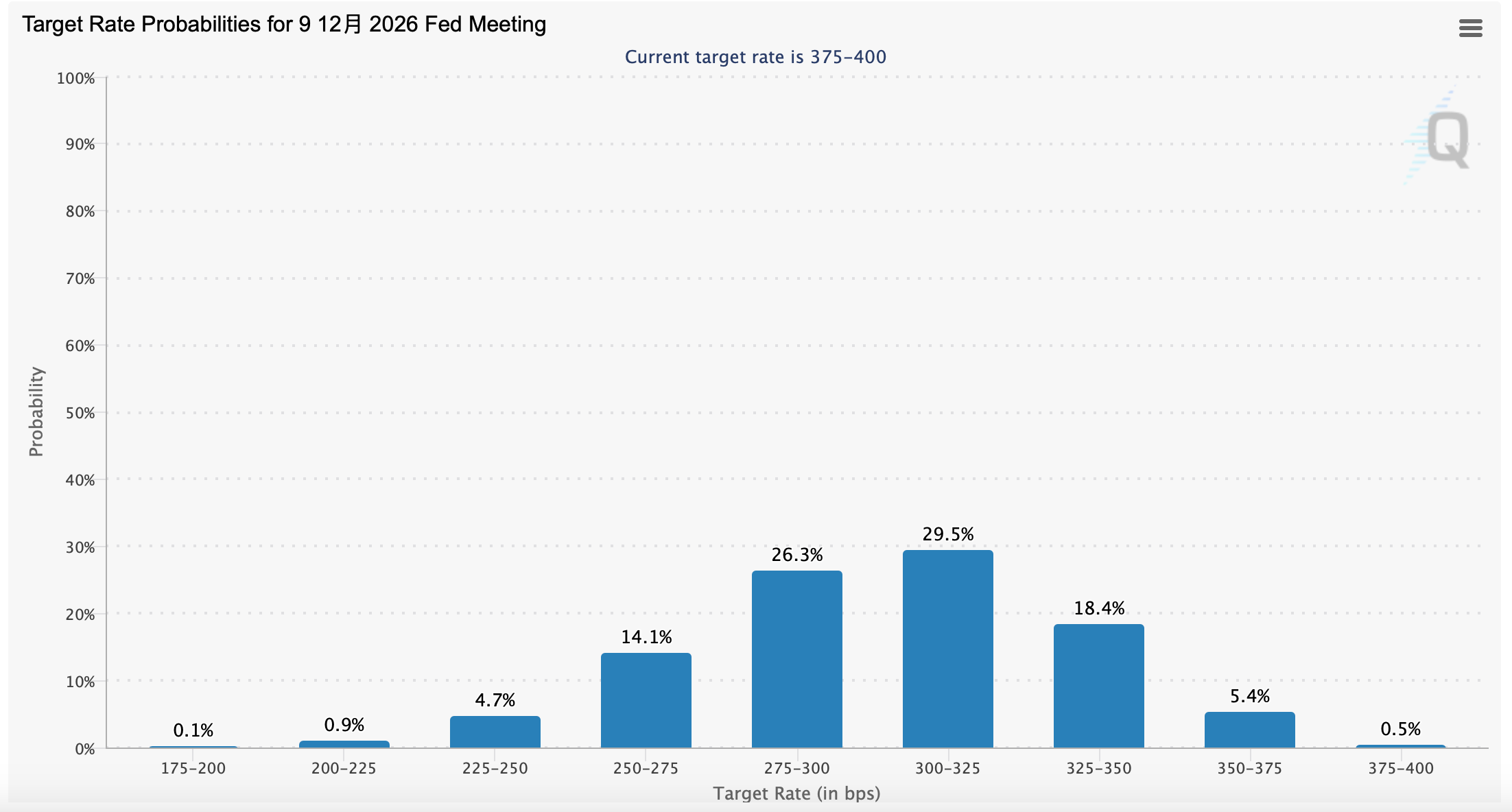

A rate forecast for December 2026. Source: CME

A critical feature of this outlook is the expected timing. Market participants largely anticipate that the majority of monetary policy easing will be front-loaded into the first six months of the year. This expectation is grounded in the perception that the economy may require more immediate support in the face of emerging weaknesses, particularly in the labor market.

