The cryptocurrency landscape has witnessed a seismic shift with the dramatic exit of one of Bitcoin's earliest and most substantial holders. Owen Gunden, a Bitcoin participant since the ecosystem's infancy, has liquidated his entire holdings of approximately 11,000 BTC, worth an estimated $1.3 billion, over several weeks culminating in November 2025. This event is not merely a substantial sell-off; it symbolizes a pivotal moment of wealth transfer from early adopters to a new class of institutional investors. While such a massive divestment historically triggered panic and prolonged bear markets, the market's structured response to Gunden's departure highlights Bitcoin's ongoing maturation. This analysis delves into the details of his exit, the immediate market repercussions, and the broader institutional trends that suggest a fundamental reshaping of Bitcoin's ownership structure, moving from a niche asset controlled by a few "whales" to an institutionally dominated financial instrument.

The End of an Era: Owen Gunden's Exit

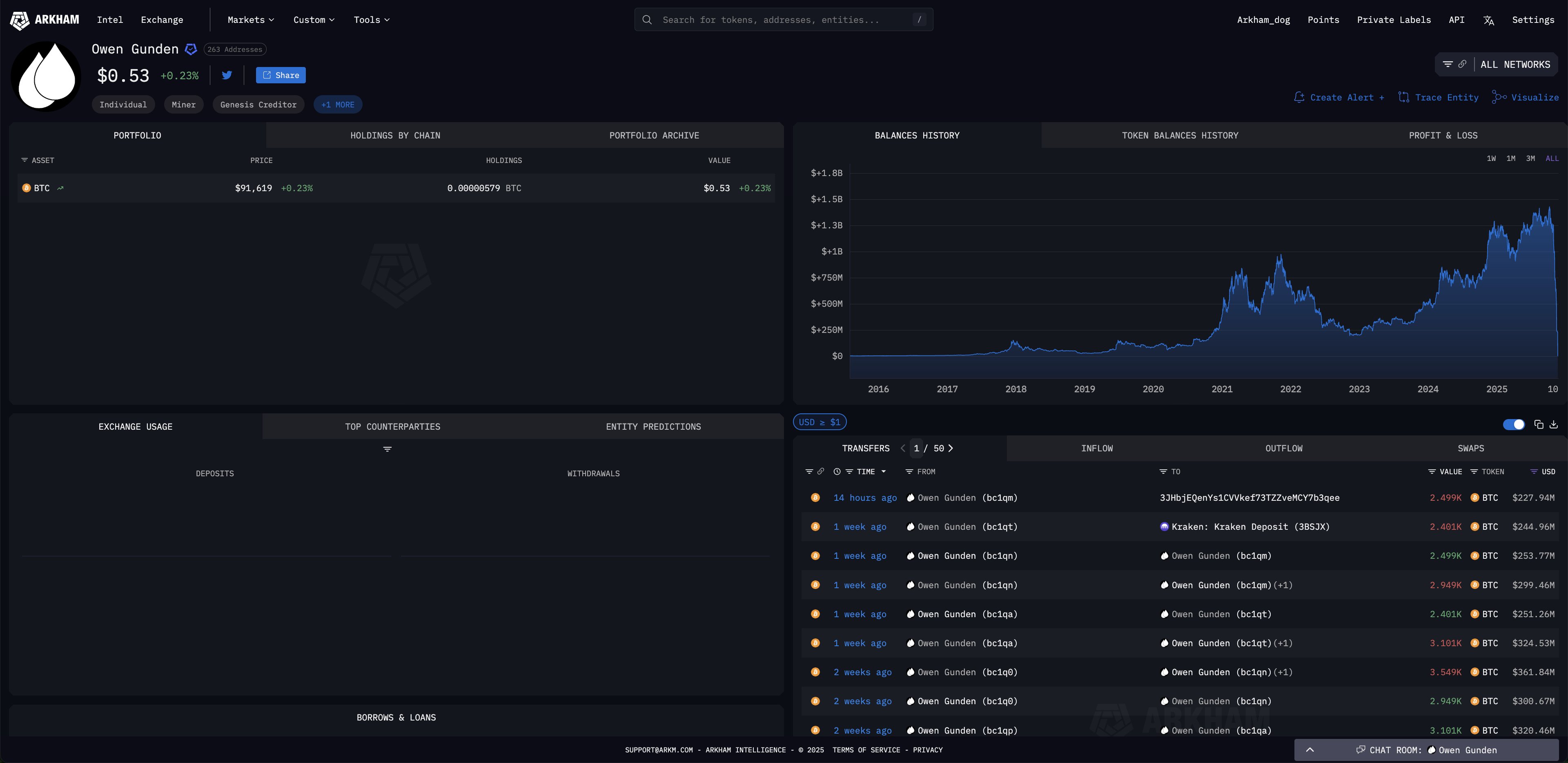

Owen Gunden's account activity. Source: ARKHAM

Owen Gunden was no ordinary investor. As an early arbitrage trader on platforms like the now-defunct Mt. Gox, Gunden had been accumulating Bitcoin since 2011, building a massive fortune that withstood multiple market cycles. His legendary status in crypto circles stemmed from his early recognition of Bitcoin's potential and his demonstrated patience, holding through extreme volatility for nearly 14 years.

