Gold has embarked on an unprecedented rally in 2025, capturing the attention of investors worldwide. With prices reaching record highs and major financial institutions revising their forecasts upward, the yellow metal demonstratesenduring appeal in a complex macroeconomic landscape. This analysis examines the current forces driving gold's performance from shifting central bank policies and persistent geopolitical tensions to evolving investment demand and synthesizes the latest price projections from leading institutions. As UBS sets a new mid-2026 target of $4,500 per ounce with potential upside to $4,900, understanding the interplay between Federal Reserve policy, central bank accumulation patterns, and global risk factors becomes crucial for navigating the precious metal's future trajectory. The convergence of monetary, geopolitical, and technical factors suggests gold's bull run may have substantial room to continue, though not without interim challenges and volatility.

Gold Price Analysis

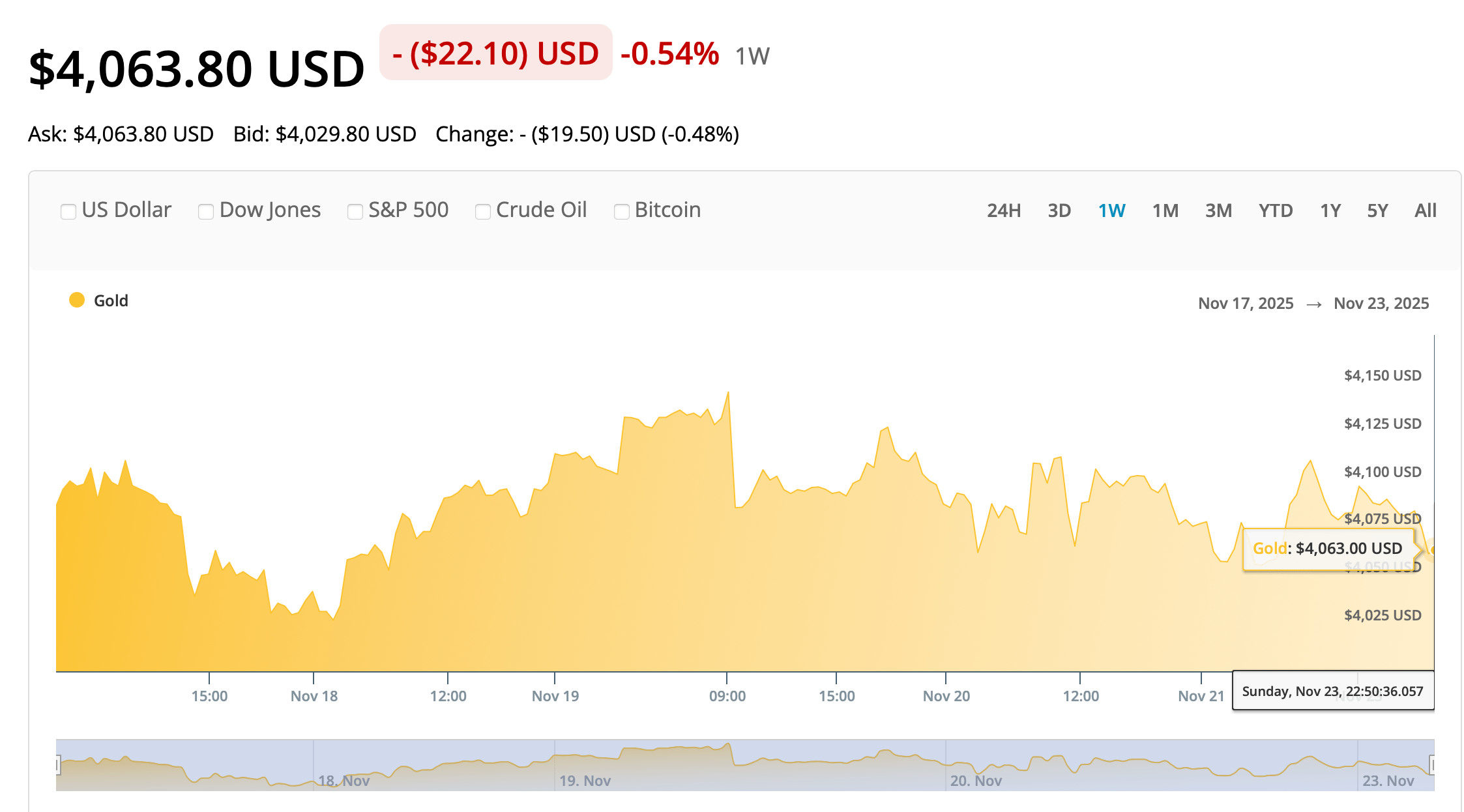

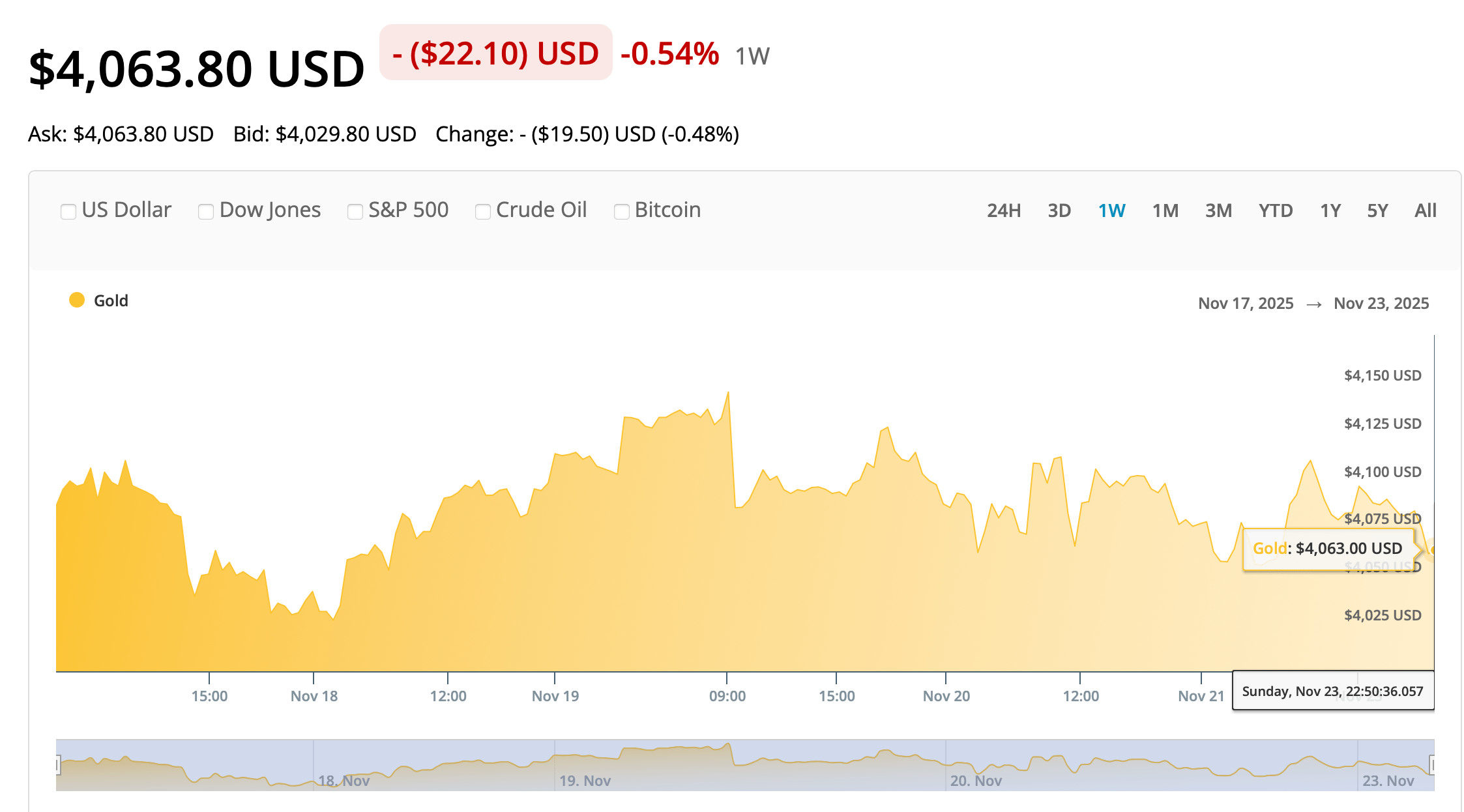

On November 24, 2025, gold prices are experiencing some volatility, opening higher but later dipping below key levels as the market weighs shifting expectations for U.S. interest rate cuts.

Several factors are influencing the gold market, creating a tug-of-war between bullish and bearish forces.

