The market is characterized by extreme fear and significant downward pressure, driven by substantial ETF outflows and macroeconomic concerns. However, some analysts point to strong underlying fundamentals that suggest a potential divergence between price and value. Meanwhile, Pump.fun team has moved 405 million USDC into Kraken in the past week alone. USDT0 and XAUT0, which are the cross-chain bridged versions of Tether's USDT stablecoin and Tether Gold managed and operated by Everdawn Labs — have launched on Solana via LayerZero's interoperability technology. Wormhole Labs introduced the Sunrise platform on Sunday with the aim of becoming the primary entry point for new digital assets into the Solana ecosystem.

Crypto Market Overview

BTC (+0.82% | Current Price: $86,991.40)

After a steep weekly drop, BTC briefly clawed back above $84,000, but the overall trend remains bearish. Analysts note that Bitcoin is hovering below its key Four-Year Cycle level near $93,000, representing an unusually deep retrace for this phase of the cycle. Core trading range is currently viewed as $85,000 - $89,000. Analysts identified $89,000 as a critical resistance level (untested since October’s pullback) and $85,000 as strong support. A break below $85,000 could trigger a further drop to $80,000 (a level tested the prior week), while a break above $89,000 may open the door to $92,000.

On November 21st, Bitcoin exchange-traded funds (ETFs) registered an inflow of $238.4 million. Fidelity's FBTC saw an inflow of 108.0 million and BlackRock's IBIT saw an outflow of 122.0 million.

ETH (+0.64% | Current Price: $2842.01)

ETH traded at $2,842 at press time, with a 24-hour trading volume increase of 36.73%. ETH performance has mirrored Bitcoin's, with its core trading range between $2,800 - $3,100. The broader market weakness has overshadowed any positive on-chain metrics in the short term. A gold cross (50-day EMA crossing above the 200-day EMA) emerged, paired with a bullish engulfing candlestick pattern, hinting at a potential short-term reversal. However,

MACDmomentum remained weak, and the long-term EMA trend (100-day, 200-day) stayed bearish. Analysts noted that “volume is insufficient to confirm a trend shift,” as ETH has failed to break above $2,850 (a key resistance zone) for three consecutive days.

On November 21st, ETH ETFs experienced a total net outflow of $55.7 million, including an outflow of $53.7 million from BlackRock's ETHA and an inflow of $95.4 million from Fidelity's FETH.

Altcoins

The Crypto Fear and Greed Index has dropped to 12, signaling "Extreme Fear" among market participants. This is a strong indicator of negative short-term sentiment.

Macro Data

The market decline this week was triggered by stronger-than-expected U.S. employment data, which has lowered the probability of a Fed rate cut in December. As of November 21, the market-implied probability of a December rate cut was only 28.5%. Fed officials have also expressed a need for caution regarding a December rate cut. U.S. Bitcoin Spot ETFs saw a massive net outflow of $12.11 billion this week, while U.S. Ethereum Spot ETFs saw outflows of $5 billion. This represents a significant source of selling pressure.

On November 21st, the S&P 500 gained 0.98%, standing at 6,602.99 points; the Dow Jones Industrial Average increased 1.08% to 46,245.41 points, and the Nasdaq Composite gained 0.88% to 22,273.08 points.

Trending Tokens

TNSR Tensor (+80.60%, Circulating Market Cap: $72.81 Million)

TNSR is trading at $0.1584, up approximately 80.60% in the past 24 hours. Tensor (TNSR) stands out as a pivotal player in the cryptocurrency landscape, particularly within the Solana blockchain ecosystem. At its core, Tensor is a foundation that empowers community-led governance over its protocols, fostering the growth of the Tensor DAO and the broader Tensor ecosystem. This foundation supports both Tensor and Vector protocols, which are essential trading infrastructures for NFTs on Solana and tokens across multiple chains. Coinbase acquired Vector (a Solana DEX aggregator built by Tensor Labs) on Nov 21, absorbing its tech but leaving TNSR token governance with the Tensor Foundation. In response, the Foundation

burned 21.6% of TNSR’s unvested supplyand redirected 100% of Tensor NFT marketplace fees to the TNSR treasury (up from 50%). The supply reduction (equivalent to ~$20M burned) tightened liquidity, while enhanced treasury revenue theoretically boosts TNSR’s utility. However, the deal excluded direct value for TNSR holders, creating mixed sentiment.