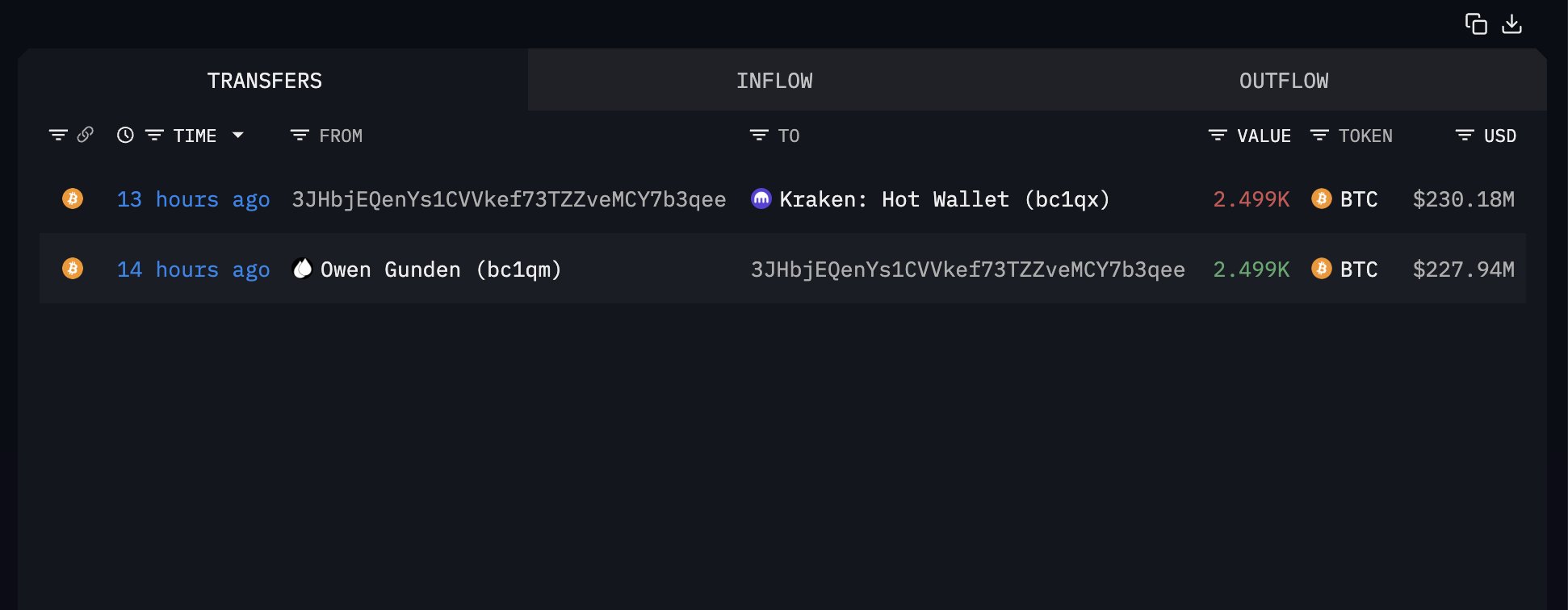

Owen Gunden's BTC transfer to Kraken. Source: ARKHAM

According to blockchain data from Arkham Intelligence, Gunden's selling spree began in late October 2025 and continued systematically through November. His final transaction occurred on November 14, when he transferred his last 2,499 Bitcoin (worth approximately $228 million) to the Kraken exchange, effectively emptying wallets that had held Bitcoin for over a decade. This concluded a total liquidation of 11,000 BTC with an approximate value of $1.3 billion.

Gunden's exit strategy appeared methodical rather than panicked. By executing his sales over multiple weeks, he potentially minimized direct market impact while maximizing returns. This careful planning reflects the sophistication