-

Federal Reserve Interest Rate Expectations: This is the dominant driver. Comments from New York Fed President John Williams, who suggested there is still room for rate cuts in the near term, boosted market sentiment. Following his remarks, the market-implied probability of a December rate cut jumped to around 70%. Higher interest rates make non-yielding assets like gold less attractive, so the prospect of cuts is supportive.

-

Geopolitical and Economic Factors: Ongoing events, such as negotiations concerning the Russia-Ukraine situation, are providing some support to gold due to its safe-haven appeal. However, there are also headwinds. The Russian Central Bank has confirmed it began selling gold reserves to fund its budget, which adds supply to the market and could pressure prices.

-

Market Sentiment and Data: After hitting a record high in late October, the gold market has entered a consolidation phase. Traders are cautiously awaiting key economic data releases, such as U.S. retail sales and producer price figures, for further clues on the health of the economy and the path of inflation

Gold price chart. Source: APMEX

Institutional Price Forecasts: Mapping the Upside

Financial institutions have markedly upgraded their gold price targets throughout 2025, reflecting growing confidence in the metal's upward momentum. UBS Group, in its November 2025 analysis, raised its 2026 mid-year gold price forecast to $4,500 per ounce, a significant increase from its previous $4,200 projection. The Swiss bank also elevated its upside scenario target to $4,900, while maintaining a $3,700 downside case, acknowledging potential headwinds despite overall bullish sentiment.

This optimistic outlook is shared by other major players, though with varying timeframes and levels. Goldman Sachs revised its early 2025 forecast to $2,900 per ounce in September, citing expected interest rate cuts in Western economies and sustained central bank purchasing. Meanwhile, Citigroup has emerged among the more bullish voices, projecting that gold could reach $3,000 in 2025 with a potential climb to $3,900 by 2026. The consensus among institutions points to steadily higher prices through 2026, with some analysts speculating about the possibility of $5,000 gold by 2030 if inflationary pressures accelerate beyond expectations.

The progression of these forecasts throughout 2025 reveals increasing institutional confidence. UBS had previously adjusted its outlook upward in August, setting its 2026 year-end target at $3,700, before making another substantial revision in November based on strengthening fundamental drivers. This pattern of successive upward adjustments suggests analysts see enduring strength in gold's underlying demand drivers rather than merely transient factors.

Macroeconomic Drivers Fueling the Rally

The gold price surge reflects multiple supportive macroeconomic factors converging simultaneously. Federal Reserve monetary policy represents perhaps the most significant short-term driver. As UBS analysts noted, "expected Fed rate cuts, declining real yields, persistent geopolitical uncertainties, and changes in the US domestic policy environment" collectively support higher gold prices. The relationship between interest rates and gold is well-established: as a non-yielding asset, gold becomes more attractive when interest rates fall, reducing the opportunity cost of holding it.

Recent comments from Federal Reserve officials have maintained market expectations for forthcoming rate cuts, despite some mixed signals. New York Fed President John Williams stated in November that the U.S. central bank "could still trim interest rates in the near term, without jeopardizing its inflation goal," providing supportive momentum for gold. Traders subsequently priced in a 74% chance of a rate cut at the Fed's December meeting, a substantial increase from earlier probability assessments.

Beyond monetary policy, concerns about the U.S. fiscal outlook have strengthened gold's safe-haven appeal. A worsening fiscal situation "is likely to sustain central bank and investor gold buying, given its lack of counterparty risk," according to UBS analysis. Meanwhile, persistent geopolitical tensions, including conflicts in Ukraine and the Middle East, along with U.S.-China tensions continue driving safe-haven demand from both institutions and individual investors. These factors combine to create a powerful, supportive backdrop for gold prices extending into 2026.

Investment Demand and Central Bank Accumulation

Investment demand for gold has surged in 2025, marking a fundamental shift in market structure. According to World Gold Association data referenced by UBS, "central banks and personal investors showed very strong and accelerating purchasing power". This trend is particularly evident in gold ETF flows, which saw inflows across all regions in July for the first time since May 2023.

The central bank purchasing phenomenon deserves special attention. While the pace of accumulation has moderated from record levels, institutional buying remains robust. UBS noted that while central bank purchasing in 2025 has run "below last year's levels, it picked up in the fourth quarter, consistent with our forecast of 900-950 tons of gold for 2025". Goldman Sachs estimated that "moderating but still significant central bank purchases on the London OTC market could drive about two-thirds of the expected rise of the gold price to $2,900 per ounce in early 2025".