However, this forecast is not a certainty, but rather a central tendency within a wide range of potential outcomes. The landscape is marked by significant uncertainty, with more extreme estimates suggesting the policy rate could fall as low as 2% or, conversely, remain steady near 4%. This divergence highlights the sensitivity of the outlook to incoming data and political developments. Notably, the Federal Reserve's own policymakers have historically presented a more cautious forecast than the market. As of their September 2025 projections, most officials expected the rate to remain above 3% through 2026, a stance that will be critically updated in their December 2025 and subsequent quarterly assessments.

The 2026 FOMC Meeting Schedule: A Roadmap for Policy Decisions

The Federal Reserve operates on a predictable schedule, providing markets with a clear calendar for potential policy adjustments. Barring economic emergencies that necessitate unscheduled meetings, the FOMC is set to convene eight times in 2026.

The confirmed two-day meetings for the year are as follows:

-

January 27-28

-

March 17-18

-

April 28-29

-

June 16-17

-

July 28-29

-

September 15-16

-

October 27-28

-

December 8-9

Each of these meetings concludes with a policy statement at 2:00 p.m. Eastern Time. Furthermore, the meetings in March, June, September, and December hold added significance as they are accompanied by the release of the FOMC's

Summary of Economic Projections (SEP) and followed by a press conference with the Federal Reserve Chair. These quarterly events offer deeper insight into the Committee's economic outlook and policy thinking, often triggering heightened market volatility and serving as key inflection points for investor sentiment. This structured timetable provides the essential framework within which the drama of data dependency and policy deliberation will unfold.

The Dominant Force: Economic Data as the Policy Compass

Despite the noise of market speculation and political influence, the Federal Reserve's decision-making process remains fundamentally anchored to economic data. The FOMC's dual mandate of price stability and maximum employment ensures that inflation and labor market indicators are the primary guides for monetary policy.

Inflation: The battle against inflation has seen considerable success, but the war is not yet over. The Personal Consumption Expenditures (PCE) price index, the Fed's preferred gauge, has moderated from its peak but remains above the 2% target. Core PCE, which excludes volatile food and energy prices, also remains elevated. The future path of inflation is the single most important variable for the pace of rate cuts. Any sign of stalled progress or a resurgence in price pressures would likely cause the Fed to halt or slow its easing cycle. Conversely, a faster-than-expected return to the 2% target could open the door to more aggressive cuts.

The Labor Market: Recent data has shifted focus toward employment conditions. Signs of softening, including a rising unemployment rate and slowing job growth, have become more pronounced. This weakening is a primary reason behind the increased market conviction for a December 2025 rate cut and a proactive easing cycle in 2026. The National Association for Business Economics (NABE) survey of forecasters projects average monthly job gains of only 58,000 in 2026, a level indicative of a markedly cooler labor market. The central debate within the FOMC now hinges on interpreting this softness. Some officials view it as a vulnerability requiring pre-emptive support, while others see it as a manageable normalization. The evolution of monthly nonfarm payrolls, the unemployment rate, and wage growth will be paramount in resolving this debate and determining the magnitude of the policy response.

Other crucial data points include consumer spending, retail sales, and business investment surveys, which collectively paint a picture of overall economic demand and health.

The Political Variable: A New Fed Chair and Fiscal Policy

The year 2026 introduces a significant political variable: the anticipated appointment of a new Federal Reserve Chair by President Donald Trump. Prediction markets suggest the administration will select a candidate with a more "dovish," or easing-oriented, policy inclination than the outgoing chair. Former economic advisor Kevin Hassett is frequently mentioned as a leading contender. A dovish chair could advocate for a faster or deeper cutting cycle, potentially tilting the FOMC's internal debates.