DYM Dymension (+27.85%, Circulating Market Cap: $48.74 Million)

DYM is trading at $0.1184, up approximately 27.85% in the past 24 hours. Dymension (DYM) is a modular blockchain network designed to simplify the creation and interoperability of scalable, application-specific chains (RollApps) while providing shared security and liquidity. DYM broke above a falling wedge pattern on the daily chart, supported by a bullish MACD crossover and RSI (59.21) signaling recovering momentum. The price reclaimed its 7-day SMA ($0.10095), with volume spiking 451% to $152M – the highest since December 2024. The wedge breakout often precedes trend reversals, attracting algorithmic traders and momentum buyers. Sustained volume above $100M could reinforce bullish sentiment.

B2 Bsquared Network (+23.38%, Circulating Market Cap: $23.11 Million)

B2 is trading at $0.4928, up approximately 35.16% in the past 24 hours. B² Network is a next-generation Layer2 scaling solution built on top of Bitcoin (BTC), aiming to significantly enhance Bitcoin’s performance and scalability without compromising its foundational security. By integrating zero-knowledge proofs (ZKP) and adopting a modular blockchain architecture, B² Network not only alleviates Bitcoin’s congestion issues but also expands its programmability and utility in the broader crypto ecosystem. B2’s 7-day RSI hit 20.39 (oversold) on November 24, while the 24h trading volume spiked to $28.1M (+29% vs. prior week averages). The oversold RSI and rising volume suggested capitulation followed by short-covering. However, B2 remains 37.35% down over 7 days, indicating volatility risk. The price ($0.489) sits below the 23.6% Fibonacci retracement ($1.71), limiting upside potential.

Market News

Pump.Fun Cashes Out $436.5M USDC, Token Slumps 24% in 1 Week

Solana-based meme coin launchpad Pump.fun has withdrawn $ 436.5 million USDC since October 15, according to on-chain analysis.

