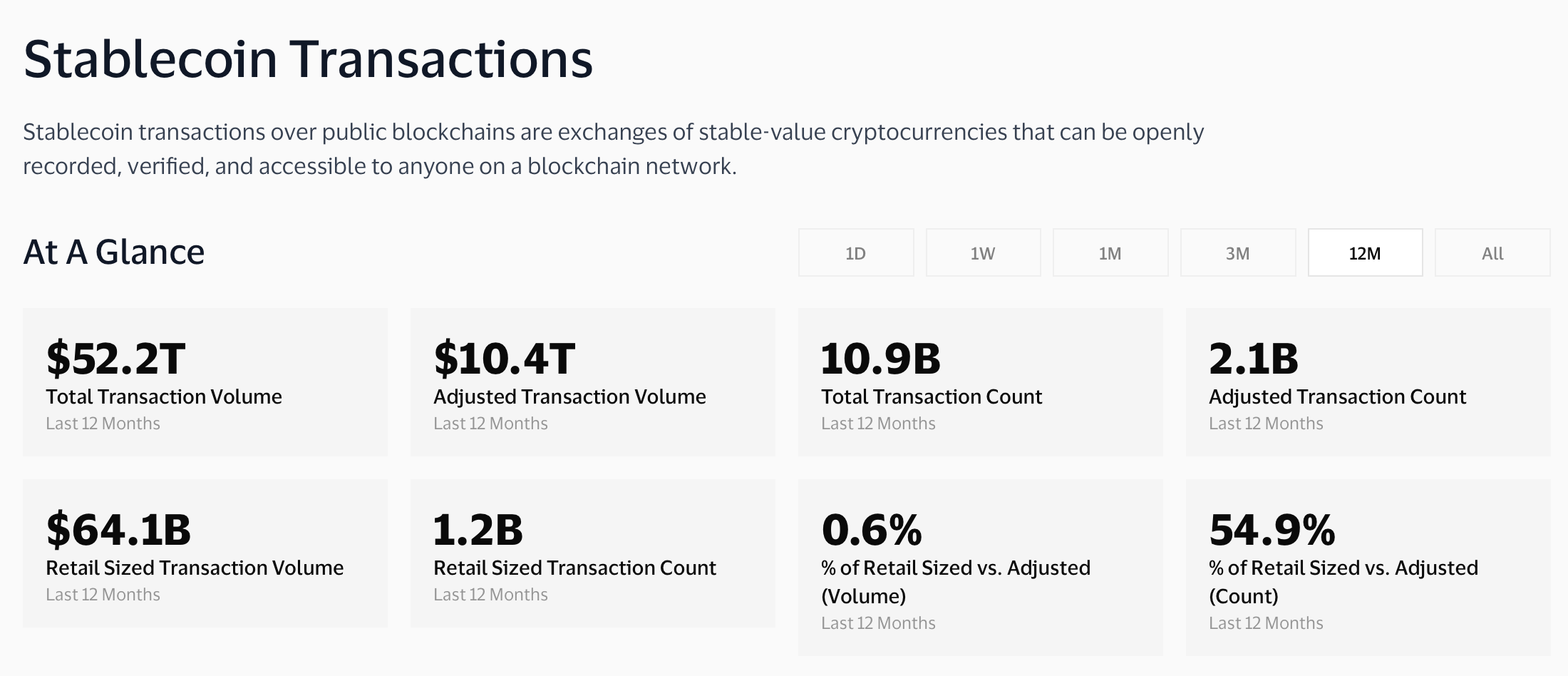

The term "stablecoin" suggests safety and predictability in the volatile world of cryptocurrency. These digital assets, pegged to stable reserves like the U.S. dollar, have become the lifeblood of the crypto economy, processing a staggering

$27 trillion in on-chain settlement volume in 2024, which is a figure that surpassed the combined total of Visa and Mastercard

. For millions in economies like Argentina and Nigeria, stablecoins such as USDT and USDC have become a digital dollar lifeline, protecting savings from hyperinflation that can exceed 200% annually. Yet, November 2025 delivered a brutal reminder of a fundamental truth that the industry has repeatedly ignored: stability is an expensive illusion. The catastrophic collapse of Stream Finance's xUSD and the subsequent domino effect that wiped out Elixir's deUSD exposed a fragile ecosystem built on opaque leverage, unsustainable yields, and flawed infrastructure, resulting in over

$285 million in direct debt exposures

and a systemic crisis of confidence that erased billions from the DeFi landscape. This article dissects the events of November 2025 to answer a critical question: Are stablecoins truly stable, or are they the next ticking time bomb in global finance?