However, the institutional design of the Fed limits the impact of any single individual. The FOMC is a committee, and while the chair holds great influence, they have only one vote. The overall composition of the committee and its entrenched data-dependent culture act as a stabilizing force. Furthermore, the broader political landscape exerts influence through fiscal policy. As noted in analyses, 2026 is a midterm election year, which historically creates pressure for more expansive fiscal policy to support the economy. The interplay between monetary easing ("wide money") and potential fiscal stimulus ("wide finance") will be critical. An excessive injection of demand into an economy with lingering supply constraints carries the risk of reigniting inflation, a scenario that would directly conflict with and potentially curb the Fed's ability to lower rates.

Cryptocurrency Market Predictions in a Shifting Macro Climate

The cryptocurrency market, while maturing, remains sensitive to global macroeconomic conditions and U.S. monetary policy in particular. The expected pivot to lower interest rates in 2026 has several key implications for digital assets.

-

A Shift in Market Dynamics and Volatility: A core prediction for 2026 is the continued maturation and institutionalization of crypto markets. Analysts from Forbes suggest that the classic "four-year boom-bust cycle" historically associated with Bitcoin may further erode. In its place, a market characterized by more stable, incremental growth is expected to emerge. Lower and less volatile interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin and can foster a "risk-on" environment, which is generally favorable for speculative assets. This could contribute to an overall reduction in crypto market volatility, reinforcing its appeal as a legitimate asset class rather than a purely speculative instrument.

-

The Rise of Refined Financial Products: The maturation trend is also evident in product development. The market is expected to move beyond simple spot exposure. The next stage involves the proliferation of more sophisticated financial products built around digital assets. This includes structured debt and equity products, strategies designed to generate yield from Bitcoin holdings (beyond mere price appreciation), and more complex derivatives that integrate with traditional risk management frameworks. The success of Bitcoin ETFs has paved the way for this evolution, with future products likely to incorporate features like staking or options strategies to deliver returns.

-

Stablecoin Ubiquity and Regulatory Bridges: Stablecoins, cryptocurrencies pegged to stable assets like the U.S. dollar, are predicted to see explosive growth in utility. Forecasts indicate they will move beyond trading pairs on crypto exchanges and become integrated into traditional payment processors, corporate treasury operations, and cross-border settlement systems. Their ability to facilitate instant, low-cost settlement is a powerful value proposition. Furthermore, compliant stablecoin projects could act as a crucial bridge, connecting U.S. investors to offshore digital asset liquidity in a regulated and transparent manner—a longstanding challenge for the industry.

-

Legitimacy for Bitcoin-Centric Businesses: The "Digital Asset Treasury" (DAT) model, where companies hold significant crypto reserves, faced skepticism and growing pains. In 2026, the market is expected to differentiate between serious operators and speculative ventures. Legitimate businesses that effectively use Bitcoin-based strategies to create shareholder value are predicted to gain traction and trade closer to the value of their underlying assets.

Conclusion

The journey of U.S. interest rates through 2026 will be a defining narrative for global finance. The expected path points toward a cautious easing cycle, bringing the federal funds rate down toward 3%, with the heaviest cuts likely occurring before mid-year. This path, however, is not pre-ordained. It will be meticulously charted by the FOMC, meeting on its eight scheduled dates, with each decision scrutinized through the lens of incoming data on inflation and employment.

While the potential appointment of a dovish new Fed Chair and the pressures of an election-year fiscal policy add layers of complexity, the central bank's data-dependent ethos is expected to remain the dominant policy compass. For the cryptocurrency market, this macro environment supports a thesis of continued maturation. Lower and steadier rates, coupled with the industry's own evolution toward sophisticated products, stablecoin utility, and legitimate business models, paint a picture of a sector moving beyond its volatile adolescence. Investors navigating 2026 must therefore pay equal attention to the Fed's policy statements, the monthly blips of economic data, and the underlying technological and financial innovations within the digital asset space itself. The trilemma of expectations, politics, and data will ultimately resolve into a new equilibrium for the cost of money and the future of finance.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.