of an experienced trader who understood the implications of moving such substantial volumes. His decision to completely exit the market after such a long tenure is a powerful statement, raising questions about the outlook for long-term Bitcoin maximalists.

Immediate Market Ripple Effects

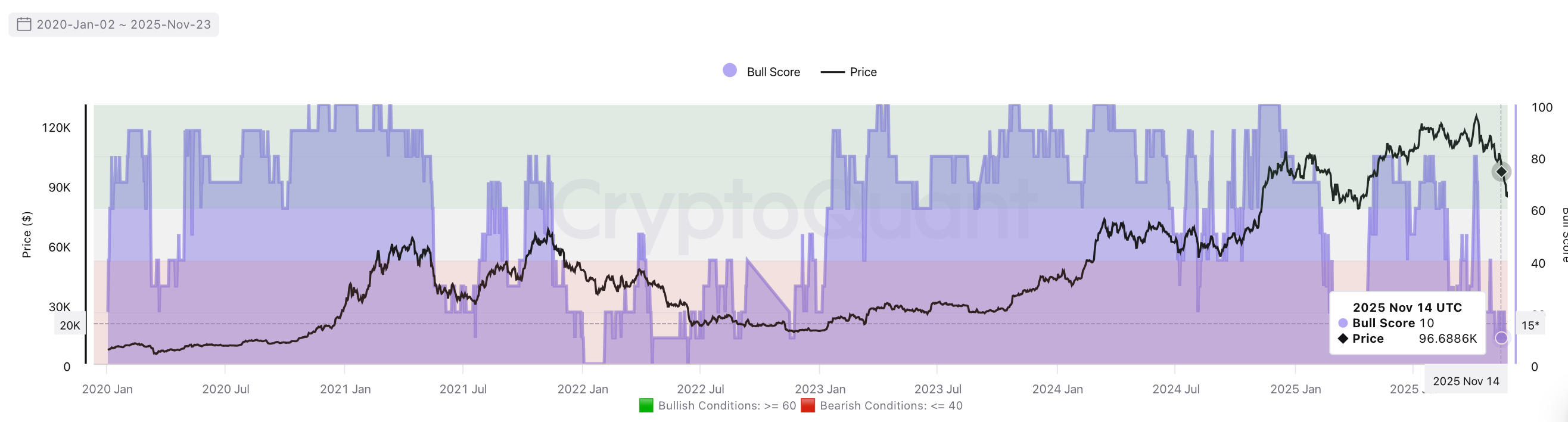

The announcement of Gunden's substantial liquidation inevitably impacted market dynamics, contributing to a bearish sentiment that pushed Bitcoin to two-month lows. The sell-off occurred amid existing market jitters, creating a perfect storm of negative sentiment. Data from CryptoQuant revealed that the market's Bull Score Index had plummeted to 20 out of 100, signaling "extreme bearish" conditions—the most pessimistic level of the current cycle.