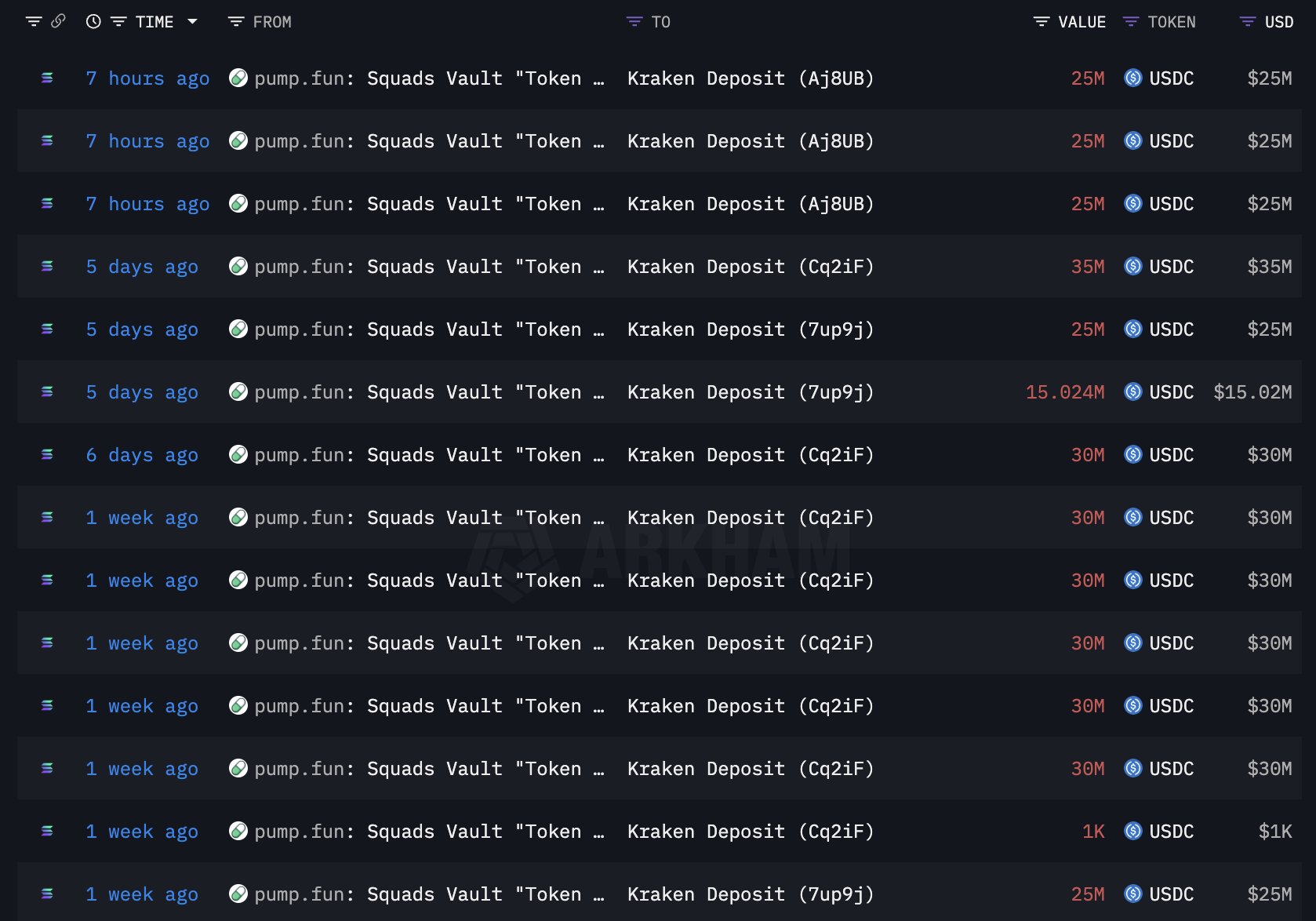

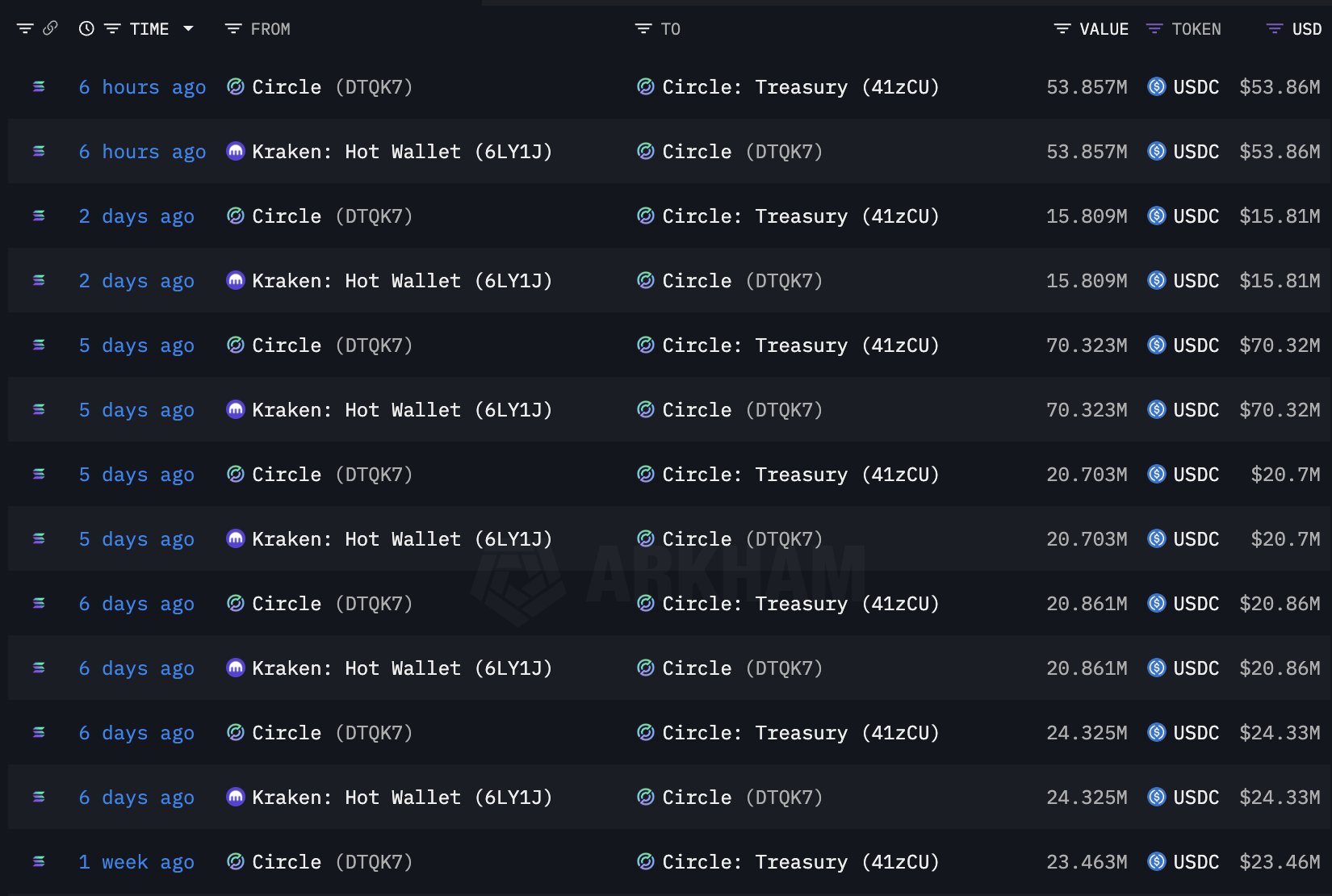

Data accumulated by crypto analyst EmberCN revealed that Pump.fun team has moved 405 million USDC into Kraken in the past week alone. During the same period, the project transferred 466 million USDC from Kraken to Circle. The move is “very likely” to be a “withdrawal,” the analyst noted.