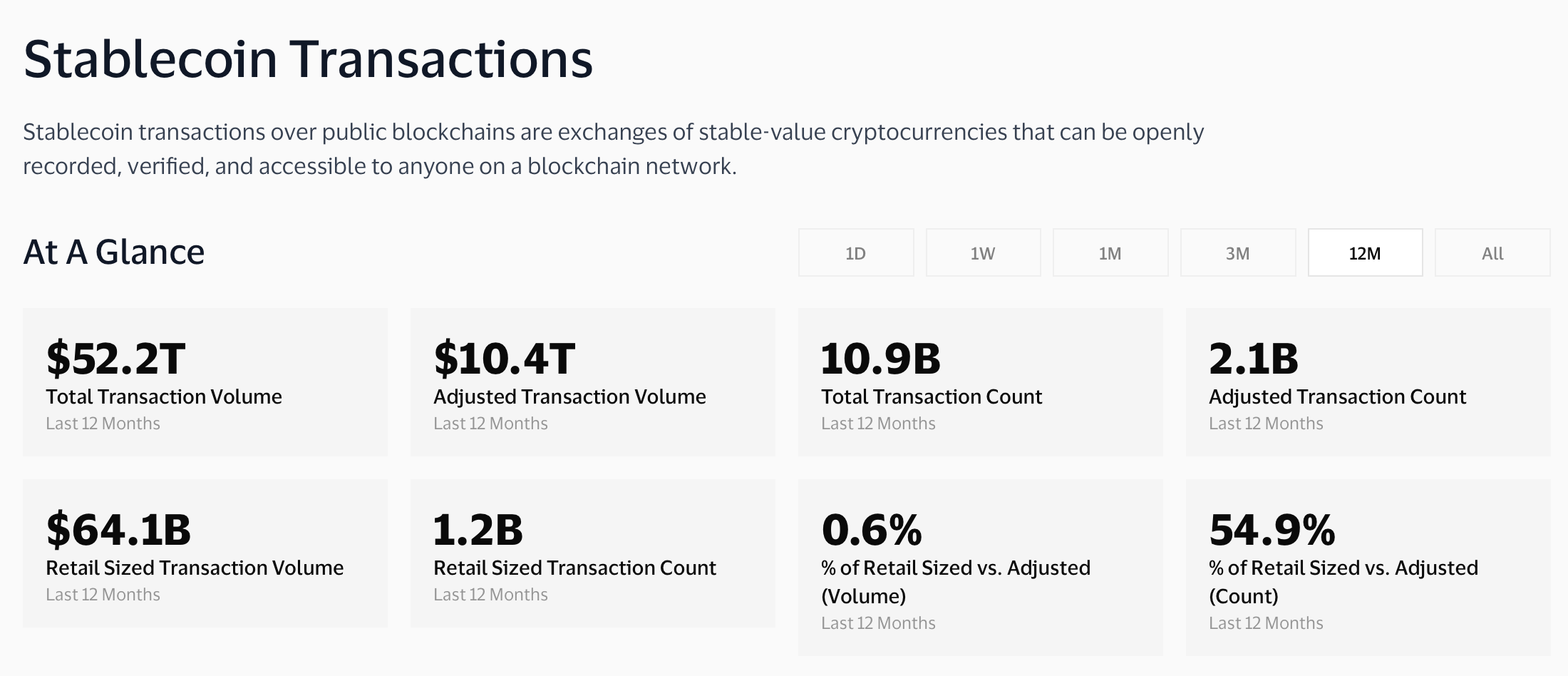

Stablecoins transactions data. Source: Visa

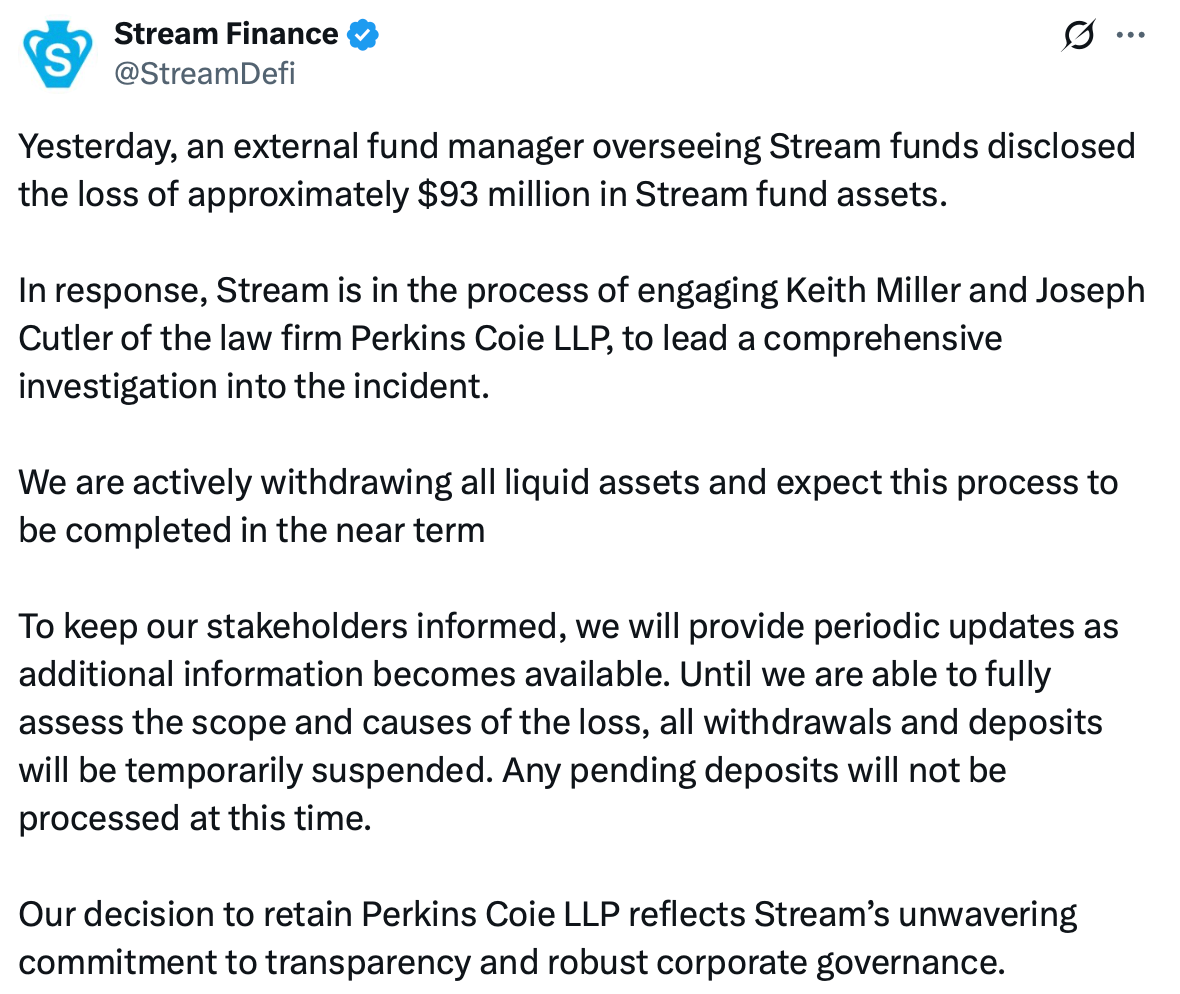

The Stream Finance Collapse: A $93 Million Trigger

The unraveling began on November 4, 2025, when Stream Finance announced it had suspended all withdrawals. The reason was a devastating

$93 million loss attributed to an external fund manager who had been trading user funds in off-chain, over-the-counter transactions. This was not a sophisticated smart contract hack or a novel attack vector; it was a classic case of financial opacity wrapped in the veneer of "decentralized" finance.