Bull score index. Source: CryptoQuant

The immediate aftermath saw significant long positions liquidated, exacerbating the downward price movement. While the exact figures from this event are still emerging, historical context shows that such large-scale sell-offs can trigger cascading effects. In early November 2025, a separate market downturn led to over $1.27 billion in liquidations within 24 hours, with long positions accounting for nearly 90% of the total. This pattern of leverage unwinding often creates a feedback loop of fear and selling, which likely amplified the impact of Gunden's sales.

The psychological impact of Gunden's exit may have outweighed the direct market impact of his sales. As a respected early holder with a proven track record, his decision to completely exit sent a powerful signal that reverberated through investor psychology, causing many retail investors to question their own holdings.

Whales Selling, Institutions Buying

While Gunden's exit captured headlines, it represents part of a broader pattern of wealth transfer in the Bitcoin ecosystem. This trend is not a one-sided collapse but rather a calculated rotation. As early individual investors like Gunden cash out, major financial firms are quietly increasing their exposure.

The most compelling evidence of this is the surge in institutional ownership of U.S. spot Bitcoin ETFs. Despite the fear gripping retail markets, institutional holdings of these ETFs climbed to 40% in November 2025, a significant jump from the 27% recorded in the second quarter of 2024. This 40% figure is considered a "conservative estimate," as it only includes firms managing over $100 million that are required to file reports with the SEC.

This growing institutional participation is particularly notable considering the challenging flow picture. According to Farside Investors, Bitcoin ETFs experienced substantial net outflows in November, with a total of $2.8 billion exiting these funds. Nevertheless, institutions appeared to be holding their shares, suggesting they view current price levels as an attractive long-term accumulation opportunity despite short-term volatility. This divergence between retail panic and institutional accumulation highlights a fundamental shift in Bitcoin's ownership structure from a decentralized asset dominated by individual enthusiasts to an institutionalized asset class.