Per EmberCN, the funds are proceeds from Pump.fun’s June private sale of PUMP tokens to institutions. Pump.fun launched its own token, PUMP, in July through an initial coin offering that raised $500 million in under 12 minutes. Despite the recent massive USDC transfers, the official X account of Pump.fun has remained silent for over a week, failing to provide any updates.

Since October 15, Pump.fun has deposited 436.5 million USDC into Kraken, followed by 537.6 million USDC flowing from Kraken to Circle, Arkham data notes. Further, the platform has sold a total of 4.19 million Solana (SOL), worth nearly $757 million, from May 2024 to August 2025.

“Of that amount, 264,373 SOL was dumped on-chain for $41.64 million, while 3.93M SOL($715.5 million) was deposited into Kraken,” Lookonchain noted. Analysts note that similar cash-outs in memecoin projects have historically led to short-term price dips. However, the latest move has triggered community backlash.

One user noted that Pump.fun has pocketed over a billion in the past year, while the project hasn’t given back to its community. “No airdrop, no marketing, no incentives,” the user wrote on X.

Another user remarked that Q4 will be the best quarter for Pump.fun team “and nobody else,” slamming its founder Alon’s claims on the project’s Q4 performance.

Tether-linked USDT0 and XAUT0 Launch on Solana via LayerZero Tech

USDT0 and XAUT0 — cross-chain bridged versions of Tether's USDT stablecoin and Tether Gold managed and operated by Everdawn Labs — have launched on Solana via LayerZero's interoperability technology.

While Tether's USDT has been available on Solana for years, USDT0 aims to expand its liquidity reach.

Existing USDT on Solana can only circulate within the Solana ecosystem. With USDT0, Solana is directly linked to more than $175 billion in native USDT liquidity across Ethereum, Tron, TON, and other major chains — with no wrapped assets, no external bridges, faster settlement, and lower fees.

Meanwhile, Tether Gold is expanding to Solana for the first time through XAUT0. The combination of omnichain dollars and gold-backed value gives developers and institutions a foundation to build the next generation of applications, ranging from global remittances and corporate treasuries to programmable lending and asset-backed innovation.

Everdawn Labs brings Tether’s USDT and XAUT tokens to more blockchains via its "Legacy Mesh" platform — a cross-chain liquidity infrastructure powered by LayerZero’s interoperability protocol. Legacy Mesh is a stablecoin-specific interoperability layer, not a general multi-asset bridge, Lorenzo noted. Every transaction on Legacy Mesh is "fully backed by real assets," with auditable liquidity pools and no wrapped or synthetic tokens, he added, noting that transfers carry a 0.03% fee paid in USDT.

The current circulating supply of USDT0 is about 7.5 billion tokens and XAUT0 is about 7,355 tokens, according to CoinGecko. For comparison, USDT’s circulating supply exceeds 180 billion and XAUT’s totals 375,572.

USDT0 and XAUT0’s Solana expansion adds to their growing network footprint. USDT0 is live on Plasma, Polygon, Arbitrum, Berachain, Ethereum, Ink, Flare, Optimism, Hyperliquid’s HyperEVM, SEI, and Rootstock, while XAUT0 is currently available on TON, HyperEVM, Arbitrum, Ink, CELO, Avalanche, and Polygon.

Sunrise Debut Streamlines Solana Token Imports as Monad Goes Live

Wormhole Labs introduced the Sunrise platform on Sunday with the aim of becoming the primary entry point for new digital assets into the Solana ecosystem.

The platform introduces a unified gateway that allows issuers and users to move tokens from any ecosystem onto the Solana blockchain.

The debut comes just before the arrival of Monad and its token, MON, on the mainnet on Monday. This gives Solana users day-one access to the token without having to navigate the usual complex web of bridges and aggregators.

Sunrise targets a growing challenge inside Solana’s fast-expanding markets. While the chain has seen accelerating activity, new assets have struggled to make their way into the ecosystem efficiently.

Users often face fragmented liquidity, multistep bridging processes, and limited early stage trading venues. Sunrise positions itself as Solana’s “canonical route” for new tokens, aiming to streamline that flow into a single, standardized interface.

Integrations with block explorer Orb and decentralized exchange Jupiter will go live as well, so any cryptocurrency brought in through Sunrise can be immediately accessed and traded in the Solana ecosystem.

The team said it expects the first major test to occur when MON is introduced, allowing the token to move from Monad to Solana in one step.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.