Announcement from Stream Finance X account.

Stream Finance had positioned itself as a yield optimization protocol, luring users with promises of an

18% annual percentage yield (APY) on its synthetic stablecoin, xUSD. This offer was wildly above the 3%-5% APY available on established lending platforms like

Aave and Compound, a red flag that basic financial literacy would flag as unsustainable. The mechanism behind these returns was shrouded in complex jargon like "delta-neutral trading," but the post-mortem analysis revealed a systemic fraud. Stream was running a recursive lending scheme that created synthetic assets with little to no real collateral. The protocol took user deposits of USDC, swapped them for USDT, used that to mint deUSD on the Elixir protocol, and then bridged those assets across chains to borrow more USDC, repeating the cycle. Astonishingly, with only

$1.9 million of verifiable USDC collateral, Stream had minted

$14.5 million worth of xUSD, inflating the synthetic asset by 7.6 times its underlying reserves, which is a modern, unregulated form of fractional-reserve banking with no safety net.

18% APY on xUSD. Source: Stream Finance official website

When the $93 million loss was revealed, the house of cards collapsed. With no redemption mechanism in place, panic ensued. Holders rushed to dump xUSD on illiquid secondary markets, causing its price to plummet

77% in hours, from $1 to a mere $0.23. A stablecoin designed to be worth one dollar was suddenly almost worthless.

A $285 Million Crisis on Elixir

The fall of Stream Finance was not an isolated event. Its failure acted like a single domino tipping over a meticulously arranged chain, demonstrating the deeply interconnected and fragile nature of the DeFi ecosystem. The crisis spread primarily through its toxic relationship with Elixir's deUSD stablecoin.

Stream and Elixir were locked in a cycle of "financial inbreeding". Stream was the largest holder of deUSD, accounting for roughly

90% of its total supply (worth $75 million). Simultaneously, a significant portion of Elixir's collateral came from loans it had extended to Stream via the Morpho lending market. In essence, these two stablecoins were propping each other up in a circular and self-referential relationship. When Stream faltered, Elixir was pulled down with it. Within 48 hours of Stream's announcement, deUSD