Whale Activity and Market Maturity

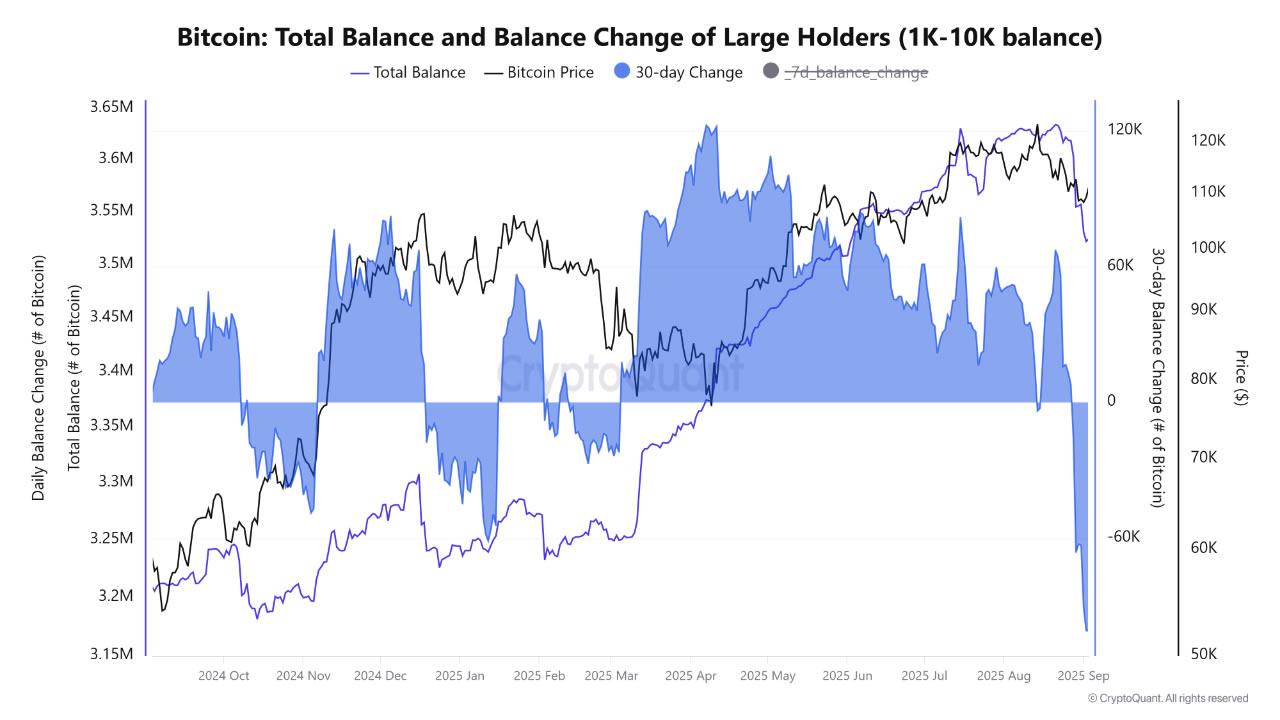

Gunden's sell-off is part of a larger wave of whale distribution. Data from CryptoQuant indicates that Bitcoin whales sold approximately 115,000 BTC, worth $12.7 billion, in a significant October 2025 sell-off, marking the most substantial such event since 2022. This indicates a broader trend of large holders taking profits or reallocating assets.

Balance change of large holders. Source: CryptoQuant

However, the market has demonstrated a remarkable ability to absorb these substantial sales without catastrophic collapse. A key factor mitigating the impact of such large transactions is the use of Over-the-Counter (OTC) desks. For instance, in a separate event in July 2025, an early whale moved 40,000 BTC, with 18,343 of those coins ($2.17 billion worth) transferred to Galaxy Digital, likely for an OTC transaction. OTC deals allow large blocks of cryptocurrency to be sold directly to buyers without hitting public order books, thus preventing massive price slippage and protecting market stability.

This maturation of market infrastructure distinguishes the current environment from earlier periods in Bitcoin's history. The presence of deep liquidity, sophisticated financial intermediaries, and institutional buyers has created a more resilient ecosystem capable of handling wealth transfers that would have previously caused severe market disruptions.

Conclusion

Owen Gunden's departure from Bitcoin after 14 years represents more than just a billionaire taking profits, which symbolizes the ongoing maturation and institutionalization of the cryptocurrency market. While his exit has undoubtedly contributed to short-term bearish sentiment and price weakness, it also demonstrates the natural market cycle of early adopters transferring wealth to new generations of investors.

The simultaneous selling by veteran holders and accumulation by institutions through regulated ETFs suggests Bitcoin is undergoing a fundamental ownership transition rather than facing a permanent bearish turn. Historical patterns indicate that distribution from long-term holders to new participants often marks the later stages of bull markets rather than their conclusive ends.

For the broader market, Gunden's exit provides a case study of Bitcoin's resilience. Even $1.3 billion in selling—while impactful, has been largely absorbed without catastrophic system failure, demonstrating the market's growing depth and maturity. As ownership rotates from mid-term holders to institutional participants, while the longest-term whales continue to hold, the market structure appears to be resetting for its next phase.

While no one can predict Bitcoin's short-term trajectory with certainty, the current market structure—with its reset leverage, growing institutional base, and ongoing rotation of ownership—suggests that reports of Bitcoin's demise are greatly exaggerated. As with previous cycles, periods of extreme fear have often presented the most compelling long-term opportunities for those with fortitude to see beyond immediate volatility. The great whale exit may well be remembered not as an end, but as a necessary passage in Bitcoin's journey toward mainstream financial acceptance.

References:

CryptoQuant. (n.d.). Cohort - Dolphin Balance (Change) [Analytics query]. CryptoQuant. https://cryptoquant.com/analytics/query/68f64c57c530660f8b91f2d8?v=68f64c57c530660f8b91f2da

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.