Retail investment has also strengthened considerably, particularly in key markets. The World Gold Association reported that "gold bar and coin demand exceeded 300 tons for the fourth consecutive quarter," indicating robust individual investor participation. In China specifically, retail investors drove gold bar and coin demand to surge 44% year-over-year to 115 tons in the second quarter. This broad-based demand across institutions and retail segments creates a more sustainable foundation for higher prices than if the rally were driven by a single participant category.

Challenges and Risk Factors

Despite the overwhelmingly bullish sentiment, several factors could potentially derail or moderate gold's ascent. UBS explicitly acknowledged that "potential Fed hawkishness and the risk of central bank gold sales remain the main challenges to their overall bullish outlook". If the Federal Reserve maintains higher interest rates for longer than currently anticipated or reverses course toward tightening, the opportunity cost of holding gold would increase, potentially pressuring prices.

Central bank behavior represents another uncertainty. While most have been consistent buyers, "the risk of central bank sales" remains a concern, particularly if liquidity needs emerge or reserve management strategies shift. Some central banks, including Kazakhstan's, have already engaged in "tactical selling through portfolio rebalancing to maintain liquidity," demonstrating how official sector sales can emerge even within a broader accumulation trend.

Technical factors also present near-term constraints. The gold market has experienced significant volatility, with prices retreating from record highs above $4,380 to trade between $4,000-$4,100 for much of November. This consolidation phase reflects both profit-taking and positioning adjustments ahead of key Federal Reserve decisions. Additionally, high gold prices have begun impacting consumption patterns, with the World Gold Association noting "jewelry demand continuing to shrink" in the second quarter as prices reached elevated levels. Such demand destruction in traditional gold markets could eventually feed back into investment calculus.

Investment Implications and Portfolio Strategy

In light of gold's projected appreciation, major institutions have begun articulating specific allocation recommendations. UBS advises investors "to allocate a medium single-digit percentage of their portfolio to gold," describing the metal as "an important part of a resilient investment strategy". This mid-single-digit allocation reflects gold's dual role as both a potential source of return and a diversification tool during periods of market stress.

The case for gold in portfolio construction rests partly on its historically low correlation with traditional assets like stocks and bonds, "particularly during times of market tension". This characteristic makes it valuable for reducing overall portfolio volatility while maintaining exposure to appreciable assets. UBS strategist Sagar Khandelwal emphasized that "despite the size and speed of the gold rebound, potentially meaning volatility may intensify, we still believe gold is an important part of a resilient investment strategy".

For investors seeking exposure, multiple avenues exist, each with a different risk-return profile. Gold ETFs offer direct price exposure with high liquidity, suitable for most portfolio implementations. More aggressive investors mightconsider gold mining companies, which offer operational leverage to gold prices but with additional company-specific risks. Physical gold offers non-counterparty exposure but requires consideration of storage and insurance costs. Regardless of the vehicle, institutions generally recommend a strategic rather than tactical allocation, given gold's role as "insurance against currency depreciation" rather than purely a return-seeking asset.

Long-Term Outlook and Conclusion

The gold market appears to be in the early stages of a structural bull market with the potential to extend well beyond current levels. The combination of supportive technical patterns, including what some analysts describe as "the completion of two classic long-term reversal patterns on the 50-year chart: the wedge of the 80s-90s and the 2013-2023 cup-and-handle", points to potentially sustained upward momentum. These patterns, combined with gold making new highs in all major currencies, suggest a broad-based reassessment of the metal's value rather than dollar-specific weakness.

Looking toward 2026, the market faces a potentially pivotal period. UBS anticipates "another consolidation at around $4,300 per ounce in late 2026, when the US midterm election ends", suggesting both near-term strength and intermediate-term pauses in the upward trajectory. The fundamental case remains compelling, however, with structural drivers, including "persistent geopolitical uncertainties", "US fiscal outlook" concerns, and continued central bank diversification away from the U.S. Dollar likely to persist regardless of short-term fluctuations.

While the path forward will undoubtedly include periods of volatility and consolidation, the overarching trend appears decisively upward. As the World Gold Association's senior market analyst, Louise Street observed, "If the global economy or geopolitical situation substantially deteriorates, it will push gold prices higher again". In an environment characterized by significant monetary policy uncertainty, geopolitical tensions, and structural economic shifts, gold's role as a perennial safe haven and store of value seems likely to sustain its appeal through 2026 and potentially throughout the remainder of the decade.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.