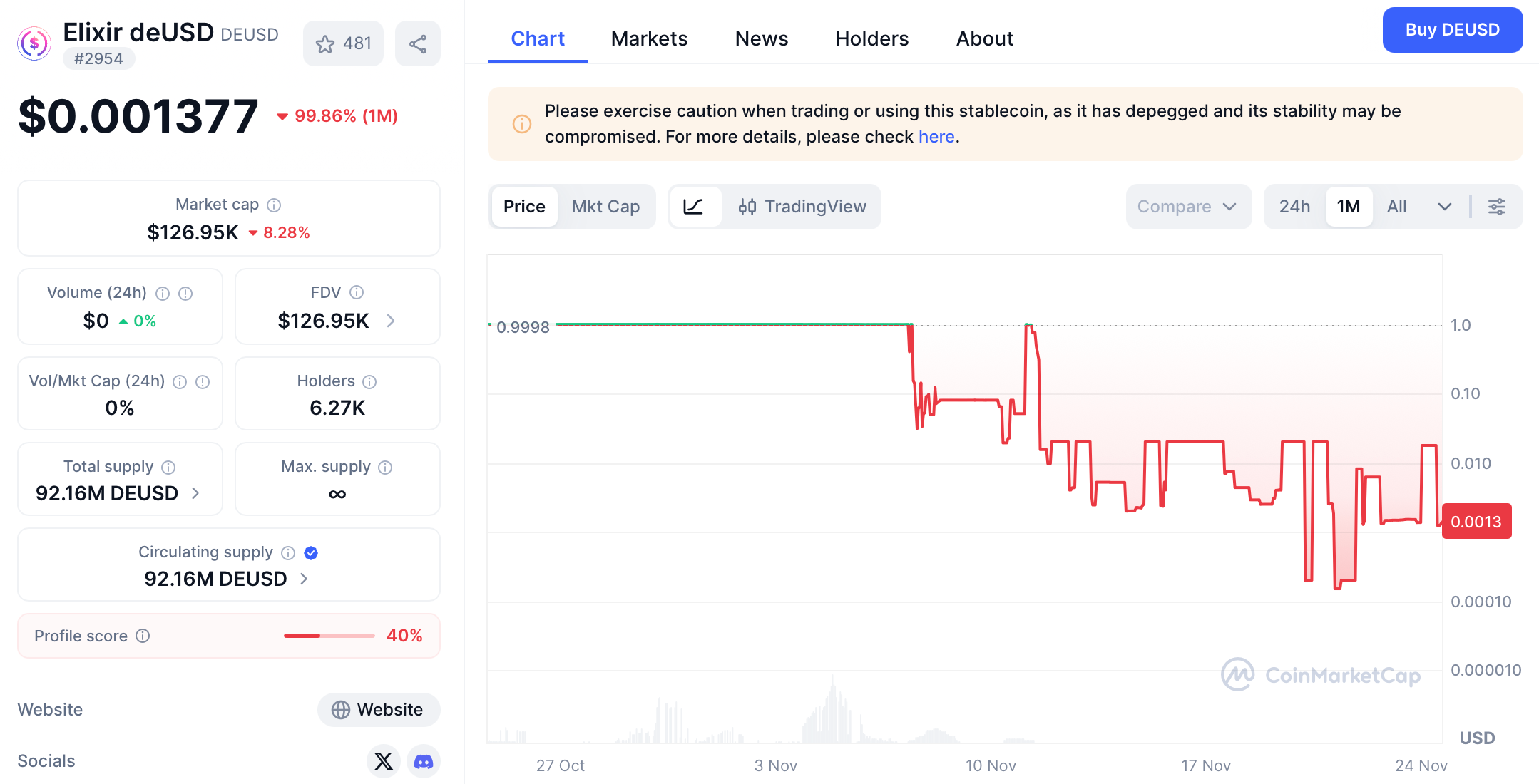

depegged from $1.00 to a catastrophic $0.015, becoming the fastest large-scale stablecoin collapse since Terra UST in 2022.

Elixir deUSD price chart. Source: CoinMarketCap

Research from DeFi organization Yields and More (YAM) soon mapped the staggering scale of the contagion. The total direct debt exposure linked to Stream Finance across the ecosystem reached

$285 million. The casualties were widespread:

-

TelosC faced the single largest exposure of

$123.64 million.

-

Elixir Network had lent

$68 million to Stream, representing 65% of the collateral backing its deUSD stablecoin.

-

Lending protocols like

Euler were facing an estimated

$137 million in bad debt.

-

Other affected entities included MEV Capital, Varlamore, and Re7 Labs, with researchers warning the list was not exhaustive.

The crisis triggered a systemic loss of confidence. Data from Stablewatch indicated that the total value locked (TVL) in yield-bearing stablecoins fell

40-50% in the week following Stream's collapse, meaning approximately

$1 billion fled from protocols that had not necessarily malfunctioned. Users, unable to distinguish robust projects from fraudulent ones, chose to exit the entire sector. The broader DeFi ecosystem saw its TVL drop by

$20 billion in early November, a clear sign of widespread risk contagion.

Why DeFi Repeats the Same Mistakes?

The collapses of November 2025 were not unprecedented; they were a stark repetition of historical failures. From Terra's UST in 2022 to Iron Finance in 2021, the DeFi sector has consistently demonstrated an inability to learn from its past, plagued by the same structural flaws.

The Mirage of Unsustainable Yields: The promise of high, risk-free returns is the siren song of DeFi. Terra's UST offered 19.5%, Iron Finance boasted an astronomical 1700% APR, and Stream Finance promised 18%. As a fundamental rule of finance dictates, if you cannot identify the source of the yield, you are the source of the yield. These returns are typically subsidized by new investor inflows or the inflationary minting of a governance token, not genuine revenue, making eventual collapse a mathematical certainty.

Dangerous Interconnectedness and Circular Dependency: The DeFi ecosystem is built like a house of cards, where protocols are deeply interdependent. The Stream-Elixir relationship was a prime example of "circular dependency," where stablecoins become mutually reinforcing. This creates a single point of failure; when one protocol falters, the risk propagates instantly through the entire network, amplifying losses.

Crippling Lack of Transparency: True decentralization should not mean opacity. A critical flaw in the Stream model was that over

60% of its reported assets were held in off-chain positions that could not be verified on the blockchain. This lack of real-time, on-chain proof of reserves allows protocols to obscure their true financial health, leaving users in the dark about the risks they are taking.

The Oracle Problem and Infrastructure Fragility

Beyond economic design flaws, the technical infrastructure of DeFi, particularly price oracles, revealed critical vulnerabilities under stress. Oracles are services that feed external data, like asset prices, onto the blockchain. Their failure can be as devastating as a financial collapse.

Just weeks before the Stream crisis, in October 2025, the market experienced a "precision attack" that highlighted this weakness. A manipulator executed a

$60 million concentrated sell-off of USDe on a single exchange. While other exchanges showed stable prices, oracles that relied on that one manipulated venue reported a sharp price drop. This false data triggered a cascade of automated liquidations across multiple DeFi protocols, wiping out positions that were, in reality, solvent.

Ethena founder Guy Young noted that

over $9 billion in stablecoin collateral was available for immediate redemption, proving the underlying assets were sound. The system was broken by faulty information, not a lack of capital.

This pattern is a recurring one, with historical precedents in attacks on Compound (2020) and Mango Markets (2022). Furthermore, during the Stream collapse, many lending protocols chose to manually freeze their oracles, keeping the price of xUSD artificially high to prevent instant insolvency and chain liquidations. While a short-term stability measure, this action shattered the trustless and automated premise of DeFi, revealing a system that remains reliant on centralized intervention during crises.

Regulatory Crossroads in 2025

The events of November 2025 have intensified the global regulatory scrutiny of stablecoins. The industry is at a crossroads, caught between the need for innovation and the demand for consumer protection and financial stability.

In the United States,

the GENIUS Act

, signed into law in July 2025, represents a significant regulatory watershed. A key provision of this act is a "ban on native interest" for payment stablecoins like USDC. The intent is clear: to draw a sharp distinction between high-risk, yield-bearing instruments and payment-focused "digital cash," and to prevent a mass exodus of deposits from the traditional banking system. This legislation directly challenges the business model of many DeFi stablecoins and pushes the market toward a bifurcated future with zero-interest, compliant stablecoins on one side, and riskier, offshore alternatives on the other.

Central banks have also amplified their warnings. The Bank for International Settlements (BIS) and the European Central Bank (ECB) have cautioned that a mass redemption event for a major stablecoin could trigger global financial instability, with the ECB highlighting the risk of a rapid "fire sale" of the reserves backing these assets.

Despite the chaos, the utility of transparent, well-regulated stablecoins is undeniable. Major traditional finance giants are now actively embracing them.

Visa integrated USDC for payroll settlements, and

Stripe acquired stablecoin infrastructure firm Bridge for $1.1 billion. They are not adopting the high-risk, yield-bearing experiments; they are building on the stable, utility-focused digital dollars that serve as more efficient payment rails.

Conclusion

The November 2025 meltdown was a painful but necessary stress test for the decentralized finance industry. It conclusively demonstrated that stablecoins are not inherently stable. Their stability is a fragile condition, dependent on transparent collateralization, sustainable economic models, and resilient technical infrastructure—all of which were found severely lacking in the cases of Stream Finance and Elixir.

The core lesson is that the "decentralized" label does not absolve financial projects from the timeless principles of finance: there is no such thing as a free lunch, and high returns always entail high risk. The industry's repeated failure to learn from Terra, Iron Finance, and others suggests a deep-seated problem with its incentive structures, which often reward short-term speculation over long-term stability.

The path forward requires a fundamental reset. It demands a commitment to radical transparency, with real-time, verifiable proof of reserves. It calls for regulatory clarity that protects consumers without stifling genuine innovation. And it necessitates a technical overhaul to fortify oracle systems and other critical infrastructure against manipulation and failure. For the millions around the world who rely on stablecoins as a financial lifeline, the success of this maturation process is not just a matter of profit, but of economic survival.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.